Capital is a broad term that can refer to anything that provides value or benefit to its owners, such as a factory and its machinery, intellectual property such as patents, or a company’s or individual’s financial assets. While money can be considered capital, it is more commonly associated with cash that is put to use for productive or investment purposes. Capital is a crucial component of running a business on a day-to-day basis as well as financing its future growth. Business capital can come from the company’s operations or it can be raised through debt or equity financing. Businesses of all types focus on three types of capital when budgeting: working capital, equity capital, and debt capital. Trading capital is a fourth component identified by a company in the financial industry.

10+ Capital Statement Samples

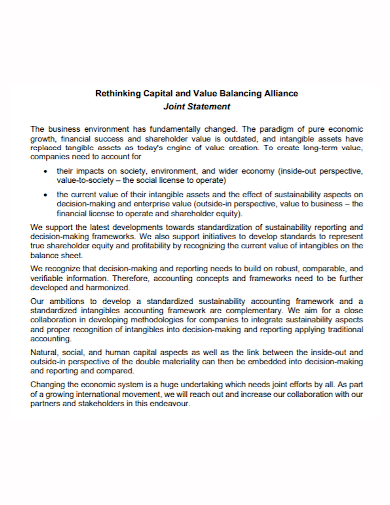

A capital statement is a document that shows the opening capital balance on the first line, then any additions in the form of investments or profits earned during the accounting period on the next line, resulting in the total capital balance. A statement by a company’s directors that the working capital (the amount needed to finance the company’s stocks and day-to-day operating expenses) available to the company and its subsidiaries are sufficient, or, if not, how the additional working capital thought necessary by the directors will be provided. Depending on the nature of the transaction being undertaken by the relevant company, this statement may be required to be made in a prospectus/listing particulars or shareholder circulars.

1. Capital Statement Template

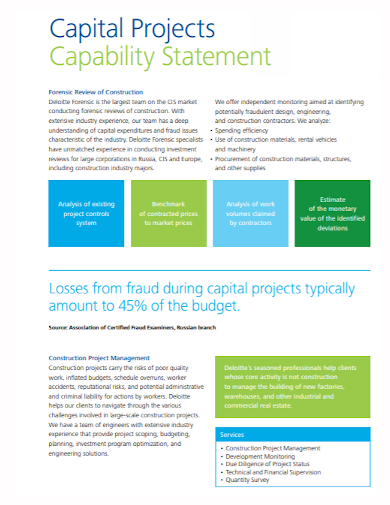

2. Construction Capital Project Capability Statement

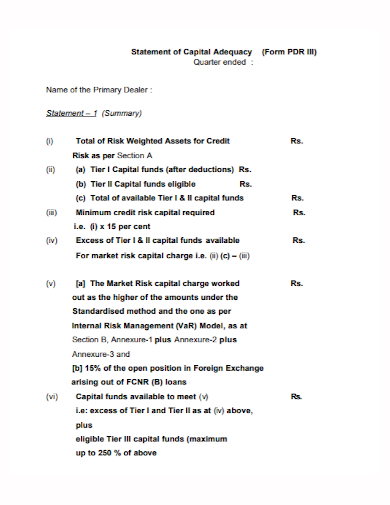

3. Capital Adequacy Statement

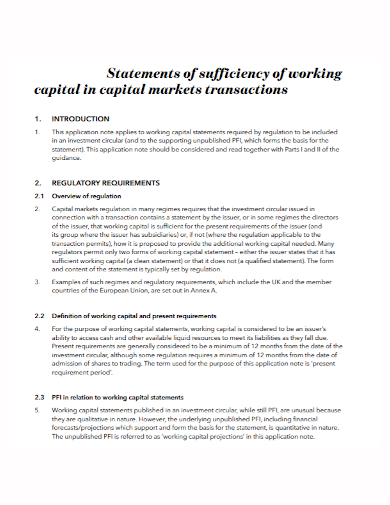

4. Working Capital Statement

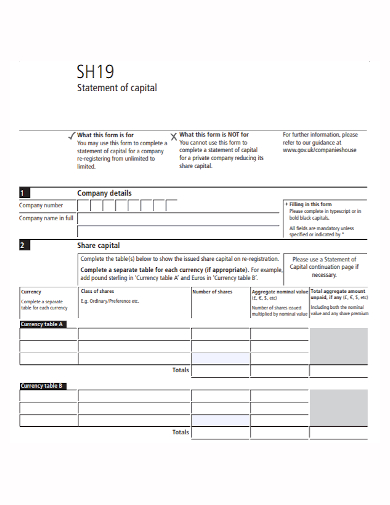

5. Company Capital Statement

6. Capital Financial Services Statement

7. Capital Market Privacy Statement

8. Capital Compliance Statement

9. Management Intellectual Capital Statement

10. Capital Joint Statement

11. Capital Liquidity Statement

Creating Capital Statement

- Assemble the required data – The Statement of Changes in Owner’s Equity is now ready to be paired with the income statement. The adjusted trial balance would be the most relevant source of data in preparing financial statements once again. Any report with a complete list of updated accounts, however, can be used. Later in the process, the Income Statement will be used as well.

- Make a heading – The heading is three lines long, just like any other financial report. The company’s name appears on the first line. The report’s title appears on the second line. Statement of Changes in Owner’s Equity, Statement of Owner’s Equity, or just Statement of Changes in Equity would be appropriate in this case. Any of the three options would be preferable. The period covered will be shown on the third line. The report is divided into sections that cover different periods of time, such as For the Year Ended, For the Quarter Ended, For the Month Ended, and so on. The phrase “For the Year Ended” is missing from some annual financial statements.

- Capital at the origin of the period – Document the capital balance at the start of the period – or the amount at the end of the previous one. Recognize that the previous period’s ending balance is the current period’s beginning balance.

- Add the supplementary contributions – The owner’s contributions raise capital, which is then added to the capital balance.

- Add the net income – Because net income raises capital, it is added to the starting capital balance. For all revenues minus all expenses, net income is sufficient. We can also refer to the income statement that was prepared for the amount previously.

- Decrease the owner’s withdrawal – The owner’s withdrawals are reported separately from the contributions. You can find it as “Owner, Drawings,” “Owner, Withdrawals,” or any other relevant account in the regulated trial balance. Withdrawals reduce capital and are therefore deducted.

- Measure ending capital balance – Estimate and draw the lines for the capital account balance at the end of the period. A horizontal line indicates the completion of a mathematical operation. Below the ultimate quantity, two horizontal lines (double-rule) are drawn.

FAQs

How capital is used?

Companies use capital to fund the ongoing production of goods and services in order to make a profit. Companies invest their capital in a variety of things in order to generate value. Two common areas of capital allocation are labor and building expansions. A business or individual invests capital in the hopes of earning a higher return than the capital costs.

What is the capital in a business?

A company’s capital is the money it has on hand to fund its day-to-day operations as well as future expansion plans. One source of capital is the company’s profits.

If you want to see more samples and formats, check out some capital statements samples and templates provided in the article for your reference.

Related Posts

FREE 10+ Payoff Statement Samples in PDF | DOC

FREE 10+ Scholarship Statement of Purpose Samples in PDF | DOC

FREE 10+ Engineering Problem Statement Samples [ Software, Mechanical, Civil ]

FREE 30+ Information Statement Samples in PDF | MS Word

FREE 50+ Policy Statement Samples in MS Word | Google Docs | PDF

FREE 50+ Summary Statement Samples in PDF | MS Word

FREE 10+ Nursing School Personal Statement in PDF

FREE 9+ Mortgage Statement Samples and Templates in PDF

FREE 10+ Independent Subcontractor Statement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Trust Distribution Statement Samples in PDF

FREE 14+ Compliance Statement Samples & Templates in PDF | MS Word

FREE 10+ Extension Impact Statement Samples in PDF | DOC

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 10+ Diversity Mission Statement Samples in MS Word | PDF

FREE 10+ Architecture Statement of Purpose Samples [ Sustainable, Graduate, Master ]