Depending on the level of the inflation rate, it can either bring beneficial results or detrimental effects on a country’s economic growth. Inflation can affect the prices of goods and services, employees’ wages, foreign exchange, and more. That makes it vital to let economists predict inflation for the authorities to anticipate it with particular action plans. In this article, we will discuss more regarding predicting inflation.

What Is Inflation?

Inflation is a substantial increase in the prices of goods and services due to the reduction of the purchasing ability of a currency unit. In other words, you have to pay more to buy commodities and avail of services. The U.S. Bureau of Labor Statistics publishes this information based on the Consumer Price Index, which the same organization publishes.

Causes of Inflation

We have mentioned at the beginning of this article that inflation can be either beneficial or detrimental to our economy, but have you ever thought about why it exists? Let’s tackle its two leading causes.

Demand-pull Inflation

Demand-pull inflation is a situation where the demand becomes higher than the supply. At this moment, consumers are willing to pay higher to obtain a product. For example, due to the most recent novel coronavirus outbreak, the demand for the masks soared to the point of the supplies falling short. As a result, its price also went up. In another instance, Helium 10 initially price a pack of 100 Universal 4533 sanitary dust masks at $8. However, due to the demand level, it went up to $200.

Cost-push Inflation

High demand is not the sole reason for inflation. At times, despite the constant demand level, since there is a supply constraint, the inflation level rises. Take the aftermath of Hurricane Katrina as an example. The hurricane caused damage in the gas supply lines, resulting in supply constraints. It causes the prices of gas to reach $5 per gallon.

9+ Predict Inflation Samples in PDF | DOC

To know more about how to predict inflation, start by looking at the following examples. You can download these documents in PDF and M.S. Word formats.

1. Predict Inflation Sample

2. Predict Inflation Template

3. Predict Inflation in PDF

4. Predict Inflation Example

5. Basic Predict Inflation Sample

6. Formal Predict Inflation Template

7. General Predict Inflation Sample

8. Sample Predict Inflation Template

9. Simple Predict Inflation in PDF

10. Predict Inflation in DOC

How to Predict Inflation

There is no way to predict inflation with 100% accuracy and consistency. However, you can estimate its figure by following the tips below.

1. Keep Track of the Economic Growth Rate

The economic growth rate is a crucial factor in predicting inflation. To do it, you have to monitor its extra capacity. For example, an economy has a long-run trend of 2.5%. This rate will not cause any inflation. However, the moment it goes as high as 3%-4%, inflation will most likely occur, following its sudden arrival to its full capacity.

2. Monitor the Unemployment Rate

Many economists believe that the unemployment rate is also an excellent inflation indicator. According to Phillips Curve, an economic concept developed by A. W. Phillips, as the unemployment rate goes down, job vacancies go up. During this state, workers can demand higher salaries. However, to maintain the profits that employers get, they may set higher prices on the goods they sell, which can result in wage-push inflation.

3. Look at Housing Prices

Are you familiar with the wealth effect? It is a theory where a person feels financially secure and confident in spending money after the prices of their assets go up. Many economists believe that during this state, inflation may go up. However, at times it won’t affect inflation. It just happens that the other factors significantly trigger it.

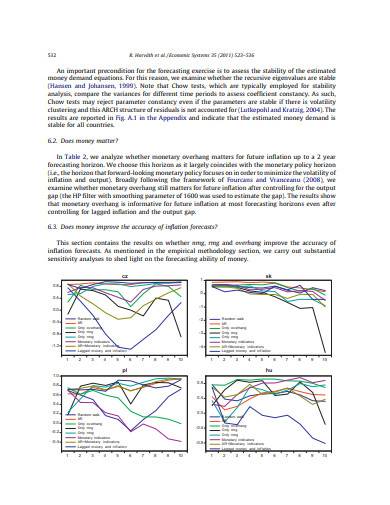

4. Observe the Money Supply

The relationship between inflation and the money supply led many to believe that the increase in the money supply causes inflation. The central banks, however, manage the number of the money supply through monetary policy. By implementing this policy, inflation due to excessive money supply will rarely happen. Most likely, when it happens, other factors may have created a significant effect.

How to Prepare Your Business for Inflation

With the tips that we have mentioned, you must already have an idea of when inflation occurs. However, knowing when it happens is not enough. You have to prepare your business to ensure that it will lessen its negative impact on your business.

1. Adjust the Pricing of Your Products

To counteract the effect of inflation, the prices of your products. You can use a price list template and a price list format to assign prices of your products effectively. However, in doing it, you have to track the prices of your competitors’ products as well to prevent them from taking advantage of your action.

2. Lessen Your Debt

Inflation can cause the costs of the raw materials and other things relevant to your business. Therefore, for a more continuous business operation, it is crucial to lessen your debts, such as bank loans. By doing it, you will have more money to deal with these unwanted inflation effects.

3. Optimize the Productivity of Your Business

Improving the productivity of your employees will allow you to create a financial plan that can sustain your business despite the occurrence of inflation. One way to do it is by determining the means to accomplish employee performance goals.

4. Reduce Your Costs

You can do it by including cost-effective technologies in your operational business plan. You can also try to find alternative suppliers for raw materials and other supplies that you need.

Predicting inflation before it occurs is a great way to ensure that your business can anticipate its detrimental effects. In this article, we’ve discussed all the necessary information on the topic. Remember that, as mentioned earlier, it’s not all the time time inflation inflicts negative consequences. A balanced economy is the key scenario to aim for, and that comes with both the good and the bad.

Related Posts

FREE 13+ Personal Care Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 4+ Event Sponsorship Proposal Samples in MS Word | Pages | Google Docs | MS Outlook | PDF

FREE 15+ Business Activity Report Samples in MS Word | Google Docs | Pages | PDF | MS Excel | Numbers

FREE 10+ Wellness Recovery Action Plan Samples in MS Word | Pages | Google Docs | PDF

FREE 3+ Construction Equipment Lease Proposal Samples in PDF | MS Word | Apple Pages | Google Docs

FREE 7+ Property Purchase Contract Samples in PDF | MS Word | Google Docs

FREE 3+ Agile User Story Samples in PDF

Deed of Assignment

Contract Termination Letter

Witness Letter

Community Petition

Research Interest Statement

Awarding Contract Letter

FREE 10+ Catering Service Proposal Samples in PDF | MS Word | Apple Pages | Google Docs

FREE 5+ Profile Summary Samples in PDF