Do you find yourself in need of a business statement? Specifically, are you looking for the right kind of financial statement to help you with your operations moving forward? If so, then you’ve come to the right place. In this article, we discuss what it means to have a financial statement and creating one by yourself, all the while presenting you with examples like the personal financial statement template. Don’t just sit there staring at your screen; read on and enrich your mind with new knowledge.

17+ Sample Financial Statement Templates

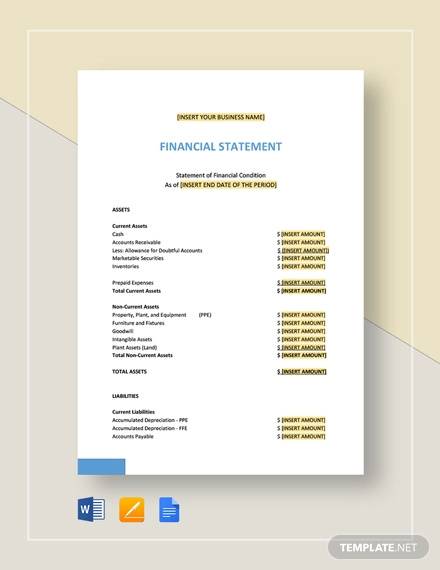

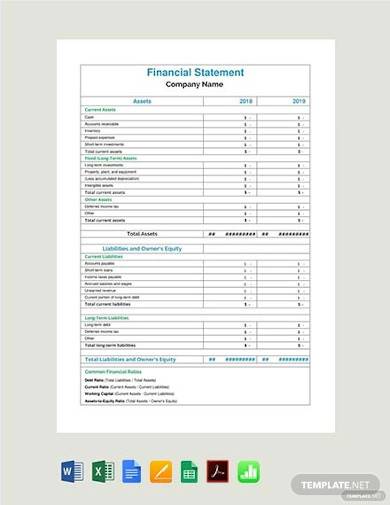

1. Financial Statement Sample

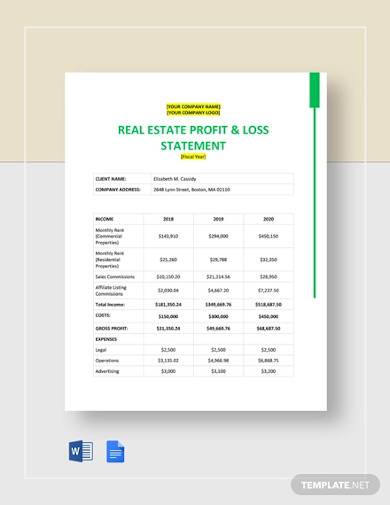

2. Real Estate Financial Statement Template

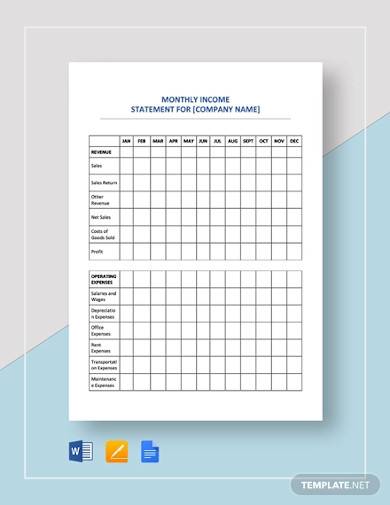

3. Income Statement Monthly Template

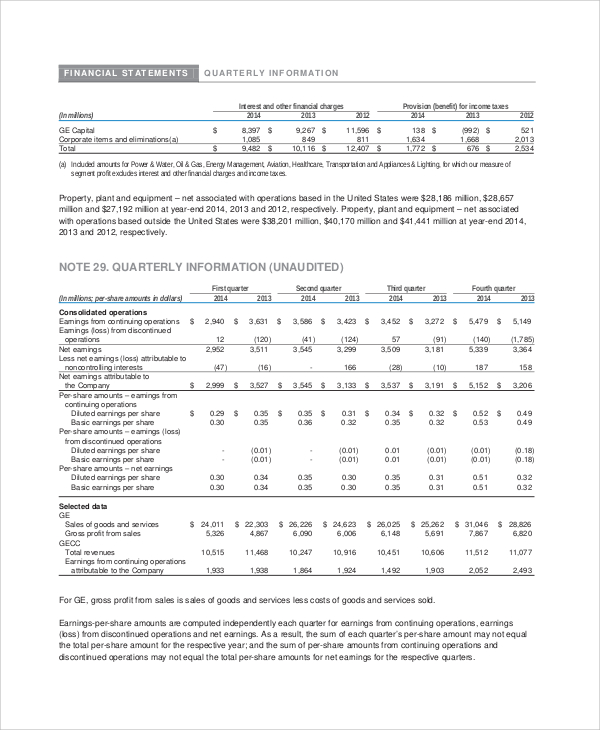

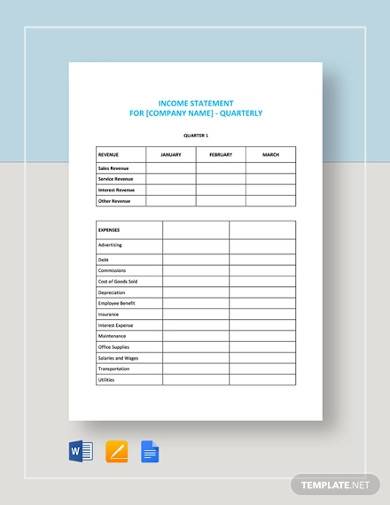

4. Quarterly Income Statement Template

5. Certification Enclosing Financial Statements Template

6. Board Resolution Approving Financial Statements Template

7. Request Delay in Providing Financial Statement Template

8. Financial Statement Analysis Template

9. Free Financial Statement Template

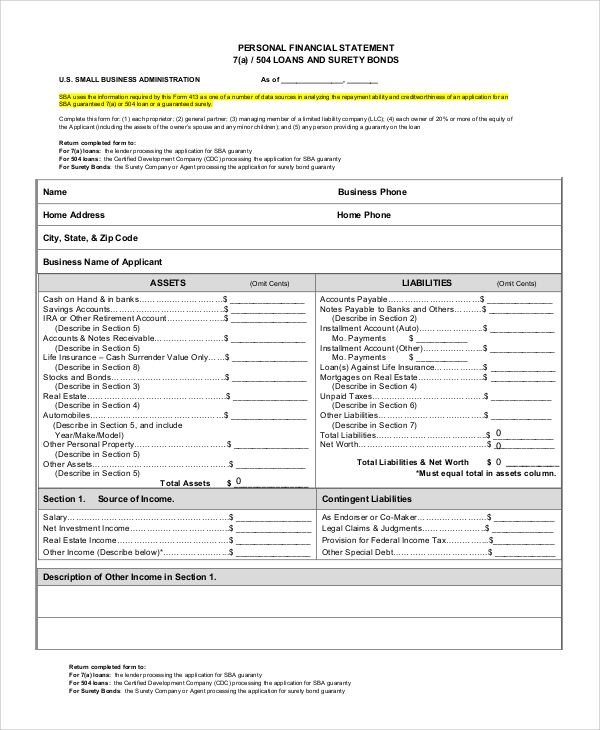

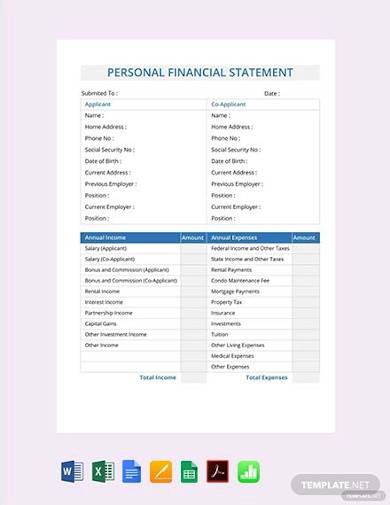

10. Free Personal Financial Statement Template

11. Personal Financial Statement Sample

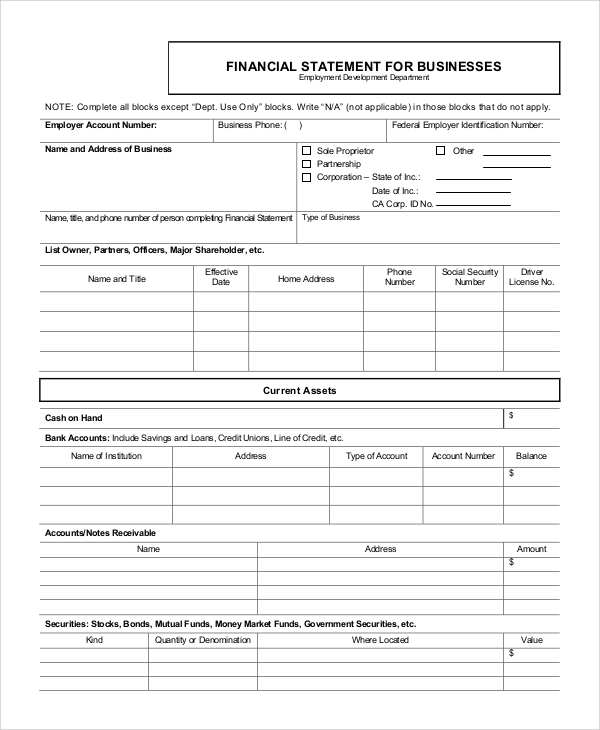

12. Business Financial Statement Sample

13. Audited Financial Statement Sample

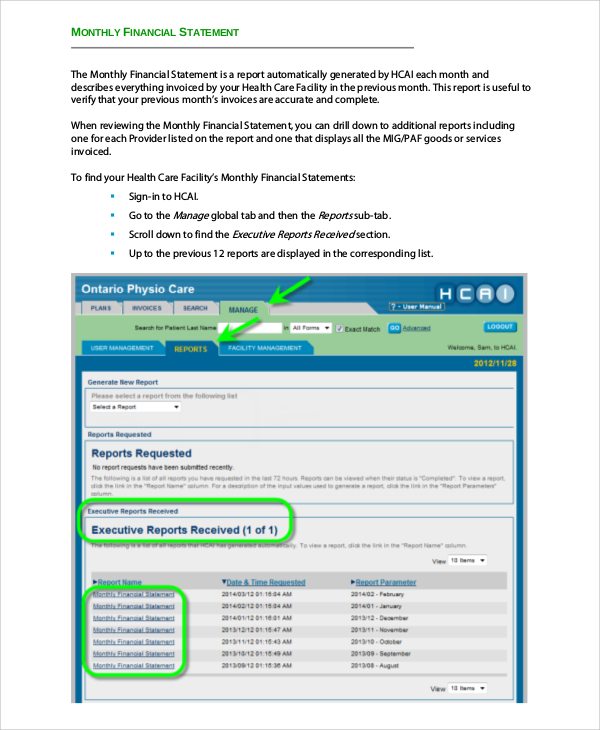

14. Monthly Financial Statement

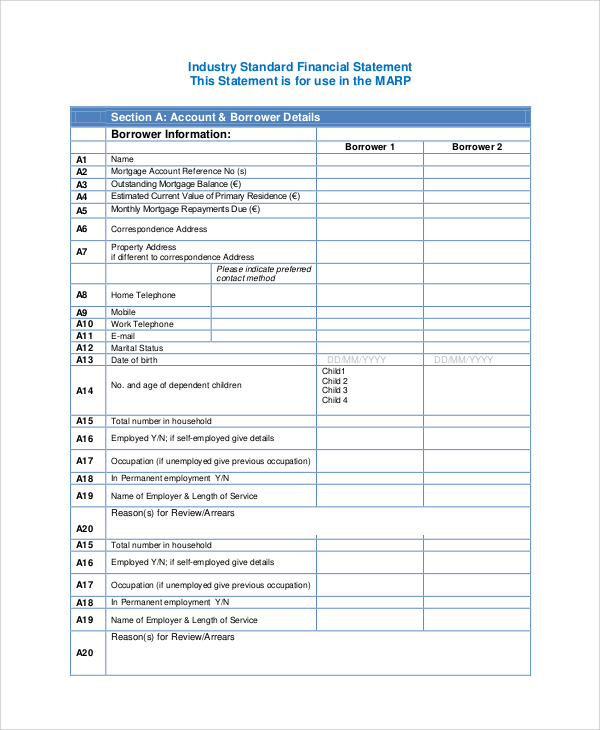

15. Standard Financial Statement

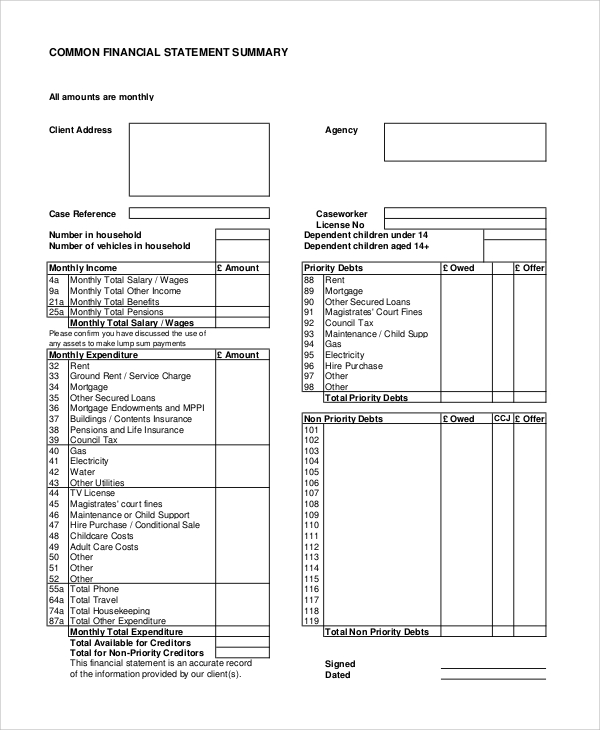

16. Common Financial Statement

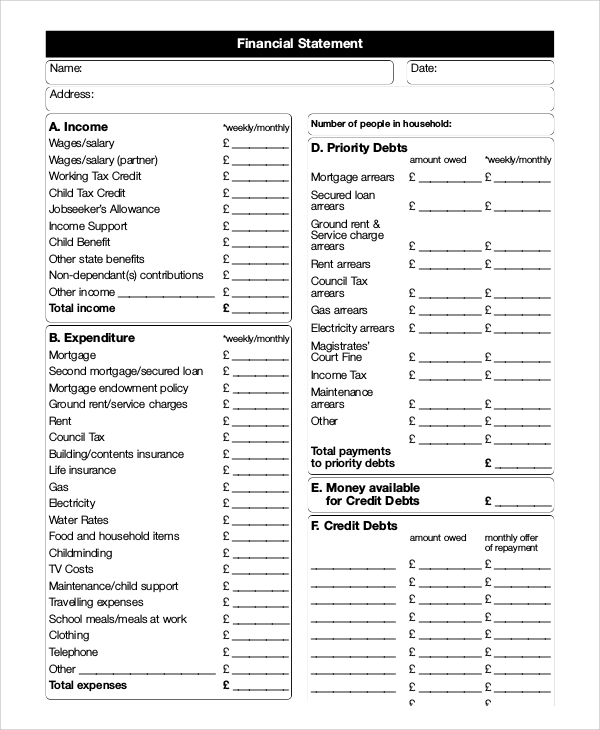

17. Blank Financial Statement

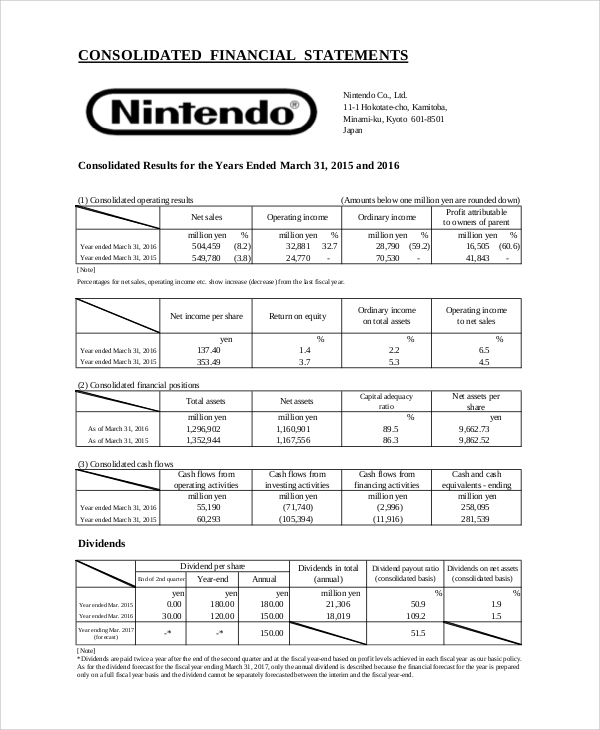

18. Consolidated Financial Statement

What Is a Financial Statement?

A financial statement—also referred to as financial reports—is a formal record of an individual or company’s financial position and activities. Due to its flexible nature, there are variants that depend on who needs it. Examples of those variants would be the personal financial statement, the business financial statement, and the nonprofit financial statement. Conducting a financial statement analysis is often key to achieving great personal and business financial success.

Tips on Writing Up Financial Statements

By now you should be quite familiar with what a financial statement template is. However, if you’d rather forgo downloading a financial statement example and create your own, then you’ve come to the right place. Although there are many kinds, tips for any financial statement format can still be generalized. The following can attest to that, as you will soon find out.

Tip 1: A Balance Sheet Comes First

Before anything else, a balance sheet is the first that you must create. This document’s underlying basis is to take your assets and subtract your liabilities. Doing so provides you with equity. Your balance sheet needs to reflect that simple equation, albeit in a more detailed manner.

Tip 2: Sort Out Your Income Statement

Once you have successfully written your balance sheet, the next thing you need to accomplish is coming up with an income statement. It begins with your net sales, followed by a calculation of your gross profit. Then comes listing down your operating expenses and writing out your non-operating expenses.

Tip 3: Detail Your Cash Flow Statement

For the cash flow statement, begin with writing down your total net income. From there, start calculating cash flows from your operating activities. From there, it’s up to you to figure out the rest of your cash flow from all other activities.

Tip 4: When in Doubt, Consult an Accountant

As useful as it can be to be able to write up these financial statements on your own, there’s always the option of reaching out to professionals. If you’re a business owner and you’ve been busy reading through accountant resumes, then perhaps it’s time to hire one so that you don’t have to do this all on your own.

FAQ’s

What are the different kinds of financial statements?

The four main kinds of financial statements are as follows: the balance sheets, the cash flow statements, the income statements, and the shareholders’ equity statements.

Why is a financial statement necessary?

This kind of business document is necessary because it provides essential data and information regarding a company’s financial health. The aforementioned data also helps business owners in making decisions for the good of the company’s future.

What are the important benefits of financial statements?

Financial statements are excellent decision-making tools. With their help, business owners can use relevant information about their finances to make important choices. Speaking of information, a related benefit is that financial statements reveal business trends, ultimately aiding business folk with trend analysis.

Whether you decide to download a financial statement template or use what you’ve learned here to make your own, know that just reading this article places you in a better position to succeed. Financial statements are clearly significant and will continue to play major roles in both personal and business finances for years and years to come. Act fast and use your new knowledge to better yourself today!

Related Posts

Sample Meeting Minutes Templates

Presentation Speech Samples & Templates

Ukulele Chord Chart Samples & Templates

Retirement Speech Samples & Templates

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF