FREE 10+ Loan Payment Schedule Samples

Paying off debt is frequently a wise decision when you have money to spare. Being debt-free has tangible financial advantages in addition to psychological ones. Although it isn’t always the best course of action, paying off loans early is rarely a bad idea. You’re in a better financial situation after paying off your debt. Your previously dedicated monthly payment money becomes accessible for other purposes. Paying off debt may be satisfying and stress-reducing. Even if they are aware that it doesn’t make the most financial sense, some people opt to pay off loans as quickly as they can. Having a schedule can guarantee that you pay off your debts on time. Need some help with creating your payment schedule? We’ve got you covered! In this article, we provide you with free and ready-made samples of Loan Payment Schedules in PDF and DOC format that you could use for your benefit. Keep on reading to find out more!

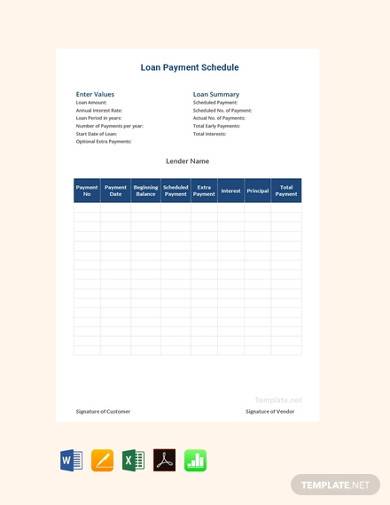

1. Loan Payment Schedule Template

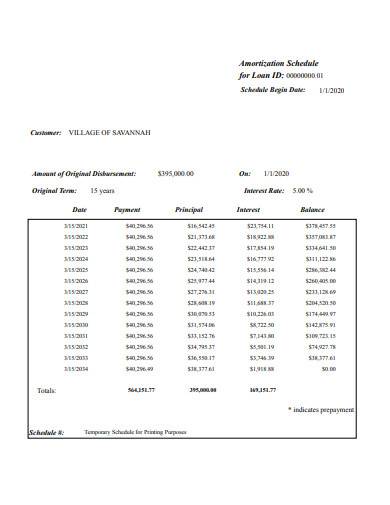

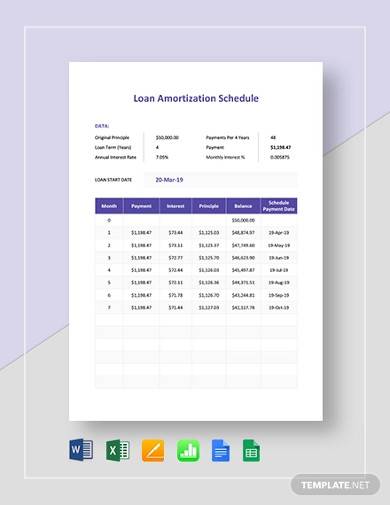

2. Loan Amortization Schedule Template

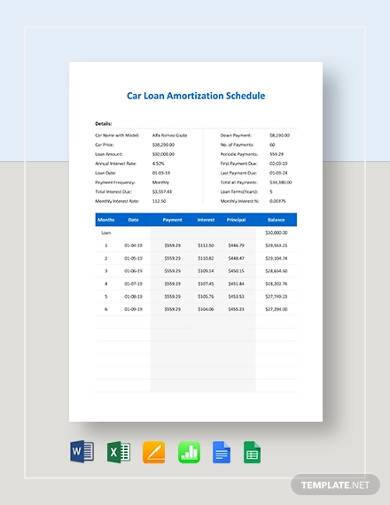

3. Car Loan Amortization Schedule Template

4. Free Loan Payment Schedule Template

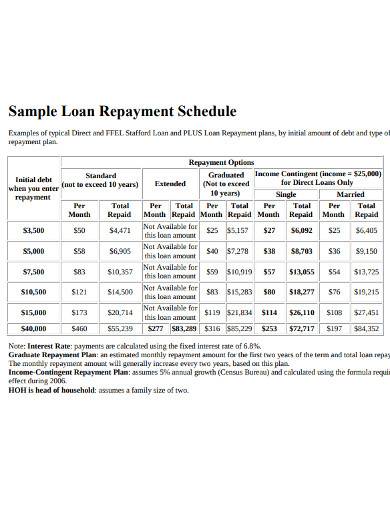

5. Sample Loan Repayment Schedule

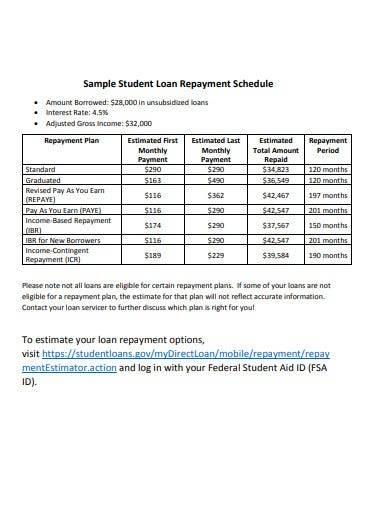

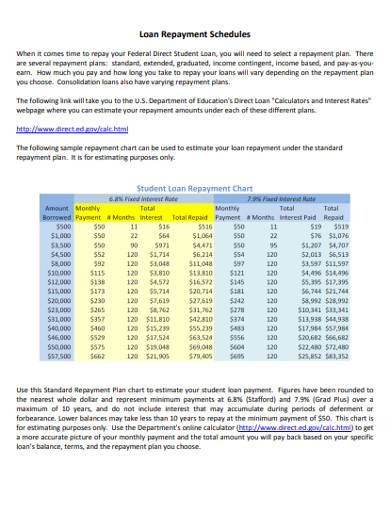

6. Sample Student Loan Repayment Schedule

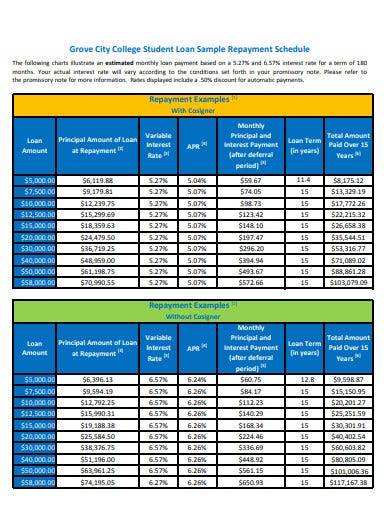

7. Student Loan Repayment Schedule Sample

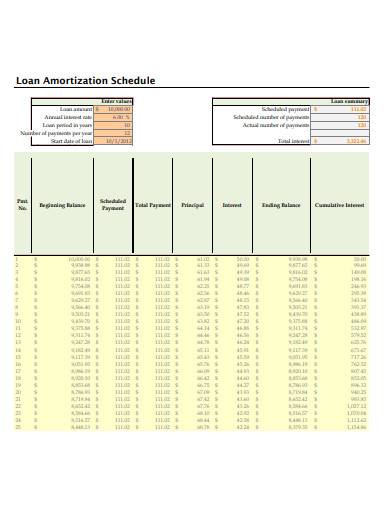

8. Loan Amortization Schedule Sample

9. Simple Loan Payment Schedule Template

10. Car Loan Payment Schedule Sample

11. Loan Repayment Schedule Sample

What Is a Loan Payment Schedule?

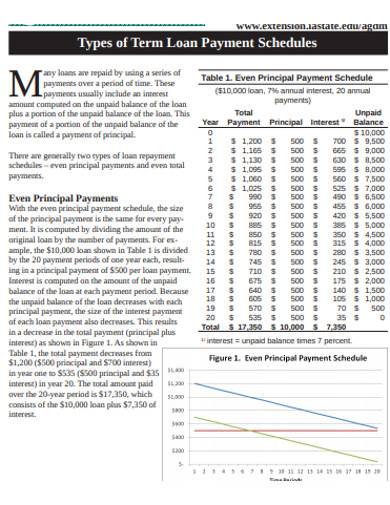

The most fundamental details about your loan and how you’ll repay it are provided by a loan payment plan. A loan payment plan is often provided when you take out a loan with a fixed rate and predetermined payback period. A complete list of all the payments you’ll have to make during the loan’s term is often included in this schedule. According to how much of each payment goes toward principle and interest, the schedule is divided into equal payments. Sometimes, all you know when considering a loan is how much you want to borrow and the interest rate.

How to Make a Loan Payment Schedule

A lot of loans are repaid over time with a series of instalments. These payments often comprise a part of the loan’s unpaid sum as well as interest calculated on the outstanding balance. A principle payment is what we refer to as this partial repayment of the loan’s outstanding sum. A Loan Payment Schedule Template can help provide you with the framework you need to ensure that you have a well-prepared and robust schedule on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, follow these steps below to guide you:

1. Make an outline of your schedule.

It is always preferable to set a payment schedule in advance that includes all the necessary details. For a useful overview and format for your payment breakdown, you may also get Excel printable schedule templates.

2. Put a provision for your agreement.

An entire agreement is an useful way to recognize that the parties to a contract want to exclude provisions that are not stated or included in the agreement directly. Reminding parties of their commitment to certain obligations should be done in this section of your payment schedule.

3. Indicate how your payments will be liquidated.

To be able to monitor the status of payments, each payment made should be accurately documented. You will also benefit greatly from using sample schedules to create the ideal schedule you require.

4. Lay down the payment schedule.

Everything is based on a specific agreement between parties, thus it is important to pay attention to a contract’s payment schedule to ensure that payments fall on the right dates.

FAQ

What advantages do amortized loans offer?

An amortized loan might enable a borrower to make an investment or purchase for which they do not now have the necessary finances.

How do amortization tables function?

Each payback installment in an amortization plan is split into equal halves and includes both principle and interest.

How does interest impact amortization?

You pay more interest the longer the amortization period lasts. You pay less interest if the amortization term is shorter.

The loan payment schedule is a crucial document for the borrower since it breaks down the total into equal monthly instalments, which makes it easier for them to comprehend their loan payback. To help you get started, download our easily customizable and comprehensive samples of Loan Payment Schedules today!

Related Posts

FREE 10+ Schedule of Value Samples in MS Word | Google Docs | Pages | PDF

FREE 50+ Blank Schedule Samples in MS Word | Google Docs | Pages | PDF

FREE 10+ Employees Schedule Samples in PDF

FREE 10+ On Call Schedule Samples in PDF

FREE 10+ Time Block Schedule Samples in PDF

FREE 10+ Gym Schedule Samples in PDF | MS Word | Apple Pages | Google Docs | Keynote |

FREE 10+ Daily Hourly Schedule Samples in PDF

FREE 10+ Weekly Schedule Template with Hours Samples in PDF

FREE 10+ 7 Day Weekly Schedule Samples in PDF

FREE 10+ Working Schedule Template Samples in PDF

FREE 6+ Preschool Schedule Template Samples in PDF

FREE 10+ Day Schedule Samples in PDF

FREE 10+ Daily Work Schedule Samples in PDF

FREE 10+ Baseball Schedule Samples in PDF

FREE 10+ Availability Schedule Samples in PDF