Retirement refers to one’s withdrawal from work either voluntarily or involuntarily. There are various reasons why people retire from work, but the most common reasons are old age and health problems. If you are no longer working, that means that you are no longer making money or earning a living. Well, you just can’t have other people take care of your needs for you, and money does not show up like magic. You may also see printable overtime calculator templates.

While you are still young and able, as early as now you need to save up for your future and for your retirement. A retirement calculator will help you easily calculate how much you need to set aside for your retirement in the future. Although you may have benefits that you claim and use at that time, relying on it alone might put you in a difficult situation someday. That is why it is always best to have a backup plan. You may also like sample net pay calculator templates.

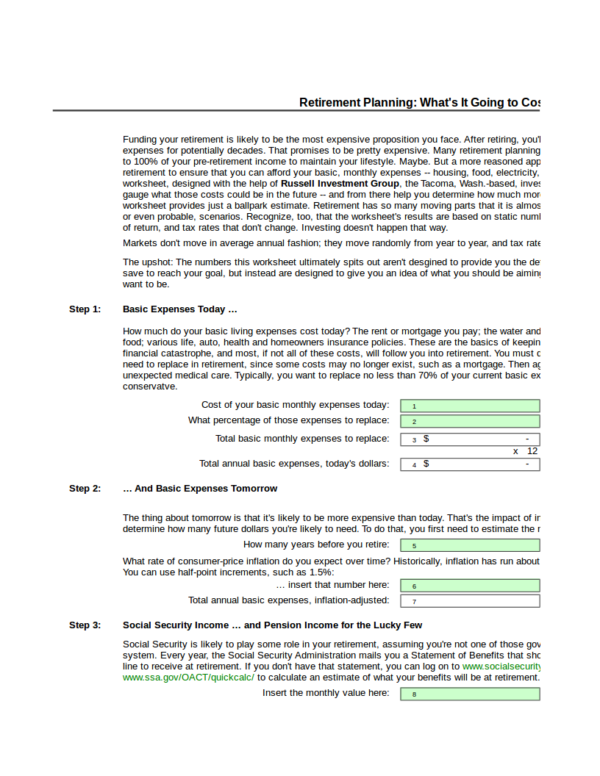

Retirement Calculator Template from Journal

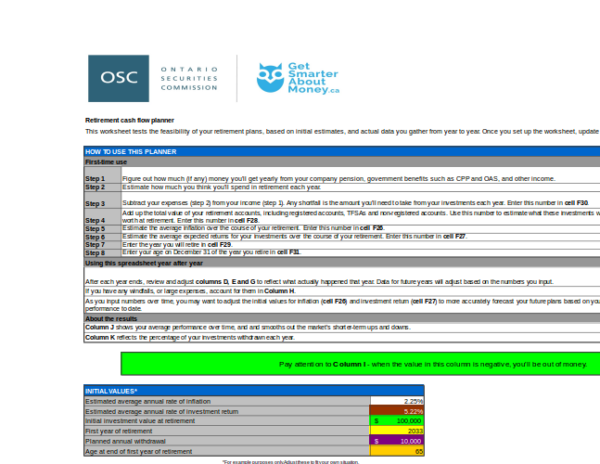

Retirement Cash Flow Calculator

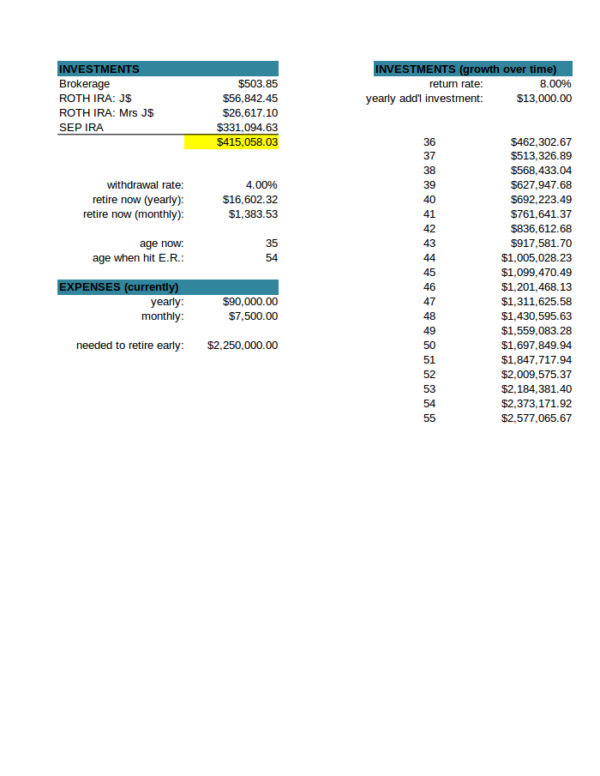

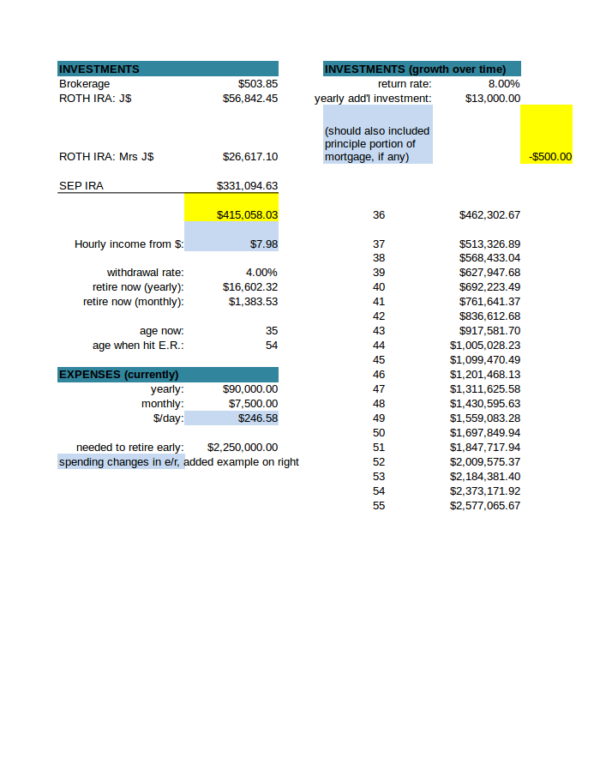

Early Retirement Calculator Spreadsheet

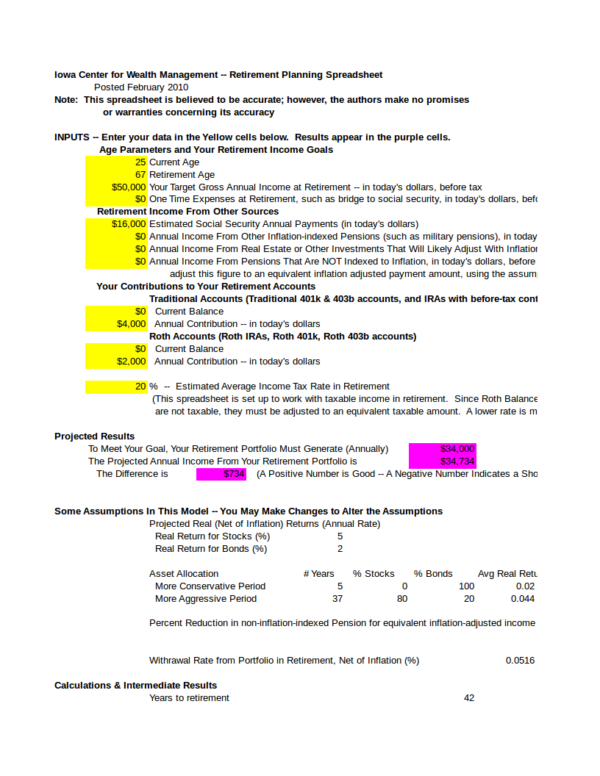

Retirement Planning Calculator

Free Calculator Template for Early Retirement

What is a Retirement Calculator?

A retirement calculator is a very useful tool that can help you set aside enough amount of money from your earnings so that you can have some money left for you to spend when you retire. A retirement calculator will aid you as you plan for your retirement. Even if you are young and able, you should plan for your retirement in the future. With its use, you will be able to calculate the amount that you need to set aside for your retirement, either on a monthly basis or annual basis. It also helps you become up to date on your social security benefits other retirement plans. It is very convenient to use as a lot of retirement and savings calculators are available online and some of them are also downloadable. On top of that, there are different retirement calculators that you can use for free!

Terminologies Used in Retirement Calculators

Retirement calculators are pretty easy to use, but you might just get a little overwhelmed with the terms used in it. To help you with its use and understand the things that you can see in it, here is a list of the terms that you can commonly see in one. You may also see monthly timesheet calculators.

1. Current Age – This is the user’s or individual’s current age or actual age by the time they are using the calculator.

2. Age of Retirement – There are people who wish to retire early and there are also those who wish to retire at a later time. The retirement age required here is the age by which one wants to retire. Some calculators would assume that you are not earning anything thus you have no contributions on the year of your retirement age. This depends on the retirement calculator you wish to use, so you should check out such details. You may also like sample retirement withdrawal calculators.

3. Total Household Income – This refers to how much your entire household is earning annually, including the income of one’s spouse if they are married.

4. Current Savings for Retirement – This includes other savings plans and benefits that you have set aside for your retirement, which includes your 401(k). 401(k) is the retirement savings plan that your employer has sponsored for their employees to let them save and invest their salaries before taxes are taken out of it. You may also check out employee timesheet calculator.

5. Annual Retirement Savings – Your annual retirement savings amount depends on how you much you have set aside or the percentage of your annual income that you have saved for your retirement. You also need to include your employers’ sponsored contributions and other retirement accounts. You might be interested in timesheet calculators.

6. Years of Retirement Income – This refers to the number of years by which you will be using the income you have earned from your retirement.

7. Return Rate Before Retirement – It refers to the return rate you get annually from your savings and other investments before you go into retirement.

8. Return Rate During Retirement – This is the return rate you get annually from your savings and other investments during your retirement. You may also see sample biweekly timesheet calculators.

9. The Expected Increase in Income – This is the increase in your household income that you expect to have annually or every year until your retirement.

10. Required Income at Retirement – This is the amount that you think is necessary or the amount that you see is enough for your entire household on your retirement.

11. Marital Status – One’s marital status can greatly affect the result of the calculations. This is because married couples are provided with higher or more social security benefits than single salary earners. And married couples with a non-working spouse also increases the benefits that one can get for retirement. You may also like sample work timesheet calculators.

12. Social Security Benefits – You can choose to include your Social Security benefits in calculations or not so that you will know how much you can actually expect and get when you retire. But this part is optional.

Want to get familiar with the different terminologies used in different retirement calculators? Then you might want to check out some sample retirement withdrawal calculators available on our website. The variety of samples that you can view and download will greatly help you learn the terms that are included in each calculator.

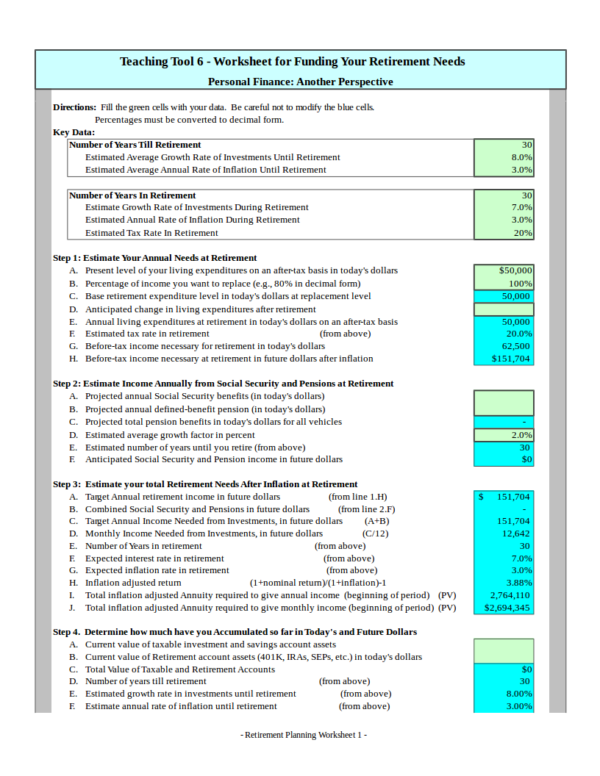

Calculator Template for Your Retirement Needs

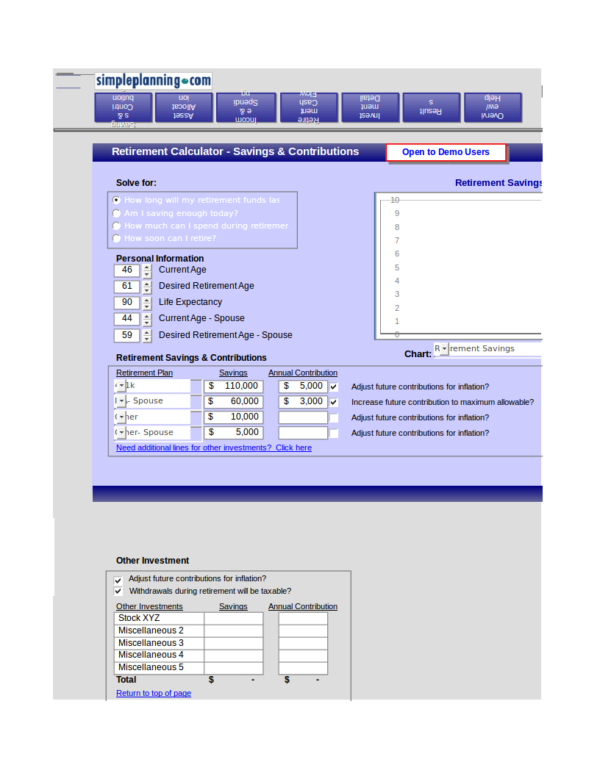

Retirement Calculator and Planner

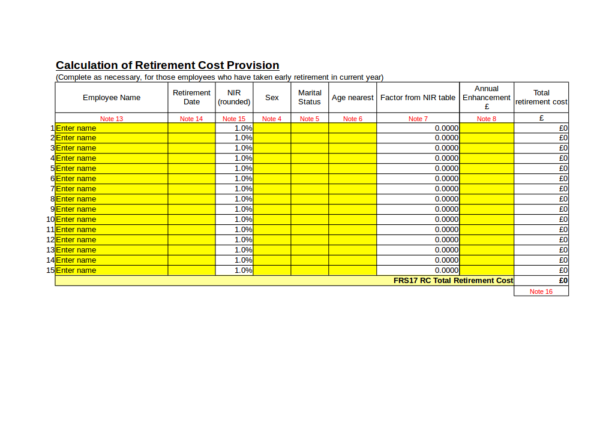

Early Retirement Provision Calculator

Federal Retirement Calculator

Uses of a Retirement Calculator

Aside from helping you do the calculations on how much you need to save from your earnings, a retirement calculator still has a lot of uses other than that. We have made a list below of the uses of a retirement calculator that need to know. You may also see sample monthly expense calculators.

1. A retirement calculator is used to help individuals easily create their retirement plans. The calculator can quickly and accurately calculate one’s retirement savings and expenses by just entering the data needed. No need for formulas or special skills. You may also like sample monthly time sheet calculator templates to download.

2. Through a retirement calculator, it is easy for any individual to take a look or view their retirement savings balance as well as keep track of whatever withdrawals that they have made for a particular period of time.

3. It allows you to calculate how much you are able to save for retirement based on the monthly income or annual income. You may also check out sample timesheet calculators.

4. It lets you become aware or informs you of certain factors that will increase your social security benefits, which will help you plan appropriately on how to best take advantage of it without doing illegal things.

5. A retirement calculator helps you calculate how much your annual expenses will be when you retire. This will help you budget your expenses accordingly so that you will not go beyond how much has been allotted by your retirement savings. You might be interested in monthly budget calculator templates to download.

6. It provides you with a visual report, such a chart or a diagram of what the trend of your savings and withdrawals, making it easy to understand.

7. You can also include the earnings that you get from other sources or investments, as part of the items to be calculated in your retirement calculator. Not only does this help you save more, it also helps you keep track of those investments. You may also see sample hourly timesheet calculators.

Calculating large numbers could be a very daunting thing to do. Good thing there are online calculators and calculator spreadsheets, just like a retirement calculator that helps make the task easy and convenient. We also have other calculator spreadsheets that you may find useful, like home affordability calculator samples and templates, paycheck calculator samples and templates,

What is the Ideal Age for Retirement?

When you’re young, you won’t actually give a care about things like retirement age. But when you come to plan for your retirement, choosing the ideal retirement age is important. There is no retirement age that is perfect for all unless it is mandated by your government or profession that you must retire when you reach a specific age. Currently, the ideal age for retirement falls between the age of 60 to 65 years old. This is said to be the age when people are financially stable, healthy, and young to do the things that they like and enjoy their time. You may also see sample payroll timesheet calculator templates to download.

However, it will still depend on the individual on what age they see as an ideal age for retirement. There are also certain factors that one must consider before finally deciding to retire and they are the following:

1. Consider the Things that You Will Do After Retirement. Many retirees end up going back to work sometime after retiring either because they did not have plans for retirement or they just got bored after all the excitement they had experienced. Having a plan would be perfect so that you can enjoy the best of your retirement time and to also help you decide if you really want to retire or not. You may also like sample employee timesheet calculator templates.

2. Can You Afford to Retire Now? Ask yourself this question but don’t answer it right away. Retiring is not a joke and it is definitely not something that you see depicted in commercials where old people are living fancy and luxurious lives. It’s not bad, but it is not applicable for all. For this, you will need to consult your retirement calculator and see if you are financially ready. You may also check out sample travel expense calculators.

3. Determine Your Health Status or Health Condition. As people get older, their physical health also starts to deteriorate, and by the time you get to a particular age, you may already have maintenance medications prescribed by your doctor. Medications are costly and are often very expensive. Can you afford this after retirement? On the other hand, if your work is the reason for your illness, you may also want to consider this as a cue for retirement.

You can find retirement-related topics on our websites, such as Retirement Program Samples & Templates, Retirement Letter Samples, and Retirement Speech Examples. These samples will be useful whether you are already decided on resigning or still thinking about it.

Related Posts

Timetable

Training Evaluation Forms

Acceptance Speech

Scientific Reports Samples & Templates

Attendance List Samples & Templates

Sample Meeting Minutes Templates

Presentation Speech Samples & Templates

Ukulele Chord Chart Samples & Templates

Retirement Speech Samples & Templates

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples