A deed is a legally binding document that transfers property from one entity to another, most commonly in a real estate transaction. A general warranty deed offers the buyer the most comprehensive protection. When a buyer is trying to secure a mortgage or title insurance, warranty deeds are frequently used. The date of the transaction, the names of the persons involved, a description of the property being handed, and the buyer’s signature are all included on all deeds. Signing deeds in the presence of a witness and/or notary may be required.

10+ Warranty Deed Samples

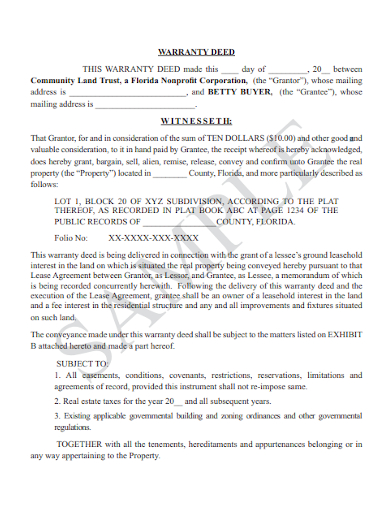

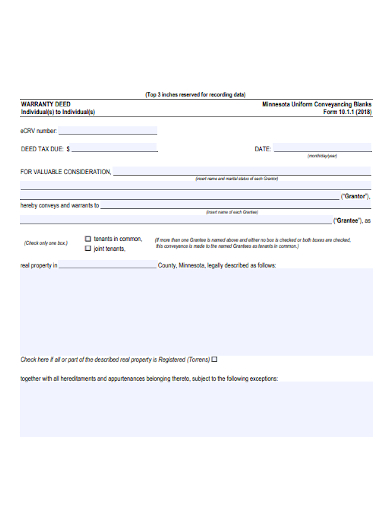

A warranty deed is a type of real estate document that offers the maximum level of protection to the property buyer. It guarantees or pledges that the owner owns the property completely free of any liens, mortgages, and other encumbrances. The seller or owner, called as the grantor, and the buyer are the two parties engaged in a warranty deed. Both parties can be individuals or businesses, and they are frequently strangers to one another. Deeds come in a variety of forms, including warranty deeds, special warranty deeds, and quitclaim deeds. The distinction between these deeds is usually established by the warranties and covenants that the seller conveys to the buyer.

1. Warranty Deed Template

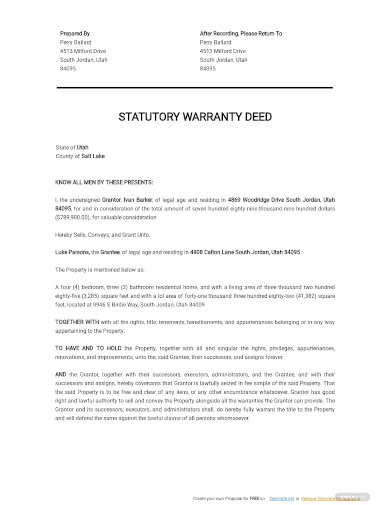

2. Statutory Warranty Deed Template

3. Free Warranty Deed Template

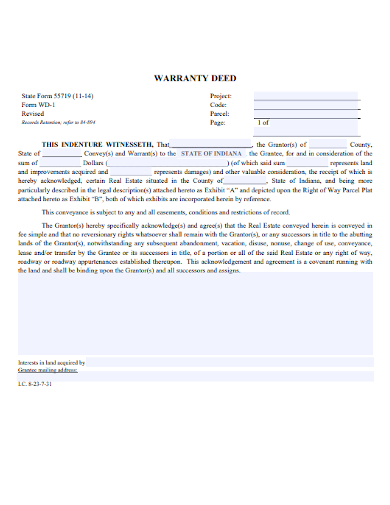

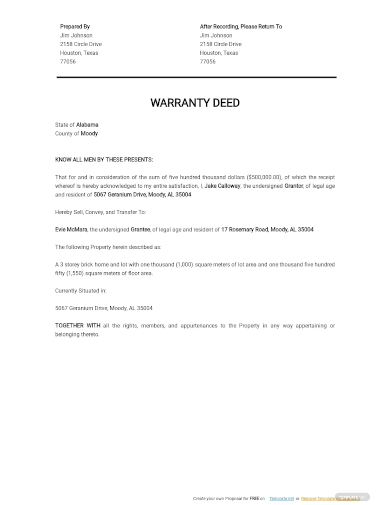

4. Sample Warranty Deed

5. Individual Warranty Deed

6. Basic Warranty Deed

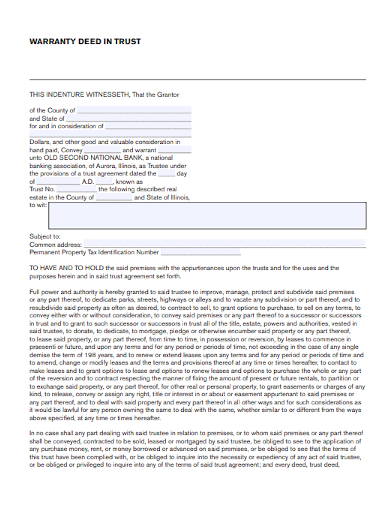

7. Warranty Deed in Trust

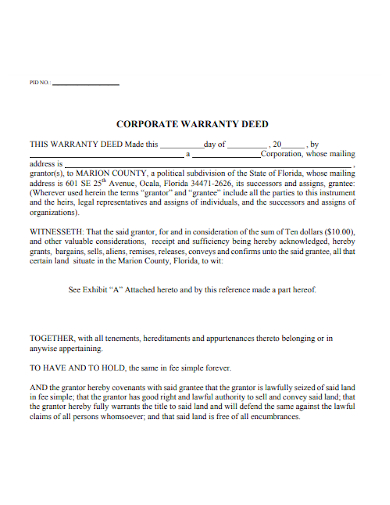

8. Corporate Warranty Deed

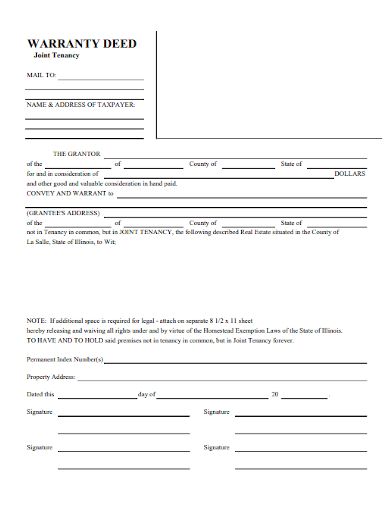

9. Warranty Deed Joint Tenancy

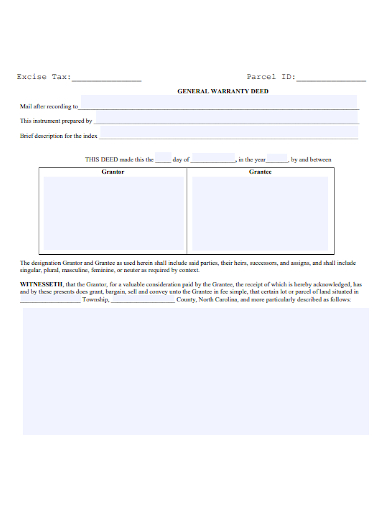

10. General Warranty Deed

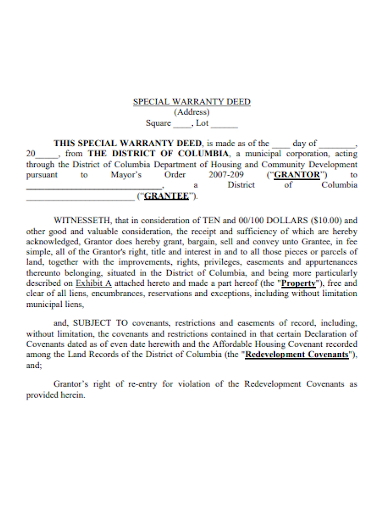

11. Special Warranty Deed

A general warranty deed holds the grantor liable for any breaches of warranties and guarantees, even if the breach occurred outside their knowledge or when the grantor was not the owner of the property. The grantor of a general warranty deed assumes a significant degree of risk because they are accountable for any breaches that occur much outside their knowledge or ownership of the property.

As a result, most purchases include title insurance to protect against any claims and liens. Before the property is transferred, a title company would conduct a comprehensive title search and look into any other potential issues.

A warranty deed may include the following covenants and protections:

- The grantor certifies that they are the legal owner of the property and that they have the authority to transfer the title.

- The grantor guarantees that the property is totally free of all liens and that no creditor utilizing it as collateral has any existing claims on it.

- There is a guarantee that the title will withstand any claims to the property by third parties.

- The grantor will do everything possible to ensure that the grantee’s title to the property is clear.

General Warranty Deed

The most prevalent kind of warranty deed in the United States is a general warranty deed. It provides the buyer with the greatest level of security by ensuring that the property is free of all defects, even those dating back to previous owners.

Special Warranty Deed

A special warranty deed, also known as a limited warranty deed, simply ensures that there were no title issues while the seller possessed the property.

FAQs

How to get a warranty deed?

A warranty deed can be obtained via your real estate agent’s office or downloaded from the internet. The date of the transaction, the names of the parties involved, a description of the property being transferred, and the buyers’ signatures must all be included on all warranty papers. Warranty deeds must be executed in the presence of a notary public to be legally binding.

When are warranty deeds used?

When you’re buying a house from someone you don’t know, a warranty deed is usually used. When applying for a mortgage or using title insurance, warranty deeds may be necessary. This is different from a quitclaim deed in that it does not require title insurance. When a property is transferred without a sale, such as from one family member to another, a quitclaim document is utilized.

Consider getting a warranty deed if you want to take extra precautions and provide your property more safety. When you don’t know the person you’re purchasing the property from, or if you need financing for a mortgage or title insurance, a warranty deed is the best option. If you want to understand more about warranty deeds and your property protection alternatives, talk to a mortgage professional.

Related Posts

Retirement Speech Samples & Templates

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]

FREE 24+ Sample Payment Schedules in PDF | MS Word

FREE 10+ Return to Work Action Plan Samples in PDF | DOC

Autobiography Samples & Templates