A Profit and Loss Budget can be made for a variety of time periods. Monthly is the most common. The goal is to compare the business’s performance to the budget and assess how things are going. The Profit and Loss Budget will essentially mirror your financial software’s Profit and Loss function. In fact, it’s ideal if they’re the same so that a business owner can look at the actual numbers and compare them to what was forecast in the budget. Many small business software packages include a feature that allows the business owner to enter their profit and loss budget into the program. You can then assess areas of business effectiveness and take action to correct any problems. It is critical to have a budget for a specific time period and at meaningful intervals.

10+ Profit and Loss Statement Budget Samples

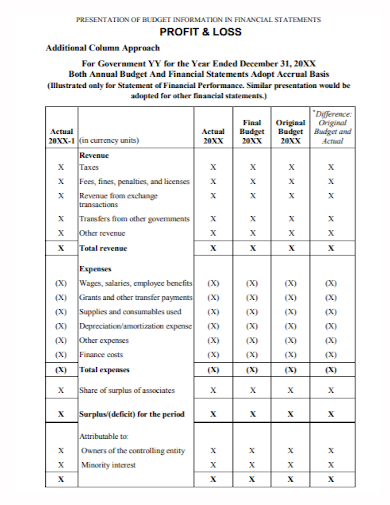

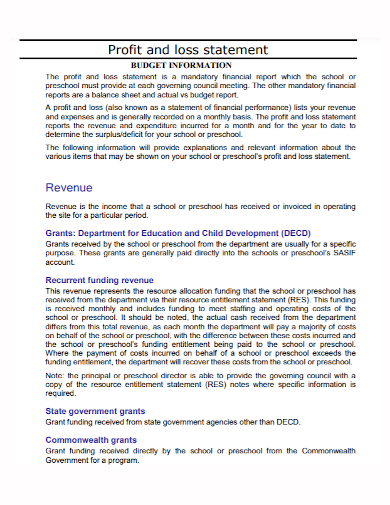

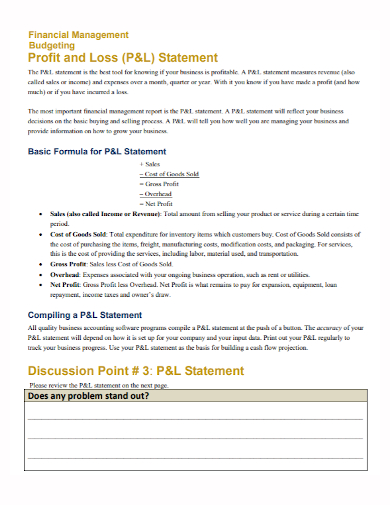

A profit and loss (P&L) statement is a financial statement that summarizes revenue, costs, and expenses for a specific time period, usually a quarter or fiscal year. These documents reveal a company’s ability (or inability) to generate profit by increasing revenue, lowering costs, or both. The cash or accrual basis is frequently used in these statements.

The profit and loss budget is a list of anticipated revenue and expenses. It’s usually prepared once a year, but depending on what you’re using the budget for, it could be shorter or longer. The income and expense information for your profit and loss budget is compared to the business operating plans for the budget period.

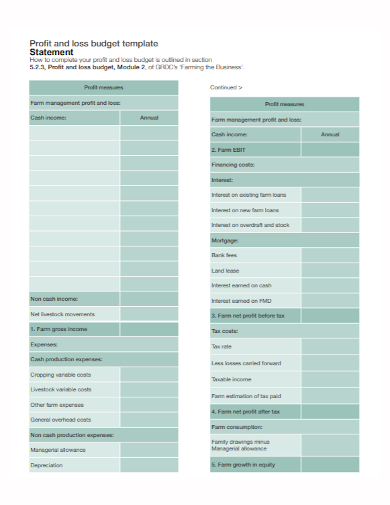

1. Profit and Loss Statement Budget Template

2. Profit and Loss Statement Budget

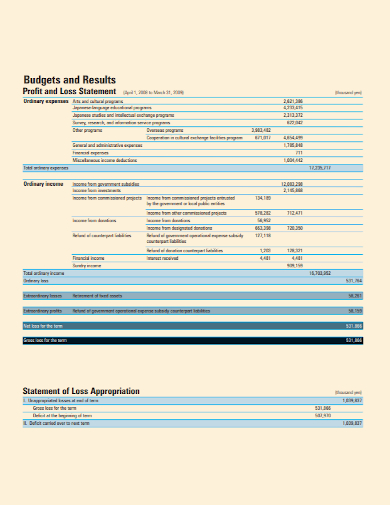

3. Profit and Loss Statement Annual Budget

4. Profit and Loss Revenue Budget Statement

5. Profit and Loss Receipt Budget Statement

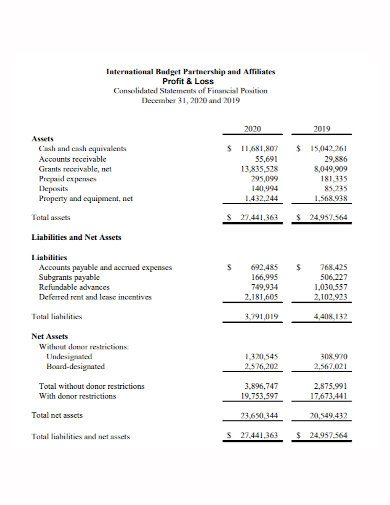

6. Profit and Loss Statement Partnership Budget

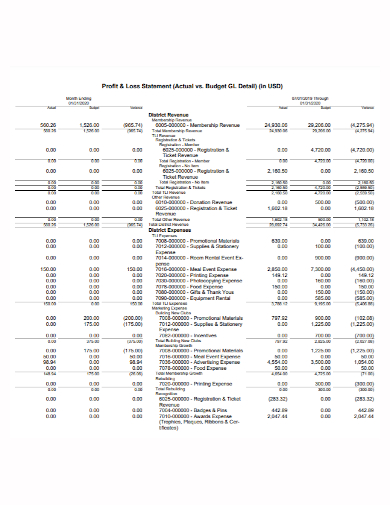

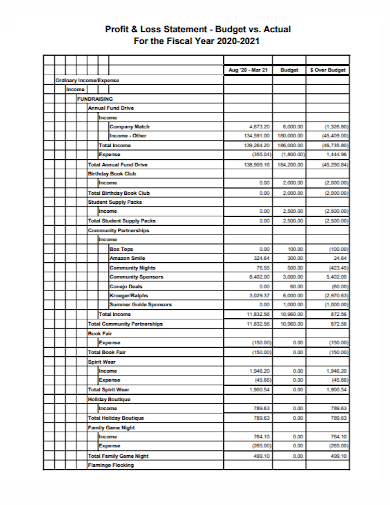

7. Profit and Loss Statement Actual Budget

8. Sample Profit and Loss Statement Budget

9. Profit and Loss Financial Statement Budget

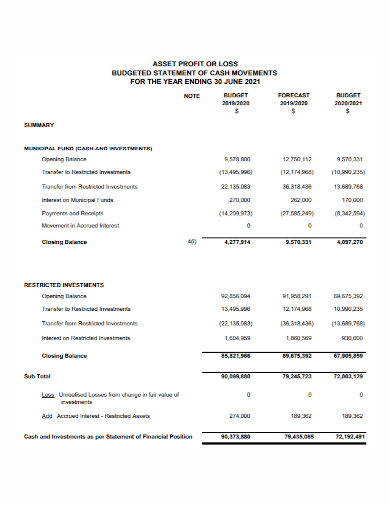

10. Profit and Loss Assest Budget Statement

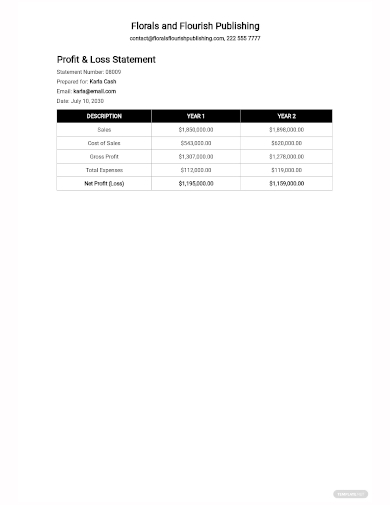

11. Standard Profit and Loss Statement Budget

What is Included in a Profit and Loss Statement Budget?

A Profit and Loss Budget, unlike a Cash Flow Budget, will include more than just cash inflows and outflows. In fact, some cash inflows and outflows will not be included in the Profit and Loss Budget. This is because, for the purposes of Profit and Loss, not all cash outflows are related to the ‘revenue account,’ as we accountants refer to it. Some of these outflows, for example, include loan repayments. The interest portion of these payments will be included in the Profit and Loss Budget, but not the principal. Depreciation and amortization will also be included in the Profit and Loss Budget, but cash purchases of new assets will not.

How to Prepare for a Profit and Loss Statement Budget?

Begin by determining your company’s objectives and involving relevant personnel. This will ensure that your budget is aligned with your objectives and that it is prepared and reviewed by the appropriate individuals.

A process for preparing an annual budget should be documented and followed. Steps in the process could include the following:

1. Examine the approved business operating plan and make a list of all activities that must be completed during the budget period.

2. For the new budget period, divide activities into existing and new categories.

3. Make a list of all assumptions you’ve made for the budget period.

4. Examine the profit and loss statements from the previous year on a regular basis, such as monthly or quarterly.

5. Prepare the profit and loss budget for the selected period using the financial statements template.

FAQs

Why is it necessary to compare the income statement and cash flow statement?

Because a company can log revenues and expenses before cash changes hands under the accrual method of accounting, it’s critical to compare the income statement with the cash flow statement.

What is the first step in creating a profit and loss statement?

Calculate all of your company’s revenue as the first step in creating a profit and loss statement. Current account balances, such as cash and current accounts receivable, can be found in your general ledger. If you’re making a monthly profit and loss statement, you’ll include all revenue received during that time period, whether or not your company has collected it. Simply add up the revenue received during the three-month period if you’ve chosen to run a quarterly statement.

What are included in the operating expenses?

Rent, travel, payroll, equipment, utilities, and postage are all examples of operating expenses.

It’s critical to create a profit and loss statement for your small business because it’s one of the most effective reports for determining whether or not your company is profitable. A profit and loss statement, which is required by lending institutions and investors alike, can also help you identify areas of success as well as areas where your business may require additional assistance.

Related Posts

FREE 6+ Research Contribution Statement Samples in PDF | DOC

FREE 10+ Marketing Problem Statement Samples [ Strategy, Digital, Social Media ]

FREE 10+ Medical Problem Statement Samples [ Surgical, Nursing, Management ]

FREE 10+ Payoff Statement Samples in PDF | DOC

FREE 10+ Scholarship Statement of Purpose Samples in PDF | DOC

FREE 10+ Engineering Problem Statement Samples [ Software, Mechanical, Civil ]

FREE 30+ Information Statement Samples in PDF | MS Word

FREE 50+ Policy Statement Samples in MS Word | Google Docs | PDF

FREE 50+ Summary Statement Samples in PDF | MS Word

FREE 10+ Nursing School Personal Statement in PDF

FREE 9+ Mortgage Statement Samples and Templates in PDF

FREE 10+ Trust Distribution Statement Samples in PDF

FREE 14+ Compliance Statement Samples & Templates in PDF | MS Word

FREE 10+ Extension Impact Statement Samples in PDF | DOC

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word