A promissory note is an agreement between a lender and a borrower with the latter giving an assurance that they will make a payment of a particular amount of money. In real estate, a promissory note is vital to making sales and increasing the profit of a real estate company in situations wherein the land buyer can’t pay for the total amount of a property’s cost. Not only land buyers can issue a promissory note but also banks and other companies as well. Either way, a promissory note is not a contract but assurances to pay are made by signing a promissory note to legalize the agreement.

The following are free Real Estate Promissory Note Samples that you can download to start writing your own.

10+ Real Estate Promissory Note Samples

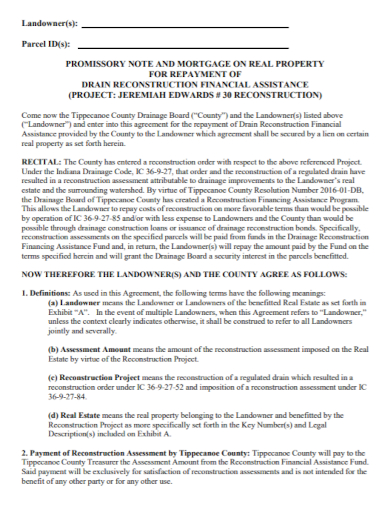

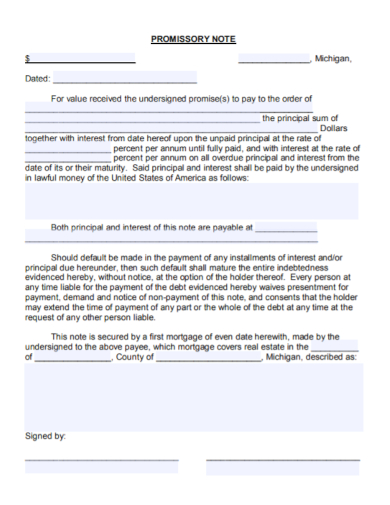

1. Real Estate Mortgage Promissory Note

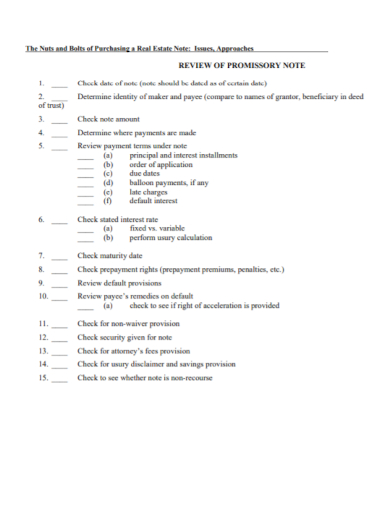

2. Real Estate Purchasing Promissory Note

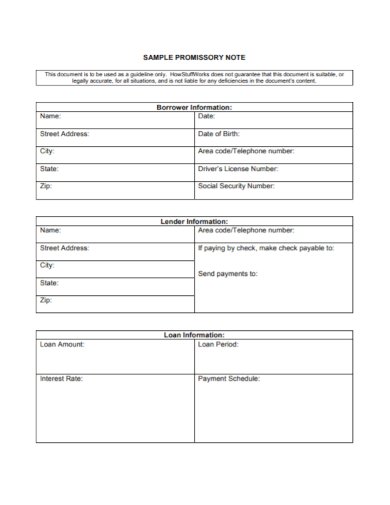

3. Real Estate Borrower Promissory Note

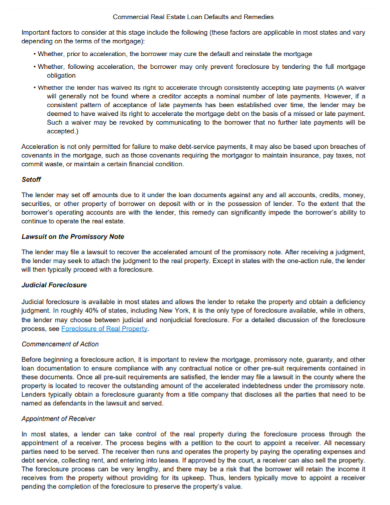

4. Commercial Real Estate Promissory Note

5. Real Estate Payable Promissory Note

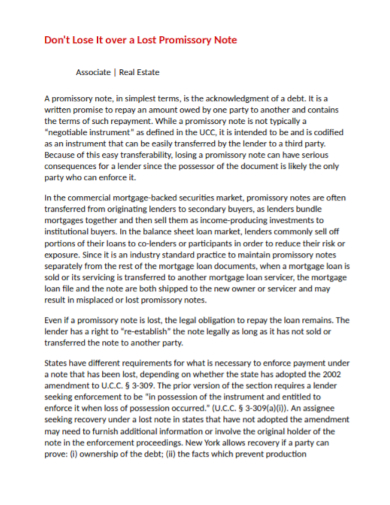

6. Real Estate Lost Promissory Note

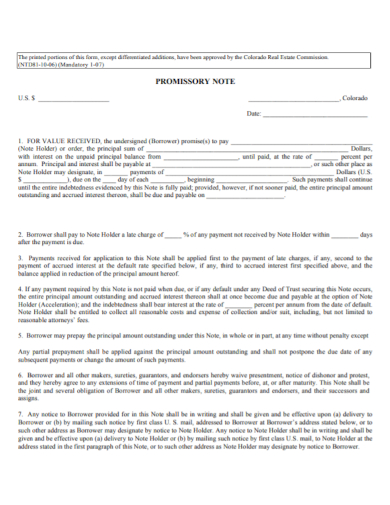

7. Real Estate Commission Promissory Note

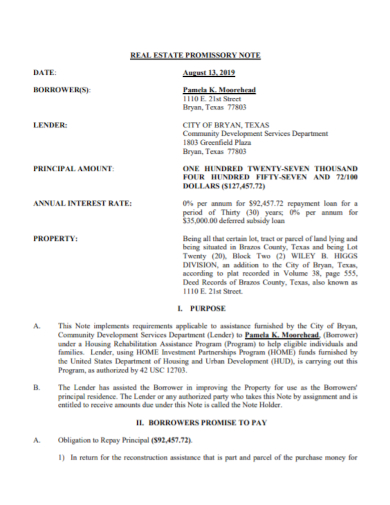

8. Real Estate Promissory Note

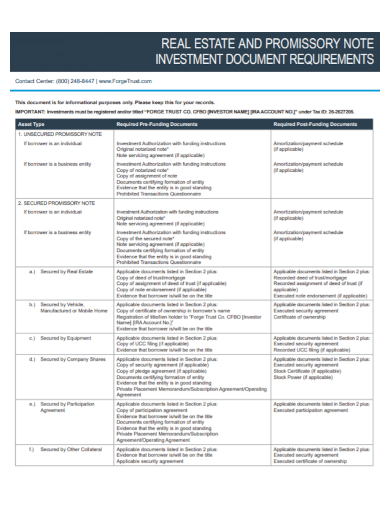

9. Real Estate Investment Promissory Note

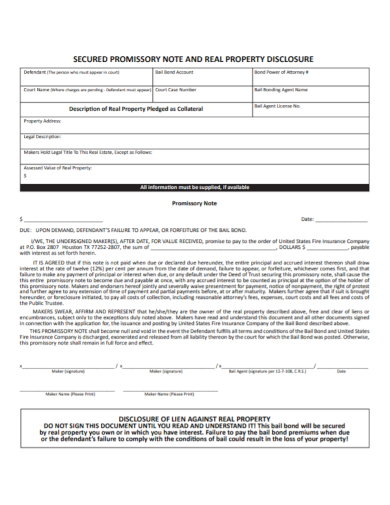

10. Real Estate Property Secured Promissory Note

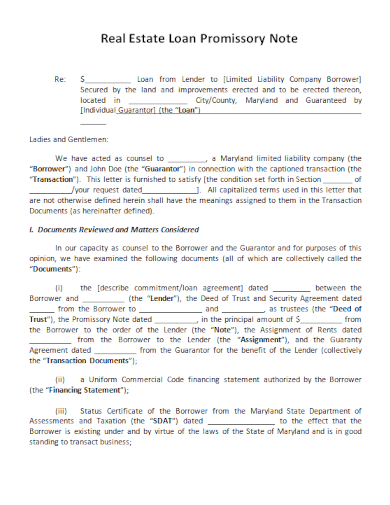

11. Real Estate Loan Promissory Note

Parts of Real Estate Promissory Note

Every state and country has its own governing laws concerning the correct format but the following elements are typically parts of a good real estate promissory note.

1. Names of borrowers and lenders

On any promissory note, the names of those who are involved must always be present. The name of the borrower or the who is receiving the sum of money and the one who will be repaid or the lender should always be present in the note. To add formalization to the agreement, some professionals make an agreement between two parties for money.

2. Amount to be repaid

No matter how small or big, the amount of money that needs to be paid should always be stated clearly. The principal amount or the borrowed money must also be indicated whether or not to include interest rates and the type of compounding(yearly or monthly) it will follow. The rate of interest is also bound to changes depending on the state you are in.

3. Payment arrangements

How the money will be paid should also be included in the promissory note so that the lender will have a sense of security that the borrower can really pay the debt. The note should indicate the maturity of the debt or the specific time date at which the debt should have fully been paid. Sometimes, a debt agreement and a contract payment schedule are also presented alongside the promissory note to help both parties manage the payment process more effectively.

4. Non-payment consequences

The borrower also needs to agree with the lender what are the consequences or sanctions for not being able to fulfill the conditions of the agreement. One of the functions of the promissory note is that it also allows the lender to seek legal assistance if ever the borrower refuses to pay. If a lawsuit takes place and the borrower loses, they will be obligated to pay an appropriate amount that will make up for the costs associated with the collection of the debt. The consequence could either be an enforcement of the lender’s side that the amount should be made or the collateral will be collected or according to the conditions stated in an arbitrary agreement called collateral management agreement.

5. Notarization

Normally, promissory notes don’t need to be notarized by an attorney. However, always consult your attorney if it is needed or if it is required by the local government or state. If a notary is needed, notary statements can be employed as a supporting document to the note.

FAQs

What is a collection agency?

A business institution that collects debts from another company or the company’s debtors.

What does it mean by skiptracing?

A method used by debt collecting companies to locate a debtor who has not settled supposed payments and who has moved to another location to avoid encounters with creditors.

What does first party mean?

A subsidiary entity of the creditor involved in a contract involving two parties.

Related Posts

FREE 10+ Nurses Notes Samples in PDF

FREE 10+ Narrative Notes Samples in PDF

FREE 10+ After Interview Thank You Note Samples in PDF

FREE 14+ Money Promissory Note Samples in PDF

FREE 10+ Thank You Notes For Coworkers Samples in PDF

FREE 10+ Meeting Notes Samples in PDF

FREE 9+ Inpatient Progress Note Samples [ Psychiatric, Hospital, Complaint ]

FREE 10+ Note Taking Samples in PDF

FREE 10+ Credit and Debit Note Samples in PDF | MS Word

FREE 3+ Comprehensive Soap Note Samples in PDF

FREE 8+ Student SOAP Note Samples [ Medical, Pharmacy, Doctor ]

FREE 10+ Return Delivery Note Samples [ Product, Service, Electronic ]

FREE 3+ Car Sale Delivery Note Samples [ Transfer, Private, Vehicle ]

FREE 6+ Goods Delivery Note Samples [ Vehicle, Movement, Return ]

FREE 10+ Doctors Excuse Note Samples [ Office, Visit, Medical ]