Non-profit organizations also have a financial activity like any other organization. It is very critical to understand how to prepare financial statements and what statistics are needed. Additionally, there are many additional considerations for reporting on non-profit financial statements. All in all, preparing and creating financial statements for non-profit organizations is not easy. It requires too much work, calculation, knowledge, and patience to make it possible. Luckily, our downloadable non-profit financial statement templates are available for you. You can use them to guide you with your financial statement. Just scroll down to learn more.

FREE 10+ Non-Profit Financial Statements Samples

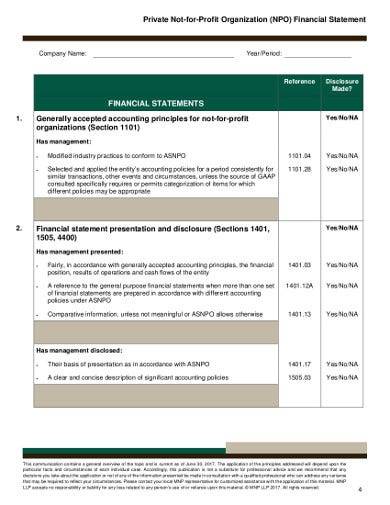

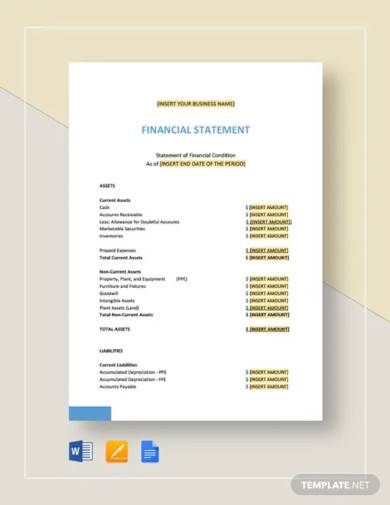

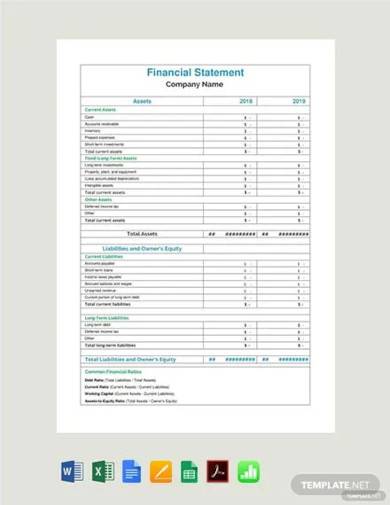

1. Financial Statement Template

2. School Financial Statement Template

3. University Financial Statement Template

4. Free Financial Statement Template

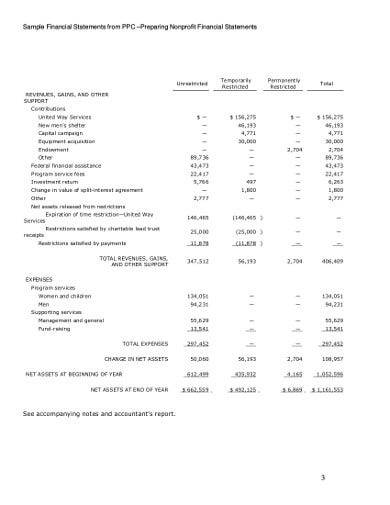

5. Sample Nonprofit Financial Statement

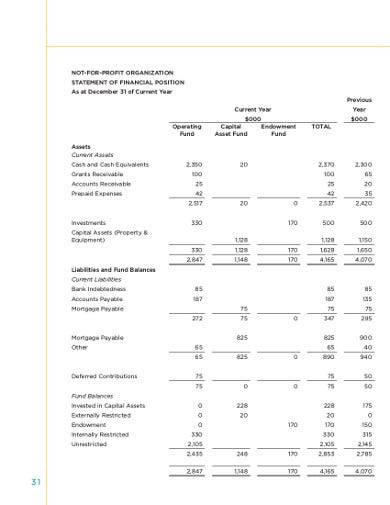

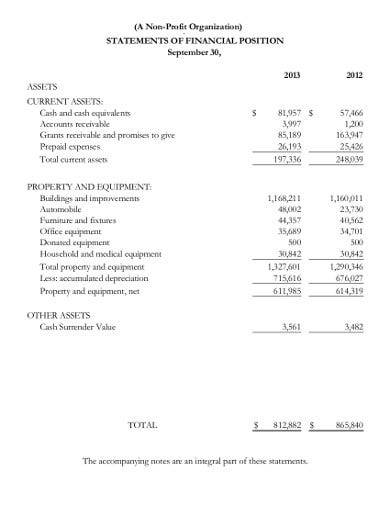

6. Statement of Financial Position

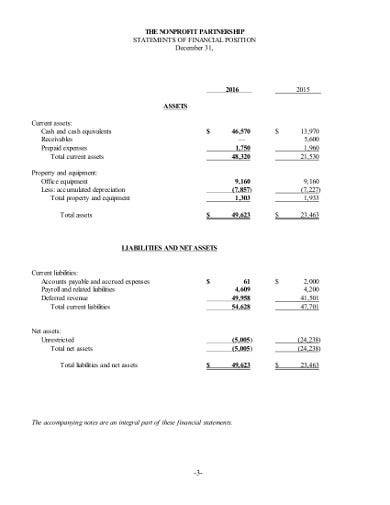

7. Nonprofit Partnership Financial Statement

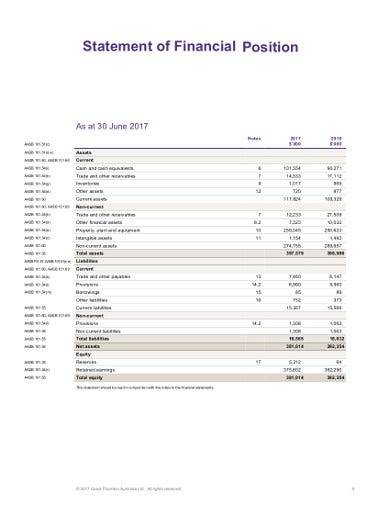

8. Nonprofit Financial Statement

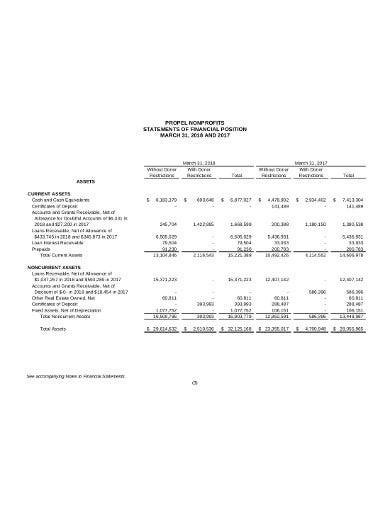

9. Nonprofit Financial Statement Format

10. Nonprofit Organization Financial Statement

11. Sample Statement of Financial Position

What Is a Non-Profit Financial Statement?

A non-profit financial statement or statement of financial position (SOP) is similar to the profit company’s balance sheet. It gives a glimpse of your organization’s finances, listing a property in order of liquidity and liabilities in order of duration of the obligation. It reports the organization’s assets and liabilities in some order, especially when the assets will convert into cash and when your organization has to pay the liabilities. Usually, SOPs are created and prepared at the end of the fiscal year. However, larger organizations or those with significant financial changes may choose to prepare SOPs quarterly or monthly.

How to Create a Non-Profit Financial Statement?

Non-profit organizations operate in the same way as profit companies in terms of finance. Both spend money to run efficiently and have revenue streams to keep products, services, and programs operational. The primary difference is that non-profit organizations reinvest their income in the services and programs they offer. Non-profit financial statements must show all incoming and outgoing financing to show how the non-profit operates. Here’s how you should create financial statements for a non-profit organization:

1. Record of Incoming Funds

Record all incoming funds a non-profit organization gets over the year. Incoming funds usually come from donations, sponsors, and fundraising events. The income may vary from month to month, so document how much the organization pulls each month during the entire year. Use a chart that shows each month’s profit or income and add a column that provides the total revenue for the year.

2. Records of Outgoing Funds

Make an outgoing funds section on your financial statement. This section must be attached to wages and salaries. Calculate how much the non-profit organization spends on monthly wages and salaries to pay the employees and non-profit managers. Also, calculate how much money each year the organization spent on salaries. In this way, you can track all the money that your non-profit organization used over the year.

3. Add the Fixed Operational Costs

Calculate all fixed operating costs that keep the non-profit organization going on every month. These expenditures are usually set on a monthly and rarely differ. Examples of fixed operating costs include non-profit rental charges, utility bills, and Internet connection. Calculate all of these expenditures every month as well as an annual amount.

4. Add Flexible Operational Costs

Aside from the fixed operational cost, you also have to calculate all the flexible operational costs. Calculate any flexible operating costs that the non-profit spends to keep the organization moving. These expenditures are not necessarily present each month, so the expenditure varies every month. Examples of these flexible operating costs include business cards, buying computers, photocopying of paper, and office supplies.

5. Write a Conclusion

Once done with all the calculations, you have to construct a conclusion. Create a conclusion section that illustrates how the non-profit organization will use these funds. It will help readers understand the organization’s objectives and priorities.

FAQs

Do non-profit organizations have a net income?

The non-profit organization’s equivalent of income is in its net assets. Net assets are documented in the non-profit organization’s statement of financial position and statement of activities and reflect revenues except for expenses and losses.

What are the types of financial statements of a non-profit organization?

The four main types of non-profit financial statements are the following:

- Statement of Financial Position

- Statement of Activities

- Statement of Cash Flows

- Statement of Functional Expenses

What is the statement of activities?

The statement of activities measures the revenues and expenditures of a non-profit entity for the fiscal period. These income and expenses are subdivided into unrestricted, temporary, and permanently restricted classifications and divided into different columns across the statement.

How to evaluate non-profit financial statements?

Examine the revenue for previous years to identify the average annual profits and compare them with the current year. It will tell you whether the institution is on track with its development objectives or is undergoing a downturn. Subtract total expenditures from total income and divide the result by overall revenue. That is how to evaluate a non-profit financial statement.

One reason that financial statements are crucial to a non-profit organization is that they are a convenient way of showing your board your organization’s financial status. Whether it’s doing well or not, your board needs to be aware of that. Some statements may also be a prerequisite when applying for grant funding. However, preparing such financial statements are very much challenging. Not only because it involves too much calculation, but also it needs to be precise and accurate to come up with the correct results. The next time you’ll create a financial statement for your non-profit organization, you can use our downloadable financial statement templates. Download it now to get started!

Related Posts

FREE 17+ Sample Financial Statement Templates in PDF MS Word ...

FREE How to Write a Needs Statement for Your Grant Proposal ...

FREE Essential Financial Statements for Your Business [ with ...

FREE 14+ Sample Profit and Loss Statement Templates in PDF ...

FREE 10+ Sample Senior Accountant Job Descriptions in MS Word ...

FREE 7+ Financial Summary Samples in PDF MS Word

FREE 26+ Annual Report Samples in MS Word PDF | Pages ...

FREE 24+ Annual Report Templates in MS Word PDF | Apple ...

FREE 19+ Sample Statement Templates in PDF MS Word | Excel

FREE 11+ Financial Statement Samples in Google Docs MS Word ...

12+ Bookkeeping Checklist Samples and Templates in PDF MS Word

FREE 16+ Sample Treasurer Reports in PDF MS Word

FREE 16+ Nonprofit Budget Samples in PDF MS Word | Excel

FREE 9+ Sample Vision Statement Templates in MS Word PDF

FREE 44+ Sample Statement Forms in PDF