A settlement statement in its most common form is a part of a loan closing package that is usually provided to a borrower at a particular lending institution. Most of the comprehensive settlement statements are required when having a mortgage loan. It is also required for other types of loan as well. Some of the online lending credit card agreements also provide some iterations with regards to settlement statements that are borrower receives. Borrowers are obliged to sign a settlement statement to ensure that they have fully completed the lending process, thus would enable them to receive their loan. The signing of the settlement statement binds various terms that are incorporated with a loan in which it cannot be easily amended. In this article, you will be able to know more about settlement statements and its samples.

10+ Settlement Statement Samples

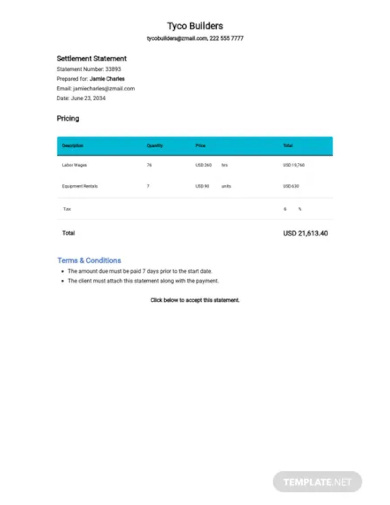

1. Settlement Statement Template

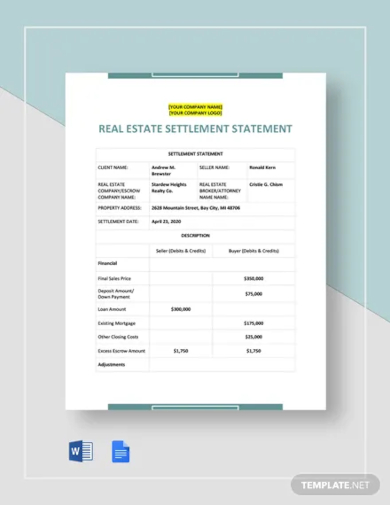

2. Real Estate Settlement Statement Template

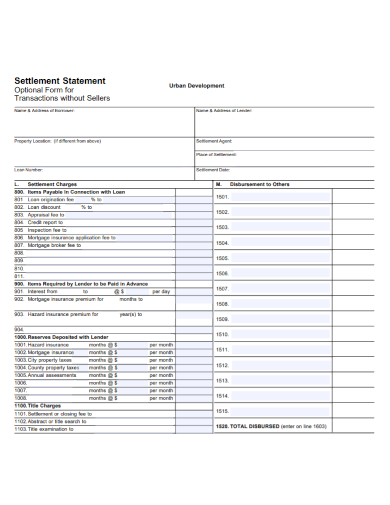

3. Urban Development Settlement Statement

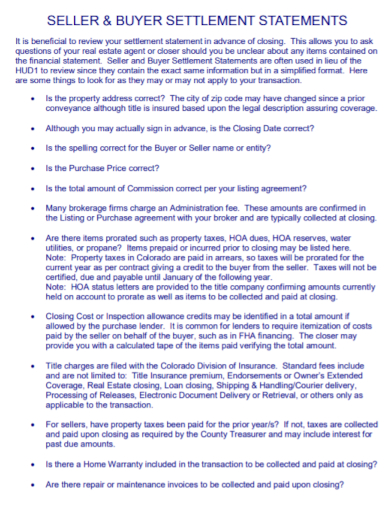

4. Seller Buyer Settlement Statement

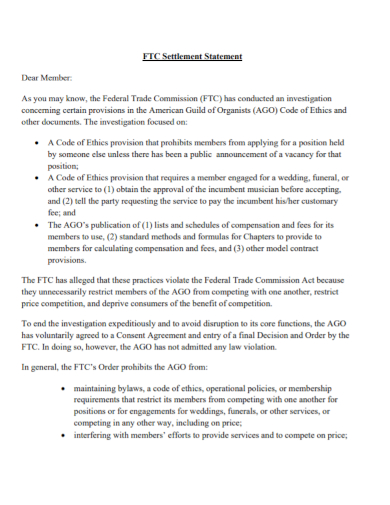

5. Trade Commission Settlement Statement

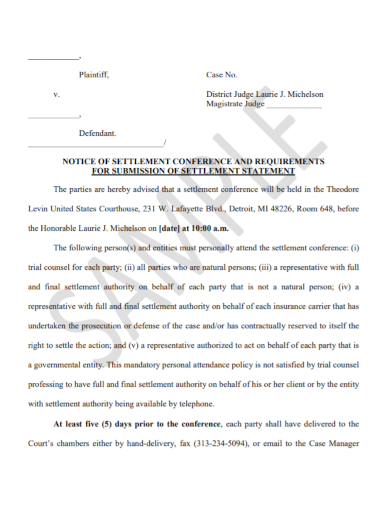

6. Notice of Settlement Statement

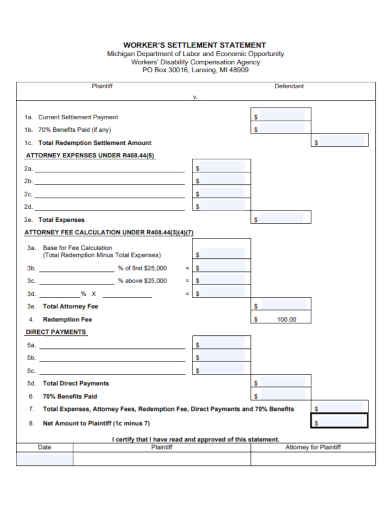

7. Worker Settlement Statement

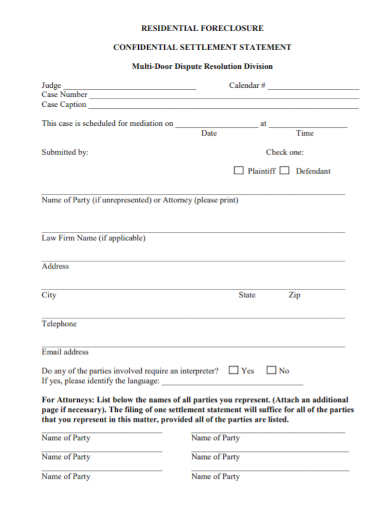

8. Residential Foreclosure Settlement Statement

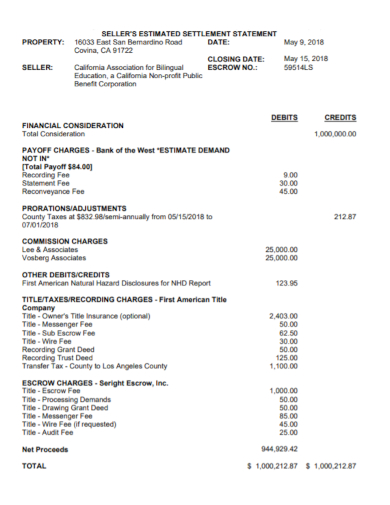

9. Seller Estimated Settlement Statement

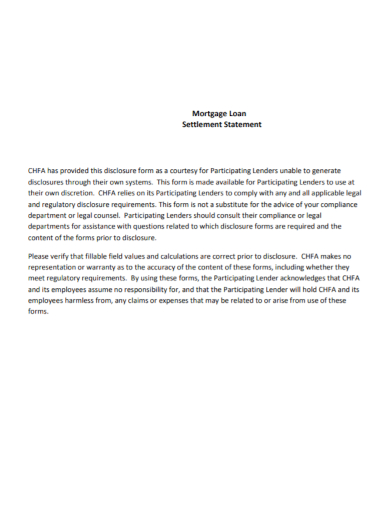

10. Mortgage Loan Settlement Statement

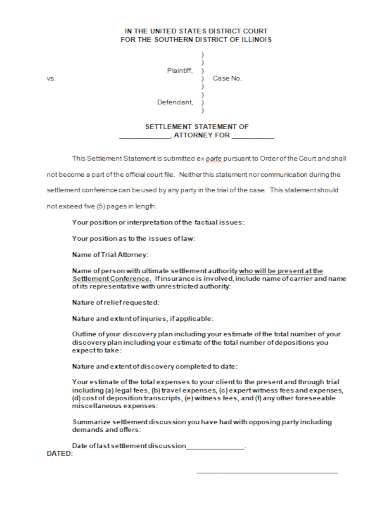

11. Settlement Statement of Attorney

What is a Settlement Statement?

A settlement statement is a type of document that provides an outline of who had paid a particular service pertaining to a mortgage or real estate transaction. This statement itself is designed to document the aspects that were involved in the transaction to ensure that both the seller and buyer have the same information received. The information that are provided in the settlement statement may include the property’s contract price, mortgage settlements, taxes that have already been paid, real estate agent and title company fees, closing costs, and other fees involved in the transaction.

The statement outlines how these particular charges would affect both the buyer and the seller. In most cases during a transaction, you are going to fill up a settlement statement form. This is referred to as the HUD-1 Uniform Settlement Statement that is generally used in HUD-based real estate transactions. The states and even some of the local regions have their own requirements for this. The closing agent will be the one who will provide a proper form for the transaction.

Example of Settlement Statement

For example, a borrower may have received a copy of a settlement statement within three business days after he or she has applied for a mortgage. The form has a length of three pages long and contains specific information about the type of mortgage, total amount paid in the amortization over the life of the loan and the total amount of money a borrower should expect to be available at the time of closing.

Example:

Page 1 — This page is a two-column page explaining the sale price of the home, amounts due from the buyer and seller, and cash due at the time of closing from the borrower to the seller.

Page 2 — Important information on this page pertains to the borrower’s loan fees, including broker fees, deposits the lender already has received, fees associated with recording the home title and an explanation of all other settlement costs.

Page 3 — This page shows any discrepancies in anticipated costs by listing the original numbers from the initial estimate as compared to the actual numbers. Borrowers will see additional information such as whether the borrower has a fixed-rate mortgage, how many payments the borrower will have to make, and the interest rate on the loan. Other details about the interest rate will be included, such as the annual percentage rate (APR) on the loan.

bankrate.com

FAQs

What are some of the added charges when you apply for a loan?

It may include origination charges, appraisal fees, title administration costs, home inspection costs, background checking fees, underwriting fees, closing fees, and loan insurance fees.

What are the other types of settlement statement?

It includes debt settlement, legal settlement, insurance settlement, banking, trading, and business transactions.

If you to see more samples and formats, you may check some of the settlement statement samples in the article to be guided.

Related Posts

FREE 10+ Marketing Problem Statement Samples [ Strategy, Digital, Social Media ]

FREE 10+ Medical Problem Statement Samples [ Surgical, Nursing, Management ]

FREE 10+ Payoff Statement Samples in PDF | DOC

FREE 10+ Scholarship Statement of Purpose Samples in PDF | DOC

FREE 10+ Engineering Problem Statement Samples [ Software, Mechanical, Civil ]

FREE 30+ Information Statement Samples in PDF | MS Word

FREE 50+ Policy Statement Samples in MS Word | Google Docs | PDF

FREE 50+ Summary Statement Samples in PDF | MS Word

FREE 10+ Nursing School Personal Statement in PDF

FREE 9+ Mortgage Statement Samples and Templates in PDF

FREE 10+ Independent Subcontractor Statement Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Trust Distribution Statement Samples in PDF

FREE 14+ Compliance Statement Samples & Templates in PDF | MS Word

FREE 10+ Extension Impact Statement Samples in PDF | DOC

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word