They say money is the root of all evil. Money is always such a sensitive topic to discuss. But talking about it helps people understand and analyze their finances. It is essential to address your financial status for you to formulate budget plans, spending decisions, and other monetary concerns. In the world of business, matters that relate to money include a company’s sales, profit, and loss statements, and investments. Studying these elements can help identify any risks the company may face. There are many documents to be familiar with; one of these is an income statement. In merchandising, you need to formulate your retail income statement.

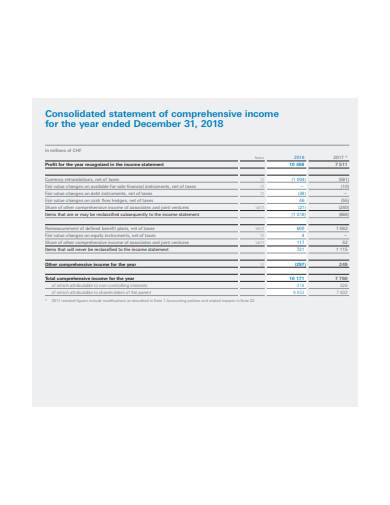

A business’s finances need careful observation and analysis. It can be a factor for investors to see if it is worth investing in. Does it have potential? Will it grow? There are three business financial statements stock investors look into. These are the balance sheet, cash flow statement, and income statement. Let’s put our focus on the third. The income statement is a summary of a company’s sales and expenses in a given fiscal year. Even small businesses put effort into making their income statements. The investment world fixates on the final net figures and other numbers indicated in the income statement. This vital business report shows how well a business is doing financially.

Income Statement Differences: Merchandising vs. Service Company

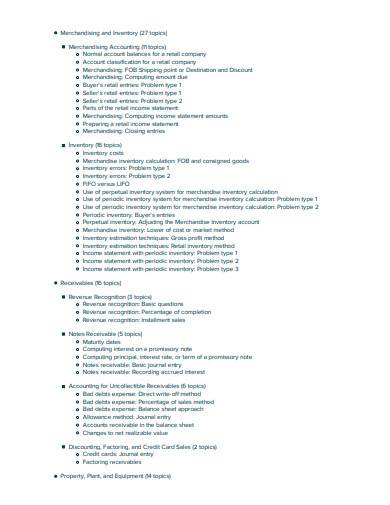

Business is quite a broad field. That is why there are many subcategories it branches out to. Two of the main areas in business are merchandising and services. Although they roll around with the same generally accepted accounting principles, they still have a fair share of differences. One of which is formulating their financial statements, especially their income statements.

Merchandising companies make their money buying and reselling goods. Service companies, on the other hand, produce income by providing services to customers. A difference in their projected income statements is present in their assets. Merchandising companies have inventory expenses, thus giving them illiquid assets. Service companies, on the other hand, note their receivable assets.

Another thing that differs between the two is that merchandising companies could face lawsuits regarding defective goods as service companies face breach of contract. Both of which can take a toll on their finances. When reading the income statement, any analyst can see that there’s a part present in merchandising that isn’t in service. That is the “cost of goods sold” line. This involves inventory list calculations that are complicated to understand. Many merchandising companies actually submit retail income statements for investors and analysts to check out.

12+ Retail Income Statement Samples in PDF | DOC

The retail business also deals with a lot of finances, most of which are present in their retail income statements. To help you understand income statements, here are 12+ retail income statements samples you can study.

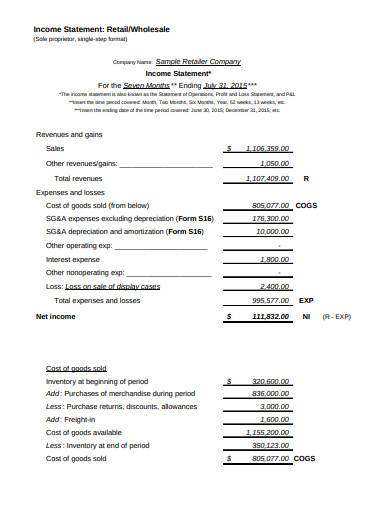

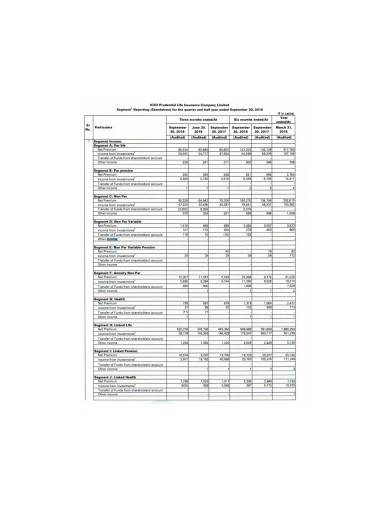

1. Retail Income Statement Sample

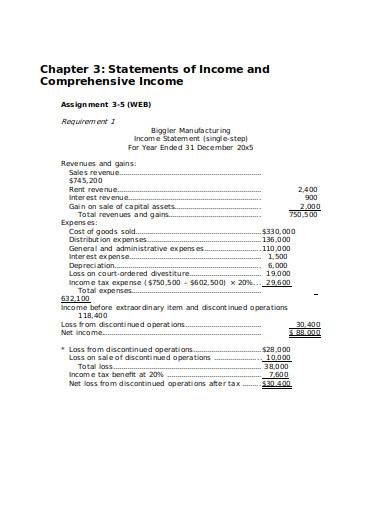

2. Retail Income Statement Template

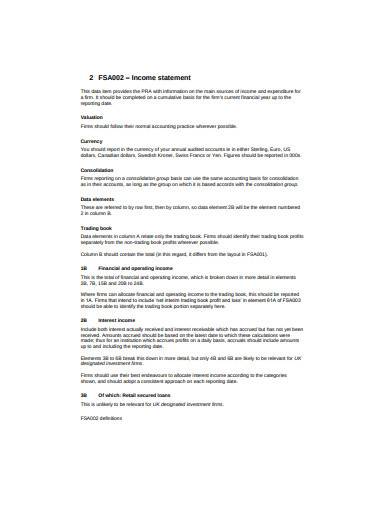

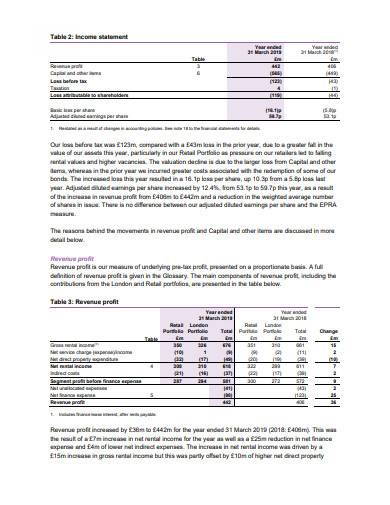

3. Retail Income Statement in PDF

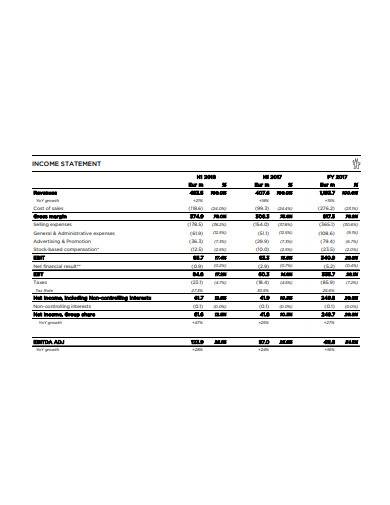

4. Retail Income Statement Example

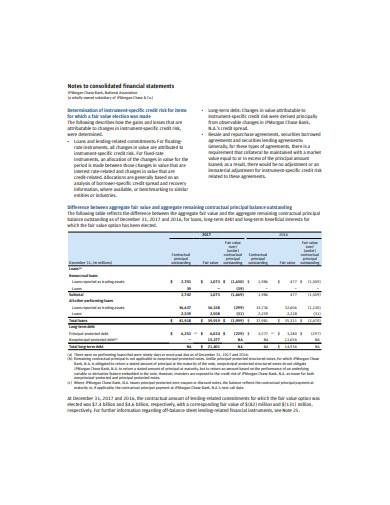

5. Financial Income Statement Sample

6. Basic Retail Income Statement Template

7. Formal Retail Income Statement Template

8. General Retail Income Statement Sample

9. Retail Financial Income Statement Template

10. Simple Retail Income Statement Template

11. Retail Income Statement in DOC

12. Annual Retail Income Statement Sample

13. Formal Retail Income Statement in PDF

Writing the Income Statement

Statement forms aren’t the easiest to create. They need a lot of time and effort to write and calculate. Since the favor of investors depends on the comprehensiveness of the retail income statement, you need to make sure you can make one that can blow their minds. Here are some things you need to remember when writing your income statement.

1. Sales

Generating large sales is the primary goal of any retail company. Your income statement must contain details about your commercial sales. Your sales figures represent the revenue the company gained. You must calculate the total sales of the business, but don’t forget to subtract the sales discounts and product returns.

2. Cost of Goods Sold

When selling products, you must first purchase certain materials to manufacture the finished item. Only when you’ve got the final merchandise can you start selling. In your income statement, you need to indicate the product cost you spent on buying the goods used in manufacturing the product. Service companies don’t necessarily have this in their income statement.

3. Gross Profit

Making a profit is one of the goals of any small business. That is why it is a need to calculate your profit carefully. Your profit is the number you get after subtracting the cost of goods sold from the company’s net sales. Indicate this in your income statement. Once you’ve done this, you can proceed.

4. Expenses

The next part you need to focus on is your expenses. It would help if you calculated all the required spending to operate your business. This includes salaries, rent, advertising plans, and other factors. The equipment used in your business is part of your expenses. You need to get a total of all these and add them to your report.

5. Taxes

Whatever business you are pursuing, you are still bound by the powers of the government. This means taxes. You need to include the total income taxes you owe the government, whether it’s the national or local government sectors. Tax reports are essential as not to get any accusations of tax evasion.

6. Net Income

The last part of your retail income statement should be the net income. First, you need to calculate the income before taxes, which is the gross profit minus the total expenses. Once you subtract the taxes, you finally get the net income. Add this data to your summary report, and you are good to go.

A company’s finances are one of its most significant assets. When presented correctly, it can get your company, numerous investors.

Related Posts

FREE 10+ Marketing Problem Statement Samples [ Strategy, Digital, Social Media ]

FREE 10+ Medical Problem Statement Samples [ Surgical, Nursing, Management ]

FREE 10+ Payoff Statement Samples in PDF | DOC

FREE 10+ Scholarship Statement of Purpose Samples in PDF | DOC

FREE 10+ Engineering Problem Statement Samples [ Software, Mechanical, Civil ]

FREE 30+ Information Statement Samples in PDF | MS Word

FREE 50+ Policy Statement Samples in MS Word | Google Docs | PDF

FREE 50+ Summary Statement Samples in PDF | MS Word

FREE 10+ Nursing School Personal Statement in PDF

FREE 9+ Mortgage Statement Samples and Templates in PDF

FREE 10+ Independent Subcontractor Statement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Trust Distribution Statement Samples in PDF

FREE 14+ Compliance Statement Samples & Templates in PDF | MS Word

FREE 10+ Extension Impact Statement Samples in PDF | DOC

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word