Have you ever purchased something that is way out of your budget but you need to have it right away? Properties such as vehicles, homes, home equipment, or emergency situations such as if you have been unexpectedly hospitalized or your family member; these instances will force you to cash out a lot of money. If you can’t pay those in full right away, vendors give you a chance to pay off your purchase by giving you a payment plan contract on which you’re given a set time period of which they will divide the rest of the money you need to pay by the month or by quarter until you complete paying the rest of the costs. If you’re going to come across this situation, it is best to know how payment plan contracts are created and how do they work. Read the article below to know more.

10+ Payment Plan Contract Samples

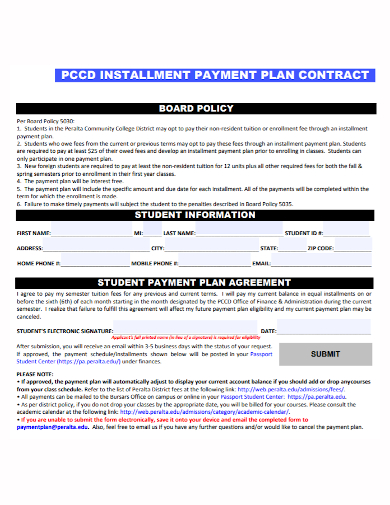

1. Installment Payment Plan Contract

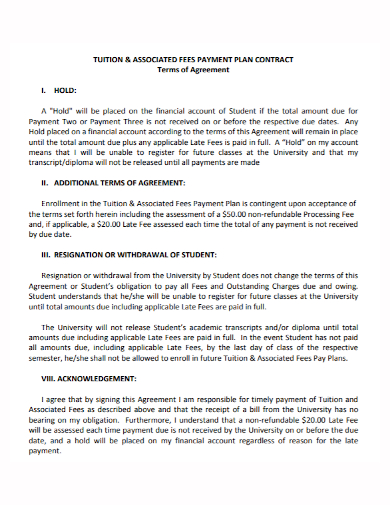

2. Tution Fees Payment Plan Contract

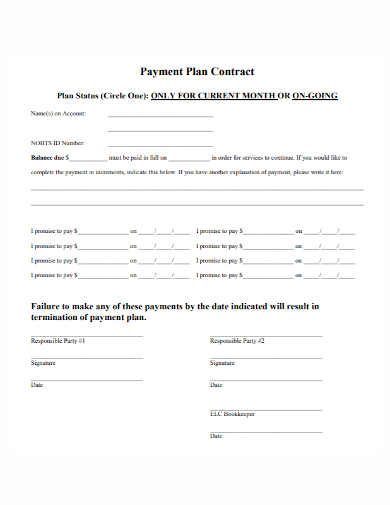

3. Sample Payment Plan Contract

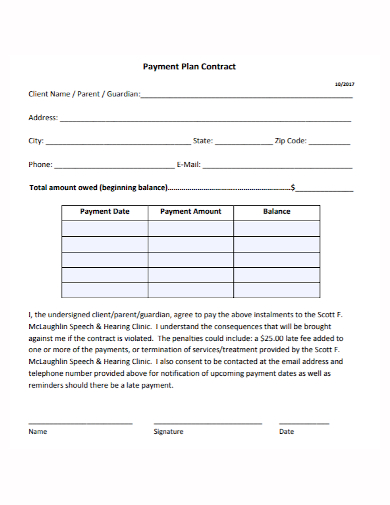

4. Client Payment Plan Contract

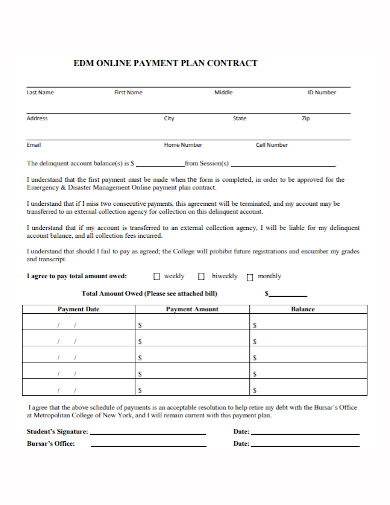

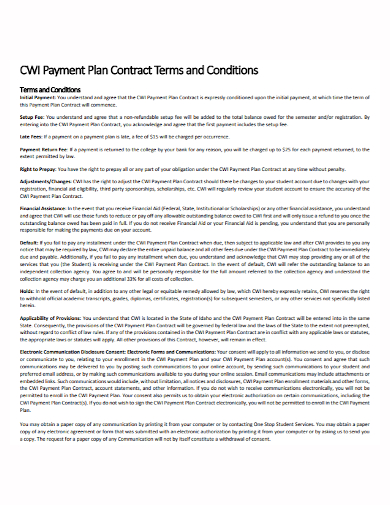

5. Online Payment Plan Contract

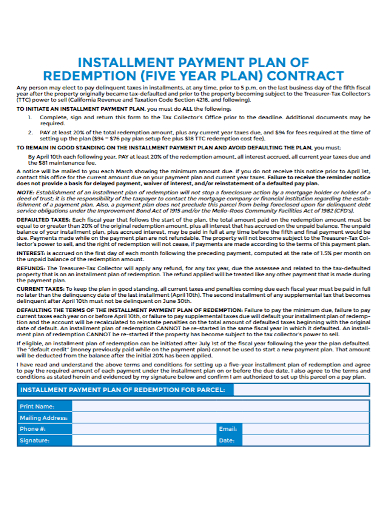

6. Payment Plan Redemption Contract

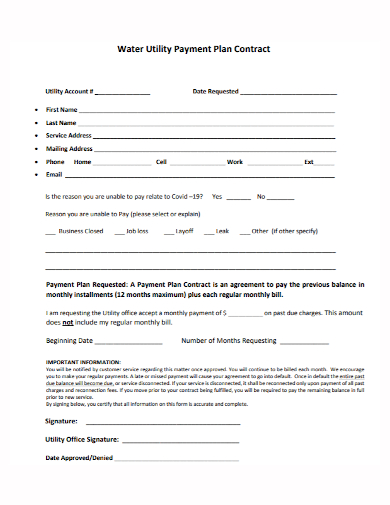

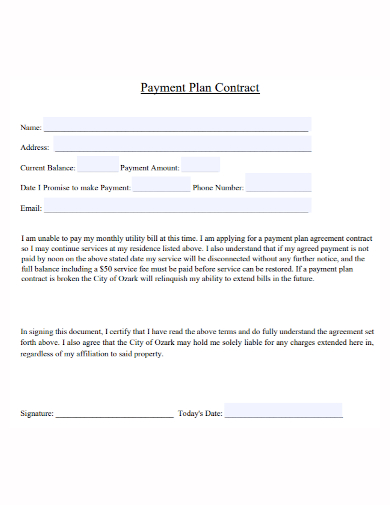

7. Utility Payment Plan Contract

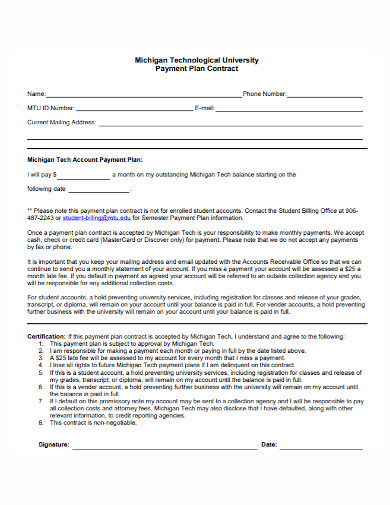

8. Account Payment Plan Contract

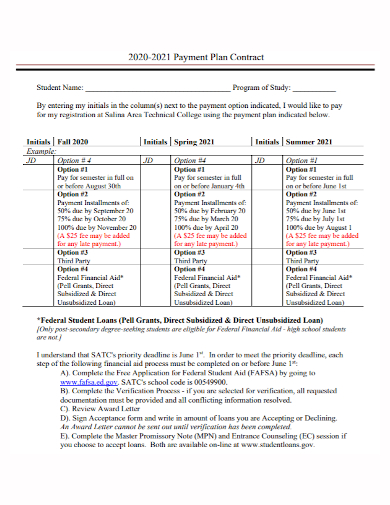

9. Student Payment Plan Contract

10. Standard Payment Plan Contract

11. Basic Payment Plan Contract

What is a Payment Plan?

A payment plan is a procedure that is agreed upon between the vendor or creditor and buyer or debtor for the buyer to pay for an item they purchased or ordered over a specified length of time. This is done when the debotr cannot afford the full amount of the item they ordered and the creditor allows them to complete their payment over the course of months or years.

How to Make a Payment Plan Contract

1. Agree on the Payment Arrangement

The debtor and creditor must agree on which type of payment arrangement would suit both of them. There are two common types of payment plans and these are:

- Goods or Services: This type of payment plan is for the debtor who purchased goods or services with the payment made over a term of around 6 to 18 months. Interest rates are included in this type of payment plan.

- Outstanding Balance: This type of payment plan is when the debtor has funds that they owed to the debtor. Some examples of these are past debt and collections.

2. Create a Payment Agreement

Once the debtor and creditor agreed to the payment plan terms, it’s time to write the contract. When writing the contract, it must have the following details:

- Creditor’s and debtor’s name and address

- Acknowledgment of the balance owed by the debtor

- Amount Owed

- Interest rate (if applicable)

- Repayment period

- Payment instructions

- Late payment terms (if applicable)

- A choice of law or governing law

- Signature lines for the creditor and debtor to sign the contract

3. Begin the Payment Schedule

Once the contract is made and is signed by both parties, the creditor must obtain the debtor’s payment details. It’s either they may set up automatic payments by charging the debtor’s credit card or debit card or get the debtor’s bank account details for each installment period.

FAQs

Is interest rate included in a payment plan?

For payment plans, there is no or little interest rate included as long as the individual made their payments on time.

What are the types of payment terms?

The types of payment terms are:

- Payment in advance

- Payment expected within 7, 10, 15, 30, 60, or 90 days after the invoice date

- End of month

- 21st of the month following the invoice date.

- Cash on delivery

- Cash next delivery

- Cash before shipment

- Cash in advance

What does a standard payment term mean?

A standard payment term is the time period that businesses provide buyers to give them enough time to pay their dues on that period. Most standard payment terms have 30 to 90 days from the date of the invoice being given to the buyer.

After the balance amount owed by the debtor has been paid-in-full, the debtor will be finally released from the financial liability from the creditor. This is completed by creating a release form where they can clear out any outstanding balance in their credit report. To help guide you on what payment plans look like and know their different formats, download our free sample templates above to use as your guide!

Related Posts

FREE 14+ Sample Music Concert Proposal Templates in MS Word | Google Docs | Pages | PDF

FREE 10+ Security Guard Contract Samples in PDF | MS Word

FREE 10+ Assurance Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Option to Purchase Agreement Samples in MS Word | Apple Pages | PDF

FREE 26+ Curriculum Form Samples in MS Word | PDF

FREE 20+ Cleaning Service Proposal Samples in PDF | MS Word

FREE 29+ Sample Loan Application Form Templates in MS Word | PDF

FREE 10+ Event Venue Contract Samples in PDF | MS Word | Pages | Google Docs

FREE 10+ SBAR Samples in PDF | DOC

FREE 12+ Music Band Contract Templates in PDF | MS Word

FREE 10+ HVAC Maintenance Contract Samples in PDF | MS Word

FREE 10+ Social Media Marketing Contract Samples in MS Word | PDF

FREE 10+ Wholesale Assignment Contract Samples in PDF

FREE 18+ Financial Proposal Samples in PDF | MS Word | Google Docs | Pages

FREE 10+ Feasibility Study Samples in PDF