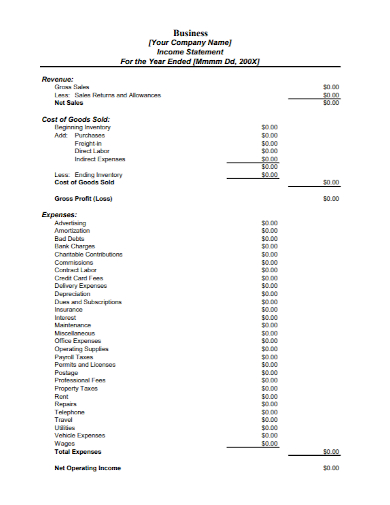

To prepare an income statement, you must first generate a trial balance report, then calculate revenue, determine the cost of goods sold, calculate gross margin, including operating expenses, calculate income, include income taxes, calculate net income, and finally finalize your income statement with business information and the reporting period. A free invoice statement template is the ideal solution if you’re having trouble finding the time to create your own statement from scratch. Small businesses must analyze and report their revenues, expenses, and profits or losses for a specific reporting period in order to prepare an income statement.

10+ Business Income Statement Samples

An income statement, which shows your revenue after deductions for expenses and losses, tells a story about your company’s performance over a set period of time, such as monthly, quarterly, or annually. An income statement typically includes revenue or sales, cost of goods sold, expenses, gross profits, taxes, net earnings, and earnings before taxes, and was previously known as a profit-and-loss statement. The income statement is the report you need if you want a detailed analysis of your company’s performance. Income statements are used by owners, managers, and financiers to compare results to the current operating period’s plan and make adjustments to improve business performance.

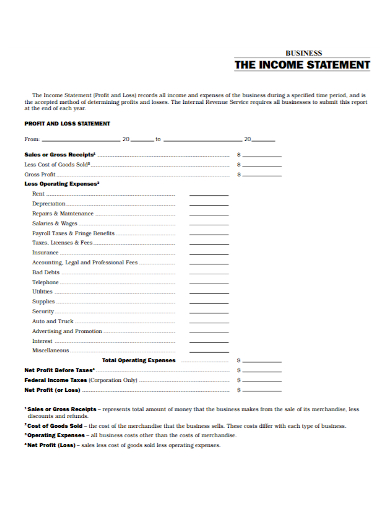

1. Business Income Profit and Loss Statement

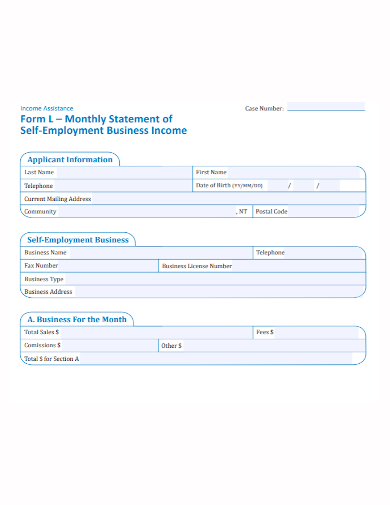

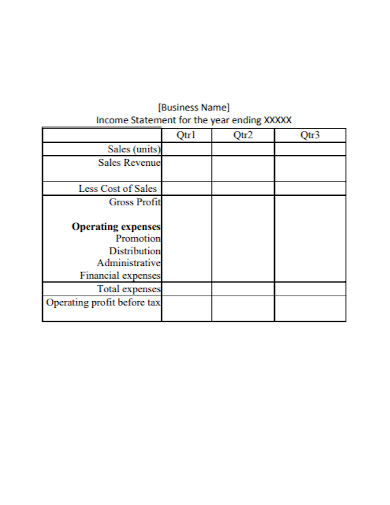

2. Monthly Business Income Statement

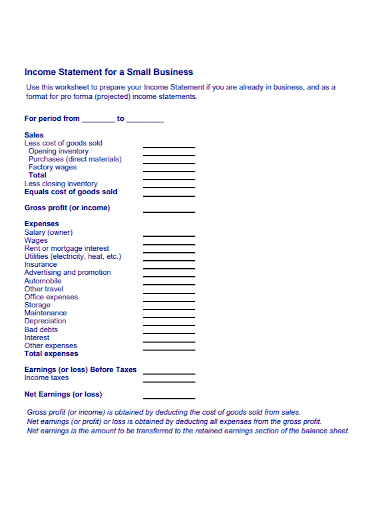

3. Small Business Income Statement

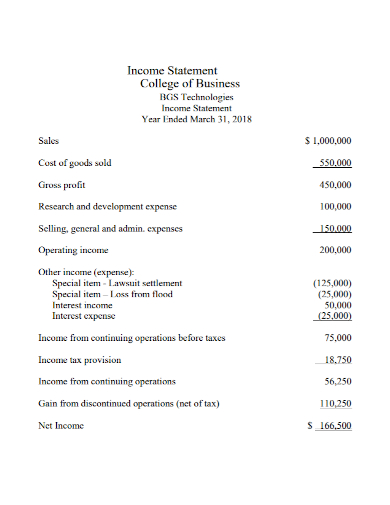

4. College Business Income Statement

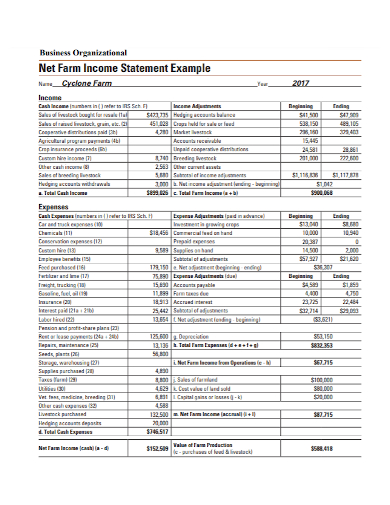

5. Farm Business Income Statement

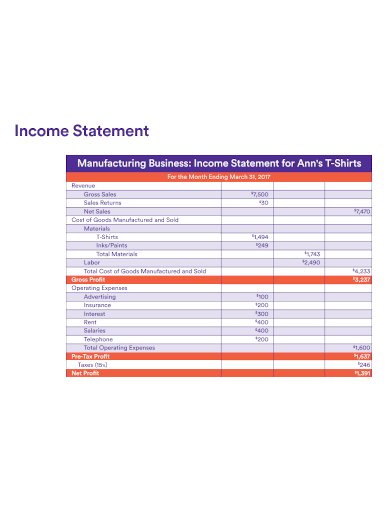

6. Manufacturing Business Income Statement

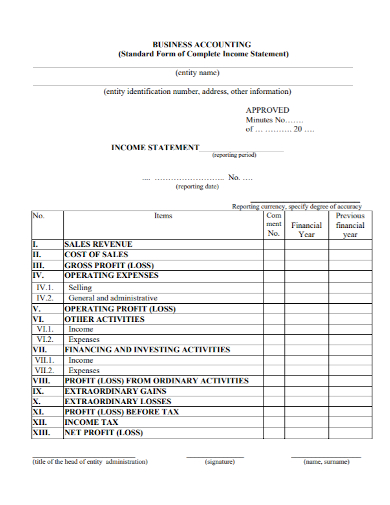

7. Business Accounting Income Statement

8. Business Enterprise Income Statement

9. Business Control Income Statement

10. Company Business Income Statement

11. Annual Business Income Statement

Writing a Business Income Statement

- Choose a reporting period – The first step in creating an income statement is deciding on the reporting period for your report. Annual, quarterly, or monthly income statements are the most common choices for businesses. Financial statements must be prepared quarterly and annually for publicly traded companies, but small businesses are not subject to the same reporting requirements. Monthly income statements can assist you in identifying trends in your profits and expenses over time. This data can assist you in making business decisions that will improve the efficiency and profitability of your company.

- Generate a Trial Balance Report – You’ll need to print a standard trial balance report to create an income statement for your company. Your cloud-based accounting software can easily generate the trial balance. Internal documents that list the end balances of each account in the general ledger for a specific reporting period are known as trial balance reports. Making balance sheets is an important part of making an income statement because it’s how a business collects data for account balances. It will provide you with all of the end-of-period figures you’ll need to make an income statement.

- Calculate your revenue – After that, you’ll need to figure out how much money your company made during the reporting period. Even if you haven’t yet received all of the payments, your revenue includes all of the money earned for your services during the reporting period. Add up all of the revenue line items from your trial balance report and enter the total in your income statement’s revenue line item.

- Know the cost of the goods sold – The direct labor, materials, and overhead expenses you incurred to provide your goods or services are included in your cost of goods sold. On your trial balance report, add up all the cost of goods sold line items and list the total cost of goods sold directly below the revenue line item on the income statement.

- Calculate the gross margin – On your income statement, subtract the total cost of goods sold from the total revenue. The gross margin, or the amount earned from the sale of your goods and services, will be determined by this calculation.

- Also include the operating expenses – Add up all of your trial balance report’s operating expenses. To ensure that you have the correct figures, double-check each expense line. In the income statement, enter the total amount as a line item for selling and administrative expenses. It’s directly underneath the gross margin line.

- Calculate your income. Include your income tax – Subtract the gross margin from the total selling and administrative expenses. This will tell you how much money you have before taxes. The amount should be entered at the bottom of the income statement. To calculate income tax, multiply your pre-tax income by the applicable state tax rate. Subtract this from the pre-tax income figure on the income statement.

- Calculate your net income – Subtract the income tax from the pre-tax income to arrive at your company’s net income. In your income statement, but the figure in the last line item. This will give you a broad picture of your company’s performance and allow you to see how profitable it has been.

- Finalize your income statement – Add a header to the report that identifies it as an income statement to complete your income statement. Fill in your company’s information as well as the income statement’s reporting period. You’ve now created an accurate income statement using all of the information you’ve gathered. This will give you a better understanding of income statement definition in the future, which will help you and your business.

FAQs

What is the difference between a balance sheet and an income statement?

The income statement is a financial statement that shows the overall results of a company’s financial performance, or how much money it makes. The balance sheet is used to determine if a company’s liquid assets are sufficient to cover its financial obligations.

Why is an income statement useful in small businesses?

Some small business owners may believe they don’t need to worry about the income statement because they already know how much money they have in the bank and how much money they’ve paid out. They also understand what they owe when it comes to taxes. The income statement, on the other hand, is invaluable to any business owner looking to cut costs or enter new markets. It can also assist you in managing your cash flow, which is the lifeblood of any company.

If you want to see more samples and formats, check out some business income statement samples and templates provided in the article for your reference.

Related Posts

FREE 10+ Scholarship Statement of Purpose Samples in PDF | DOC

FREE 10+ Engineering Problem Statement Samples [ Software, Mechanical, Civil ]

FREE 30+ Information Statement Samples in PDF | MS Word

FREE 50+ Policy Statement Samples in MS Word | Google Docs | PDF

FREE 50+ Summary Statement Samples in PDF | MS Word

FREE 10+ Nursing School Personal Statement in PDF

FREE 9+ Mortgage Statement Samples and Templates in PDF

FREE 10+ Independent Subcontractor Statement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Trust Distribution Statement Samples in PDF

FREE 14+ Compliance Statement Samples & Templates in PDF | MS Word

FREE 10+ Extension Impact Statement Samples in PDF | DOC

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 10+ Diversity Mission Statement Samples in MS Word | PDF

FREE 10+ Architecture Statement of Purpose Samples [ Sustainable, Graduate, Master ]

FREE 13+ Project Scope Statement Samples in PDF | MS Word