10+ Mortgage Payoff Statement Samples

The purpose of a mortgage loan is to purchase a property or to getting the funds you need against the value of a home that you currently own. If you can’t afford the whole cost of a property out of pocket, a mortgage is a must. Even if you have the money to pay it off, there are some situations when having a mortgage on your house makes sense. There are many steps in obtaining a mortgage, one of the most basic steps is the payoff statement. Not sure what this is? Look no further! In this article, we provide you with free and ready-made samples of Mortgage Payoff Statements in PDF and DOC formats that you can use for your benefit. Keep on reading to find out more!

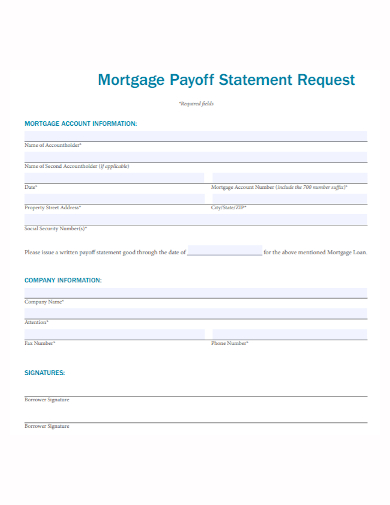

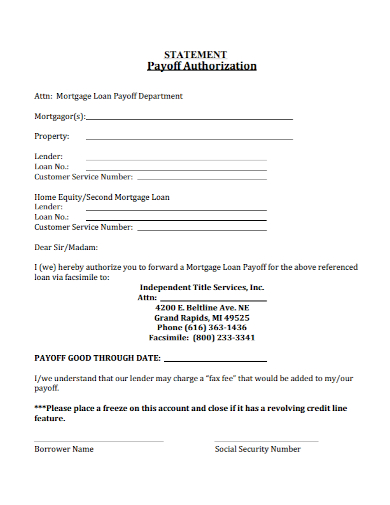

1. Mortgage Payoff Statement

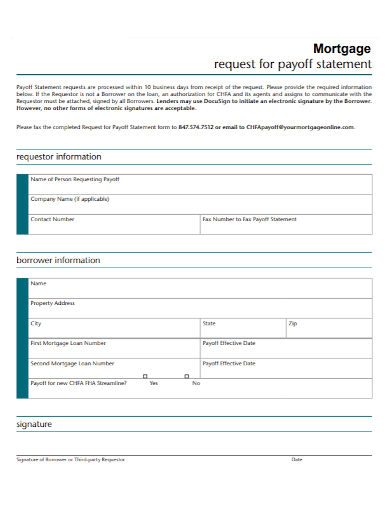

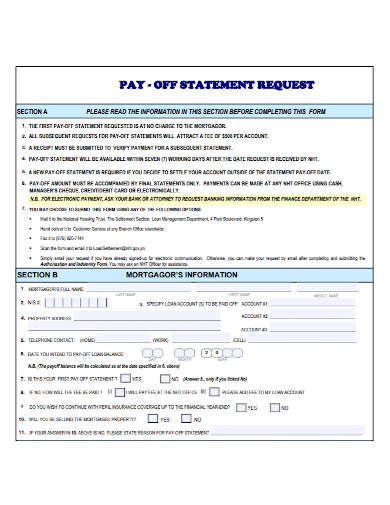

2. Mortgage Payoff Request Statement

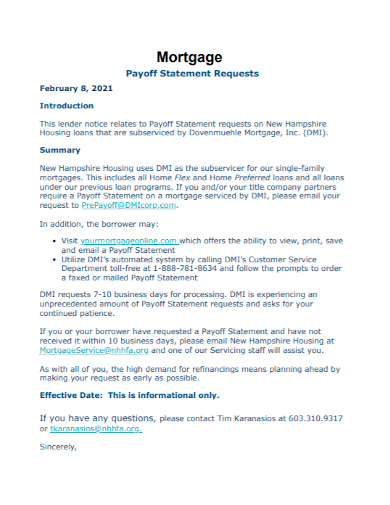

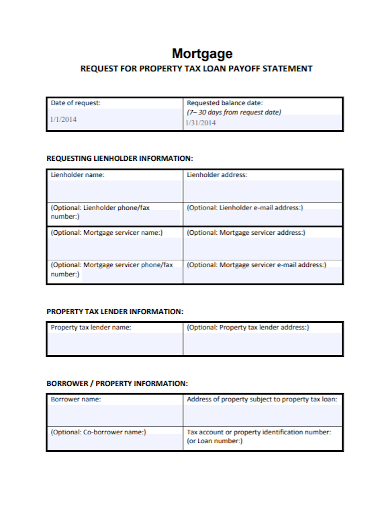

3. Sample Mortgage Payoff Statement

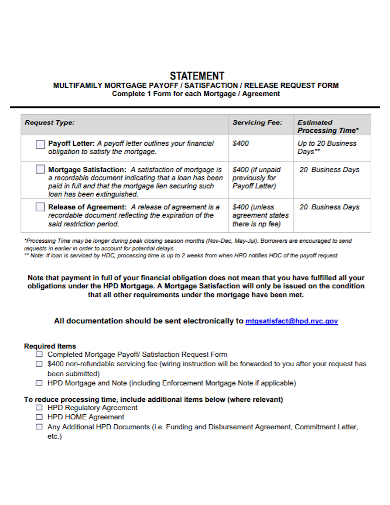

4. Multifamily Mortgage Payoff Statement

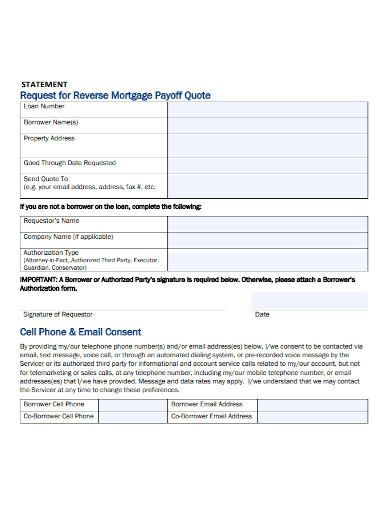

5. Reverse Mortgage Payoff Statement

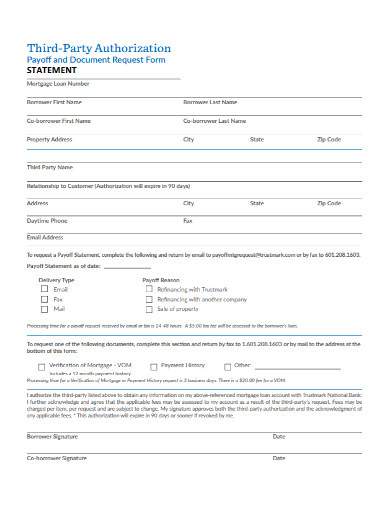

6. Third-Party Mortgage Payoff Statement

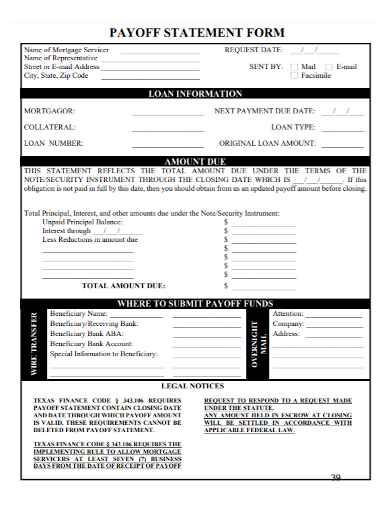

7. Mortgage Payoff Statement Form

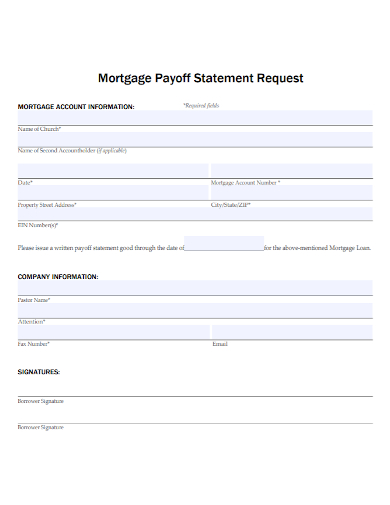

8. Mortgage Account Payoff Statement

9. Mortgage Loan Payoff Statement

10. Standard Mortgage Payoff Statement

11. Mortgage Property Payoff Statement

What Is a Mortgage Payoff Statement?

A mortgage payback statement, also known as a payoff letter, is a document that specifies the precise amount of money required to fully repay your home debt. Because the interest on your loan balance is charged everyday, the payback statement is an important document. Because the interest on your loan balance is charged everyday, the payback statement is an important document. The actual amount owing varies depending on the conditions of the loan, so you can’t just assume what you owe.

How to Make a Mortgage Payoff Statement

Liens are frequently coupled with payoff statements, which indicate that a legal claim has been filed to confiscate property if full payment is not obtained. A Mortgage Payoff Statement Template can help provide you with the framework you need to ensure that you have a well-prepared and robust statement on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, follow these steps below to guide you:

1. Obtain all of the terminology as well as additional details.

A payback statement should be written to the lender who requested the payoff and contain the name and address of the lender who prepared the statement. The customer’s name, the loan number, and the loan terms, including the balance and interest rate, must all be included.

2. Complete the letter’s content.

This will tell you what the payback figure is and how long it lasts. If the payback due date expires, the statement should contain a per diem amount, which can be used to determine a new payout figure. You can multiply the per diem figure by the amount of interest accrued each day after the initial payment date expires. The letter should also state the date on which interest has been paid.

3. Determine the rest of the amount that needs to be paid.

Calculate your payoff. This is probably one of the most important step of the statement, as this discloses how much you need to pay for your mortgage.

4. A breakdown should be included.

A summary of any fees, interest payable, and the principle balance, as well as an explanation of per diem costs that will be imposed if the check is received after the due date, should be included on the payback statement. In addition, the statement should mention who should receive the check.

FAQ

On a payout statement, what components are included?

Any interest you owe through the day you plan to pay off your loan is also included in your payout amount. Other costs you’ve incurred but haven’t paid may be included in the payback amount.

How can I find out how much I owe on my mortgage?

Request a payback statement from your mortgage provider by calling them. Your new lender will obtain a payback statement from your lender in the course of a refinance and will share it with you, but you can request it yourself.

When you seek a payment quotation, what happens?

The remaining balance on your mortgage loan, including the outstanding principle balance, accumulated interest, late charges/fees, and any additional sums, is shown on a payoff quotation.

In a nutshell, the payback statement provides you the precise amount needed on the day you pick to retire the mortgage. To help you get started, download our easily customizable and comprehensive samples of Mortgage Payoff Statements today!

Related Posts

FREE 13+ Operating Statement Samples

FREE 10+ Rental Billing Statement Templates

FREE 10+ Sample Confidentiality Statement

FREE 10+ Research Disclosure Statement Samples

FREE 9+ Yearly Income Statement Samples

FREE 9+ Billing Statement Samples

FREE 9+ Product/Service Benefit Statement Samples

FREE 7+ Sample Closing Statement

FREE 7+ Sample Billing Statement

FREE 14+ Notary Statement Samples

FREE 13+ Narrative Statement Samples

FREE 12+ Scope Statement Templates

FREE 10+ Racial Impact Statement Samples

FREE 9+ Sample Personal Financial Statement

FREE 7+ Sample Profit and Loss Statement Forms