10+ Business Monthly Statement Samples

You might be wondering, as a business owner, how to offer a summary of the things and services that were billed to your customers. By means of a statement! A statement also assists business owners in validating payments made by a client over the course of a statement period, which is often a month. Need some help with this? We’ve got you covered! In this article, we provide you with free and ready-made samples of Business Monthly Statements in PDF and DOC formats that you could use for your benefit. Keep on reading to find out more!

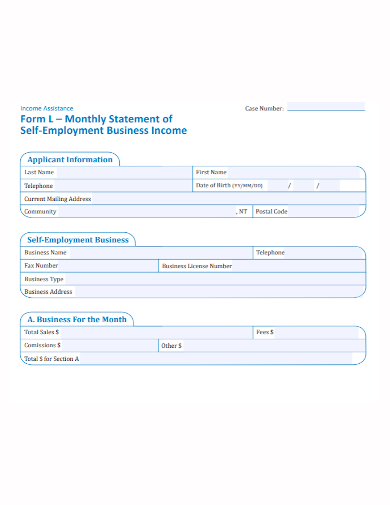

1. Monthly Business Income Statement

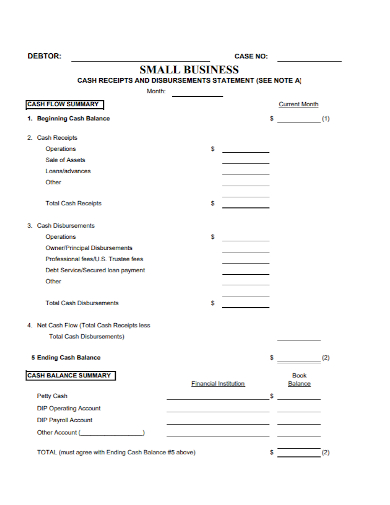

2. Business Monthly Cash Statement

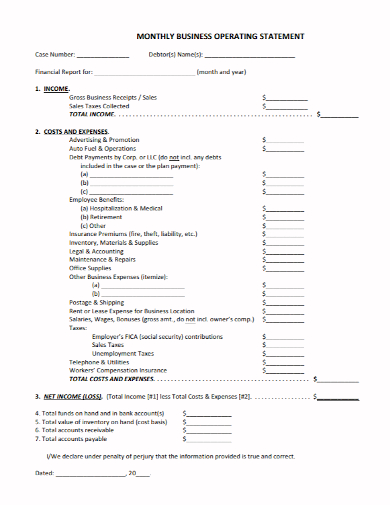

3. Business Monthly Operating Statement

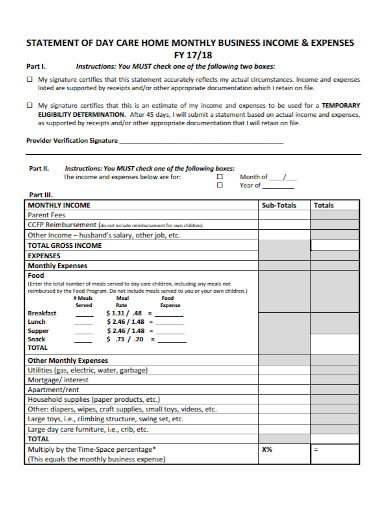

4. Day Care Business Monthly Statement

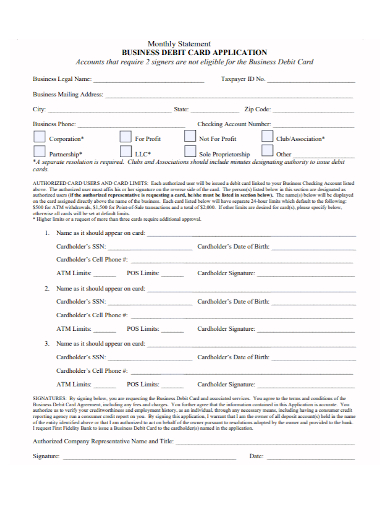

5. Business Debit Card Monthly Statement

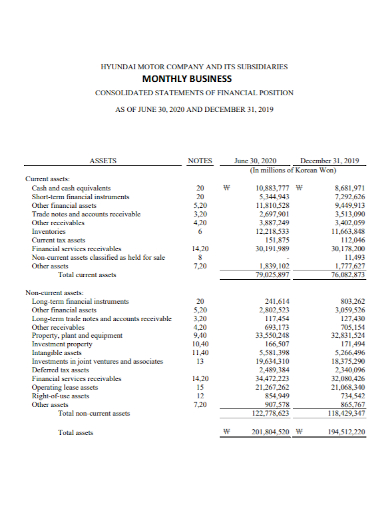

6. Company Business Monthly Statement

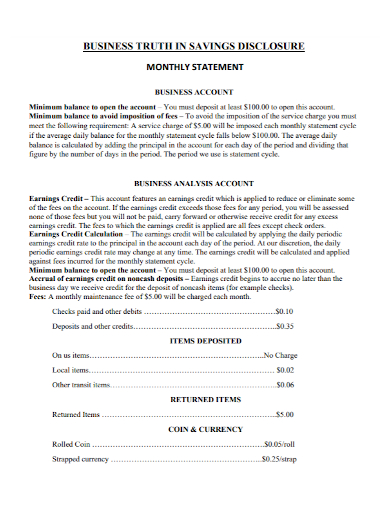

7. Business Disclosure Monthly Statement

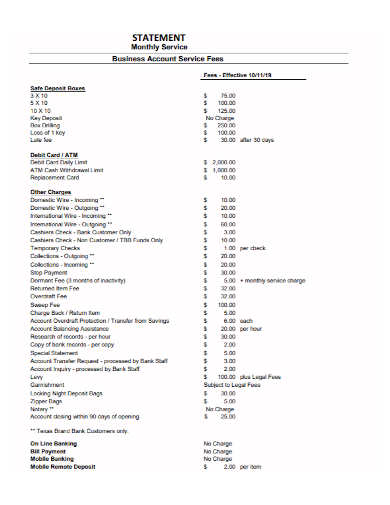

8. Business Account Service Monthly Statement

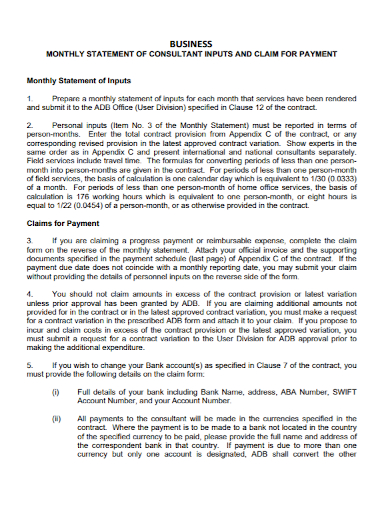

9. Business Consultant Monthly Statement

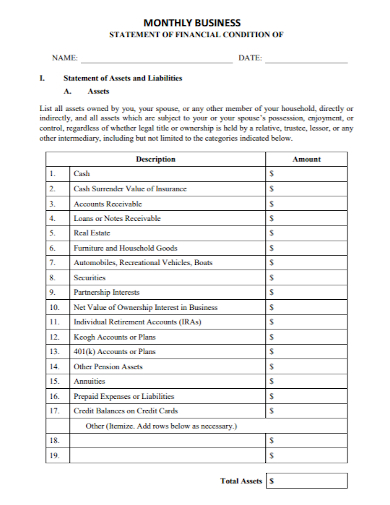

10. Business Monthly Financial Statement

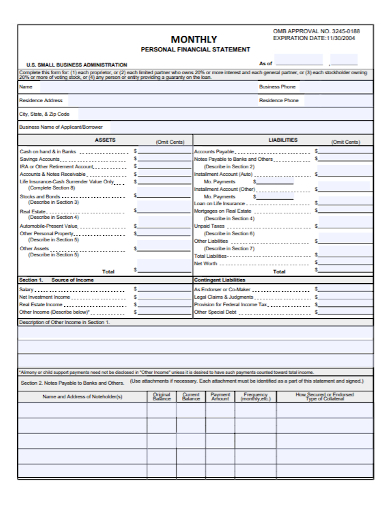

11. Personal Business Monthly Statement

What Is a Business Monthly Statement?

Financial statements are a formal and official record of the financial operations of your firm. The balance sheet, income statement, and cash flow statement are the three most significant financial statements that your firm will have. It is a management method of receiving a succinct summary of the preceding month’s financial situation in order to have up-to-date reporting of the cash management, profit and loss statements, and to evaluate future plans and actions.

How to Make a Business Monthly Statement

If you’re a small company owner, you might be worried about how to keep track of and record your money properly. That’s why you’ll require a business statement. A Business Monthly Statement Template can help provide you with the framework you need to ensure that you have a well-prepared and robust statement on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, follow these steps below to guide you:

1. Define your goal and target market.

You must clearly identify your goals and what you are aiming to achieve with the report, whether you are a little firm or a major corporation. Internal and external stakeholders who are unfamiliar with your company or financial data would benefit from this. You’ll know how to structure the information you’ll need to deliver, as well as how sophisticated the jargon will be, once you’ve defined the objective and audience.

2. Decide on your metrics.

This stage requires you to define the key performance indicators that will indicate your company’s financial health. Take your time to choose the ones you want to include in your company’s financial report so you don’t have to repeat the process.

3. Select the appropriate visualizations.

Following up on our previous point, it’s time to add visualizations once you’ve specified the financial statement and metrics you want to provide. This is vital since raw data is difficult to absorb for the ordinary reader, especially if you work with big amounts of data.

4. Create a cash-flow statement.

This is a statement that displays how much money is coming in and going out of your company. Your cash flow statement is based in part on sales projections, balance sheet items, and other assumptions. Historical financial statements should be available for existing businesses to help in projecting cash flow. It is critical to understand how you will invoice in order to obtain these forecasts.

FAQ

What are the five financial statements, and what do they mean?

The income statement, statement of financial position, statement of change in equity, and cash flow statement are the five types of financial statements.

Which three financial statements are the most important?

Financial statements such as the income statement, balance sheet, and statement of cash flows are necessary.

What does a good balance sheet look like?

Balance sheets that are built to support the entity’s business goals and maximize financial performance are known as strong balance sheets.

You’re operating in the dark if you don’t have regular financial statements. To help you get started, download our easily customizable and comprehensive templates of Business Monthly Statements today!

Related Posts

FREE 10+ Marketing Problem Statement Samples [ Strategy, Digital, Social Media ]

FREE 10+ Medical Problem Statement Samples [ Surgical, Nursing, Management ]

FREE 10+ Payoff Statement Samples in PDF | DOC

FREE 10+ Scholarship Statement of Purpose Samples in PDF | DOC

FREE 10+ Engineering Problem Statement Samples [ Software, Mechanical, Civil ]

FREE 30+ Information Statement Samples in PDF | MS Word

FREE 50+ Policy Statement Samples in MS Word | Google Docs | PDF

FREE 50+ Summary Statement Samples in PDF | MS Word

FREE 10+ Nursing School Personal Statement in PDF

FREE 9+ Mortgage Statement Samples and Templates in PDF

FREE 10+ Independent Subcontractor Statement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Trust Distribution Statement Samples in PDF

FREE 14+ Compliance Statement Samples & Templates in PDF | MS Word

FREE 10+ Extension Impact Statement Samples in PDF | DOC

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word