Are you ready to purchase the company of your dreams? Or are you planning to sell your company? In a Business Sale Contract, all parties’ interests must be protected because it spells out the terms of the sale. This paperwork, which makes the deal legally binding, will help you prevent any future issues. A Business Sale Contract is used to transfer a seller’s business assets to a buyer. A lot of documentation and a proper contract is required when selling a firm. When a business owner sells his or her company, a business sale agreement is a legal contract that describes and records the price and other facts. After the deal has been finalized, this is the final step in transferring ownership. It may be necessary for the new owner to show proof of ownership and register the company with state and municipal authorities.

10+ Business Sale Contract Samples

A Business Sale Agreement is a contract that allows a seller to transfer ownership of a business to a buyer. It contains the terms of the sale, as well as what is and is not included in the sale price, as well as optional provisions and warranties to protect both the seller and the buyer after the transaction is done. It can be used to buy or sell a variety of businesses, including retail stores, industrial stores, restaurants and cafes, professional service offices, and more.

1. Business Sale Contract Template

2. Business Purchase and Sale Contract Template

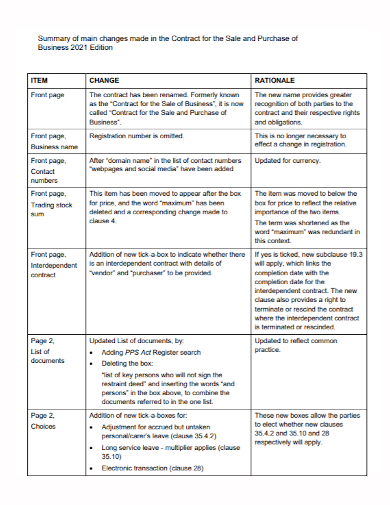

3. Business Sale Summary Contract

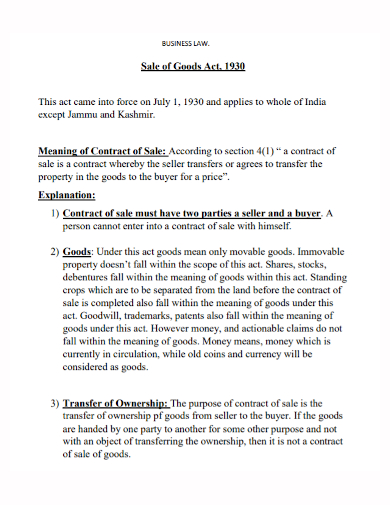

4. Business Sale of Good Contract

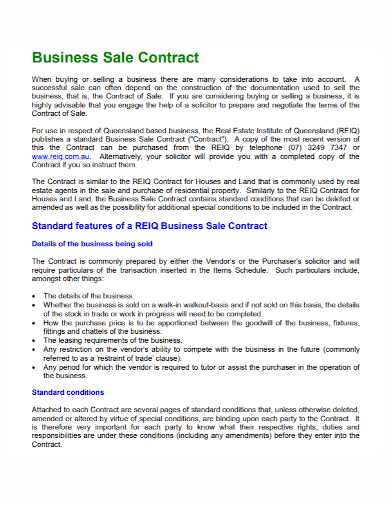

5. Sample Business Sale Contract

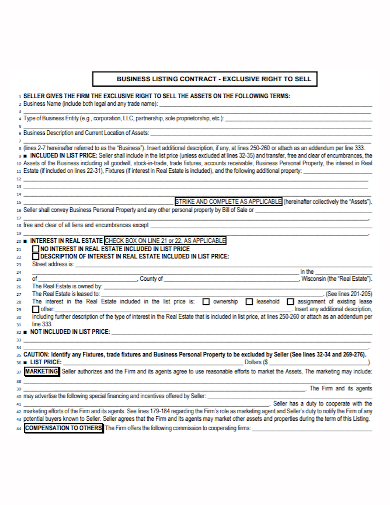

6. Business Listing Sale Contract

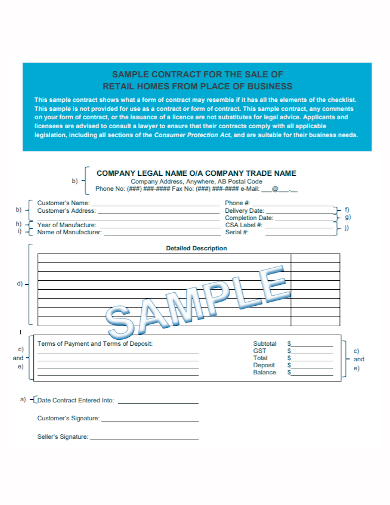

7. Business Retail Home Sale Contract

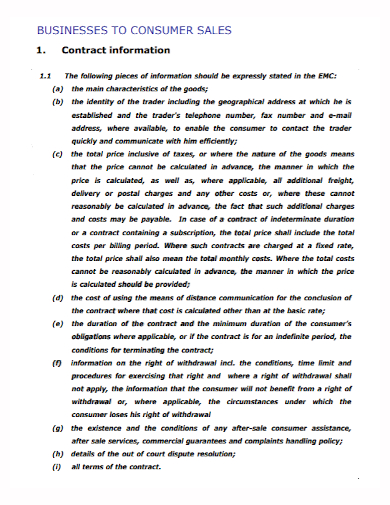

8. Business Consumer Sale Contract

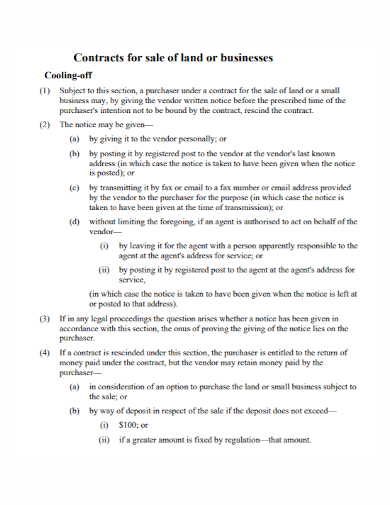

9. Business Land Sale Contract

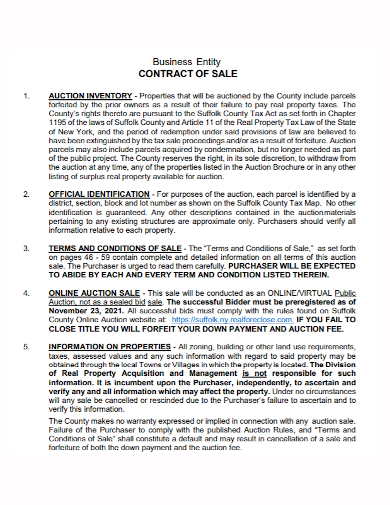

10. Business Entity Sale Contract

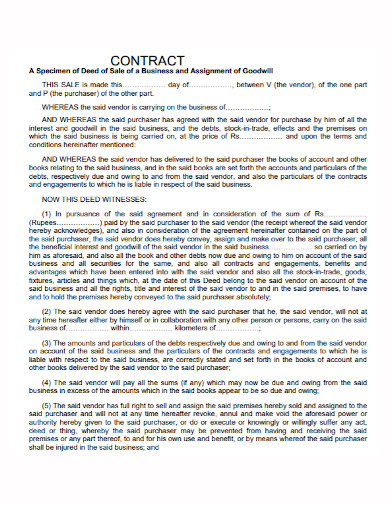

11. Business Sale Deed Contract

Parts of Business Sale Contract

- Parties – In the first paragraph or two of the contract, the buyer and seller’s names and addresses will be clearly specified. The name and location of the company being sold must also be stated in clear language.

- Assets – The agreement will specify the assets that will be transferred. Real estate, automobiles, merchandise, furnishings, fixtures, machinery, and equipment are examples of physical assets. Accounts receivable and cash are examples of financial assets that could be transferred. The company name, goodwill, and customer lists are examples of intangible assets. If any assets will not be sold, this will be stated as well.

- Liabilities – Any obligations assumed by the buyer as a result of purchasing the business will be stated here. Taxes owing to municipal, state, and federal governments, accounts payable, and ongoing loans are examples of liabilities. A statement that the buyer is not taking on any unlisted liabilities is frequently included in this section.

- Terms – The buyer’s purchase price is certainly a significant portion of this section. The transaction’s closing date will also be listed here. It will also be indicated whether the price will be paid in one lump sum or in installments. If the buyer is required to put up security or collateral, this will be stated here. The price section will also indicate how the purchase amount will be allocated among categories as determined by the Internal Revenue Service for tax purposes. Sellers choose a stock or equity sale because they can regard the transaction as a capital sale and hence pay the long-term capital gains rate if a profit is earned on the sale.

- Disclosures – Both sides will reveal any potential transaction stumbling blocks in this section. Outstanding debts, pending litigation, commitments, and fines are just a few examples.

FAQs

Do signatures still required in the document?

Yes. Make sure that all parties engaged in the transaction sign and date the contract. After you’ve finished drafting your contract, have it reviewed by an attorney before anyone signs it. Tell them to sign their names and titles in full. Obtain a witness signature from each side. Make numerous copies for each signatory so that both parties have an original copy. A notary public should notarize the documents.

When to use a business sale contract?

If you need to sell a business, use this agreement.

– You’ve negotiated a business sale or buy;

– You wish to spell out the terms of the sale or purchase;

– You’re a small to medium-sized company in need of a succinct sales document.

A business sale contract is a result of what could have been a lengthy and tough negotiation. It describes the agreement reached on the transaction’s price and other specifics. It ensures that each party keeps their word and gets what they want out of the contract. It also gives a foundation for resolving any future conflicts that may arise.

Related Posts

Sample Excuse Letter for School

Feature Writing Samples

FREE 10+ Security Guard Contract Samples in PDF | MS Word

FREE 10+ Option to Purchase Agreement Samples in MS Word | Apple Pages | PDF

FREE 26+ Curriculum Form Samples in MS Word | PDF

FREE 20+ Cleaning Service Proposal Samples in PDF | MS Word

FREE 29+ Sample Loan Application Form Templates in MS Word | PDF

FREE 10+ Event Venue Contract Samples in PDF | MS Word | Pages | Google Docs

FREE 10+ SBAR Samples in PDF | DOC

FREE 12+ Music Band Contract Templates in PDF | MS Word

FREE 10+ HVAC Maintenance Contract Samples in PDF | MS Word

FREE 10+ Social Media Marketing Contract Samples in MS Word | PDF

FREE 10+ Wholesale Assignment Contract Samples in PDF

FREE 18+ Financial Proposal Samples in PDF | MS Word | Google Docs | Pages

FREE 10+ Feasibility Study Samples in PDF