As a homeowner, paying off their mortgage is a huge accomplishment but it’s not the last task to be completed. You also have to make sure that you have completed all proper and legal documentation. After paying off your mortgage, a satisfaction of mortgage must be prepared by your lender, and require all parties involved to sign the document so it can get notarized. The preparation of the satisfaction of a mortgage with the right records office is one of the responsibilities of a lender.

FREE 10+ Satisfaction of Mortgage Samples

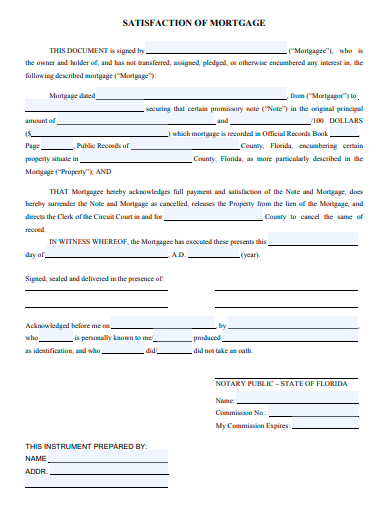

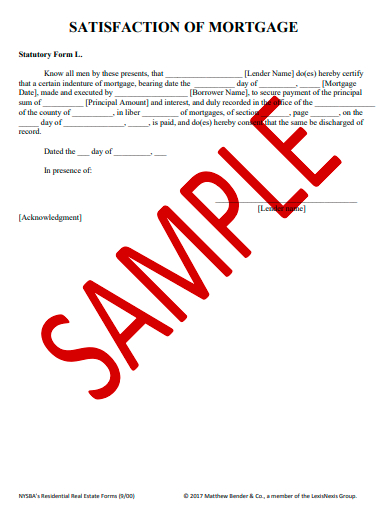

1. Satisfaction of Mortgage Template

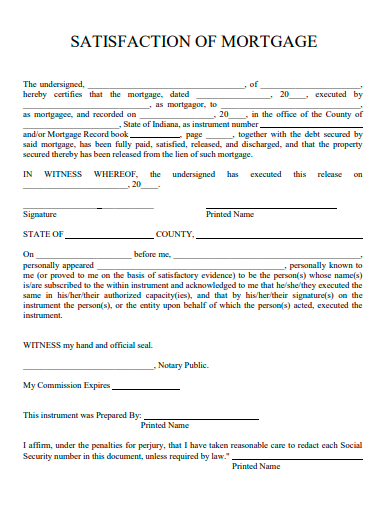

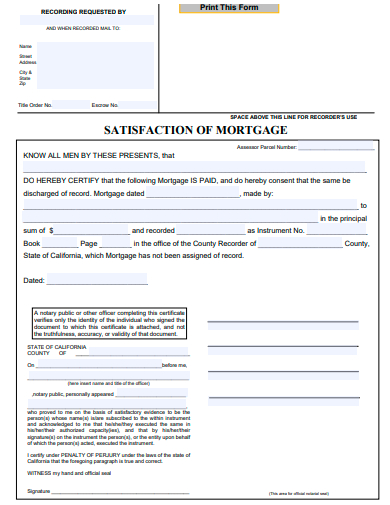

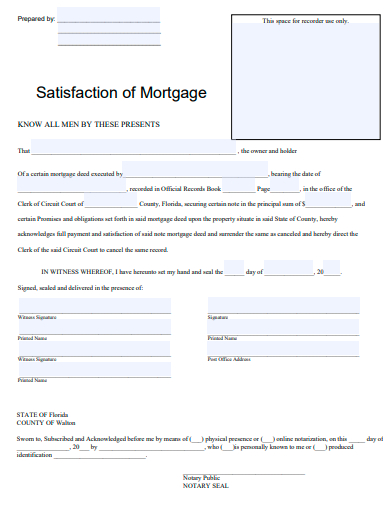

2. Basic Satisfaction of Mortgage

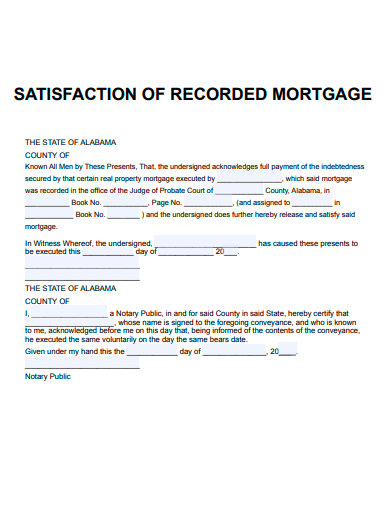

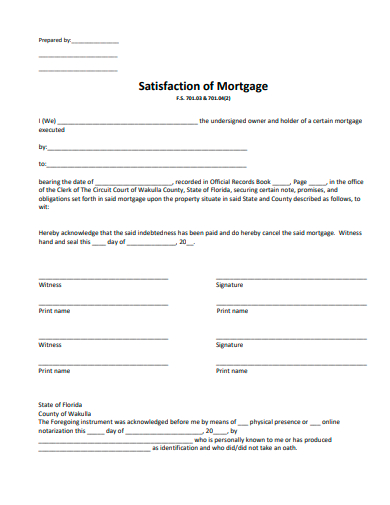

3. Satisfaction of Recorded Mortgage

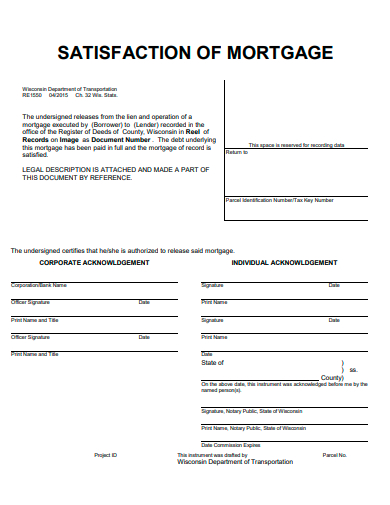

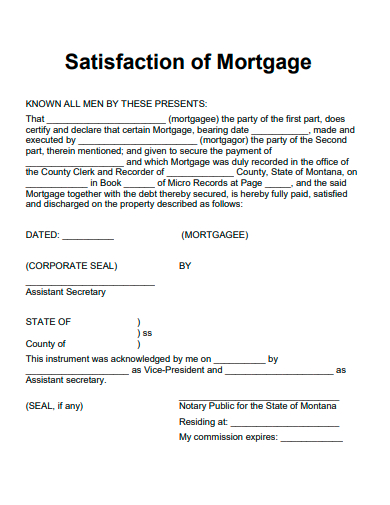

4. Satisfaction of Mortgage Example

5. Sample Satisfaction of Mortgage

6. Printable Satisfaction of Mortgage

7. Satisfaction of Mortgage in PDF

8. Standard Satisfaction of Mortgage

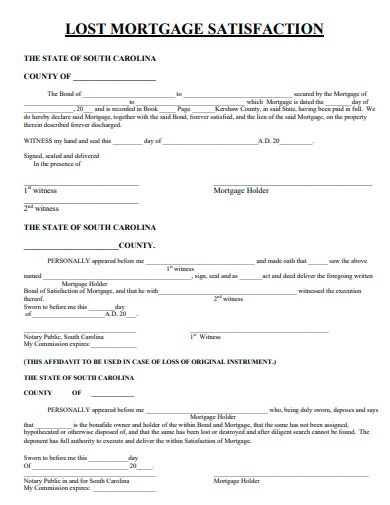

9. Satisfaction of Lost Mortgage

10. Formal Satisfaction of Mortgage

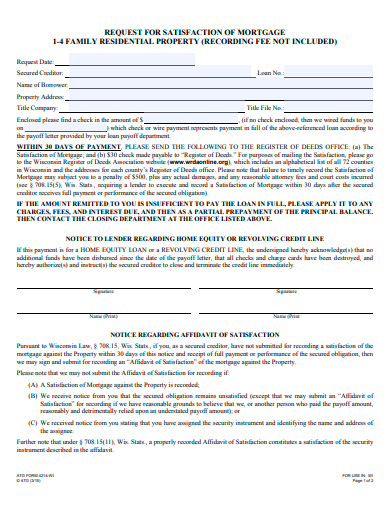

11. Request For Satisfaction of Mortgage

What is a Satisfaction of Mortgage?

Satisfaction of mortgage is a legal document used as proof and confirmation that a mortgage has been paid off and contains the necessary information and provisions for the transfer of collateral title rights. the preparation and filing of the satisfaction of mortgage fall under the responsibility of the lending institutions and the procedures are governed by individual states. This document usually includes details on the borrower and lender’s contact information, loan agreement and property information, and notarization.

How to Complete a Satisfaction of Mortgage?

After paying off your mortgage, the Satisfaction of Mortgage is a document that serves as legal proof that the mortgage is completed and the title is clear of allegations. This legal document is filed by a lender with a local authority such as a county recorder or city registrar but it also depends on the requirements of a certain state.

Step 1: Determine the Parties Involved

The two main parties involved in this contract agreement are the mortgagor which refers to an individual or borrower of cash to secure and pay for a home and the mortgagee which refers to an entity that provides the funds to the mortgagor which was used to secure and buy a home.

Step 2: Provide the Necessary Information

Signed by a mortgagee, the satisfaction of mortgage requires information such as the name of the payee, the owner of the mortgage holder, the total amount of mortgage, the mortgage date of execution, full and legal description of the property, the acknowledgment that all payments have been made in full, the acknowledgment releasing the lender from filing a lien against the property, and the date signed and signature of all important parties.

Step 3: File and Record the Form with your Local Office

After signing and notarization, the Satisfaction of Mortgage will be recorded with the local Country Recorder’s Office or Land Registry.

Step 4: Receive the Satisfaction of Mortgage

It usually takes 30 days before your receive your Satisfaction of Mortgage but it can also depend on the laws and regulations of your state. Some states give the lenders 60 days to prepare and record the documentation from the time a borrower completed his mortgage.

FAQs

When can I use a Satisfaction or Mortgage?

Also known as a discharge of mortgage, the release of mortgage, and cancellation of mortgage, you can use a Satisfaction of Mortgage when you just paid off your mortgage to a private lender or you sold a property with the help of a private loan agreement that was fully paid.

What are the other documents related to the Satisfaction of Mortgage?

Other related documents are the Deed of Reconveyance which proves full repayment of a property or real estate loan, the Mortgage Agreement which establishes a lien on the property to ensure a lone, Contract for the Deed which enables buying and selling of the property with nontraditional financial management, and the Deed of Trust which provides a trustee to keep and secure a land title.

What happens if a lender fails to file a Satisfaction of Mortgage?

If the lender or a financial party fails to record and sign the Satisfaction of Mortgage on a given timeline, they will be responsible for all the damages and penalties paid to the borrower. They will be not able to sell the property to other clients in the future until they have provided all legal documentation in full payment.

A Satisfaction of Mortgage or also known as Mortgage Lien Release is a legal document that proves that the mortgage has been fully paid, all terms of the loan have been achieved, and provides necessary information about the transfer of collateral title rights. This document is prepared and filed by a lending institution with the right local recorder, land purchase or registry office, city registrar, or recorder of deeds.

Related Posts

FREE 10+ Consultant Questionnaire Samples in PDF MS Word

FREE 10+ Down Payment Contract Samples in PDF

FREE 8+ Land Purchase Agreement Samples in PDF MS Word ...

FREE 9+ Sample Warranty Deed Form Templates in PDF MS Word

FREE 9+ Sample Release of Lien Forms in MS Word PDF

FREE 8+ Against Medical Advice Forms in PDF

FREE 8+ Sample Sign Off Form Templates in PDF

FREE 7+ Sample Release Note Templates in PDF

FREE 70+ Basic Agreement Templates in PDF MS Word | Excel

FREE 16+ Sample Promissory Note Templates in Google Docs MS ...

FREE 10+ Import and Export Price Index Samples in PDF MS Word

FREE 9+ Sample Land Contract Forms in MS Word PDF

FREE 7+ Realtor Job Description Samples in MS Word PDF

FREE 6+ Sample Home Purchase Agreement Templates in PDF ...

FREE Simple Agreement Templates in PDF