When purchasing an automobile, not all of us have the capacity to pay the full amount just then and there. Something as costly as purchasing a vehicle is done better in certain monthly installments, a popular alternative that attracts a lot of new vehicle owners. Whether you choose to pay in full or opt to pay in installments, a car dealer should be able to prepare an auto payment contract to lay out the terms of the payment process. This is especially important so both parties are able to understand and agree on the terms set upon in the document. To learn more about this, let us discuss this further below. And if you need to prepare a payment contract, then we’ve got you covered! Just download our free auto payment contract samples that are available on this page.

10+ Auto Payment Contract Samples

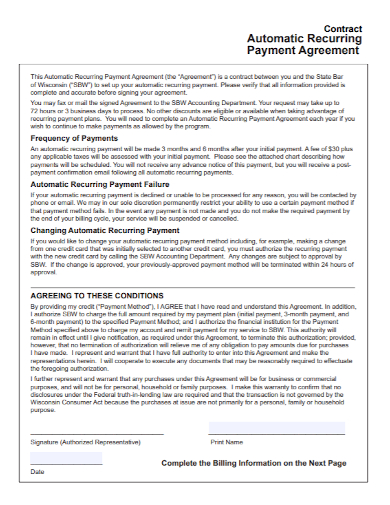

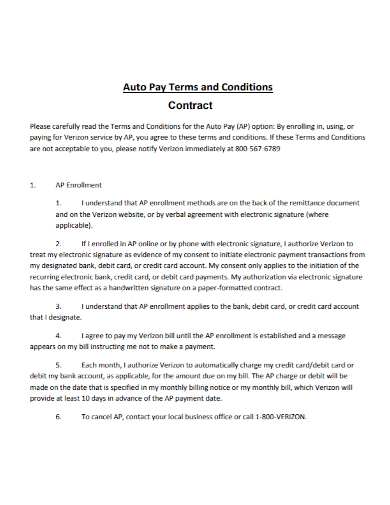

1. Auto Recurring Payment Contract

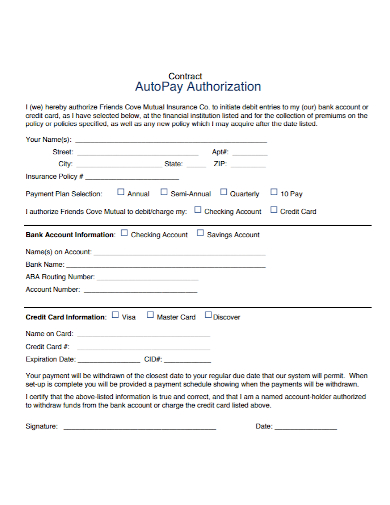

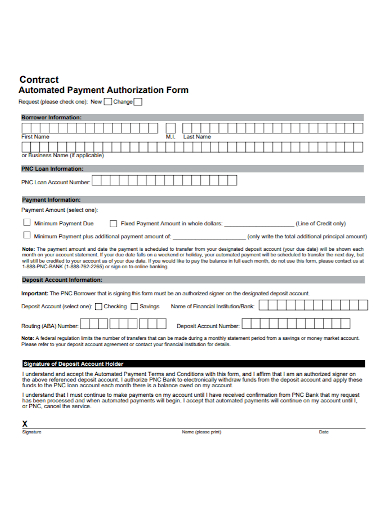

2. Auto Payment Authorization Contract

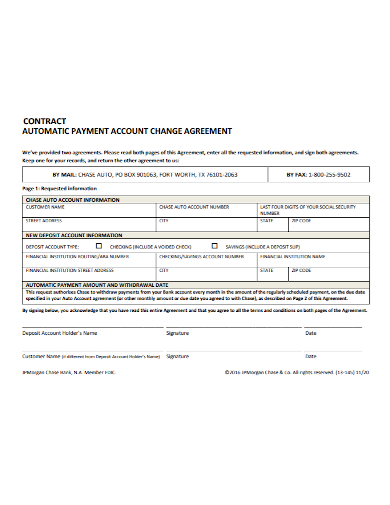

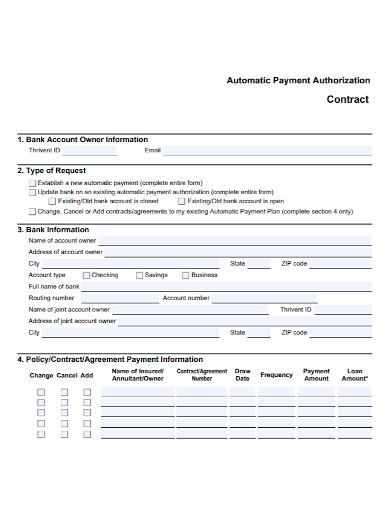

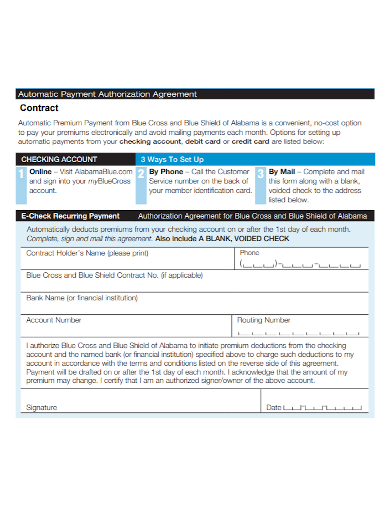

3. Automatic Account Payment Contract

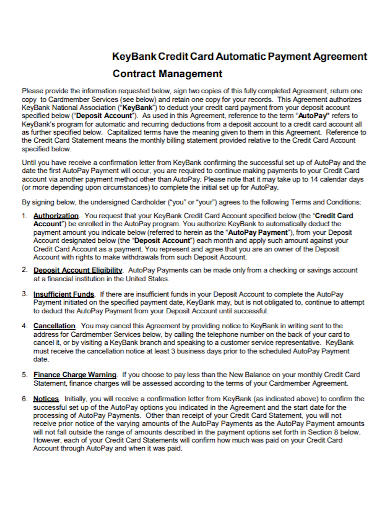

4. Credit Card Automatic Payment Contract

5. Sample Auto Payment Contract

6. Auto Payment Management Contract

7. Bank Account Auto Payment Contract

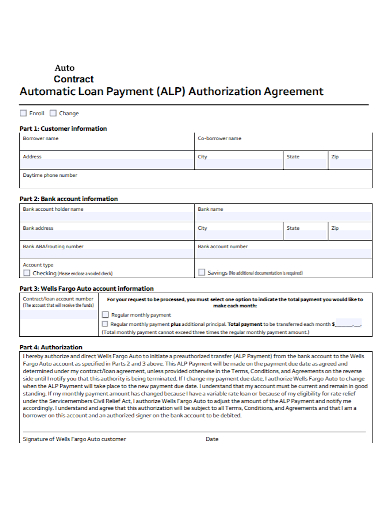

8. Auto Loan Payment Contract

9. Auto Payment Contract Form

10. Automatic Payment Agreement Contract

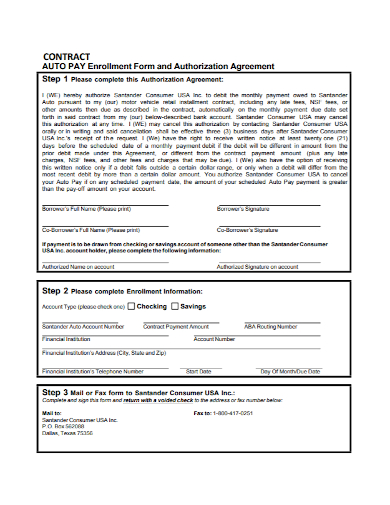

11. Auto Payment Enrollment Contract

What Is an Auto Payment Contract?

A payment contract outlines the terms and condition that is part of a loan. So, in terms of purchasing a vehicle in which some clients would prefer paying in installments for a number of months to several years, an auto payment contract should be able to provide those details and the conditions. Car dealers may be able to arrange these, or you will need to coordinate with any funding facilities such as banks or lending companies. The payment terms would differ depending on the car dealers or firm’s policies, but this is usually drafted to make sure the client is capable of paying their dues. Whether you are the borrower or the lender creating a payment contract in writing is a vital process. Because in case there is a breach in the contract, legal actions can be enforced.

How To Create an Auto Payment Contract?

Basically, a payment contract must cover major areas such as payment terms, the amount to be paid, and the interest rates. But of course, you need to add more details depending on the purpose of the document. In this case when purchasing an automobile and if a client decides to get a loan or an installment then you need to incorporate the following details below in your contract.

1. Name of The Parties

Indicate the names of the parties in the contract, as well as their addresses.

2. Contract Identification

Identify what the payment contract is being drafted for, in this case, an auto payment.

3. Description of the Vehicle

Briefly describe the vehicle including details such as the model number, body style, mileage, etc.

4. Agreement Terms

The main section of the contract should include the payment amount, the payment term and schedule, duration, method, and if there are any interest rates or late payment charges.

5. Termination Clause

Include a termination clause in the event should the contract be terminated due to unforeseen events. And what are the conditions and remedies should this take effect.

6. Date

The contract should include the date to prove the payment contract is in effect. This is usually done during the signing of the contract.

FAQs

What are the Types of Payment Contracts?

A business payment contract concerns any business-related payment transactions that would require this type of contract. A personal payment contract that is relevant to smaller transactions with fewer specifications. Then there are installments that can help you number the payments, amount, and interest rates.

What Is the Importance of a Payment Contract?

Payment contracts can set the terms and conditions of the payment that is due to the lender by the borrower. And in case of a breach, legal actions can be authorized.

Why Are Installments Convenient?

Installments are convenient for buyers since this can give them flexibility and time to save when paying on a monthly basis.

Help your client secure the vehicle of their dreams by preparing a well-crafted auto payment contract. Don’t forget to download our free samples above!

Related Posts

Sample Material Lists

Sample Excuse Letter for School

Feature Writing Samples

FREE 14+ Sample Music Concert Proposal Templates in MS Word | Google Docs | Pages | PDF

FREE 10+ Security Guard Contract Samples in PDF | MS Word

FREE 10+ Assurance Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Option to Purchase Agreement Samples in MS Word | Apple Pages | PDF

FREE 26+ Curriculum Form Samples in MS Word | PDF

FREE 20+ Cleaning Service Proposal Samples in PDF | MS Word

FREE 29+ Sample Loan Application Form Templates in MS Word | PDF

FREE 10+ Event Venue Contract Samples in PDF | MS Word | Pages | Google Docs

FREE 10+ SBAR Samples in PDF | DOC

FREE 12+ Music Band Contract Templates in PDF | MS Word

FREE 10+ HVAC Maintenance Contract Samples in PDF | MS Word

FREE 10+ Social Media Marketing Contract Samples in MS Word | PDF