10+ Loan Payment Contract Samples

Loans help an economy’s total money supply to rise while also allowing new firms to compete. Through the usage of credit facilities and credit cards, interest and fees from loans are a key source of revenue for many banks and certain shops. As long as you pay it back on time, a loan shouldn’t have a negative connotation. To legally bind and protect all parties of a loan payment, you would need a loan payment contract. We’ve got you covered! In this article, we provide you with free and ready-made samples of Loan Payment Contracts in PDF and DOC formats that you could use for your benefit,

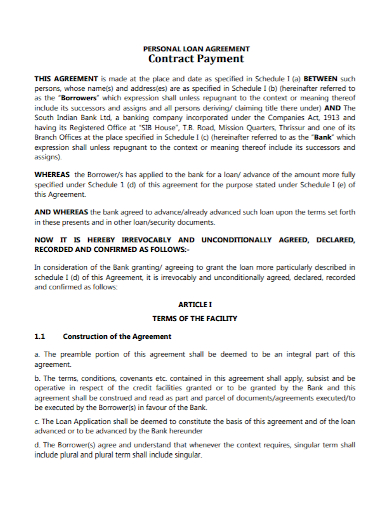

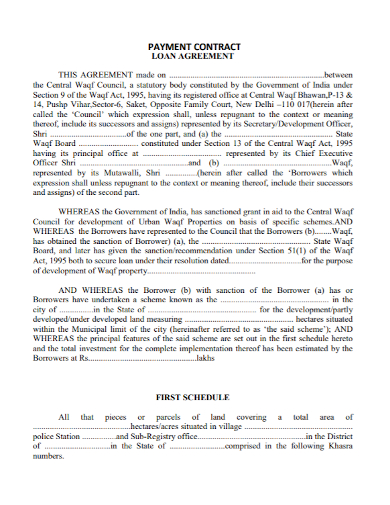

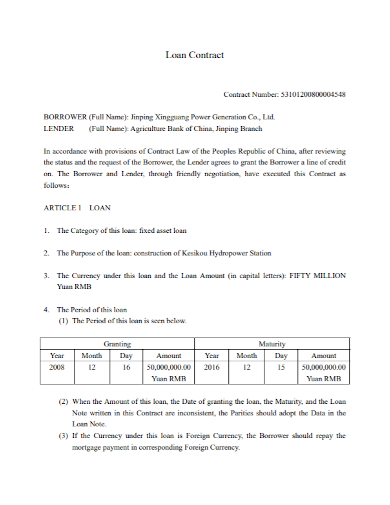

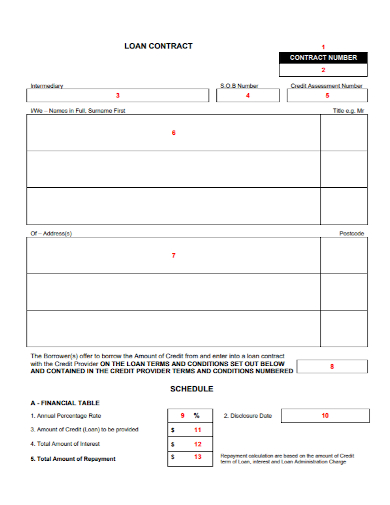

1. Personal Loan Payment Contract

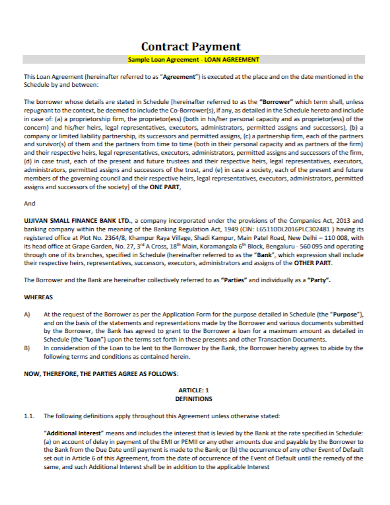

2. Loan Payment Agreement Contract

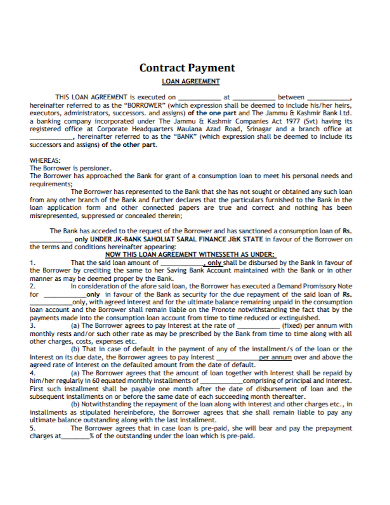

3. Bank Loan Payment Contract

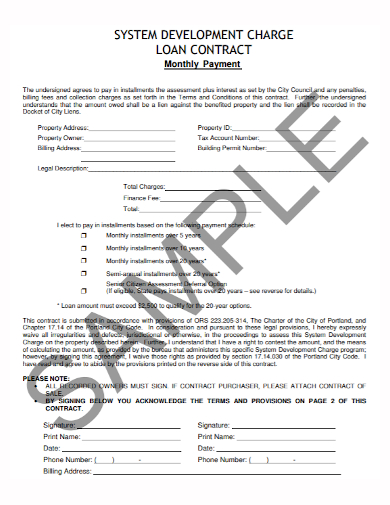

4. Monthly Payment Loan Contract

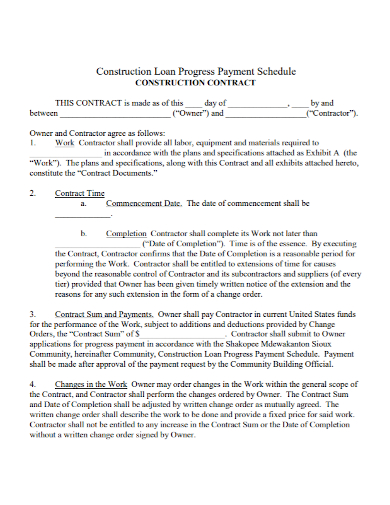

5. Construction Loan Contract Payment Schedule

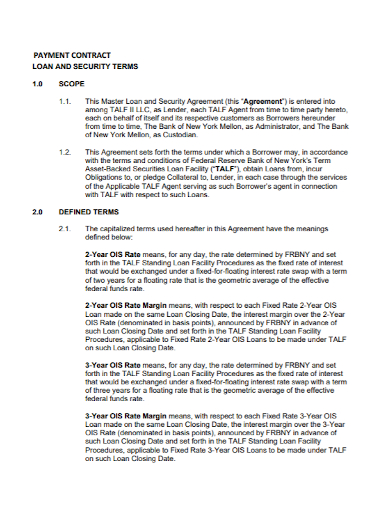

6. Loan Security Payment Contract

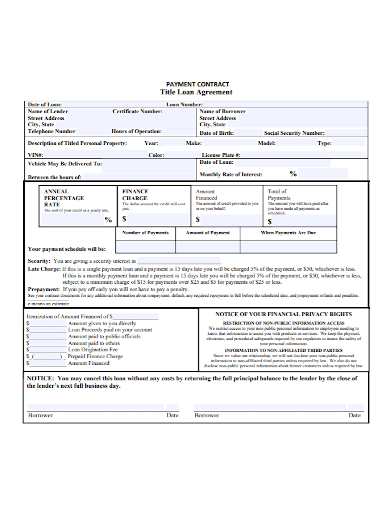

7. Vehicle Loan Payment Contract

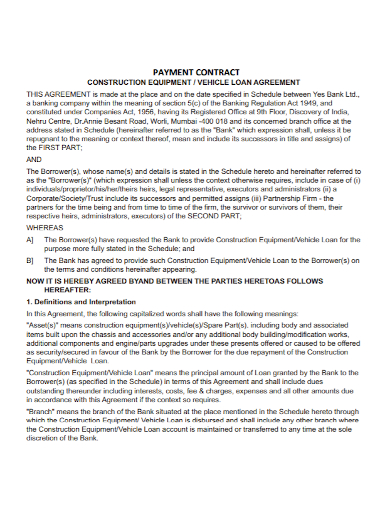

8. Equipment Loan Payment Contract

9. Loan Payment Schedule Contract

10. Sample Loan Payment Contract

11. Loan Repayment Contract

What Is a Loan Payment Contract?

An agreement between a borrower and a lender that formalizes the loan process and outlines the conditions and timetable connected with repayment is known as a loan contract. Other terminology such as note payable, term loan, IOU, or promissory note are occasionally used interchangeably. From relatively simple letters that describe how long a borrower has to return the loan and what interest will be charged to more sophisticated paperwork like mortgage agreements, loan agreements vary depending on the purpose of the loan and the amount of money borrowed.

How to Make a Loan Payment Contract

It’s a good idea to establish a formal agreement even when giving money to relatives or close friends to avoid any misunderstandings that might harm your connection. A Loan Payment Contract template can provide you with the framework you need to ensure that you have a well-prepared and robust contract on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, follow these steps below to guide you:

1. Stipulate the interest rate that will be charged.

Interest is utilized by lenders to compensate for the risk of providing money to the borrower. Usually, interest is represented as a percentage of the original loan amount, also known as the principle, that is then added to the amount loaned. This additional fee is specified at the time the contract is signed, but it can be added or raised if a borrower misses or makes a late payment.

2. Provide a repayment schedule.

Demand and fixed loans are the most common ways to decide repayment schedules. Demand loans, on the other hand, are often utilized for short-term borrowing of small sums without the need for security. This form of payback arrangement is often only utilized between people with whom you have a strong bond, such as friends and relatives. In contrast, repayment on a fixed loan follows a timetable defined in the loan agreement and has a maturity date by which the loan must be entirely repaid.

3. Specify the length of a contract.

The amortization schedule, which sets a borrower’s monthly payments, is commonly used to estimate the length of a loan arrangement. In order to pay back the loan in full, the amortization plan divides the amount of money being lent by the number of installments that must be made.

4. If payments are late or missing, state what will happen.

The steps that can and will be done if the borrower fails to make the agreed payments are usually outlined in the loan agreement. When a borrower pays off a loan late, the loan is deemed violated or in default, and they may be held accountable for any damages incurred by the lender as a result.

FAQ

Is notarization required for loan agreements?

A notary signature is not required on a loan agreement.

What are the four components of a legally binding contract?

Mutual assent, indicated by a legitimate offer and acceptance; appropriate consideration; capacity; and legality are the key characteristics necessary for the agreement to be a legally enforceable contract.

Are loan agreements that haven’t been signed legally enforceable?

A court will consider all of the facts before deciding that the parties meant to be bound by an unsigned written contract.

Taking the effort to create a detailed loan payment contracts saves a lot of time and headache in the future. To help you get started, download our easily customizable and comprehensive samples of Loan Payment Contracts today!

Related Posts

Sample Material Lists

Sample Excuse Letter for School

Feature Writing Samples

FREE 14+ Sample Music Concert Proposal Templates in MS Word | Google Docs | Pages | PDF

FREE 10+ Security Guard Contract Samples in PDF | MS Word

FREE 10+ Assurance Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Option to Purchase Agreement Samples in MS Word | Apple Pages | PDF

FREE 26+ Curriculum Form Samples in MS Word | PDF

FREE 20+ Cleaning Service Proposal Samples in PDF | MS Word

FREE 29+ Sample Loan Application Form Templates in MS Word | PDF

FREE 10+ Event Venue Contract Samples in PDF | MS Word | Pages | Google Docs

FREE 10+ SBAR Samples in PDF | DOC

FREE 12+ Music Band Contract Templates in PDF | MS Word

FREE 10+ HVAC Maintenance Contract Samples in PDF | MS Word

FREE 10+ Social Media Marketing Contract Samples in MS Word | PDF