The process of creating a bank reconciliation statement begins with obtaining the bank statement from the financial institution. This statement will show all transactions that have been processed by the investment bank, including security deposits, withdrawals, and any fees or charges that have been assessed. The company’s own records, such as the general ledger sample, are then reviewed to identify any transactions that the bank has not yet processed.

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

1. Bank Reconciliation Statement

2. Printable Bank Reconciliation Statement

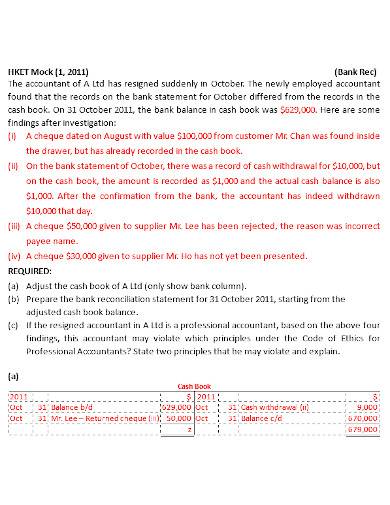

3. Bank Reconciliation Statement Making

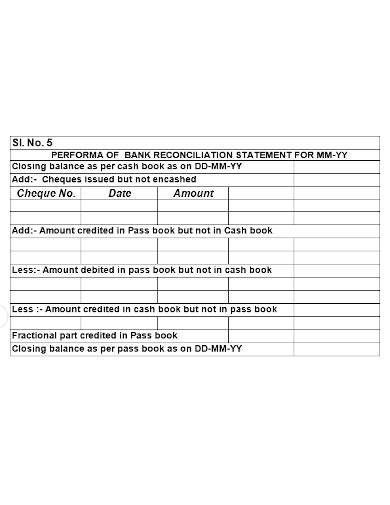

4. Performa of Bank Reconciliation Statement

5. Bank Reconciliation Statement Guide

6. Bank Reconciliation Statement in PDF

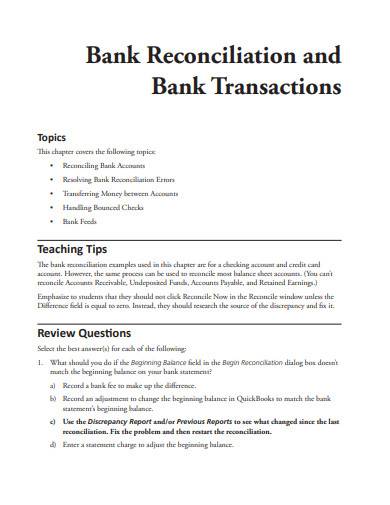

7. Bank Reconciliation and Bank Transactions

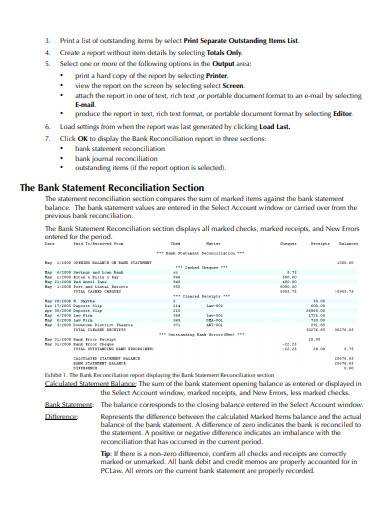

8. Bank Reconciliation Report Template

9. Bank Reconciliation Template

10. Bank Reconciliation Statement Example

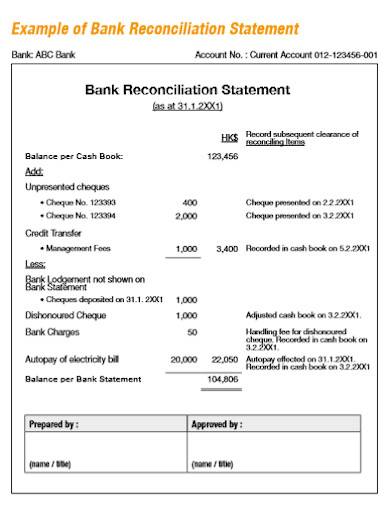

11. Example of Bank Reconciliation Statement

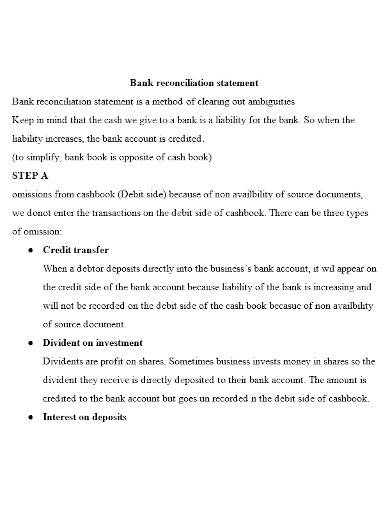

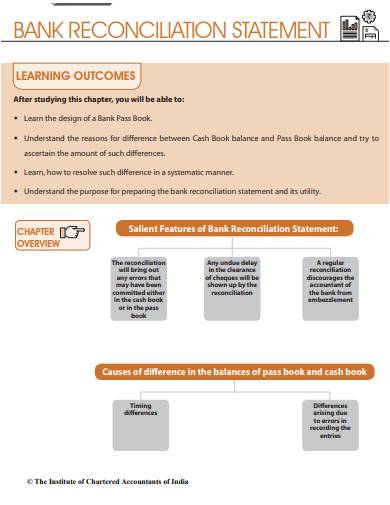

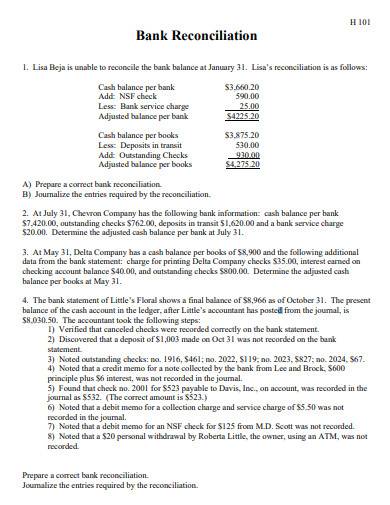

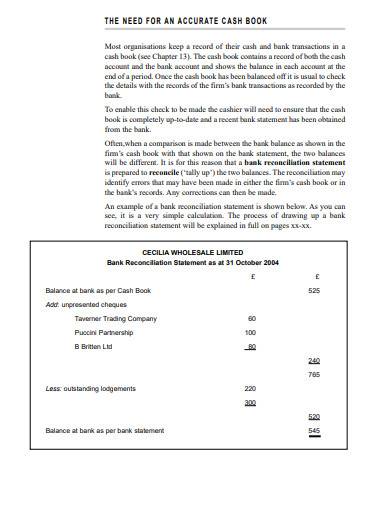

What Is a Bank Reconciliation Statement?

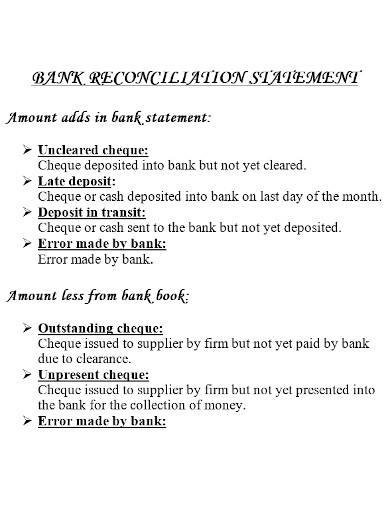

A bank reconciliation statement is a document that compares a company’s bank account balance as recorded in its own accounting service records to the balance reported by the bank. The statement is used to identify and reconcile any discrepancies between the two balances, such as outstanding checks, deposits in account transit, and bank errors. The purpose of the bank reconciliation is to ensure that the company’s records are accurate and that all transactions have been recorded correctly.

How to Make a Bank Reconciliation Statement

It is important to note that bank reconciliation is not a one-time process; rather, it should be done regularly to ensure that the company’s records are accurate and up-to-date. This process is also an important internal control measure that helps to detect and prevent fraud. To make a bank reconciliation statement, the following steps should be taken:

Step 1: Obtain Bank Statement

This statement will show all transactions that have been processed by the bank, including deposits, withdrawals, and any fees or charges that have been assessed. Review the company’s own records, such as the general ledger, to identify any transactions that the bank has not yet processed. These transactions may include outstanding checks, deposits in transit, and other transactions that have not yet cleared.

Step 2: Make Adjustments

Make any necessary adjustments to the company’s records. For example, if a check has been written but has not yet cleared the bank, it should be recorded as an outstanding check in the company’s records.

Step 3: Compare the Records

Compare the company’s records to the bank statement and identify any discrepancy sample. These discrepancies can include errors made by the bank or by the company business. Resolve any discrepancies by making the necessary adjustments to the company’s records.

Step 4: Prepare the Bank Reconciliation

Prepare the bank reconciliation statement. The statement should include the beginning balance, all transactions and adjustments, and the ending simple balance. Review the statement for accuracy and completeness. Sign and date the statement, indicating that the reconciliation has been completed.

FAQs

How often should a bank reconciliation be done?

It’s recommended to do bank reconciliation on a regular basis, usually at least monthly.

What is an outstanding check in the context of a bank reconciliation?

An outstanding check is a check that has been written by a company but has not yet cleared the bank. It will be recorded as an outstanding check in the company’s records during the bank reconciliation process.

What is a deposit in transit in the context of a bank reconciliation?

A deposit in transit is a deposit that has been made by a company but has not yet been credited to the company’s account by the bank. It will be recorded as a deposit in transit in the company’s records during the bank reconciliation process.

In conclusion, a bank reconciliation statement is a crucial tool for any business as it helps to ensure the accuracy of financial records, reconcile discrepancies between the bank statement and the company’s own records, and detect and prevent errors and fraud. It is important to regularly reconcile the bank account to keep the records accurate and up-to-date.

Related Posts

FREE 6+ Research Contribution Statement Samples in PDF | DOC

FREE 10+ Marketing Problem Statement Samples [ Strategy, Digital, Social Media ]

FREE 10+ Medical Problem Statement Samples [ Surgical, Nursing, Management ]

FREE 10+ Payoff Statement Samples in PDF | DOC

FREE 10+ Scholarship Statement of Purpose Samples in PDF | DOC

FREE 10+ Engineering Problem Statement Samples [ Software, Mechanical, Civil ]

FREE 30+ Information Statement Samples in PDF | MS Word

FREE 50+ Policy Statement Samples in MS Word | Google Docs | PDF

FREE 50+ Summary Statement Samples in PDF | MS Word

FREE 10+ Nursing School Personal Statement in PDF

FREE 9+ Mortgage Statement Samples and Templates in PDF

FREE 10+ Independent Subcontractor Statement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Trust Distribution Statement Samples in PDF

FREE 14+ Compliance Statement Samples & Templates in PDF | MS Word

FREE 10+ Extension Impact Statement Samples in PDF | DOC