4+ Nonprofit Financial Statement Samples

No matter what it’s called, the statement of financial activities (SOA) shows the nonprofit organization’s income and expenses for a specific period of time. The report reflects the changes to an organization’s net assets resulting from income and expenses that occur during the current fiscal year. A non-profit organization is a group organized for purposes other than generating profit and in which no part of the organization’s income is distributed to its members, directors, or officers. Non-profit entities are organized under state law. These financial statements are made for the purpose of tracing the development of the organizations and creating necessary changes to make it more progressive. In making this, you don’t need to undergo the tedious process of doing it from the very scratch, we offer you free, available, ready-made yet customizable templates that you can choose from to satisfy your template needs. Just choose among these templates and customize the template of your choice.

For other statement template needs, our site is also offering templates for Racial Impact Statements, Community Impact Statement, Quality Assurance Statement, Engineering Problem Statement, Undergraduate Research Statement, Authors Declaration Statement, Audited Financial Statement, Research Contribution Statement, Safety Policy Statement, Grant Proposal Problem Statement, Teaching Statement, Questionnaire Opening Statement and more in the storage for you. This article will not only give you free and customizable templates but also provide you with essential information that you need to know and consider in making your statement.

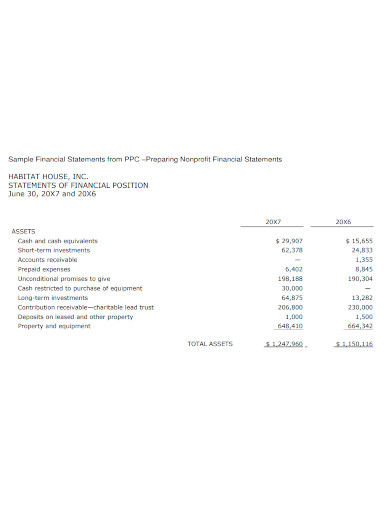

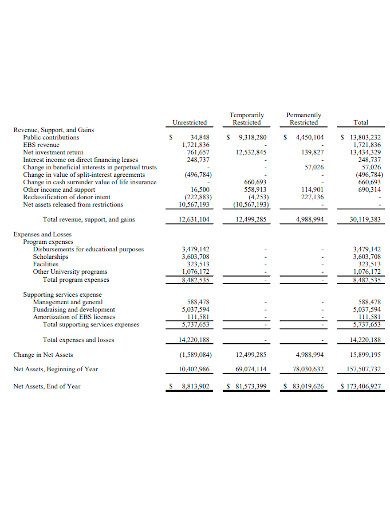

1. Nonprofit Financial Statement Sample

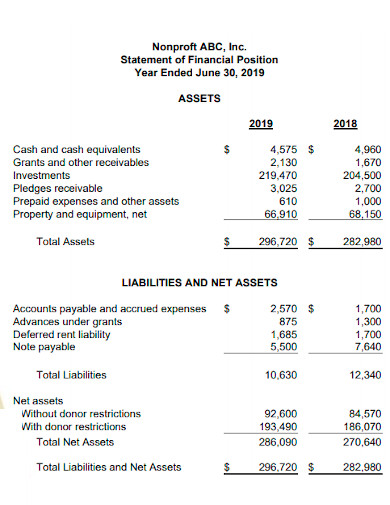

2. Printable Nonprofit Financial Statement

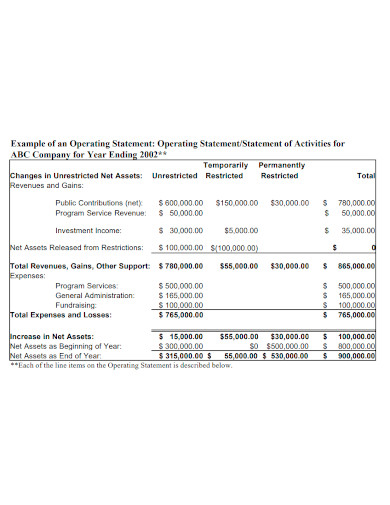

3. Standard Nonprofit Financial Statement

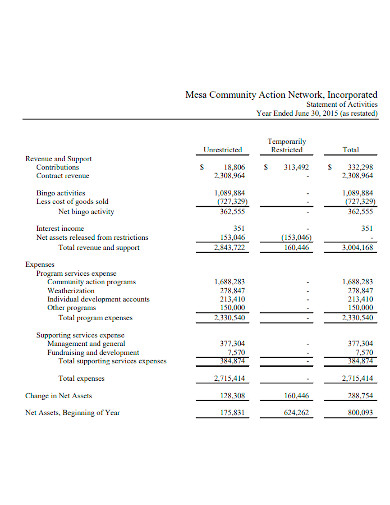

4. Editable Nonprofit Financial Statement

5. Nonprofit Financial Statement Format

Nonprofit Organizations

Nonprofits are organizations that are not owned by shareholders and are not intended to earn profit for distribution. Instead, nonprofits typically seek to earn revenue to distribute for programs, grants and other societal support systems. Nonprofits use four main financial reporting statements: balance sheet, income statement, statement of cash flows and statement of functional expenses. Three of these are similar to common for-profit company statements, with the functional expenses statement being unique.

Balance Sheet

The nonprofit balance sheet is also commonly referred to as a statement of financial position or statement of financial condition. The balance sheet is based on the accounting formula, assets equals liabilities plus net assets. This is a mirror of the for-profit balance sheet other than for-profits have owners’ equity instead of net assets. The balance sheet offers the best overall perspective on the nonprofit’s stability. In particular, leaders want to know if it is overwhelmed by liabilities.

Income Statement

Often referred to as a statement of activity since income statement is more associated with for-profit companies and earnings, the nonprofit income statement follows the formula, revenues minus expenses equals change in net assets. Revenues less expenses is the general equations for earnings in for-profits. For a nonprofit, it shows the changes in funds coming into the organization versus costs in operating it. Nonprofits need positive changes in net assets to maintain stability in managing programs.

Functional Expense Statements

The statement of functional expenses is only used by nonprofit organizations based on the importance of monitoring expenditures. Nonprofits do not use the statement of owners’ equity common to for-profits. In general, this statement breaks down organizational expenses into common categories, such as programs, management expenses, direct mail campaigns and the salaries of fundraising staff. This helps the company track how it spends its money.

The statement also shows the breakdown of expenses between program services and support services. One of the reasons nonprofits track expenses is to report on the percentage of its funds that go toward programs compared to funds spent on administration costs, such as employee salaries.

Cashflow

The statement of cash flows is similar to the one used by for-profits. It has similar category breakdowns of operating, investing and financing activities to show where cash is coming from and how it is going out. Nonprofits want to track changes in cash flow to see whether it has an adequate supply of incoming cash to cover program and support needs.

FAQs

How do nonprofit organizations make money?

Nonprofits do not exist to make money. Charitable nonprofits (also known as public charities) generally receive money through donations, and also from grants from foundations or state and federal governments. In contrast, the main goal of a nonprofit is to benefit the public.

Can one person run a non-profit organization?

No one person or group of people can own a nonprofit organization. Ownership is the major difference between a for-profit business and a nonprofit organization. But nonprofit organizations do not have private owners and they do not issue stock or pay dividends.

Related Posts

FREE 16+ Nonprofit Budget Samples

FREE 13+ Narrative Statement Samples

FREE 10+ Charity Annual Report Samples & Templates

FREE 9+ Sample Vision Statement Templates

FREE 8+ Charity Audit Report Samples & Templates

FREE 8+ Cash Analysis Samples

FREE 8+ Sample Financial Confidentiality Agreement Templates

FREE 7+ How to Make a Non-Profit Annual Budget Samples

FREE 6+ Sample Accounting Manual Templates

FREE 38+ Samples of Statement Templates

FREE 20+ Sample Annual Reports

12+ Bookkeeping Checklist Samples

FREE 7+ Board Resolution Samples

FREE 7+ Charity Commission Annual Report Samples

FREE 5+ Charity Impact Report Samples