9+ Insurance Investment Contract Samples

Insurance plans can assist you in paying for medical emergencies, hospitalization, illness and treatment, as well as future medical care. Insurance policies can compensate the financial loss incurred by the family as a result of the death of the single breadwinner. Traditional insurance is an investment in the sense that you’re putting money aside to assist you or your family in the event of a financial setback. In theory, it’s a financial security investment for your family. Before you get an insurance, you need a contract to legally bind and seal the deal. Need some help with this? You’ve come to the right place! In this article, we provide you with free and ready-to-use samples of Insurance Investment Contract in PDF and DOC formats that you could use for your insurance deal. Keep on reading to find out more!

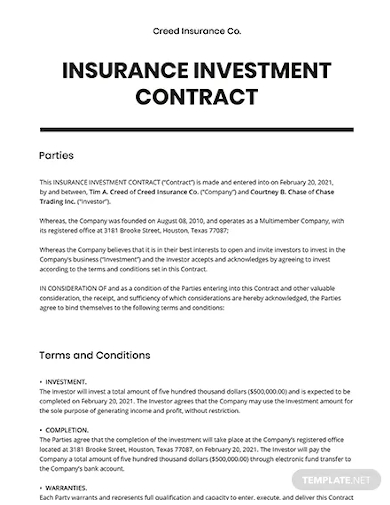

1. Insurance Investment Contract Template

2. Impact on Insurers Investment Contract

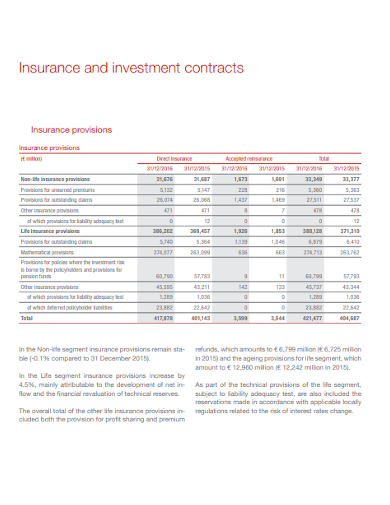

3. Sample Insurance & Investment Contract

4. Investment Contract with Insurance Company

5. Insurance Law Guaranteed Investment Contract

6. Insurance or Bank Investment Contract

7. Investment Components with Insurance Contract

8. Insurance Company Product Investment Contract

9. Insurance Company Capital Investment Contract

10. Insurance Guaranteed Investment Contract

‘What Is an Insurance Investment Contract?

The insurance contract, often known as an agreement, is a contract in which the insurer agrees to pay benefits to the insured or to a third party on their behalf if certain specific events occur. In order to be legally legitimate, an insurance contract must fulfill four requirements: it must be for a lawful purpose; the parties must have legal ability to contract; there must be proof of a meeting of minds between the insurer and the insured; and there must be payment or consideration. When one party makes a contract offer or proposal, and the other party accepts the offer, an insurance contract is formed. To be legitimate, a contract must be straightforward.

How to Make an Insurance Investment Contract

Your insurance adviser is always there to assist you with the ambiguous terminology in insurance papers, but you should also understand what your contract says for yourself. An Insurance Investment Contract Template can help provide you with the framework you need to ensure that you have a well-prepared and robust contract on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, check out these elements that completes an insurance contract below to guide you:

1. Make the policy clear.

The first page of an insurance contract is normally this page. It specifies the insured, the risks or property covered, the policy limits, and the duration of the policy. The name of the person covered and the face value of the life insurance policy will also appear on the Declarations Page of a life insurance policy.

2. Contracting parties in an insurance contract.

An insurer can be any corporation, partnership, or organization that has been properly allowed to do insurance business. The insurer is the person that undertakes to compensate another in the event of a specific occurrence. In the event of a loss, the insured is the person who will be compensated. When an insurance policy matures, the beneficiary is the individual who receives the benefits.

3. Contract terms and conditions.

Conditions are clauses in a policy that restrict or qualify the insurer’s guarantee to pay or perform. The insurer has the right to refuse a claim if the policy criteria are not satisfied. The necessity to register a proof of loss with the company, to secure property after a loss, and to participate during the firm’s investigation or defense of a liability lawsuit are all common requirements under a policy.

4. Terms used in the contract are defined below.

A Definitions section is usually included in most policies, and it specifies terminology that are used throughout the policy. It might be a separate section or a sub-section of another. It is necessary to read this part in order to comprehend the words used in the policy.

FAQ

Is it wise to invest in the insurance industry?

Insurance stocks may be a valuable asset to any investment portfolio.

Is it wise to invest in the insurance industry?

Insurance stocks may be a valuable asset to any investment portfolio.

It’s an investment in the mental tranquility that comes with knowing your family is being taken care of. To help yo get started, download our easily customizable and comprehensive samples of Insurance Investment Contracts today!

Related Posts

Argumentative Writing Samples & Templates

Contract Cancellation Letter Samples & Templates

Sample Material Lists

Sample Excuse Letter for School

Feature Writing Samples

FREE 10+ Security Guard Contract Samples in PDF | MS Word

FREE 10+ Option to Purchase Agreement Samples in MS Word | Apple Pages | PDF

FREE 26+ Curriculum Form Samples in MS Word | PDF

FREE 20+ Cleaning Service Proposal Samples in PDF | MS Word

FREE 29+ Sample Loan Application Form Templates in MS Word | PDF

FREE 10+ Event Venue Contract Samples in PDF | MS Word | Pages | Google Docs

FREE 10+ SBAR Samples in PDF | DOC

FREE 12+ Music Band Contract Templates in PDF | MS Word

FREE 10+ HVAC Maintenance Contract Samples in PDF | MS Word

FREE 10+ Social Media Marketing Contract Samples in MS Word | PDF