To receive their pay is always something that all employees look forward to. It just feels so good to finally harvest the fruits of their labor. Not only does a good payroll make sure that employees are actually earning at their jobs, it also keeps a business running by keeping their employees happy and well paid. Payroll is a main factor in the business and corporate world, to make sure that the employees are paid the equal amount of work or the nature of work that they have done and accomplished. Payroll also refers to the company’s records or audits or payments that were made previously to an employee, along with the amount that each employee should receive for the time worked or the tasks that they have completed. It can be wages, salaries, bonuses, taxes, etc. Given the massive scope of this component and its importance to the overall business, the pressure is always on for employers to keep and distribute a well rounded payroll in their company. Making sure that everyone gets what they are due without sacrificing the budget and finances of the company.

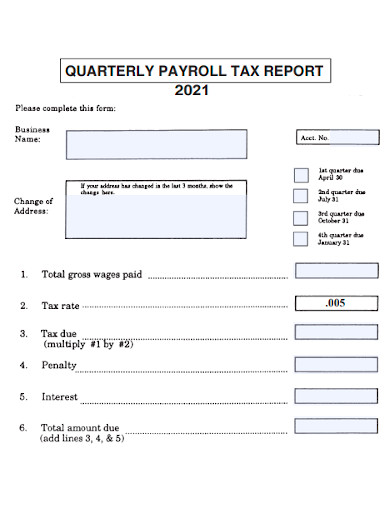

When it comes to drafting and managing payroll, employers or HR managers have quite a lot of tasks on their hands. Gathering timesheets, distribute pay stubs and pay slips, these are only some of the extensive tasks that they have to accomplish to come up with an effective payroll. There can be a lot of steps to consider that goes into paying the employees, especially if you have a large workforce, which is more common in large scale businesses and companies. But the tasks doesn’t stop after paying the employees. It’s only after where the real work begins, filing payroll reports. Payroll reports are documents that are used to notify government agencies that are concerned with taxes, the IRS, benefits, and employment tax liabilities. Payroll reports summarize quite a lot of things pertaining to the employee’s taxes and finances, making it easier for lenders and government agencies to properly analyze the payroll costs of a business. To find out more what a quarterly payroll report is and what’s it do, check out these quarterly payroll report samples that we have listed below. After getting the document and its composition, you can then use these samples as guides or even as a template for when you want to draft your own report.

5+ Quarterly Payroll Report Samples

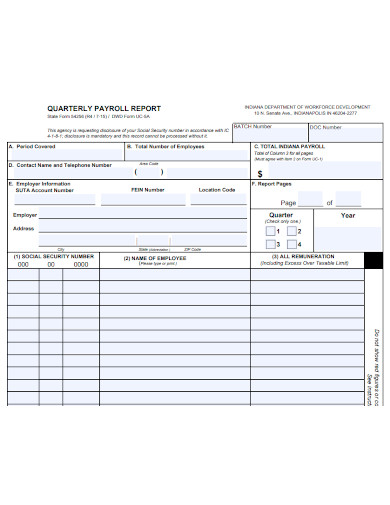

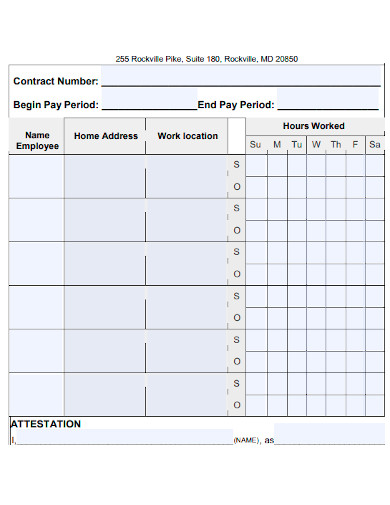

1. Quarterly Payroll Report Sample

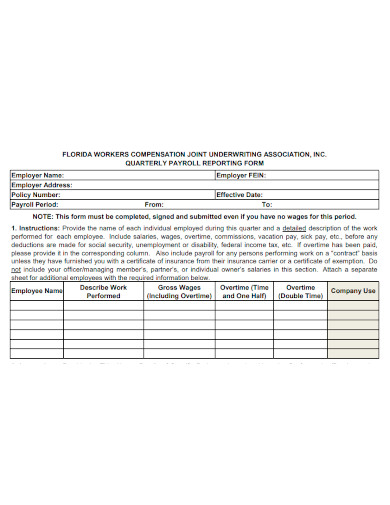

2. Standard Quarterly Payroll Report

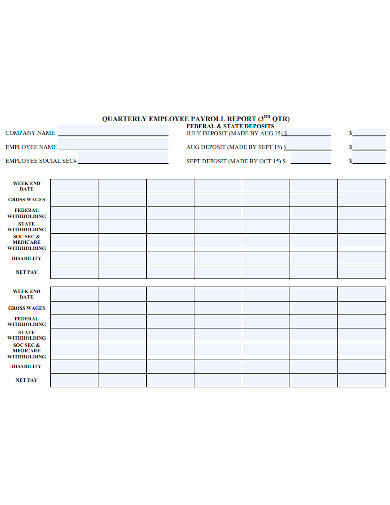

3. Employee Quarterly Payroll Report

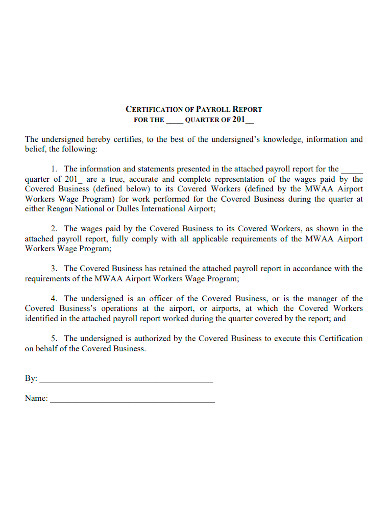

4. Quarterly Payroll Report Certification

5. Editable Quarterly Payroll Report

6. Quarterly Payroll Tax Report

What Is a Quarterly Payroll Report?

A payroll report is a document that employers use to check and verify the tax liabilities of a company and cross-check financial data. It usually includes components like pay rates, hours worked, overtime accrued, taxes withheld, wages, employer tax contributions, vacation subsidies, and a whole lot more. These documents provided valuable insights in the workforce that can help the company understand and control labor costs in a much better way. This document is also widely used in audits or when preparing tax forms for the concerned government agencies. There are several different types of payroll reports depending on the customization and the needs curated by the payroll provider to meet the reporting needs of an employer or the manager. Payroll reports are often generated periodically, each pay period, annually, and in this case, quarterly.

What Are the Steps in Processing Payroll

Payroll processing is one of the more complex task a business or company must complete. It can easily be an overwhelming task due to the wide scope of things and documents that you have to cover, which easily makes it incredibly confusing. To better understand how payroll reports contribute to the overall process, you’d first need to know the steps required to properly and completely process payroll. Which includes calculation of employment taxes and submission of tax payments. These steps will be discussed in more detail below.

- Data collection

When a new employee is hired, employers need to collect various data such as tax withholding information, especially on FORM W-4. Federal income taxes are also withheld and may include dollars to pay for company provided benefits. - Calculate net pay

The net amount of an employee pay is the gross pay without any deductions for tax and benefit payment withholdings. Medicare and Social Security taxes are also calculated. - Payments

Always pay the employees wage by check or directly into their bank accounts on time. - Reporting

Filed taxes for federal and state tax withholdings must be submitted to the concerned government agencies like the IRS and the Department of Revenue. Retirement plan contributions, state unemployment payments, Medicare taxes, and Social Security taxes are reported to their respective entities. - Withheld payments

All tax and benefit payments are to be forwarded to the taxing authorities, retirement plan firms, and other respective providers. - Post accounting entries and pay stubs

All transactions or payroll must be posted to the accounting system in the company. Various states require employers to report all of their payroll information to employees on a pay slip.

Remember that the process changes depending on the changes in your business or company. Especially workforce related adjustments like employee promotions, resignations, new hire, and sometimes employee rotations.

FAQs

What is the payroll process in HR?

Payroll processes begin with the creation of a list of employees who are to be paid and should conclude with the recording of those charges. This procedure is widely complicated that requires the collaboration across different departments of a company.

What is payroll?

Payroll is the total compensation a business or company must pay to its employees after a set period of time or work. It’s usually managed by the accounting department or the HR.

What is a payroll summary?

Payroll summaries or payroll activity reports show an overview of the overall payroll activity of a company.

Completing payroll reports become more and more difficult as your company continues to progress. That’s websites such as ourselves exist, to provide assistance and just make your job relatively easy. Making sure that you can spend less time on payroll, and more time in developing your business.

Related Posts

FREE 19+ Sample Project Management Reports

FREE 18+ Production Report Templates

FREE 15+ Sample HR Report Templates

FREE 10+ Financial Status Report Samples

FREE 9+ Project Progress Report Samples

FREE 7+ Financial Summary Samples

FREE Sample Survey Reports

FREE 43+ Report Examples

FREE 31+ Payroll Samples

FREE 14+ Sample Project Status Reports

FREE 12+ Sample Construction Progress Reports

FREE 12+ Sample Performance Reports

FREE 10+ Research Progress Report Samples

FREE 9+ Sample Status Reports

FREE 6+ Sample Staff Report Templates