All of us needs a shelter to live in and raise a family. We call this shelter a home. It is considered as one of the basic needs of humans, but even with that being said, it is still very difficult to buy one that you can call your own. With the housing business in boom right now and a lot of developers racing through every land sale contract they can get, the prices of these homes just shoot up to an all-time high. You’d probably ask yourself if you can really afford a home.

Because the demand is high and a lot of people are looking into ways on how they can afford buying their own homes, home affordability calculators are made available and accessible for everyone. These calculator spreadsheets will help you find out if you can really afford a home and what type of home would that would be. You are also welcome to browse through other sample spreadsheets on our website.

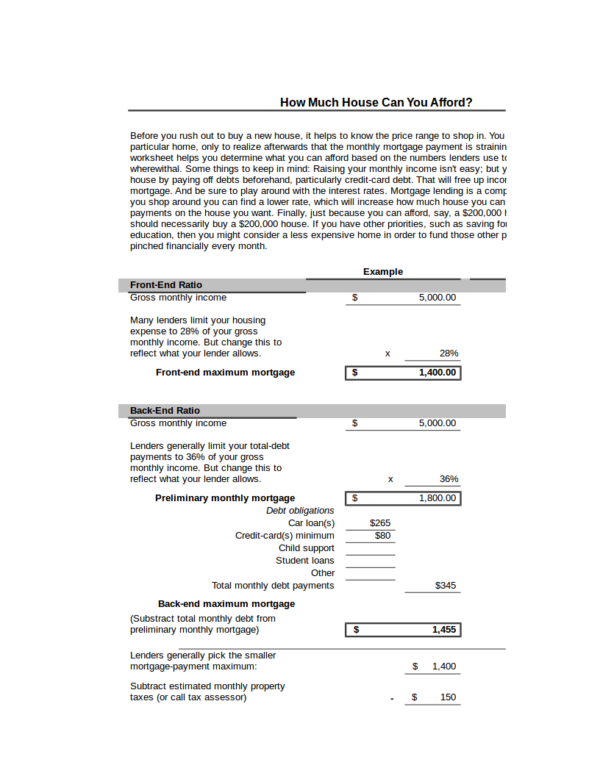

Home Affordability Calculator Template from Journal

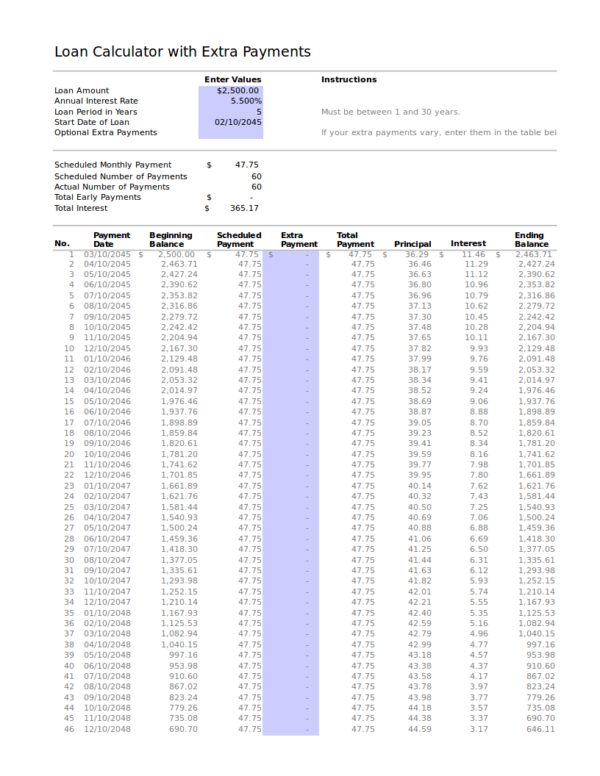

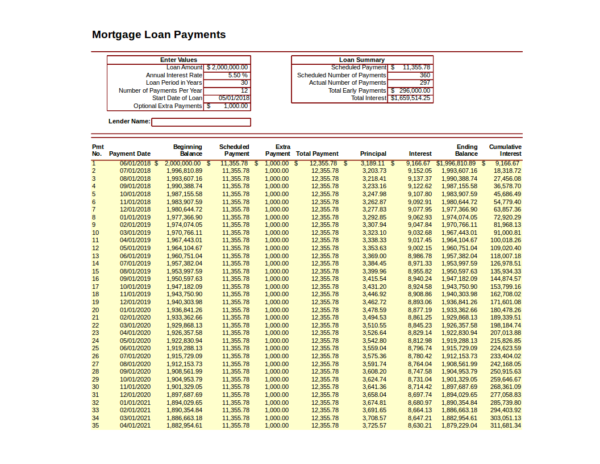

Home Loan Calculator With Extra payments

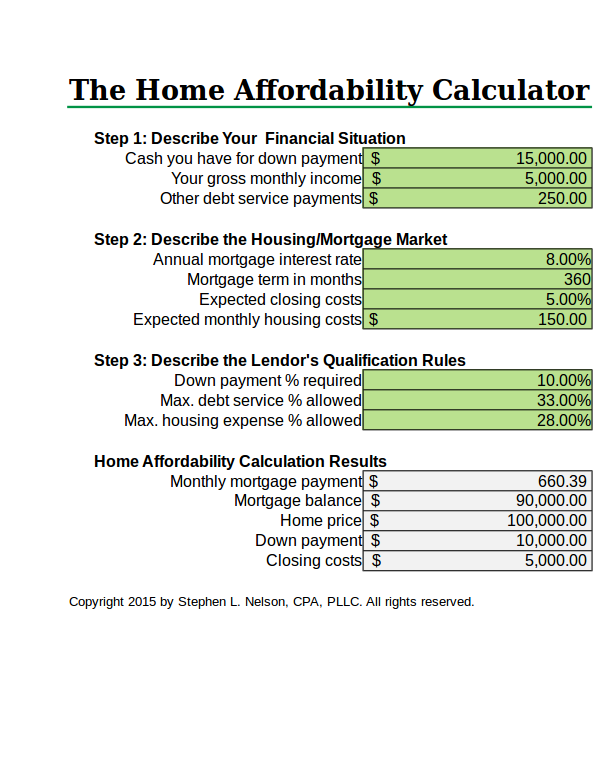

Home Affordability Calculator with Instructions

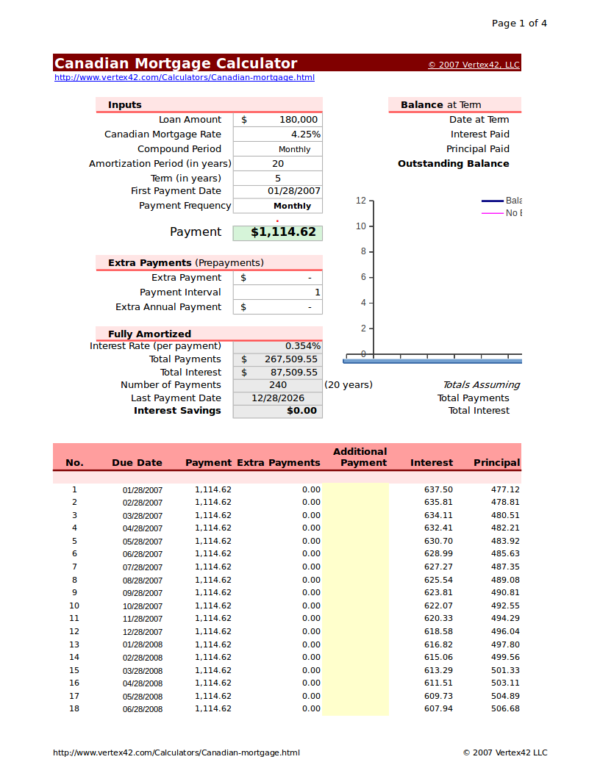

Canadian Home Affordability Calculator

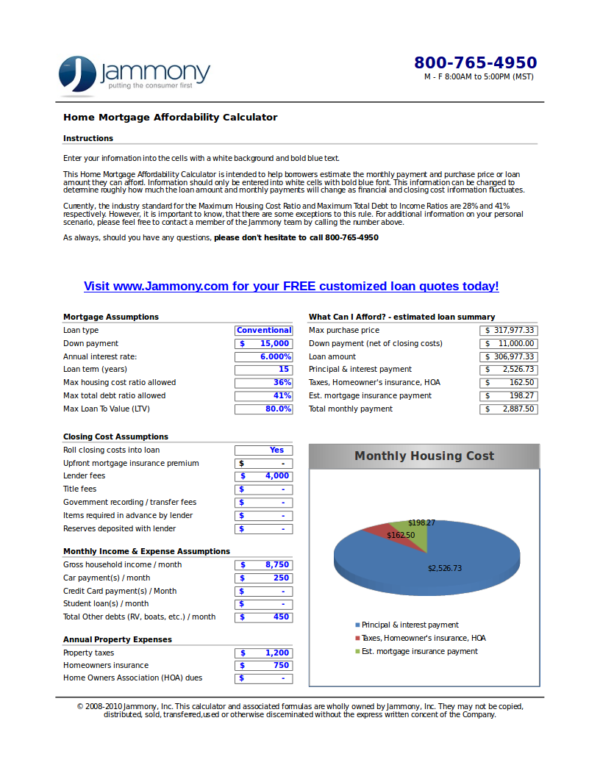

Home Mortgage Affordability Calculator

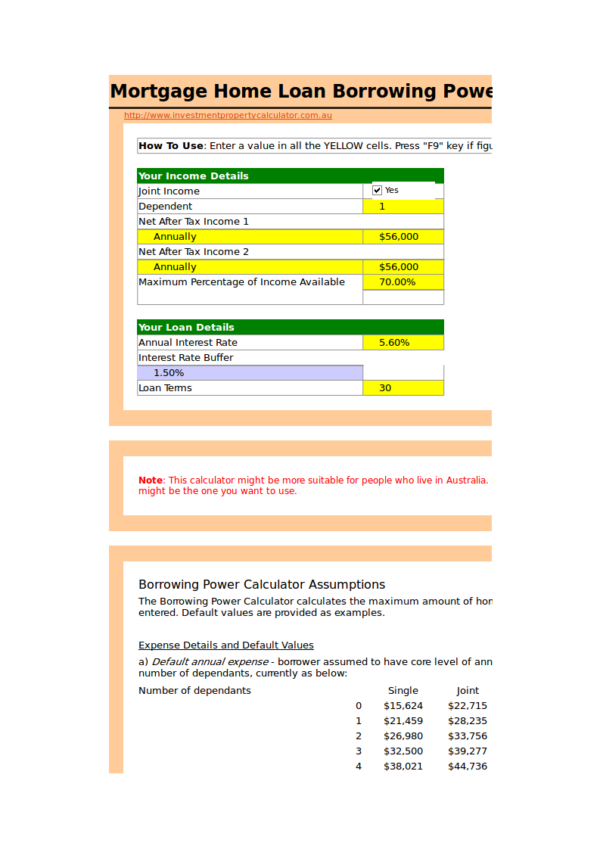

Home Loan Borrowing Power Calculator

What Is a Home Affordability Calculator?

How will you know if you can afford to buy a house? There are three ways on how you can actually have that done. You can consult a real estate agent to help you tailor fit which house can fit in to your general budget. You can also check with your bank about their home loan offers, how you can qualify, and if you can afford a home loan based on your income. Another way is to use a home affordability calculator. It is the easier and most convenient way for anyone to determine if they can afford to buy a home or not.

A home affordability calculator can be a calculator spreadsheet or an online calculator that is used to do the various complex calculations needed to determine if you can afford to buy a house based on a income. This tool is very easy to use because you mainly need to copy, paste, and type in the needed data in their appropriate fields. Below are some of its uses. You may also see financial calculator samples.

1. It is used to calculate the type of house that one can afford based on the income they are earning. It can also provide the estimated amount or value of the house that they can comfortably buy with the earnings they have.

2. A home affordability calculator can also be used to store and organize data so that the result of the calculations will look presentable. Since data can also be stored in it, making changes will also be easy as they only need to change the information that was changed.

3. Data can be easily analyzed if it is in tabular form, which is what most home affordability calculators are made with.

4. It is used to determine how long you will need to pay for a house based on a particular amount.

Other useful calculator samples and templates you might be interested in are net worth calculator samples and templates, paycheck calculator samples and templates, and sample monthly expense calculators.

Why Is It Important to Determine If You Can Afford to Buy a House?

It is important that you know what you are up to especially when it comes to buying a home because such feat is never something to take lightly. And if you still don’t know, here are some reasons why it is important to determine if you can afford to buy a house. You may also see marketing calculator templates.

- Buying a house without finding out if you can afford it or not is just like doing something without a plan. You will never be able to prepare and defend yourself for whatever it is to come.

- Finding out if you can afford to buy a house or not helps you decide if you are ready to take on this big challenge. You may also like sample credit card payment calculators.

- It helps you prepare yourself mentally and financially for what it is that you will be facing before you actually take on this big responsibility. Buying a house is not only costly, but it is also a mentally and financially draining situation if purchasing one has not been planned properly. You may also check out sample income tax calculators.

- If for some reason you still can’t afford to buy a house, especially the one you have been wanting to buy, then this allows you create a plan on how you will be able to acquire that house in the future.

- Because you know how much you will need to buy a house but still live comfortably, you will know what you are going to aim for to have this done. You may also see retirement withdrawal calculator samples.

- It helps you determine what type of house your household can afford to buy, how big the house is, how many rooms, in what type of community, and how long do you need to pay for it.

- It also tells you how much you can loan from the bank, the amount you need to take care of for the property, and how much your home mortgage would be.

Keeping these reasons in mind will guide you through successfully deciding on when to buy a home and what home to buy without taking any unwanted risks. To know more about purchasing a home and how much it would cost you, here are some related topics that would be perfect for your needs. They are mortgage amortization spreadsheet samples, mortgage deed samples and templates, and mortgage statement samples and templates.

Australian Home Affordability Calculator

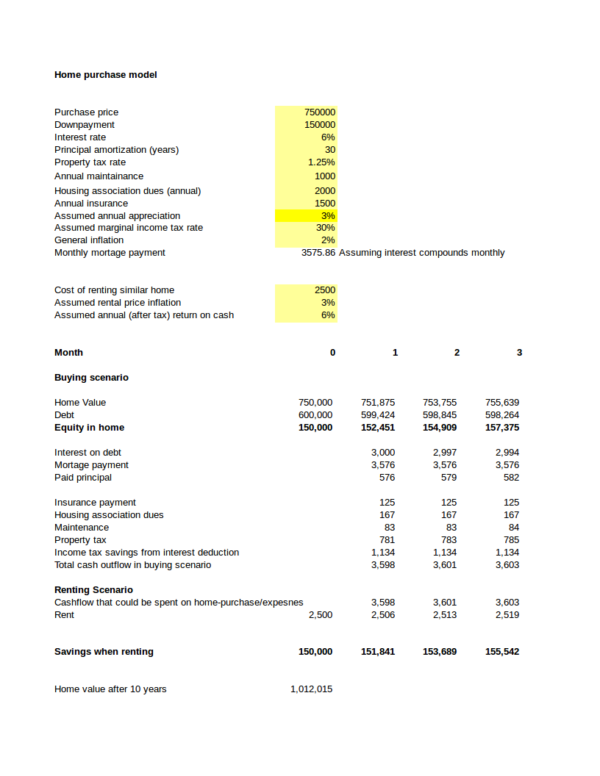

Home Buying Calculator Template

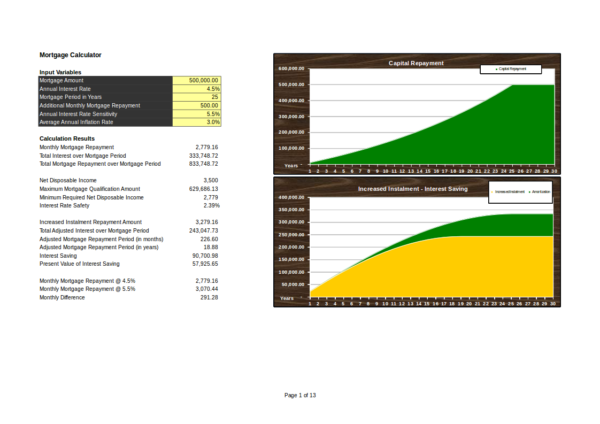

Home Loan Amortization Calculator

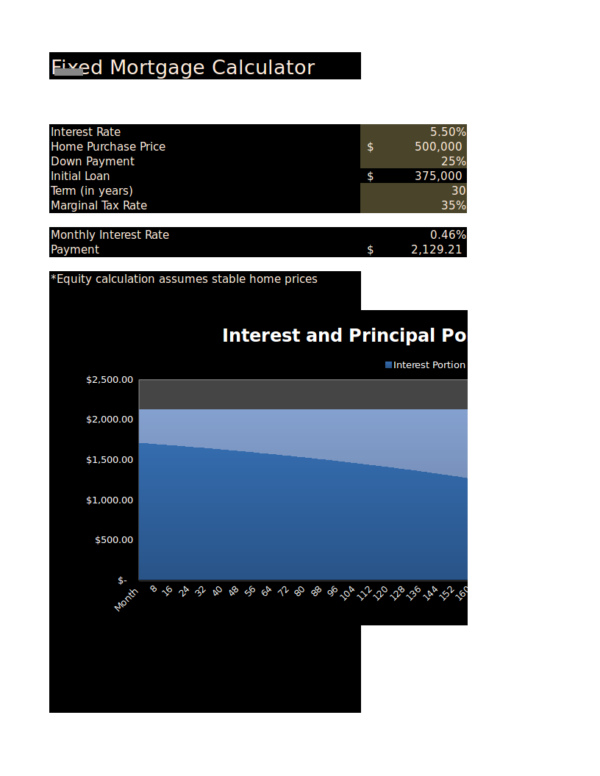

Fixed Home Mortgage Calculator Template

How to Use a Home Affordability Calculator in Excel

There are a lot of home affordability calculators right now that can be used for free and all of them provide the same accurate results, which varies depending on some factors and the date that you have entered to it. It is pretty easy to use a home affordability calculator or an Excel mortgage calculator if you are well-versed with Excel sheets. But for those who are not that familiar with it, here are some easy-to-follow steps that can help you.

1. Download the home affordability calculator of your choice

You can use any home affordability calculator that you prefer. There are a lot of Excel calculator spreadsheets available online and most of them are free. There are calculators that also calculate extra payments such as a mortgage calculator extra payment, and there are also those that help you calculate your payments for an entire year just like an annual payment calculator.

2. Open the calculator and check it

Well, some of these calculators may or may not have what you are looking for, so before you start with anything else, open the calculator spreadsheet to check out if it is what you need. If it is, then proceed to the next step. If not, then look for another one that you would prefer using.

3. Gather all the data required to get accurate results

Once you have landed on the calculator spreadsheet of your choice, take note of the data required to do the calculations. You may write all of them down on the same sheet so that you can just look at the same sheet and find them all in one place. You may also like paycheck calculator samples and templates.

4. Enter the gathered date into the appropriate fields

Now that you have all the data that you need, it’s time to transfer them to the home affordability calculator spreadsheet you have chosen. Enter the required data on their appropriate fields one by one. Make sure that you enter the data carefully because even the tiniest mistake can give you a disastrous result. You may also check out payment calculator mortgage samples.

5. Check the details of the computation

After entering all the data in the right fields, the calculator will automatically do the calculations in a matter of seconds. This is made possible with the pre-programmed formula on each cell on the simple spreadsheet. Everything that you see on the spreadsheet is the information you need to determine if you can afford that home.

6. Change the entered data into a different value

If you want to check other possibilities and change some of the data you have entered, you can easily do so by clicking on the cell whose data you wish to change and directly type in the new data you want to enter. To edit the cell instead of entirely changing the content, you can double click on the cell. You may also see hours worked calculator samples.

7. Save your work when you’re done

You can save everything that you have entered into the sheet so that when you open it again to review or make revisions, you will still see the same data and calculations. You can still change everything by then even if you chose to save the entered contents. You can also close the Excel application without saving anything so that when you open the sheet, everything will be blank. You may also like sample time card calculators.

It’s that easy to use a home affordability calculator and you don’t have to download a new one every time you want to use one because you can have it edited any way you want to.

What You Should Know before Buying a House

While buying a home would be a good financial investment, it is also a big financial responsibility at the same time. Some may be able to afford one or they may not. So before finally deciding that you want that house, you should definitely know the following:

1. Purchasing a house always comes with a contract

It could be a house sale contract or a mortgage contract. These contracts will bind you to the transaction and will hold you responsible. But before you get yourself tied up, remember that a contract is negotiable and that you can talk about some changes that you wish to be done on the contract. Never settle for a contract that is only favorable to the seller’s side.

2. Consult a trusted realtor

A lot of people would avoid getting a realtor when buying a house because they just make the prices jack up to who knows how much. Instead of saving, you end up paying more than you have to. But considering to get advice from a realtor can definitely help you decide on which house to buy. You just need to make sure that you talk to someone who is reliable and trustworthy. You may also see printable overtime calculator templates.

3. Don’t just think of the fixed price of the house

You may be able to afford the house, but how about the other fees that are not part of the mortgage? It will cost you to pay for homeowners membership, to do the regular maintenance of the house, and other taxes and fees you need to take care of. You should also have those things considered. You may also like sample net pay calculator templates.

4. Can you afford that house?

If you think you can only afford to buy this kind of house on this monthly payment then you should really believe in yourself. Mortgage companies may think differently though and you may be surprised at how much they think you can afford. You know your income and expenses, which means you know what you can actually afford. You may also check out monthly budget calculator templates to download.

5. Planning to renovate the house after purchasing it? Think again

If you buy that house, make sure that it’s the one you want and not because you want to change that particular room or area. It will only cost you more and will add up to your expenses.

6. Spare something for yourself and family

Don’t go all out on buying a house. Leave some for yourself so that even if you are paying for something big, you can still enjoy every day and live comfortably. You may also see loan calculator Excel samples.

7. Plan and look into the future

Are you planning to stay for long in the company you work in? Do you have a stable job right now? Ask yourself these questions as they may be the source of your troubles in the future.

8. Owning a home is not for everyone

While a home is one of the basic humans needs, it doesn’t really mean that everyone has to buy one. Sometimes renting or leasing is more reasonable than buying a house. There are people who work in different locations and some who prefer to be always on the move. Rental agreement contracts or a lease contract are more preferable choices, and they also seem like a more practical thing to do.

Keep these things in mind before you ever decide on buying a house. If you have considered everything, then that is the time you can finally say you are ready. Now, you don’t have to rely on a single source. You may learn more about home affordability and mortgages by checking out other related topics. They are mortgage agreement contracts samples and templates, sample mortgage release forms, and house sales contacts samples and templates, to name a few.

Related Posts

Timetable

Training Evaluation Forms

Acceptance Speech

Scientific Reports Samples & Templates

Attendance List Samples & Templates

Sample Meeting Minutes Templates

Presentation Speech Samples & Templates

Ukulele Chord Chart Samples & Templates

Retirement Speech Samples & Templates

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples