Management accounts refer to the financial reports that are produced for business owners and managers to review every week, month, or on a quarterly basis, which usually include profit and loss reports and balance sheets. It is used for more informed decision-making and to operate the company based on its recent performance evaluation as well as to give valuable insights into the business’s financial analysis report and performance. Management accounting or managerial accounting is the process of issuing financial statements, information, and resources to the managers who are responsible for decision-making.

FREE 3+ Charity Management Accounts Samples & Templates in PDF

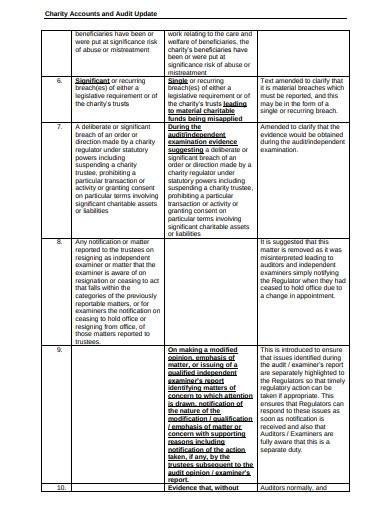

1. Charity Accounts and Audit Template

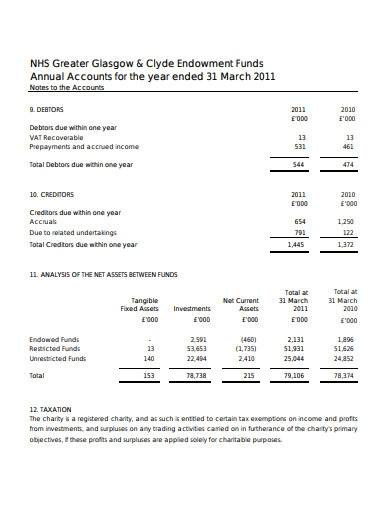

2. Charity Annual Accounts Template

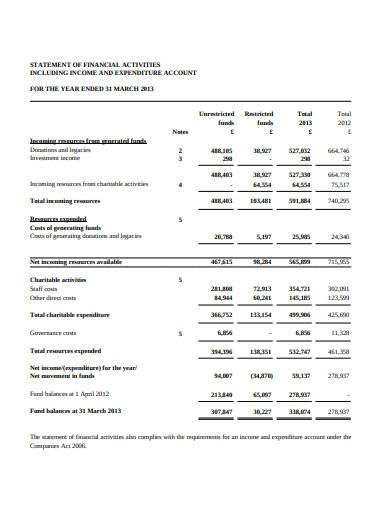

3. Charity Financial Account Statement

What are Charity Management Accounts?

Charity management accounts are tools that provide accurate information on a nonprofit organization’s financial reports. This report provides a clear picture of how the organization’s various operations perform or works as well as helps in forming strategic planning on its course development plan for the future. Charity management accounts also provide stakeholders with accurate information about the organization’s charitable activities and outputs.

How To Accomplish Charity Management Accounts

Management accounting or managerial accounting is the process of getting reports on business operations ready to assist company managers to think of short and long-term decisions. It allows the company to achieve its business goals and objectives by determining, measuring, evaluating, interpreting, and relaying relevant information to the management. Management accounts aim to utilize statistical data to create informed decisions, enabling companies to control their business, activities, and development.

Step 1: Provide Comparisons

Provide relevant comparisons by including the previous month’s data to analyze whether an action plan is necessary or not. You can also use quarterly and annual comparisons. This will be useful when you implement key performance indicators in your business.

Step 2: Include Necessary Details

Management accounts vary depending on the type of business. If a business is experiencing its growth mode, it will be necessary to provide details in specific areas to easily determine areas with issues that affect the progress of the business. You can use your accounts payable templates, accounts receivable templates, and budget statements to get the insights you need.

Step 3: Make Sure That Information is Accessible

Using an accessible spreadsheet for your figures allows you to analyze them easily and quickly. Use visual presentations like graphs and pie charts to enable non-finance professionals to determine which areas are working well and identify areas for improvement.

Step 4: Gather Information for the Management Account

Use solutions to automate and connect your business finance processes as well as to eliminate manual data entry. This provides you with available and quick access to the spend data you require as well as helps you save more valuable time.

What are the functions of management accounting?

The main use of management accounting includes helping in forecasting the future for better decision-making, providing essential insights for make-or-buy decisions, forecasting cash flows, helping better understand performance variances, and analyzing the rate of return.

What are the different types of management accounting?

The different types of management accounting or managerial accounting are product costing and valuation, cash flow analysis, inventory turnover analysis, constraint analysis, financial leverage metrics, accounts receivable management, and budgeting, trend analysis, and forecasting.

What are the advantages of management accounting?

With management accounting, the managerial team can implement better decision-making processes, and strategic planning, control their business operations, and organization of procedures, better understand financial data, identify business areas with problems and issues, and deliver effective and efficient strategic management.

Charity management accounts enable nonprofit organizations to measure their performance, judge investments, implement tax planning, review their service performance, bankers and investors, and budget and targets. Management accounting documents contain financial reports for managers and business owners that involves performing cash flow analysis to identify the cash impact of a business’s decisions and determine its financial position. It can utilize working capital management strategies to control cash flow while ensuring that the organization has enough liquid assets to perform its short-term responsibilities. Management accounting is utilized by business owners or managers, investors, banks or lenders, factoring or invoice discounting, accountants, and tax planners.

Related Posts

FREE 10+ Charity Mission Statement Samples and Templates in MS Word | PDF

FREE 10+ Charity Pay Policy Samples & Templates in MS Word | PDF

FREE 5+ Charity Investment Policy Samples & Templates in MS Word | PDF

FREE 10+ Charity Privacy Policy Samples & Templates in MS Word | PDF

FREE 10+ Charity Standing Order Form Samples & Templates in MS Word | PDF | MS Excel

FREE 10+ Charity Risk Management Policy Samples & Templates in PDF

FREE 3+ Charity Investment Strategy Samples & Templates in PDF | MS Word

FREE 5+ Charity Marketing Policy Samples & Templates in PDF

FREE 5+ Charity Recruitment Policy Samples & Templates in MS Word | PDF

FREE 10+ Charity Gift Aid Form Samples & Templates in MS Word | PDF

FREE 10+ Charity Strategy Samples & Templates in MS Word | PDF

FREE 6+ Charity Marketing Strategy Samples & Templates in MS Word | PDF

FREE 10+ Charity Financial Policy Samples & Templates in MS Word | PDF

FREE 10+ Charity Financial Policies and Procedures Samples & Templates in MS Word | PDF

FREE 10+ Charity Expenses Policy Samples & Templates in MS Word | PDF