The Charity Commission encourages charities to maintain adequate charity reserves policy to ensure they are financially sustainable and can continue to deliver their charitable weekly activity schedule in the long term. However, the Charity Commission also recognises that excessive reserves can be detrimental to a charity’s beneficiaries, as it may indicate that the charity is not using its funds effectively.

FREE 10+ Charity Commission Reserves Policy Samples & Templates in MS Word | PDF

1. Charity Commission Reserves Policy Template

2. Charity Financial Reserves Policy

3. Sample Charity Commission Reserves Policy

4. Charity Commission Reserves Policy Format

5. Reserves Policy of Charity Commission

6. Reserves Policy of Charity Commission Format

7. Charity Commission Reserves Policies

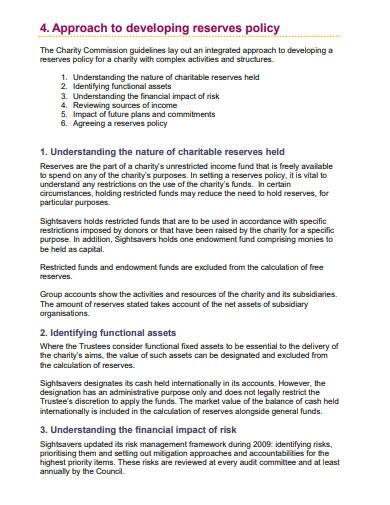

8. Charity Commission Developing Reserves Policy

9. Standard Charity Commission Reserves Policy

10. Basic Charity Commission Reserves Policy

11. Official Charity Commission Reserves Policy

What is Charity Commission Reserves Policy?

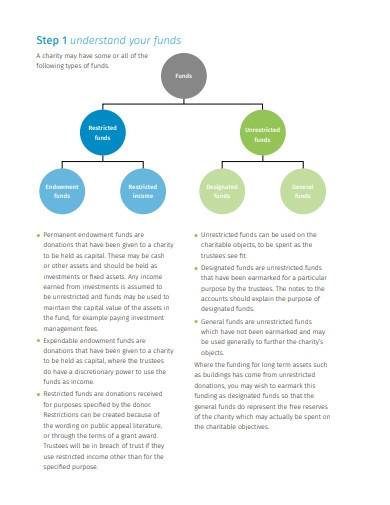

The Charity Commission Reserves Policy is an important set of guidelines for charities to follow when managing their financial reserves. Reserves are fundraising tracker that charities set aside to help them deal with unexpected financial projection, such as a sudden drop in income report or an increase in independent cost estimate. The policy provides advice on how much reserves charities should maintain and how they should be managed.

How To Make Charity Commission Reserves Policy?

The policy recognizes that reserves are an essential part of a charity’s financial planning, as they can help to ensure the charity’s long-term sustainability and enable it to continue delivering its charitable activities. Creating a Charity Commission Reserves Policy involves a number of steps. Here is a general outline of the process:

Step 1- Assess your charity’s financial risk

The first step in creating a reserves policy is to assess your charity’s financial risk management plan. This involves reviewing your income and expenses, identifying any potential sources of financial instability, and considering external factors that could impact your finances, such as changes in government policy or economic downturns.

Step 2- Determine an appropriate level of reserves

Based on your assessment of financial risk, determine an appropriate level of reserves to maintain. This will depend on factors such as the size of your charity, the nature of your activities, and the potential impact of external factors on your finances.

Step 3- Establish guidelines for managing reserves

Once you have determined an appropriate level of reserves, establish guidelines for managing them. This may include specifying how reserves can be used, who has authority to access reserves, and under what circumstances reserves should be used.

Step 4- Review and revise the policy regularly

It’s important to review your reserves policy regularly to ensure it remains relevant and effective. This may involve revising the policy based on changes in your charity’s circumstances or external factors that could impact your finances.

Why do charities need reserves?

Reserves are an essential part of a charity’s financial planning, as they can help to ensure the charity’s long-term sustainability and enable it to continue delivering its charitable activities.

How much reserves should a charity have?

The appropriate level of reserves will depend on factors such as the size of the charity, the nature of its activities, and the potential impact of external factors on its finances. The Charity Commission Reserves Policy provides guidance on determining an appropriate level of reserves.

How should reserves be managed?

Reserves should be managed in accordance with the charity’s reserves policy, which should establish guidelines for how reserves can be used, who has authority to access reserves, and under what circumstances reserves should be used.

In conclusion, the Charity Commission Reserves Policy is a vital tool for charities to manage their financial reserves effectively. By following the guidelines set out in the policy, charities can ensure they maintain an appropriate level of reserves to manage financial risk while also using their funds effectively to benefit their beneficiaries. The policy provides a framework for charities to ensure they are acting in the best interests of their beneficiaries while also meeting their obligations as responsible financial stewards.

Related Posts

FREE 10+ Charity Standing Order Form Samples & Templates in MS Word | PDF | MS Excel

FREE 10+ Charity Risk Management Policy Samples & Templates in PDF

FREE 3+ Charity Investment Strategy Samples & Templates in PDF | MS Word

FREE 5+ Charity Marketing Policy Samples & Templates in PDF

FREE 5+ Charity Recruitment Policy Samples & Templates in MS Word | PDF

FREE 3+ Charity Management Accounts Samples & Templates in PDF

FREE 10+ Charity Gift Aid Form Samples & Templates in MS Word | PDF

FREE 10+ Charity Strategy Samples & Templates in MS Word | PDF

FREE 6+ Charity Marketing Strategy Samples & Templates in MS Word | PDF

FREE 10+ Charity Financial Policy Samples & Templates in MS Word | PDF

FREE 10+ Charity Financial Policies and Procedures Samples & Templates in MS Word | PDF

FREE 10+ Charity Expenses Policy Samples & Templates in MS Word | PDF

FREE 10+ Charity Donation Letter Samples & Templates in MS Word | PDF

FREE 4+ Charity Request Letter Samples & Templates in MS Word | PDF

FREE 5+ Charity Impact Report Samples in PDF