The top richest man in the world are not celebrities or stars, but they are simple businessmen who did extraordinarily in business. According to forbes.com, Bill Gates’s net worth amounts to $90.3 billion, Jeff Bezoz with $119.8 billion, and Mark Zuckerberg with $74.7 billion dollars. This makes them one of the richest men in the world. You may also see time card calculators

Where did all these numbers come from and how did they manage to get that much money? The richest men in the world are ranked based on their net worth. A person’s net worth is measured by certain factors and with the use of a net worth calculator. Knowing your net worth is important in a lot of things and is definitely to your advantage. You may also like savings account calculators

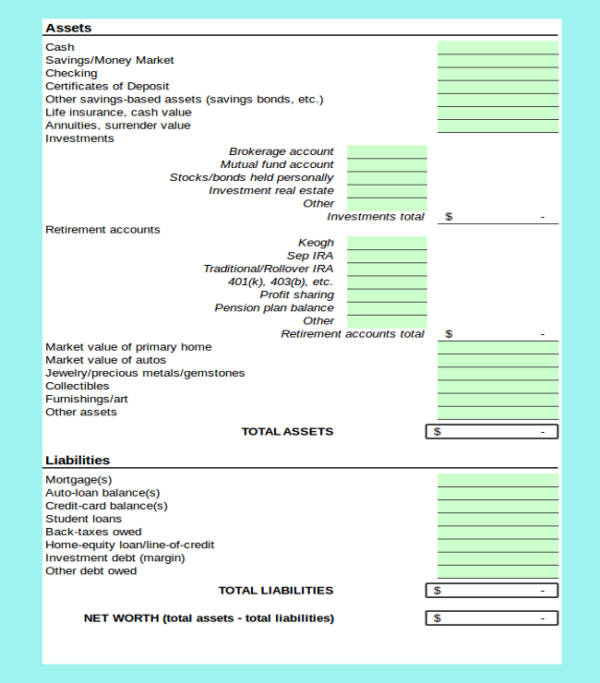

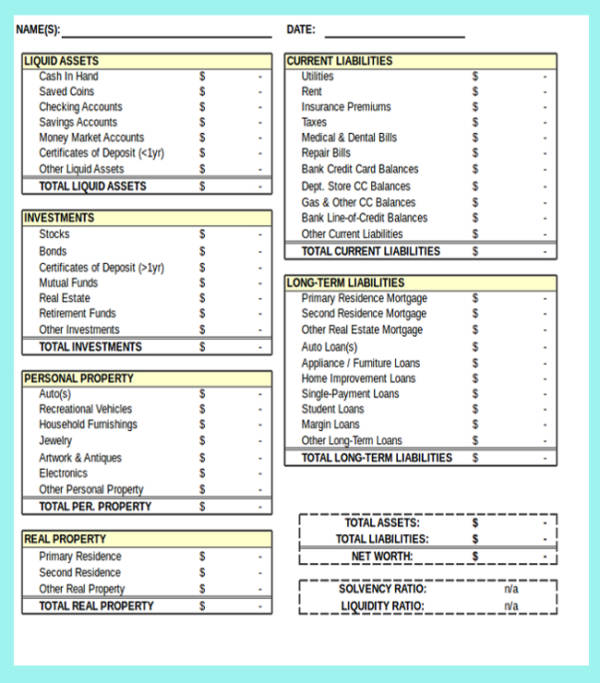

Net Worth Calculator from Journal

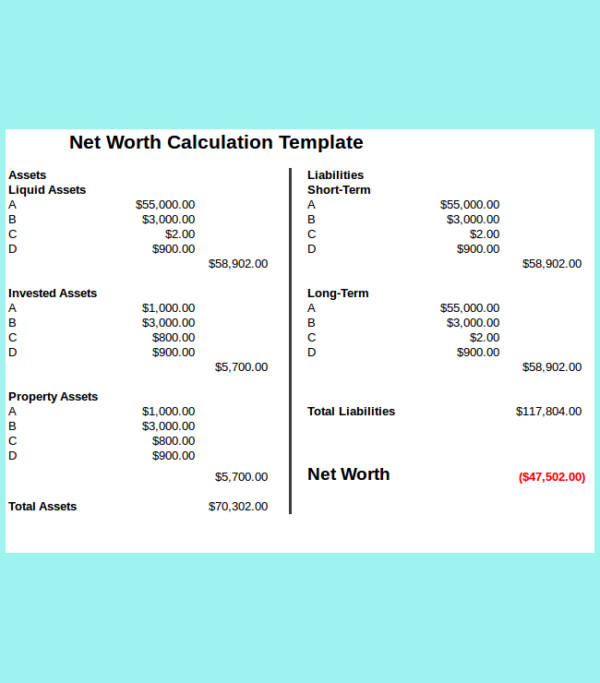

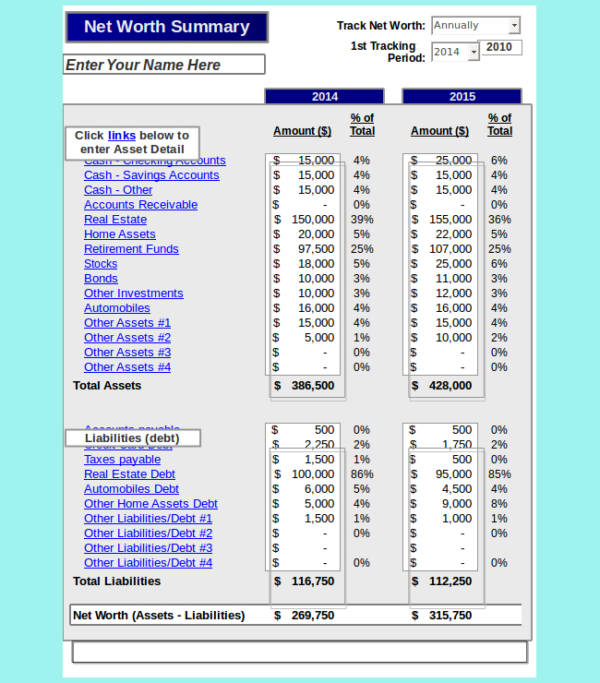

Spreadsheet for Net Worth Calculation

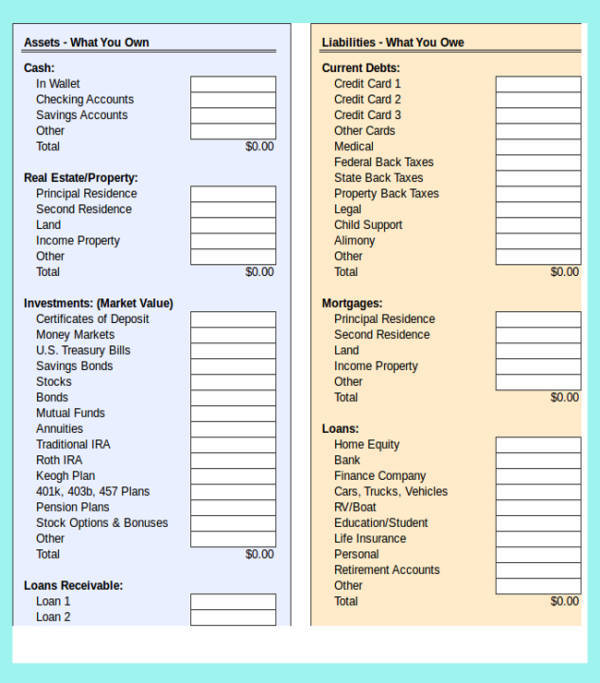

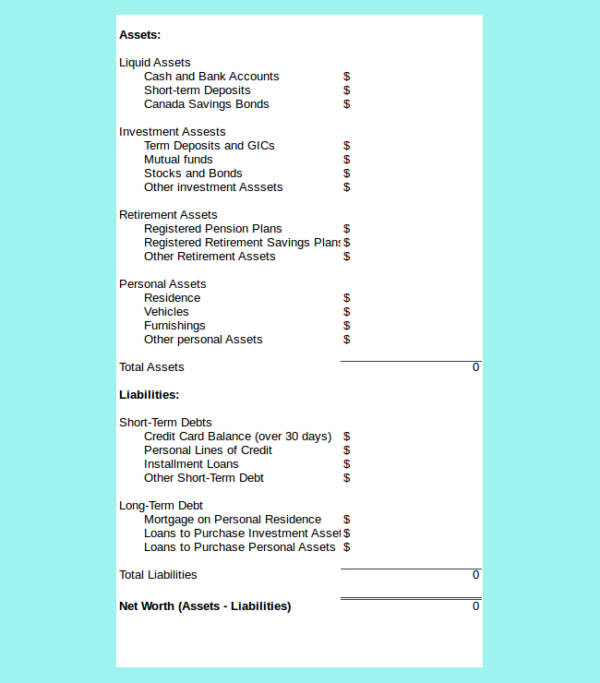

Free Net Worth Calculator for Americans

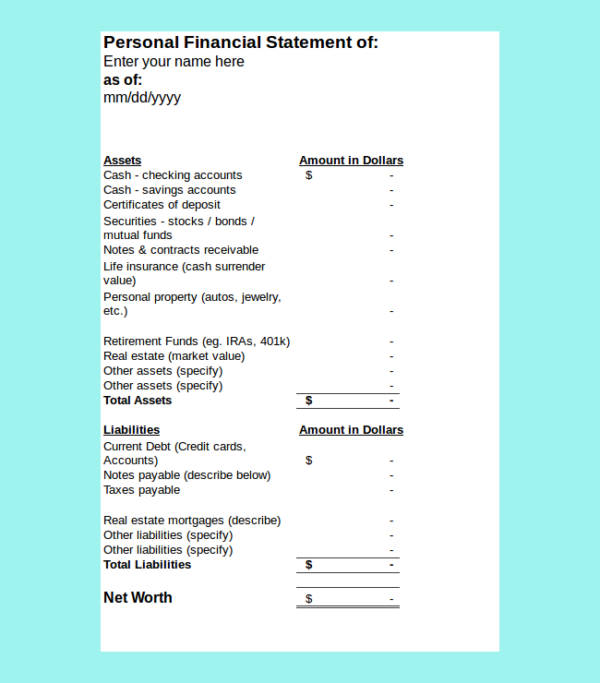

Personal Net Worth Calculator with Net Worth Tracker

What Is Net Worth?

What is your worth? How valuable are you? We often hear these questions being asked in conversations that are about love and life. I know you get what I mean. Well, a net worth is nowhere near those cheesy stuff and all about love. A net worth is a term used in accounting, businesses, and the corporate world that refers to the monetary value of an individual or a person. Why would you want to know the monetary value of a person? That is just so prejudiced! Some of you might think this way. But no, it’s not prejudiced. In the corporate world or business industry, the net worth of a person is one of the basis or criteria for them to be doing business and also an opportunity for some to expand their business. You may also check out hours worked calculator

A person’s net worth is determined by adding up all of their assets and subtracting all of their liabilities from it. The difference would be the amount or value of that person. A simpler way to understand how a person’s net worth is calculated is by adding up the value of everything they own and subtracting all of their debts from it. You may also see retirement withdrawal calculator

A net worth is not only applicable to individuals but also to companies or businesses. It also allows you to determine the financial standing or position of a person or business through their net worth. If there is a constant increase in one’s net worth, then that means that they have more assets than they have debts. On the other hand, the decrease in one’s net worth means that they have more liabilities than their assets. This is a sign of financial problems. You may also like retirement and savings calculators

What Are Assets and Liabilities?

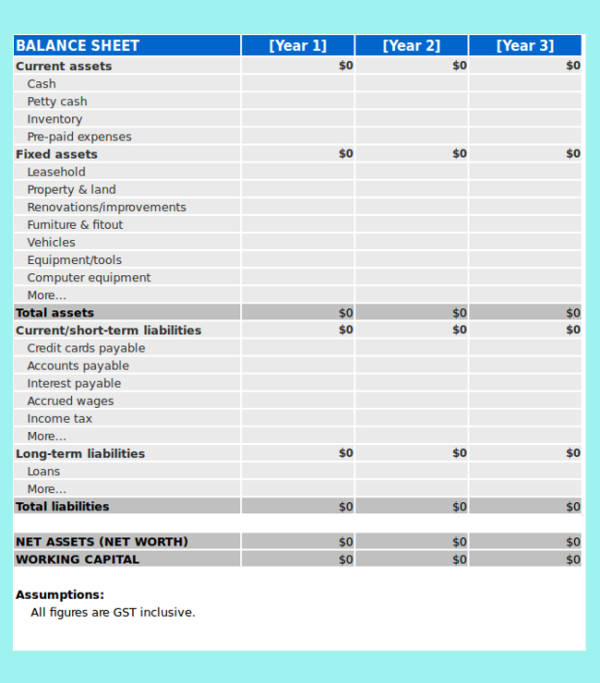

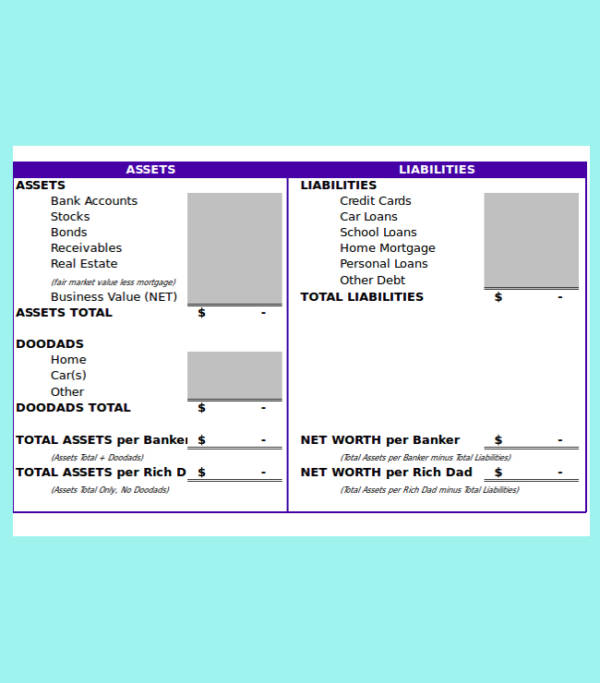

A person’s or a company’s net worth is determined by their assets and liabilities. As mentioned above, to get the net worth, one’s assets are added and then all of their liabilities are taken out from it. The answer or the difference is the person’s net worth. But what really are assets and liabilities?

Assets are defined as the things that a person or a company owns that is of financial value. Assets are divided into three categories and they are current assets, non-current assets, and investment and income producing assets. You may also check out budget calculators

1. Current assets

It refers to the assets that an individual or company owns that can be turned into cash or money that does not depreciate or lose any value. Examples of current assets are savings accounts, cash, tax refund, term deposits, and money owed to you, like a loan. You may also see timesheet calculators

2. Non-current assets

These assets are mostly those that are tangible or things that you can touch. Examples are properties, such as a house, car, and furniture. These assets can be sold at a certain value if you need to use the money. You my also like credit card payment calculators

3. Investments and income producing assets

As the name suggests, these assets are what’s generating you money or where you get your income. Some examples are your shares and investments in different companies or businesses.

Liabilities can simply be defined as the money you owe or your debts. This includes your credit card bills, service bills from different service contracts, mortgage balance from your mortgage contract, loans coming from your loan contacts, and any unpaid business taxes.

Personal Net Worth Calculator

Detailed Net Worth Calculator with Introduction

Sample Net Worth Calculator with Chart

Sample Net Worth Tracking Calculator

Long Term Net Worth Calculator for a Happy Retirement

Net Worth Calculator for Business

Net Worth Calculator and Personal Financial Statement

Why Is It Important to Calculate Your Net Worth?

It is said that a person’s value is not measured or cannot be measured by how much money they have or how many businesses and properties they own, but who they are as a person. While this sample statement is true, it is not at all the primary concern when it comes to business and the economy. In the business industry, the wealthier you are, the more valuable of a person you become. This makes calculating your net worth important, whether you are trying to become one of the richest personalities in the world or if you just simply want to keep up with your market value.

1. Calculating your net worth makes you aware of the direction you are moving into in terms of finances. Through your net worth, you will be able to know if you are financially healthy or if you are having financial problems. This is because you will be able to check all of your assets and at the same time also take a look at your liabilities. It is easy for an average person to take note and take care of their debts, but it is different when it comes to businesses or people who are earning a huge amount of money. Because they have a lot, chances are they also spend a lot without noticing that they overdid it. You may also see paycheck calculator

2. Calculating your net worth allows you start your financial plan. Because you know how much you have and how much you really are earning, you will be able to make sort of long-term financial plans that you can use to your advantage. These plans can be income-generating plans for your future or for a temporary cause.

3. Calculating your net worth lets you know the amount of money that you have. Not all of your assets are in cash, but in order to compute your net worth, you will need to determine its current monetary value. You can sell any of your assets. In other words, they are as good as cash. You may also like time card calculator templates

4. Calculating your net worth holds you accountable for your actions. Well, we are referring to one’s earning and spending actions. Owing your net worth helps you keep track of how much you have been earning and how much you owe from other people or businesses. This is a great way to keep your expenses and earrings organized. You may also check out financial calculator samples

5. Calculating your net worth keeps you motivated. Your net worth changes depending on your attitude toward earning and spending. If you earn a lot and save a lot, then your net worth will continue to increase over a period of time, and that will motivate you even further. You may also see debt reduction calculator

Benefits of Using a Net Worth Calculator

We want to make tasks simple and easy, that is why a lot of things were created so that we may live better lives. It might not be a physical thing that you use to clean the house or do the laundry, but a net worth calculator is sure to make your life better. How? We have listed some of its benefits below.

1. A net worth calculator allows you to easily compute your net worth. With just the asset and liabilities being said, it is easy to think that computing one’s net worth is a piece of cake. What most people don’t know is that there are a lot of things that needs to be gathered when computing one’s net worth. With a net worth calculator, you won’t have to look for all those things. All you need to do is gather the equivalent value of those required things and it works just like home mortgage calculators and paycheck calculators.

2. A net worth calculator keeps you organized and updated with your assets and liabilities. Since you will be gathering the value of your assets and liabilities, you will be updated of what is going on with those things as well as other market values of other things that are related to you. You will definitely know where you stand. You may also like inflation calculators

3. A net worth calculator makes it easy for you to determine and gather important information to compute your net worth. The list of the things that you need to gather is already provided for you so you don’t have to go rummaging through books or look them up on the Internet. You may also check out

4. A net worth calculator enables you to compute accurate net worth results. Most net worth calculators are online calculators and others are different simple spreadsheets. All the necessary formula that you need are programmed or formatted to those sheets, which ensures that your computations are accurate. This is better than any manual computation.

5. A net worth calculator is easy to use and hassle-free. All that there is left for you to do is know the value of your assets as well as the value of your liabilities and have them entered into the appropriate fields or cells in the blank spreadsheet.

6. A net worth calculator allows you to save time. You don’t have to do any manual computations and you are definitely not required to do it. That means you can save a lot of time. Manual computations can be laborious, especially when a lot of numbers, mostly large numbers, are involved. You may also see car loan calculators

7. A net worth calculator is very accessible. There are a lot of net worth calculators that are available online for free, so getting hold of them would be a fairly easy thing to do. Just type in the keywords “net worth” or “net worth calculator” and it will show you a lot of websites to choose from. You may also like payroll tax calculator templates

Online calculators and spreadsheets are truly blessings in disguise. At first, they may appear difficult and so much hassle, but once you know how they work and how to use them, only then will you know that they are useful. Other calculators that you might be interested in are monthly expense calculators, annual payment calculators, and retirement withdrawal calculators.

Related Posts

Timetable

Training Evaluation Forms

Acceptance Speech

Scientific Reports Samples & Templates

Attendance List Samples & Templates

Sample Meeting Minutes Templates

Presentation Speech Samples & Templates

Ukulele Chord Chart Samples & Templates

Retirement Speech Samples & Templates

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples