The benefits of Gift Aid are significant for charity strategy. It provides an additional 25% on top of the donation amount, meaning that a £100 donation becomes £125 with Gift Aid. This extra money can be used for funding proposal of vital services contract and support for those in need, making a real difference to people’s lives.

For donors, making a Gift Aid donation is a straightforward process. They need to complete a Gift Aid declaration form, providing their name and address, and confirming that they are a UK taxpayer. Once they have done this, the charity can claim Gift Aid on their donations for up to four years after the share donation agreement was made.

FREE 10+ Charity Gift Aid Form Samples & Templates in MS Word | PDF

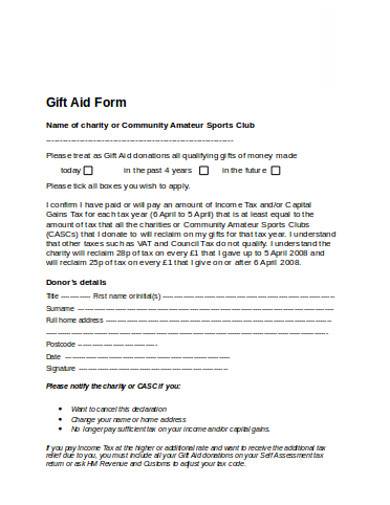

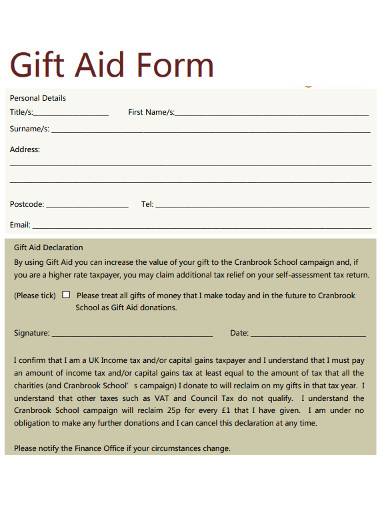

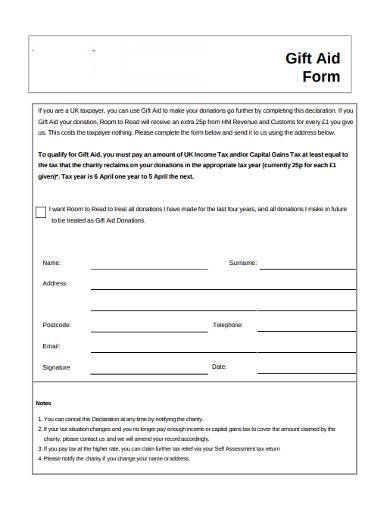

1. Charity Gift Aid Form Template

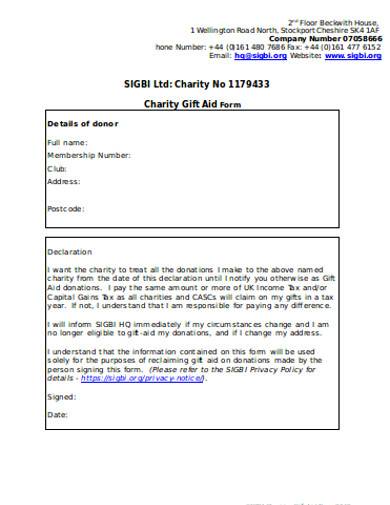

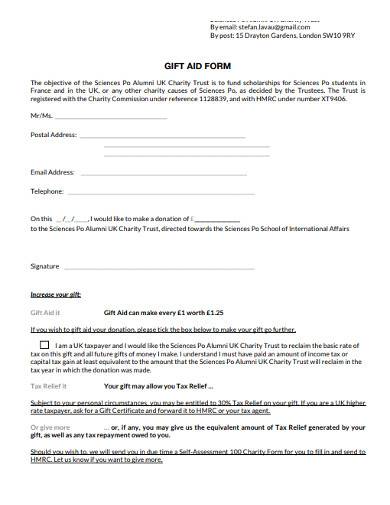

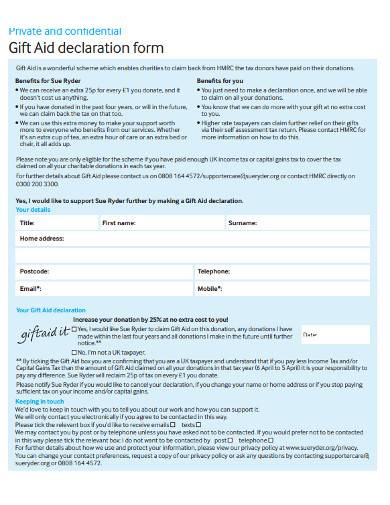

2. Sample Charity Gift Aid Form

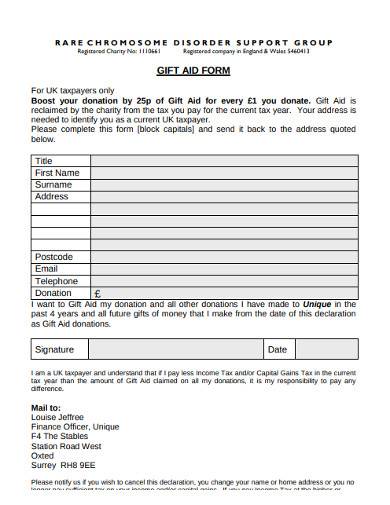

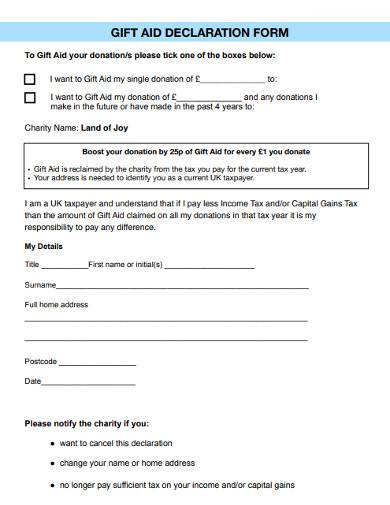

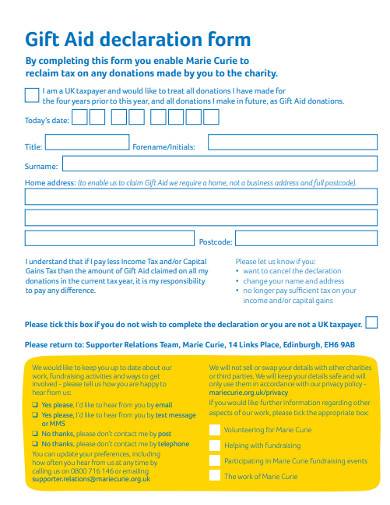

3. Simple Charity Gift Aid Form Template

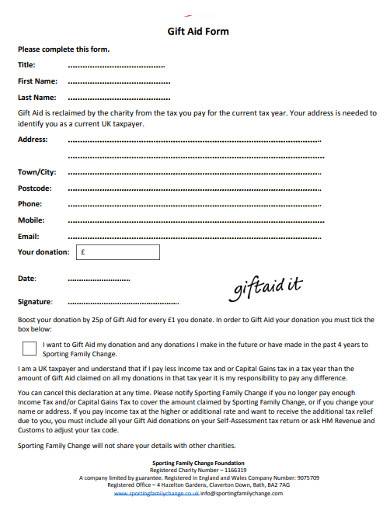

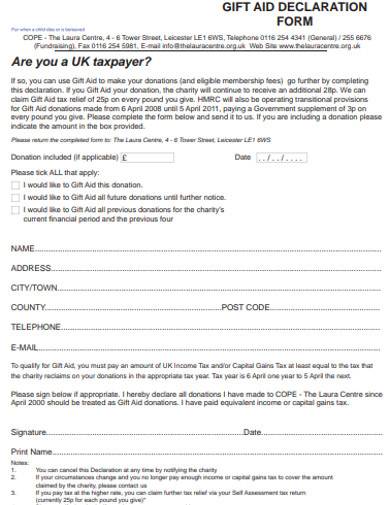

4. Sample Foundation Gift Aid Form

5. Personal Charity Gift Aid Form

6. Basic Charity Gift Aid Form Template

7. Gift Aid Declaration Form Template

8. Sample Gift Aid Declaration Form

9. General Charity Gift Aid Form

10. Formal Charity Declaration Gift Aid Form

11. Standard Charity Gift Aid Declaration Form

What is Charity Gift Aid Form

The Charity Gift Aid form is a simple document that allows charities to collect the necessary information from donors from right to information act to claim Gift Aid on their donations. The form typically includes the donor’s name, address, and confirmation statements that they are a UK taxpayer. This information is essential for the charity to claim the extra 25p for every £1 donated, as it confirms that the donor has paid enough tax compliance statement to cover the Gift Aid claimed by the charity.

How To Make Charity Git Aid Form?

The Gift Aid scheme is a win-win for charities and donors alike. Charities can increase their fundraising event budget revenue, while donors can support causes close to their hearts and have their donations go further. However, it’s worth noting that there are some limitations to Gift Aid, and not all donations are eligible. For example, donations from companies or non-UK taxpayers are not eligible for Gift Aid. Creating a Charity Gift Aid form is a straightforward process that involves gathering the necessary information from donors to claim Gift Aid on their donations. Here are the steps to create a Charity Gift Aid form:

Step 1- Gather Information

You’ll need to collect the donor’s name, address, and confirmation that they are a UK taxpayer. This information is crucial for the charity to claim Gift Aid on their donations.

Step 2- Create a Template

You can create a template for your Charity Gift Aid form using software such as Microsoft Word or Google Docs. Alternatively, you can use online tools that provide ready-to-use templates, such as Canva or JotForm.

Step 3- Design the Form

The form should be easy to read and include all the necessary fields for donors to provide their information. You can include the charity’s logo proposal or branding plan templates to make it look professional. The form should include a Gift Aid declaration that confirms that the donor is a UK taxpayer and that they want the charity to claim Gift Aid on their donations. You can use the standard declaration wording provided by HMRC, or you can create your own.

Step 4- Test the Form

Before using the form, make sure to test it to ensure that it’s working correctly and that all the necessary information is being collected. You can make the form available to donors in several ways, such as including it on your website samples, sending it by email, or providing paper copies at events or in-store.

What information is required on a Charity Gift Aid form?

The form typically includes the donor’s name, address, and confirmation that they are a UK taxpayer. The form should also include a Gift Aid declaration that confirms that the donor wants the charity to claim Gift Aid on their donations.

Can I claim Gift Aid on all donations?

No, Gift Aid is only available on donations made by UK taxpayers. Donations from companies or non-UK taxpayers are not eligible for Gift Aid.

How long can charities claim Gift Aid for?

Charities can claim Gift Aid on donations for up to four years after the donation was made.

In conclusion, creating a Charity Gift Aid form is a simple process that involves gathering the necessary information from donors to claim Gift Aid on their donations. By making the form easy to use and accessible, charities can increase their fundraising revenue and provide vital services and support to those in need.

Related Posts

FREE 10+ Charity Privacy Policy Samples & Templates in MS Word | PDF

FREE 10+ Charity Standing Order Form Samples & Templates in MS Word | PDF | MS Excel

FREE 10+ Charity Risk Management Policy Samples & Templates in PDF

FREE 3+ Charity Investment Strategy Samples & Templates in PDF | MS Word

FREE 5+ Charity Marketing Policy Samples & Templates in PDF

FREE 5+ Charity Recruitment Policy Samples & Templates in MS Word | PDF

FREE 3+ Charity Management Accounts Samples & Templates in PDF

FREE 10+ Charity Strategy Samples & Templates in MS Word | PDF

FREE 6+ Charity Marketing Strategy Samples & Templates in MS Word | PDF

FREE 10+ Charity Financial Policy Samples & Templates in MS Word | PDF

FREE 10+ Charity Financial Policies and Procedures Samples & Templates in MS Word | PDF

FREE 10+ Charity Expenses Policy Samples & Templates in MS Word | PDF

FREE 10+ Charity Donation Letter Samples & Templates in MS Word | PDF

FREE 4+ Charity Request Letter Samples & Templates in MS Word | PDF

FREE 5+ Charity Impact Report Samples in PDF