5+Small Business Expense Reports Samples

Expenses. We can’t get away from them. Business expenditures are costs incurred when running a business. Business expenses range from storefront rent to payroll costs for small businesses. Your costs influence whether you make a net profit or a loss during a certain time period. Since you know what corporate expenditures to deduct, you can be sure you’re not spending more than necessary. This is crucial for your small business, so you need a full-on and rigid report for your success. Need some help with this? We’ve got you covered! In this article, we provide you with free and ready-made samples of Small Business Expense Reports in PDF and DOC formats that you could use for your benefit. Keep on reading to find out more!

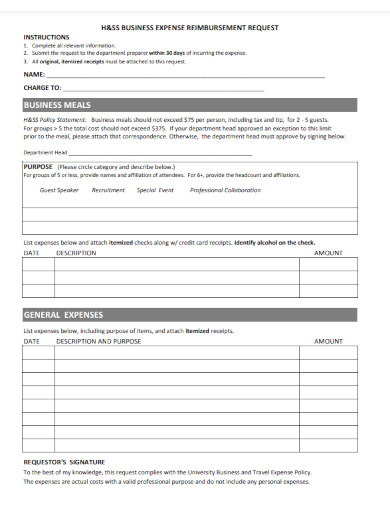

1. Small Business Expense Report

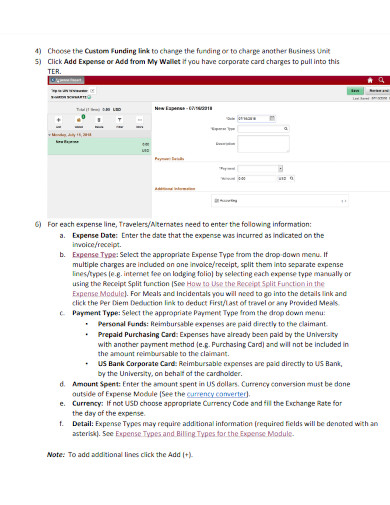

2. Small Business Expense Report Module

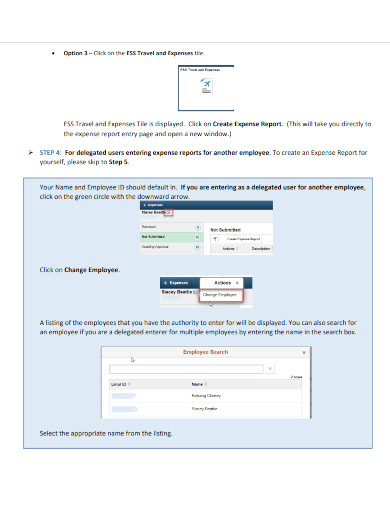

3. Creating Small Business Expense Report

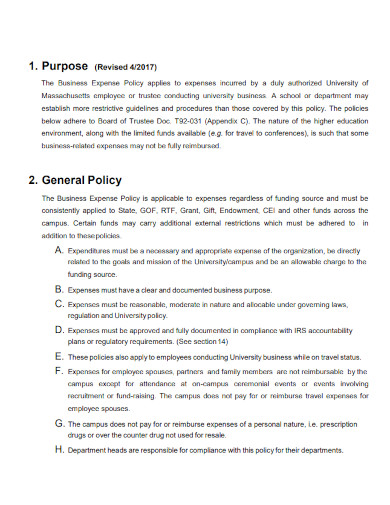

4. Small Business Expense Policy Report

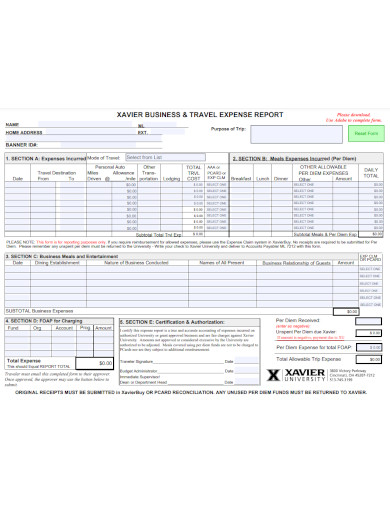

5. Travel Expense Reports

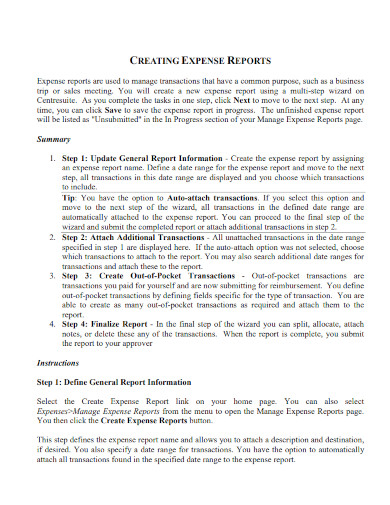

6. Creating Small Business Expense Reports

What Is a Small Business Expenses Report?

A new small business may not have a lot of costs to keep track of. However, when your business expands, so will your expenditures. You’ll need to keep track of your expenditures with an expense report. Expense reports reveal how much expenditure throughout the entire organization, a department, or on a specific project. Employees can also utilize them to get reimbursed for business-related costs. This report assists the employer or finance team in determining how much money was spent, what was obtained, and how much of the expenditure is eligible for reimbursement.

How to Make a Small Business Expenses Report

Ideally, cost management should begin with a review of expenditure report data. This aids in tracking your company’s expenditure over time by providing a clearer understanding about just how much funds are spent and on what. A Small Business Expenses Report Template can help provide you with the framework you need to ensure that you have a well-prepared and robust report on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, follow these steps below to guide you:

1. Select a program.

To create an expense report, you should use a expenditure-tracking software. Making an expenditure report from scratch may be time consuming. You’ll want to update to expense-tracking software as your business and quantity of costs develop to save time. Connect your company bank account so that expenditures are added as you go. Alternatively, you may use the matching app to picture paper receipts as you receive them.

2. Make changes to your columns.

Your columns should represent regular business expenditures. If you take clients out for coffee or supper on a regular basis, you’ll need a “traveling” column. A “vehicle commute” column is required if you use a vehicle for business purposes. This is required for companies to deduct certain expenditures and requires them to break down the totals by category.

3. Include itemized expenses.

Add each expense on a new line, making sure to provide as much information as possible. To guarantee proper tracking, make sure to mention the customer and project the spending is for. Enter your costs in chronological sequence, with the most recent expense at the end. Add the total of each cost, including tax.

4. If required, include receipts.

Employees who submit financial documents for compensation must include receipts to back up their claims. If you’re printing the expenditure report, tape the receipts to printer paper and photocopy them so you may save the originals. Even if you’re a business owner who creates an expense report to track spending, you’ll need to maintain your receipts or invoices.

FAQ

What are the monthly costs of running a business?

Wage, Salary, Payroll, and Benefits are all terms used in the workplace. Office Supplies and Other Expenses Professional charges. Costs of advertising and marketing

Is food an expenditure for business?

When traveling for business, attending a corporate event, or entertaining a client, meals are tax-deductible business expenses.

What are the four sorts of small businesses?

The four primary forms of business organizations are sole proprietorship, partnership, corporation, and Limited Liability Company, or LLC.

Budgets are critical to the proper operation of any firm. Detailed and precise spending reports aid in the development of a solid and well-informed financial strategy for your organization’s future. To help you get started, download our easily customizable and comprehensive samples of Small Business Expenses Reports today!

Related Posts

FREE 9+ Employee Payroll Report Samples [ Active, Balance, History ]

FREE 12+ Sample Company Reports in MS Word Google Docs ...

FREE 15+ Restaurant Report Samples in MS Word Google Docs ...

FREE 9+ Sample Business Analysis Reports in PDF MS Word ...

FREE 13+ Sample Feasibility Reports in MS Word PDF | Google ...

FREE 7+ Sample External Audit Reports in MS Words Pages

FREE 5+ Small Business Payroll Statement Samples in PDF

FREE 10+ Monthly Business Report Samples [ Development ...

FREE 12+ Retail Income Statement Samples in PDF MS Word

FREE 6+ Construction Profit and Loss Samples in PDF

FREE 12+ Income & Expense Worksheet Samples in MS Word MS ...

FREE 5+ Marketing Business Report Samples [ Digital, Operations ...

FREE 10+ Monitoring a Budget Samples in PDF MS Word

FREE 10+ Small Business Worksheet Samples in MS Word MS ...

FREE 9+ Quarterly Report Samples in PDF MS Word