In today’s complex work environment, workers receive employee compensation in various forms. One crucial document that provides a comprehensive breakdown of an individual’s earnings is the paystub. A paystub, also known as a paycheck stub or payslip template, serves as a detailed record of an employee’s wages slip, personal tax deductions, and net pay. Understanding the components and significance of a paystub is vital for financial risk management and transparency. Paystubs serve as valuable records for businesses, supporting internal record-keeping and audit investigation report. Accurate and well-organized paystubs can help during financial audits, tax audits, or inquiries from regulatory bodies.

30+ Paystub Samples

1. Real Estate PayStub Template

2. Corporate Pay Stub Template

3. Pay Check Pay Stub Template

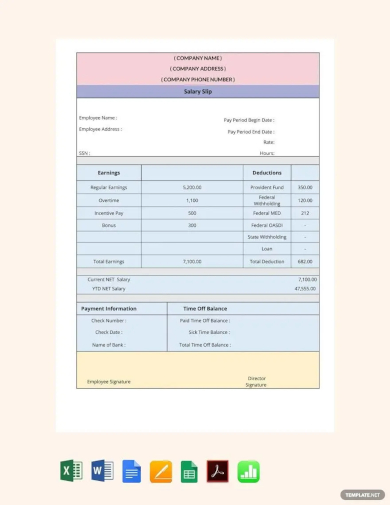

4. Incentives Pay Stub Template

5. Packing Pay Stub Template

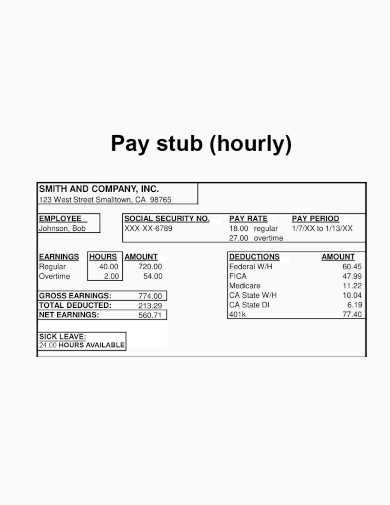

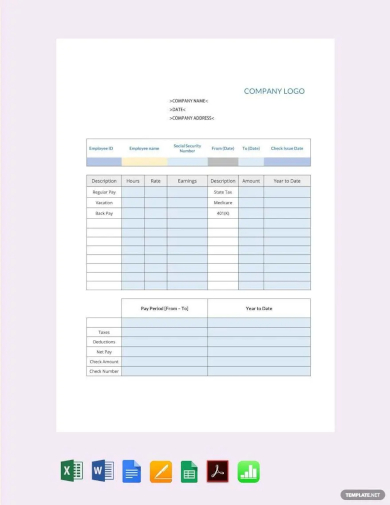

6. Paystub Hourly

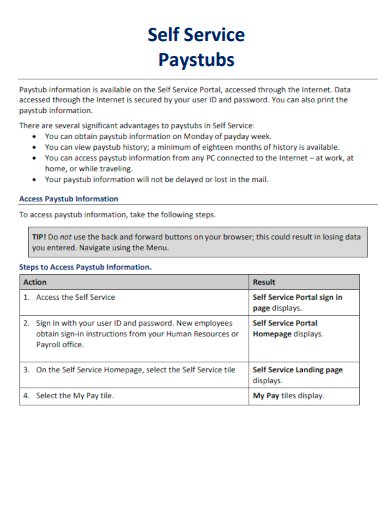

7. Self Service Paystub

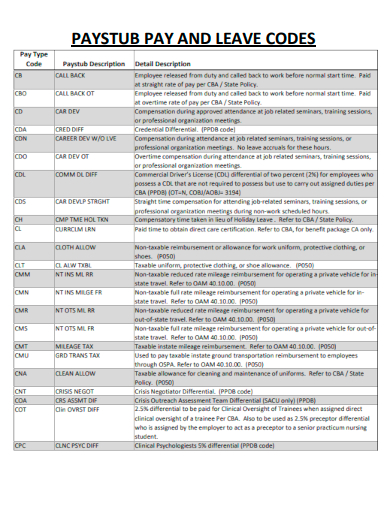

8. Paystub Pay and Leave Codes

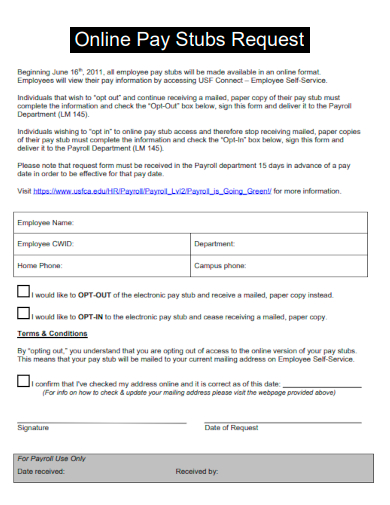

9. Online Paystubs Request

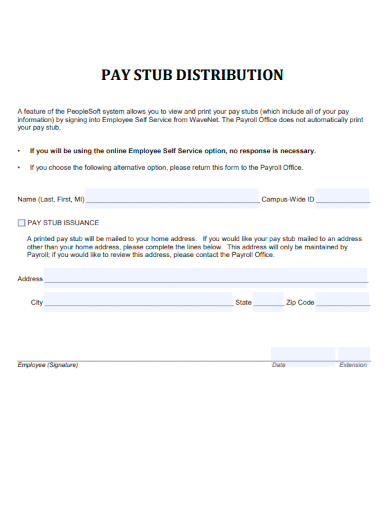

10. Paystub Distribution

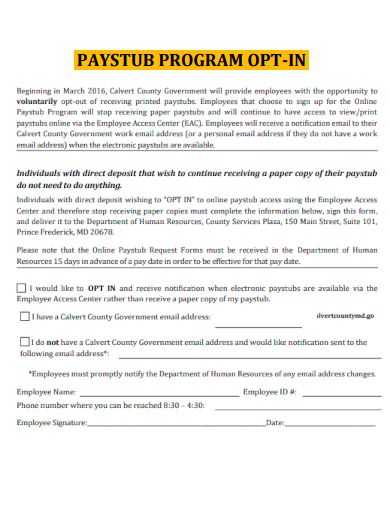

11. Paystub Program OPT-IN

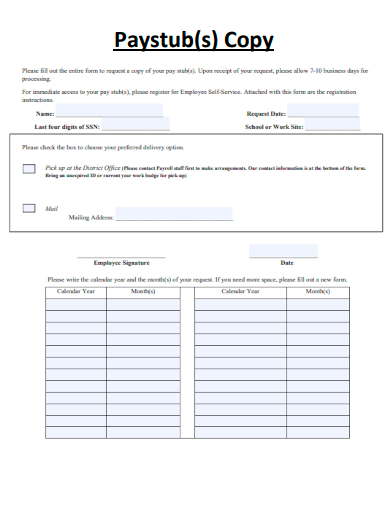

12. Paystub Copy

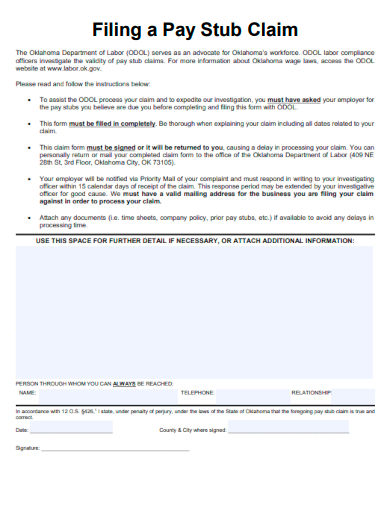

13. Filing a Pay Stub Claim

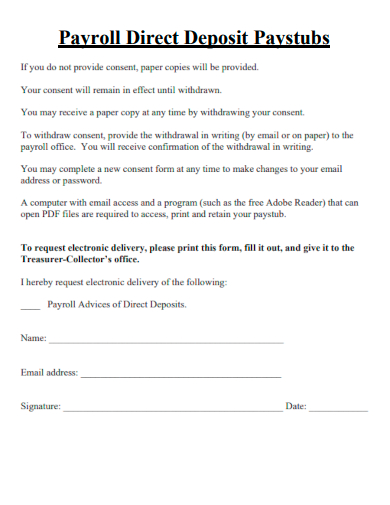

14. Payroll Direct Deposit Paystubs

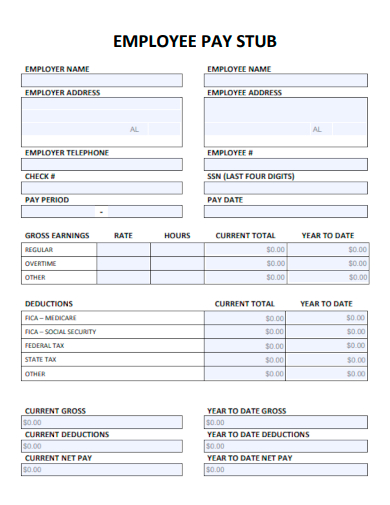

15. Employee Paystub

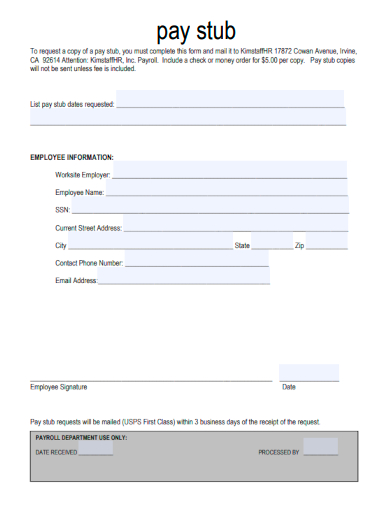

16. Sample Paystub

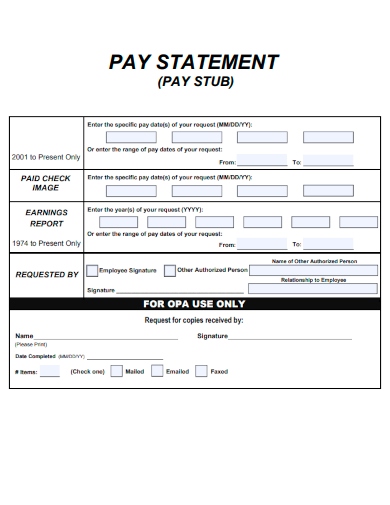

17. Pay Statement Paystub

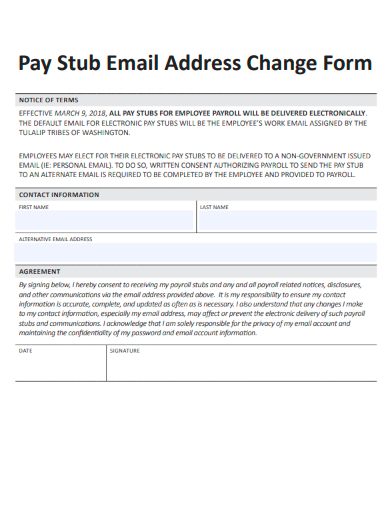

18. Pay Stub Email Address Change Form

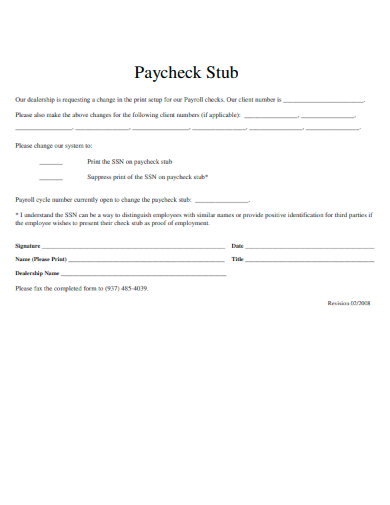

19. Printable Paycheck Stub

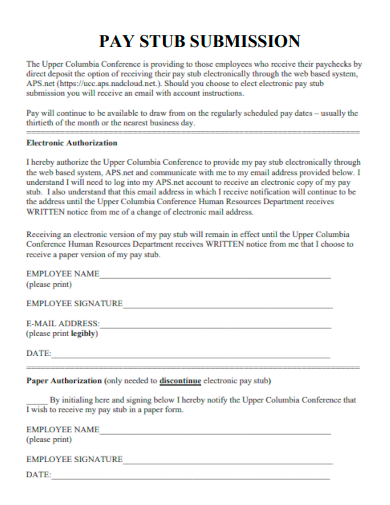

20. Paystub Submission

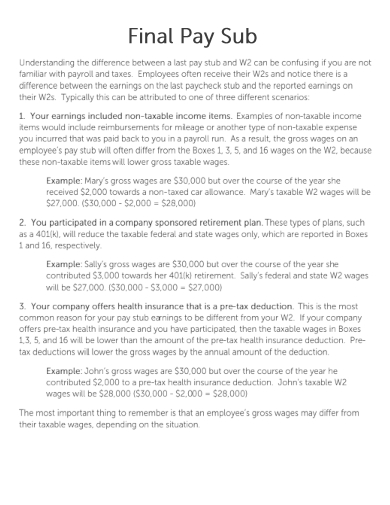

21. Final Paystub

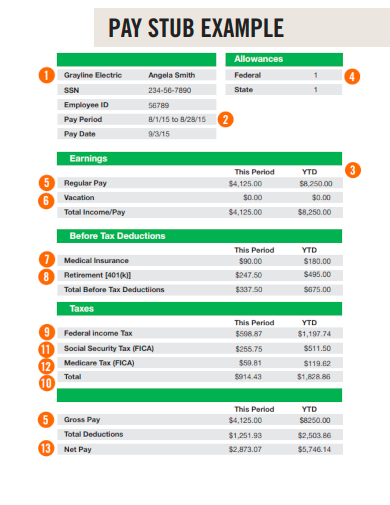

22. Paystub Example

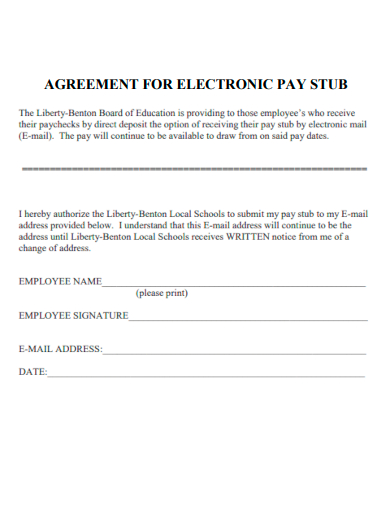

23. Agreement for Electronic Paystub

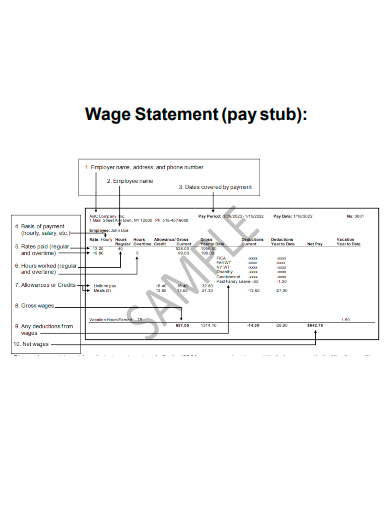

24. Wage Statement Paystub

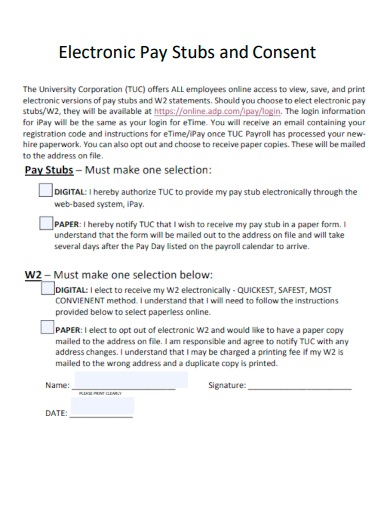

25. Electronic Paystub and Consent

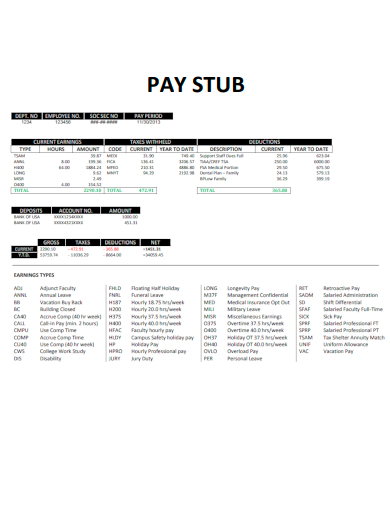

26. Basic Paystub

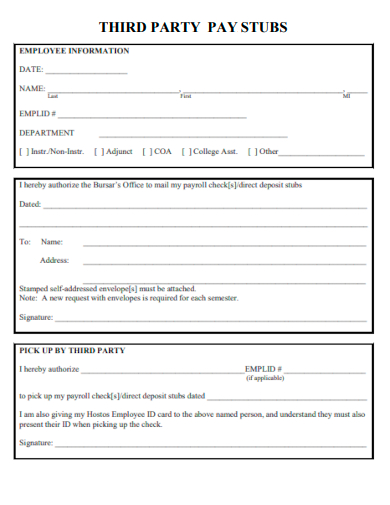

27. Third Party Paystubs

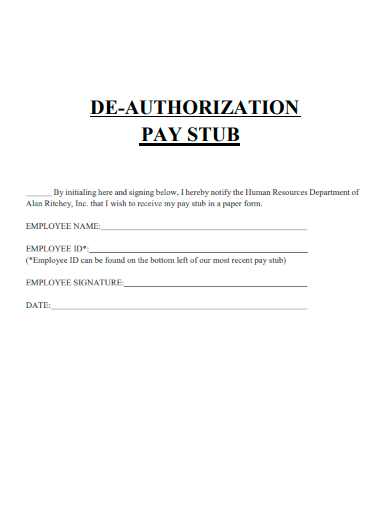

28. De-Authorization Paystub

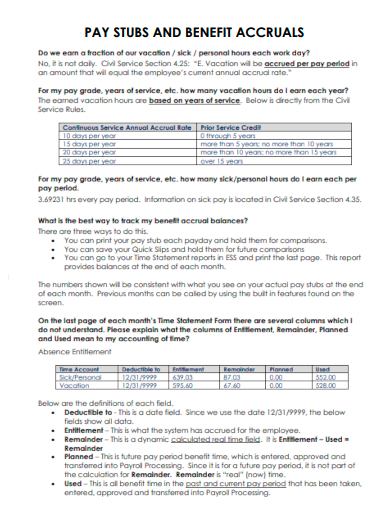

29. Pay Stubs and Benefits Accruals

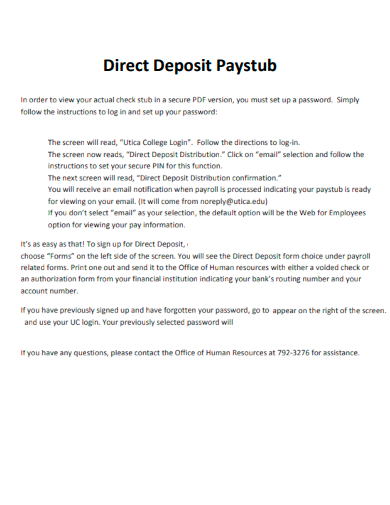

30. Direct Deposit Paystub

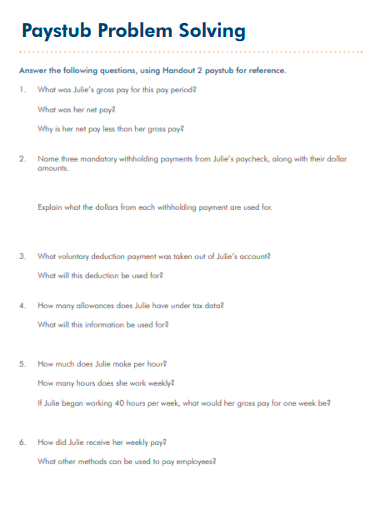

31. Paystub Problem Solving

What is Paystub Samples?

A paystub, also known as a paycheck stub or payslip, is a document provided by an employer to an employee that provides a detailed breakdown of the employee’s earnings and deductions for a specific pay period. It serves as a comprehensive record of the employee’s wages, taxes withheld, and any other deductions or additions to their compensation.

How To Make Paystub Samples?

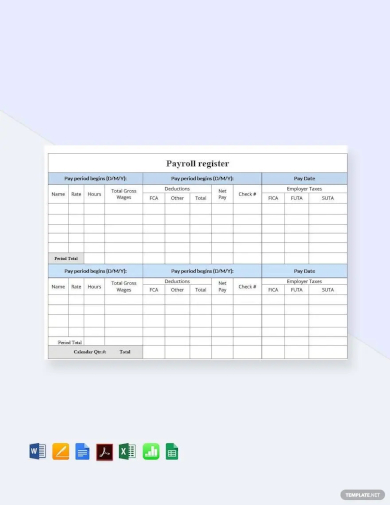

Paystubs are important for financial transparency, verifying income, tax compliance, and resolving any payment-related disputes. Creating a paystub involves compiling accurate information about the employee’s earnings and deductions and presenting it in a clear and organized format. While it is recommended to use payroll software or consult with a professional accountant for precise and compliant paystub generation, here is a general step-by-step guide to creating a paystub:

Step 1- Calculate Deductions

Identify applicable deductions such as federal and estimated taxes, social security contributions, Medicare contributions, retirement contributions, health insurance premiums, and any other authorized deductions. Consult tax tables and regulations to determine the correct amounts to withhold for taxes.

Step 2- Determine Net Pay

Subtract the total deductions from the gross income to calculate the employee’s net pay (take-home pay). Summarize the employee’s total earnings and deductions for the year up to the current pay period. This information helps employees track their overall income and deductions for tax purposes.

Step 3- Design the Paystub Format

Create a table or use a paystub template to organize the information. Include clear headings for each section, such as “Employee Information,” “Earnings,” “Deductions,” “Taxes,” “Net Pay,” and “YTD Totals.” Ensure the paystub is visually appealing and easy to read, using appropriate fonts and formatting.

Step 4- Input the Information

Enter the employee’s personal details, including name, address, Social Security number, and employee identification number, at the top of the paystub. Fill in the earnings section with the breakdown of the employee’s income, specifying different types of compensation if applicable. List each deduction separately, along with the corresponding amount withheld.

How often are paystubs issued?

Paystubs are typically issued on a regular basis, such as monthly, bi-weekly, or weekly, depending on the employer’s payroll schedule.

Can paystubs be provided electronically?

Yes, many employers provide paystubs electronically through employee portals or email. However, it is important to comply with any legal requirements for electronic paystub delivery in your jurisdiction.

Can I use a paystub as proof of income?

Yes, paystubs can serve as proof of income when applying for loans, renting apartments, or providing documentation for government assistance programs. They validate an individual’s employment status and financial stability.

Paystubs are important for several reasons. They promote financial transparency by helping employees understand how their earnings are calculated and how various deductions affect their take-home pay. Paystubs also serve as documentation for verifying income, complying with tax requirements, and resolving payment-related disputes.

Related Posts

Argumentative Writing Samples & Templates

Contract Cancellation Letter Samples & Templates

Sample Material Lists

Sample Excuse Letter for School

Feature Writing Samples

FREE 10+ Security Guard Contract Samples in PDF | MS Word

FREE 10+ Option to Purchase Agreement Samples in MS Word | Apple Pages | PDF

FREE 26+ Curriculum Form Samples in MS Word | PDF

FREE 20+ Cleaning Service Proposal Samples in PDF | MS Word

FREE 29+ Sample Loan Application Form Templates in MS Word | PDF

FREE 10+ Event Venue Contract Samples in PDF | MS Word | Pages | Google Docs

FREE 10+ SBAR Samples in PDF | DOC

FREE 12+ Music Band Contract Templates in PDF | MS Word

FREE 10+ HVAC Maintenance Contract Samples in PDF | MS Word

FREE 10+ Social Media Marketing Contract Samples in MS Word | PDF