Unreimbursed expenses are those that the employee incurred for business or professional work but the employers never refund those expenses. The employee needs to keep a record of those expenses so that those expenses can be deducted from the income and thereby, reducing the overall tax liabilities. The following unreimbursed employee expense samples have the perfect format to keep a record of such Sample Expense Reimbursement Forms and furnish while filing income tax.

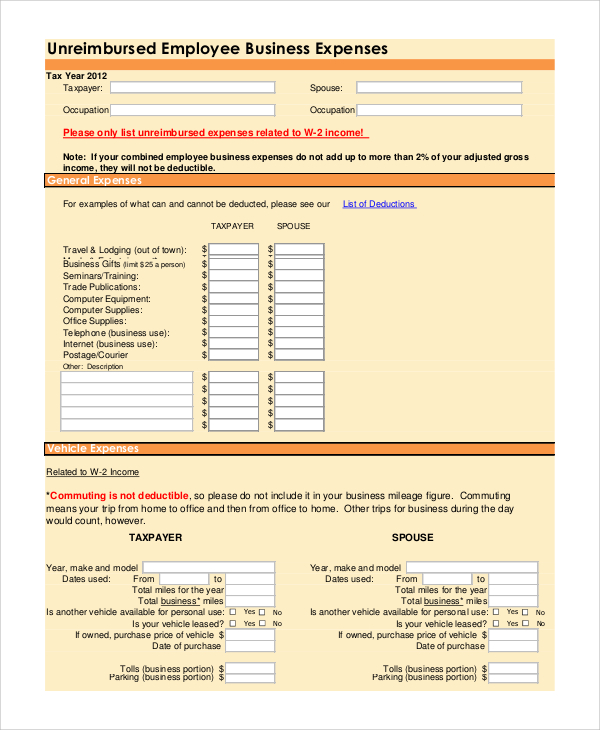

Sample Unreimbursed Employee Business Expense

This is a sample form to keep a record of the unreimbursed business expense for an individual employee. It contains fields for general expenses, vehicle expenses, home and office expenses. Under all these sections, there are multiple parameters to divide the exact expense into various sub-categories.

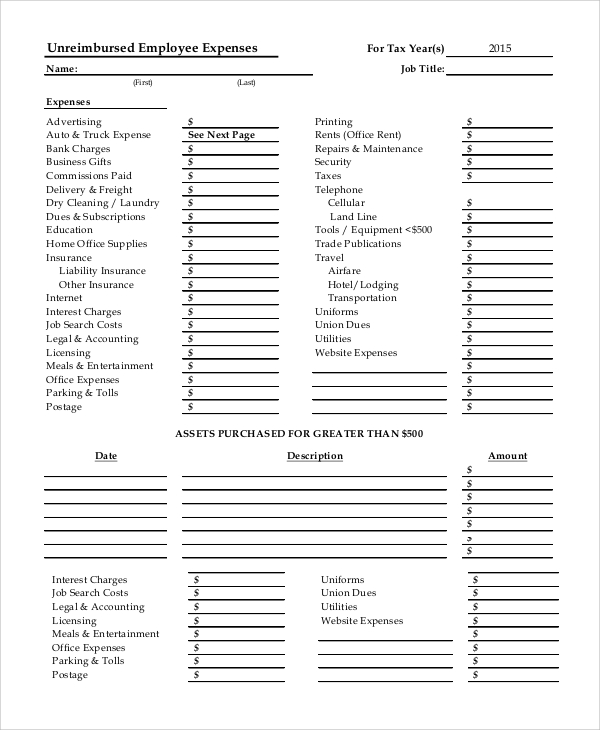

Unreimbursed Employee Expense Example

This is a perfect example and format for filling unreimbursed employee expenses. This will help to keep a record and lessen the tax liabilities. It has all the parameters and fields which are applicable under the unreimbursed category. It has provisions for general expenses, travel expenses, the asset purchased and likewise.

Usage of Sample Unreimbursed Employee Expenses

Every employee, especially the ones in a relatively high position such as a team leader, project manager need to incur some Sample Expense Reports for professional purposes which the company or the employer do no refund to the employees and such expenses can be subtracted from the income so that the overall tax liability decreases.

The above-listed unreimbursed employee expenses formats have all the parameters and the fields that one needs to be aware of and fill at the end of the year while filing the income tax.

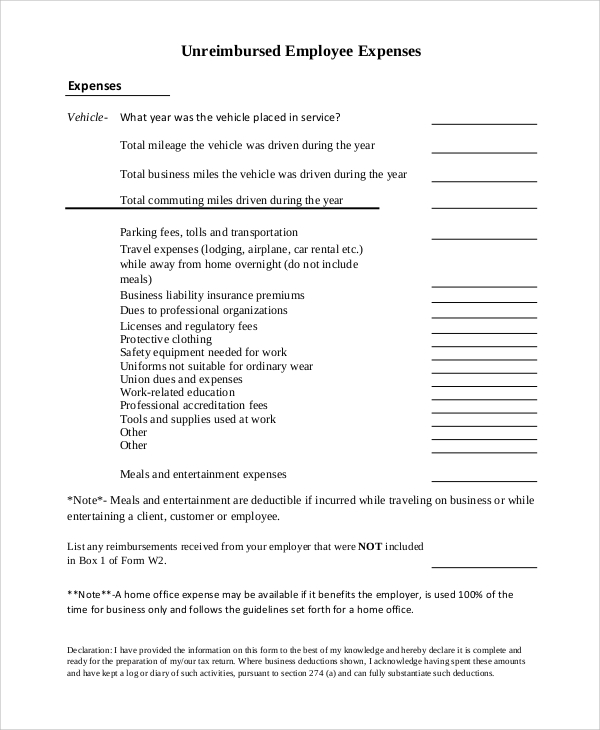

Unreimbursed Employee Travel Expense

This is a form to collect and write down the different types of travel expenses that an employee incurred and the expenses that are unreimbursed by the employer. It contains fields for total mileage, rental charges, parking tolls, vehicle insurance premiums, license and regulatory fees and likewise.

Unreimbursed Employee Expense Deduction

This is a complete manual that explains the different terms associated with unreimbursed employee expense deduction. It explains accountable and noon-accountable reimbursed plans with illustration and examples for both the freshers as well as the experienced employees.

Targeted Audiences

The targeted audiences for unreimbursed employee expenses are obviously the employees who incur expenses for professional purposes. This is highly useful for the managers and high authorities who incur expenses on a regular basis and preserve the bills to note them down later. As a matter of fact, all workers need to have them whenever the unreimbursed expense becomes significant enough to reflect on the taxes paid on income. You can also see the Expense Reports.

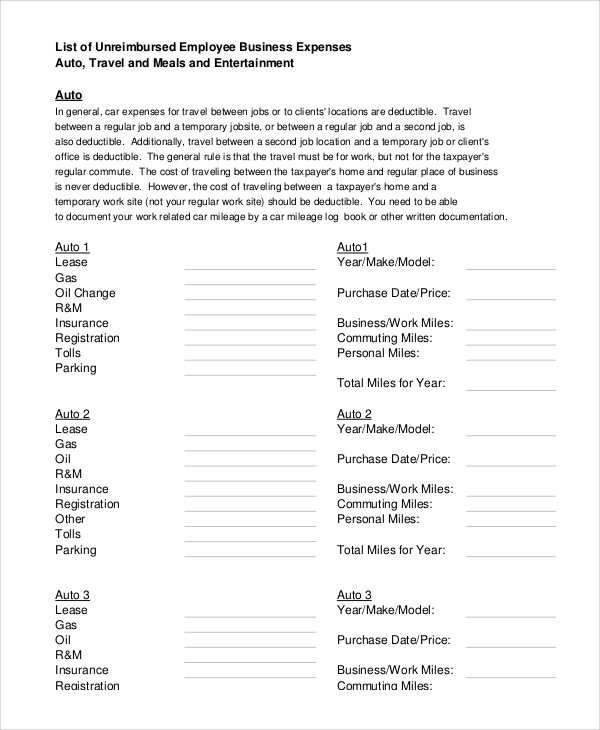

Unreimbursed Employee Business Expense Sample

This is a complete list of the items and the things that should come under unreimbursed expenses incurred by an employee. Starting from the general expenses, computer and cell phones charges, to the vehicle, travel, and other miscellaneous expense, it has provisions for all of them.

Unreimbursed Employee Expense Worksheet Format

The above-listed unreimbursed employee expenses templates have different types to cater to all kinds of such expenses such as general expenses, travel and vehicular expenses, rental and miscellaneous expenses and likewise. A proper format has to be maintained so that there will be a reduction in tax liabilities else such expenses will not be considered. The Sample Expense Sheets have all the possible parameters, and you can simply sit and fill them up by checking your preserved bills.

If you have any DMCA issues on this post, please contact us.

Related Posts

Retirement Speech Samples & Templates

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 16+ Nonprofit Budget Samples in PDF | MS Word | Excel | Google Docs | Google Sheets | Numbers | Pages

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples