Nonprofit organizations, like businesses, should be informed about their financial status. This will help management assess the internal financial system of the charity, as well as its operations. And just like any other profitable organization, a charity needs an auditor to investigate. The process does not stop there. Charity auditors need to analyze the data and record it using reports. This is where audit reports are a necessity. In this article, you will be able to learn the purpose of using a charity audit report in auditing. Read below.

FREE 8+ Charity Audit Report Samples & Templates in MS Word | PDF

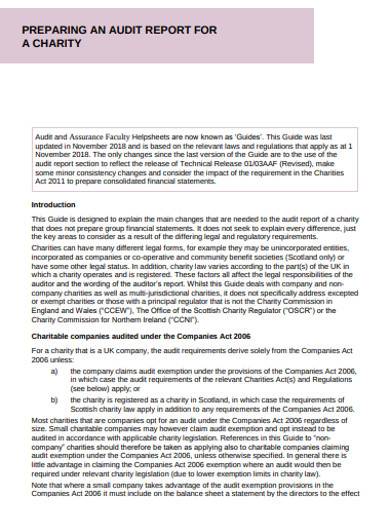

Here are preformatted charity audit report samples and templates that contain professionally written suggestive content that you can use as a guide. These sample templates are customizable and print-ready using PDF and MS Word file formats. Check them out below!

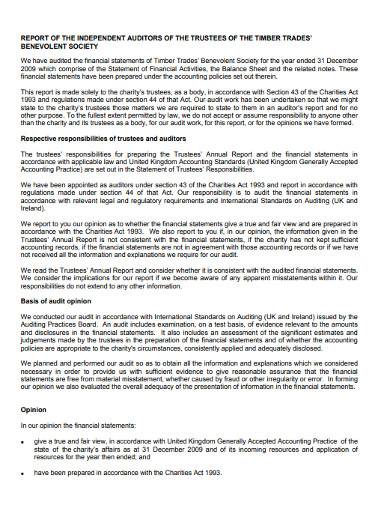

1. Charitable Trust Annual Audit Report

2. Charity Audit Report Template

3. Charity Audit Education Report

4. Sample Charity Audit Report Template

5. Charity Activities Audit Report

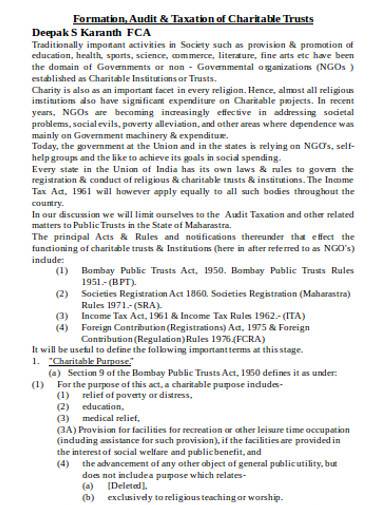

6. Charitable Trust Audit & Taxation Report

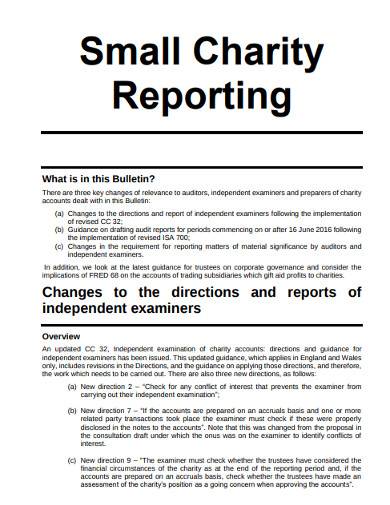

7. Small Charity Audit Reporting

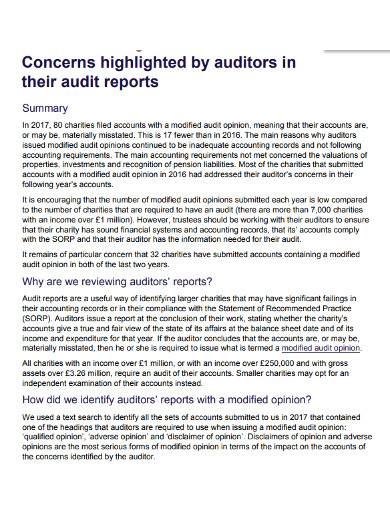

8. Format of Charity Audit Report

9. Standard Charity Audit Report

What is a Charity Audit Report?

According to an article from the National Council of Nonprofits, nonprofit organizations such as charities must conduct an audit to show the financial transparency of the organization. Regular auditing is also essential in building charitable nonprofit organizations’ integrity, professionalism, and transparency. Since it is a necessity, the auditing process should be accurate, from audit data gathering down to data analysis. To ensure that they present the collected audit data efficiently, auditors utilize charity financial audit reports.

A charity audit report is a written document that presents the entirety of the financial health status of a charitable organization. Basically, it is an end-result of an audit. Auditors use audit reports to record the data collected during their fieldwork and provide an opinion about the audited financial data. This type of financial statement is made available for the organizations’ shareholders.

How to Make a Charity Audit Report

A charity audit report serves a vital role in an organization. That is why it is only necessary to ensure that it is well-written and clear. If you are tasked to record an audit report for a charity, and you have no idea where to start, then you are in the right place. Below are some easy-to-follow and accurate tips and guides that you may follow in writing a professional and informative financial charity report. Here’s how.

1. Outline the Report

Before you begin writing the content for your charity audit report, you have to create an outline first. In doing this, you may assess the results from the audit and determine the key components that need to be present in your audit report. The standard outline for an audit report includes headings that are presented using Roman numerals and sub-headings that use letters. Nevertheless, you can still pick and use other organizational strategies that you think will work for you.

2. Provide a Clear Introduction

Once you already have an outline for your charity audit report, you may now start writing by providing your readers with a brief overview of the audit. With this, you have to write a clear and precise audit report introduction. Doing this is necessary since it will give the readers a background of what the audit is all about. You also need to define the areas audited, such as the balance sheet, cash flow statements, and other financial statements that are present in your charity.

3. State the Purpose and Scope

After the introduction, the next thing you need to follow is stating the purpose of the audit. This area will answer the question, “Why is the audit necessary for your charity?” You also have to include the scope of the audit and determine what information was included and whatnot. Also, in your charity accounting worksheet, specify the audit objectives and its time period.

4. Write the Result of the Audit

The next essential information that needs to be stated in your charity audit report is the findings. But before that, you have to provide an opening statement, maybe a one-paragraph statement, that presents the idea of the information that you will provide in this section. After that, you may proceed to write the results. In doing this, you may use bullet points to break complex information into understandable ones. This is to make sure that the data of your audit results are accessible by your readers.

5. Propose Adequate Recommendations

The final necessary information that should be presented in your charity audit report is effective recommendations. It is imperative to list down recommendations using bullet points to ensure that every detail is well-explained. However, make sure that your suggestions are relevant, positive, and specific. Nevertheless, recommendations must be brief.

FAQs

What should a charity audit report include?

There are seven basic elements that need to be present in a charity audit report. These key elements include the report title, introductory statement, report scope paragraph, executive summary, opinion statement, auditor’s name, and auditor’s signature. These elements are essential since it will make the audit report professional and accurate.

What are the four types of audit reports?

An audit report is essential for businesses and organizations since it determines future financial status. There are four types of audit reports that can be used by organizations—unqualified or clean audit report, qualified audit report, adverse opinion reports, and disclosure of opinion. However, the most commonly used type of audit report is the unqualified opinion. Nonetheless, these four types are useful and accurate.

What are the advantages of an audit report?

Besides providing an overview of the financial status of an organization, audit reports have several advantages that businesses and organizations will benefit from. These advantages include helping the management in providing integrity to shareholders, determining financial and non-financial problems, and generating better organizational planning and budgeting.

Audit reports for charitable organizations are indeed important. This is where charity management will be able to gain ideas regarding their financial health status. This document is also essential in decision-making and improves charity operations. Hence, this type of report should be well-written to be useful and effective. Therefore, if you want to have a professionally written and comprehensive financial report for your organization, you might as well check out the sample templates provided above. Download now!

Related Posts

FREE 12+ HR Audit Report Templates in PDF Google Doc | MS ...

FREE 10+ Environmental Audit Report Samples & Templates in PDF ...

FREE 15+ Sample Internal Audit Reports in MS Word PDF | Pages

FREE 16+ Sample Audit Reports in PDF MS Word

FREE 14+ Internal Audit Report Templates in PDF MS Word

FREE 11+ Sample Audit Reports in PDF MS Word

FREE 11+ Energy Audit Report Samples & Templates in PDF MS ...

FREE 8+ Project Audit Report Samples in PDF

FREE 8+ Access Audit Report Samples in PDF MS Word

FREE 10+ Brand Audit Report Templates in PDF

FREE 11+ Clinical Audit Report Templates in PDF MS Word

FREE How to Create a Financial Audit Report [10+ Samples]

FREE 10+ Private Company Audit Report Samples & Templates in ...

FREE 9+ HR Audit Report Samples in PDF

FREE 7+ Sample Risk Assessment Report Templates in PDF MS ...