Effortlessly manage your billing as an independent contractor with our expertly crafted sample invoice template. Tailored to meet the needs of freelancers and self-employed professionals, this template ensures clarity, accuracy, and prompt payments. Reflect your professionalism and attention to detail in every transaction, and save time with a format that’s easy to use and understand. Elevate your business with an invoicing solution that works as hard as you do.

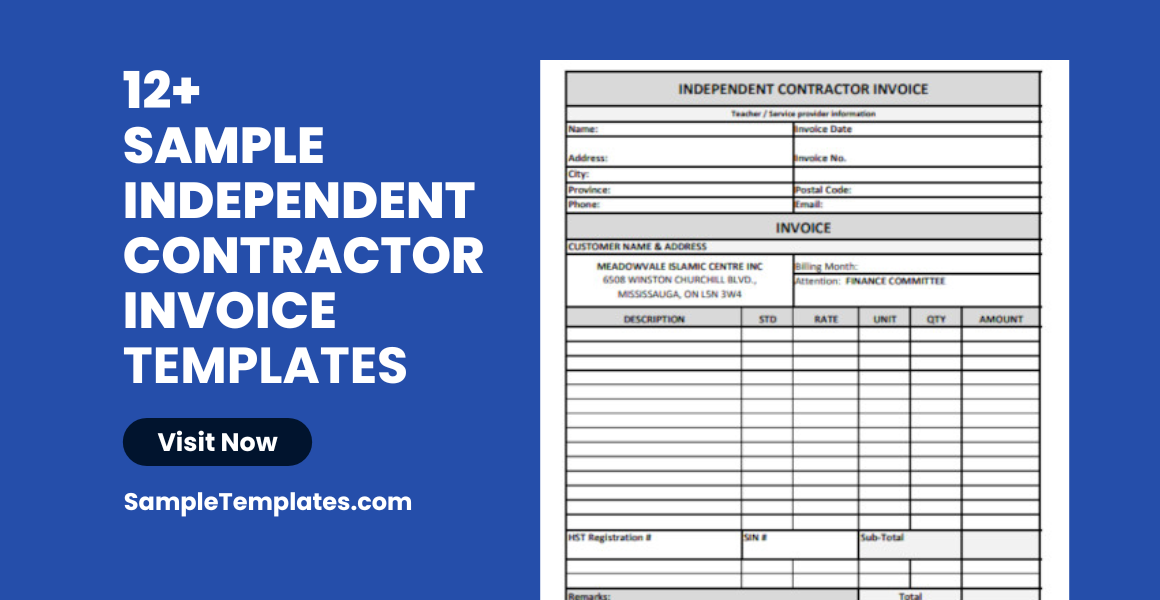

12+ Independent Contractor Invoice Samples

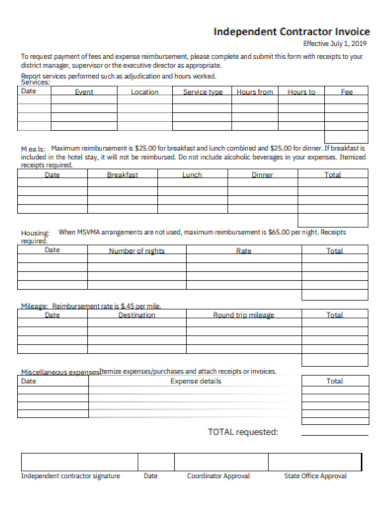

1. Sample Company Independent Contractor Invoice

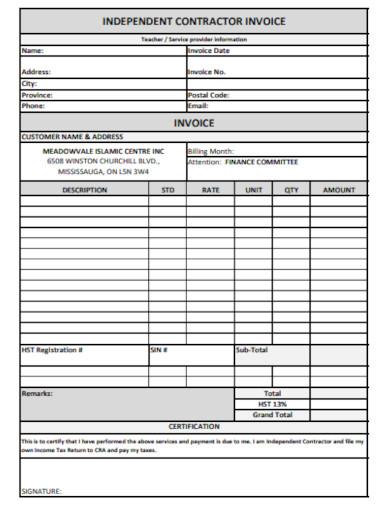

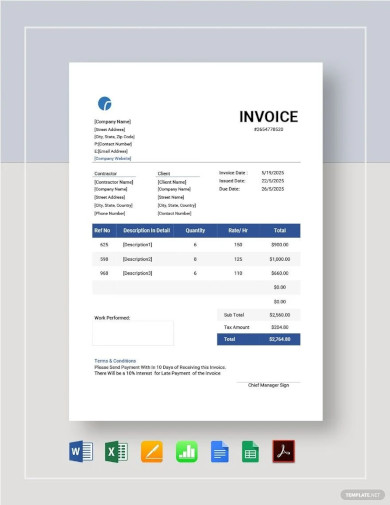

2. Sample Independent Contractor Invoice Template

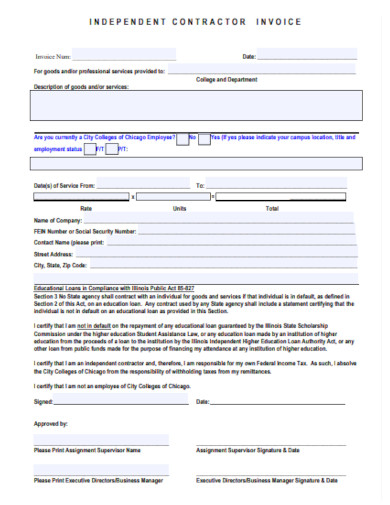

3. Sample Contractor Invoice Template

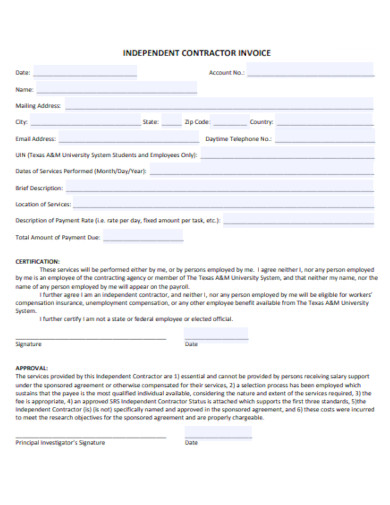

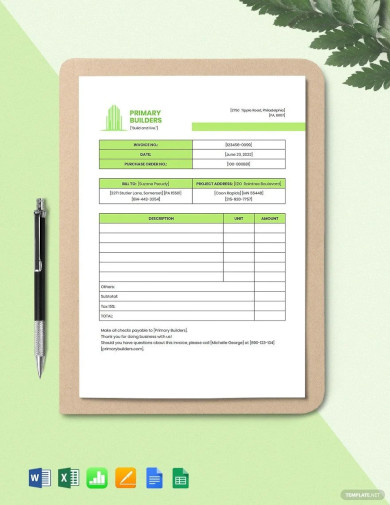

4. General Contractor Invoice Template

5. Sample Invoice Template

What is Independent Contractor Invoice?

An independent contractor invoice is a billing document used by contractors to charge their clients for services rendered. Unlike traditional employees, independent contractors are self-employed individuals who operate under a separate business name from their clients. This invoice serves as a formal request for payment, detailing the services provided, the agreed-upon rates, and the total amount due. You can also see more templates like Contractor Invoice Samples.

Key Elements of an Independent Contractor Invoice

To ensure clarity and prompt payment, an effective invoice should include several key components:

- Contractor Information: This includes the full name or business name of the contractor, contact information, and often a logo for branding purposes.

- Client Information: The name and contact details of the client receiving the invoice.

- Invoice Number: A unique identifier for each invoice which is crucial for record-keeping and sample tracking payments.

- Date of Issue: The date when the invoice is sent to the client.

- Description of Services: A detailed list of services provided, including dates, hours worked, and any other relevant details.

- Pricing and Rates: Clearly stated rates for each service, whether it’s an hourly rate, a per-project fee, or a combination.

- Total Amount Due: The sum total of all services provided, including any taxes or discounts.

- Payment Terms: These are the agreed-upon terms which include the due date for payment, acceptable forms of payment, and any late payment penalties.

Best Practices for Independent Contractor Invoices

To maintain professionalism and encourage timely payments, consider the following best practices:

- Prompt Billing: Send invoices immediately after completing work to keep sample cash flow consistent.

- Clear Communication: Ensure that the invoice clearly states what the client is paying for and when the payment is due.

- Follow-Up: If payment is not received by the due date, follow up with the client promptly.

- Record Keeping: Keep a copy of all invoices for financial records and tax purposes.

How to Invoice for Independent Contractor Services?

Invoicing for independent contractor services involves a clear, organized approach to ensure you are paid accurately and promptly for your work. Here’s a guide to help you create an effective format invoice:

1. Personalize Your Invoice Start with a template that reflects your brand. Include your logo, if you have one, and personalize the color scheme to match your business identity.

2. Include Your Contact Information At the top of the invoice, clearly state your name or business name, address, phone number, and email address. This makes it easy for clients to contact you if they have questions.

3. Add the Client’s Contact Information Below your contact information, add the client’s name, company, address, and other contact details. This ensures the professional invoice goes to the right place and person.

4. Assign an Invoice Number Each invoice should have a unique number for easy tracking. This can be sequential, alphanumeric, or follow a specific system that you prefer.

5. Date Your Invoice Include the date you’re issuing the invoice and the payment due date. This sets clear expectations for when you expect to be paid.

6. Provide a Detailed Description of Services List each service you provided, along with a description. For example:

- Web Design Services for [Project Name], including layout design, content integration, and responsive optimization – 30 hours at $50/hr

- Graphic Design Work for [Project Name], creating custom graphics for social media – 15 hours at $60/hr

7. List the Prices for Your Services After each service description, list the price. If you charge by the hour, include the number of hours worked and your hourly rate.

8. Include Any Additional Charges If there are any additional charges, such as materials, software licenses, or travel expenses, list these separately.

9. Calculate the Total Amount Due Add up all the charges to provide a grand total. Make sure to include any taxes if applicable.

10. Specify Your Payment Terms Clearly state your payment terms, including accepted methods of payment, and any late payment penalties. For example:

- Payment is due within 30 days of the invoice date.

- Accepted payment methods: Bank Transfer, Credit Card, PayPal.

- Late payments will incur a charge of 2% per month.

11. Add Payment Instructions Provide detailed instructions on how to make a payment. If you accept bank transfers, include your bank account details.

12. Include a Personal Note A brief, polite thank you message can enhance client relationships and encourage prompt payment.

13. Review the Invoice Double-check your invoice for any errors. Ensure all information is accurate and clearly presented.

14. Send the Invoice Promptly Send your invoice as soon as the work is completed or according to the payment schedule agreed upon with the client.

15. Follow Up If the payment due date passes without receipt of payment, send a polite follow-up to remind the client of the outstanding invoice.

Essential Information for an Independent Contractor Invoice

To ensure your independent contractor invoice is complete and professional, it should contain the following information:

1. Your Business Information

- Your Name/Business Name: If you have a business name, use it, along with your own name.

- Your Address: The address where you conduct business, which may also be your home address if you work from home.

- Contact Information: Your phone number and email address, so clients can reach you with questions.

- Logo: If you have a business logo, include it for branding purposes.

2. Client’s Information

- Client’s Name/Company Name: The name of the person or the business you’re invoicing.

- Client’s Address: The physical or mailing address of the client.

- Client’s Contact Information: Additional details like the client’s phone number or email address, if applicable.

3. Invoice Specifics

- Invoice Number: A unique identifier for the printable invoice.

- Invoice Date: The date you issue the invoice.

- Payment Due Date: The date by which you expect to be paid.

4. Details of the Service Provided

- Description of Services: A clear and detailed description of the services you provided.

- Dates of Service: The date or range of dates when the services were provided.

- Hours Worked: If you’re billing by the hour, include the number of hours worked.

- Rate: Your hourly rate or project fee.

5. Payment Information

- Line Items: A breakdown of services provided and their corresponding costs.

- Subtotal: The total before taxes or discounts.

- Taxes: Any sales tax, VAT, or other taxes that apply to the services provided.

- Discounts: Any discounts you’ve agreed upon with the client.

- Total Amount Due: The final amount the client needs to pay.

6. Payment Terms

- Accepted Payment Methods: Such as check, bank transfer, online payment platforms, etc.

- Late Payment Policy: Any fees or interest that apply to late payments.

7. Additional Notes

- Notes Section: A place for any additional information relevant to the services or payment.

- Thank You Message: A polite thank you note expressing appreciation for the client’s business.

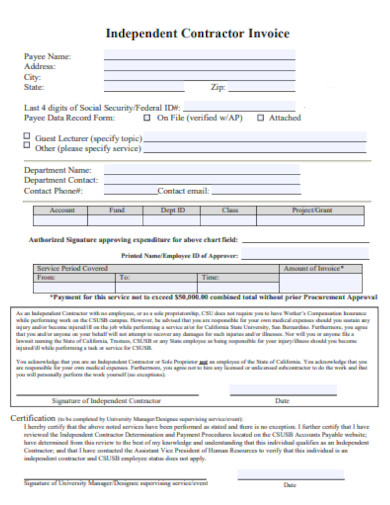

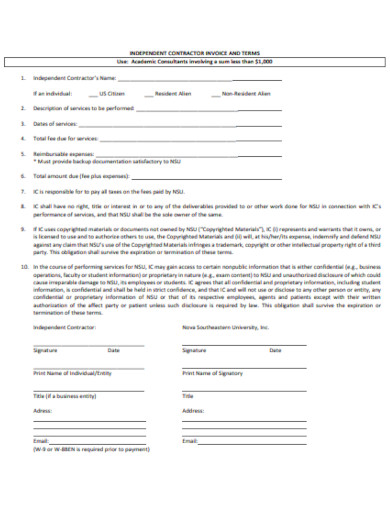

6. Sample University Independent Contractor Invoice

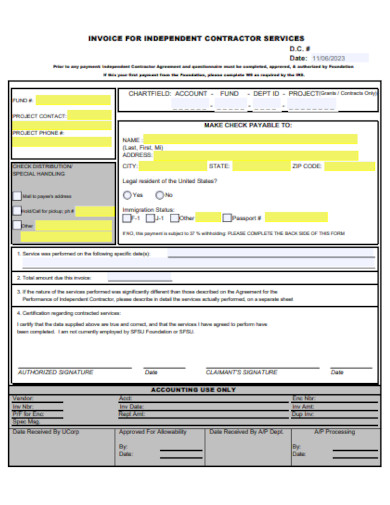

7. Sample Invoice For Independent Contractor Services

8. Self Employed Independent Contractor Invoice

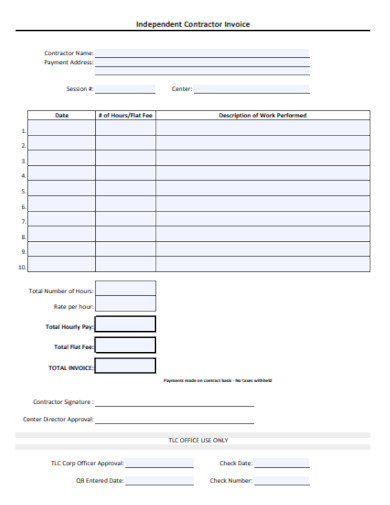

9. Basic Independent Contractor Invoice Template

10. Administrative Independent Contractor Invoice

11. Fillable Independent Contractor Invoice Template

12. Sample Independent Contractor Payment Invoice

13. Independent Contractor Consultant Invoice Template

Effective Tips for Managing Your Independent Contractor Invoices

Managing your independent contractor invoices efficiently is crucial for maintaining a healthy cash flow and ensuring that you get paid on time for your services. You can also see more templates like Subcontractor Invoice Samples. Here are some tips to help you manage your invoices effectively:

1. Stay Organized

- Keep a dedicated folder, either digital or physical, for all your invoicing and payment records.

- Use a consistent naming convention for your invoice files to make them easy to locate.

2. Use Invoicing Software

- Consider using invoicing software to automate the invoicing process. Many platforms can also track payments and send reminders to clients.

3. Set Clear Payment Terms

- Clearly state your payment terms on each invoice, including due dates and late payment penalties.

- Be consistent with your payment terms across all clients unless otherwise negotiated.

4. Invoice Promptly

- Send out invoices as soon as the job is completed or according to the agreed-upon schedule (e.g., weekly, bi-weekly, monthly).

5. Follow Up on Late Payments

- If a payment is late, send a polite reminder immediately, and follow up regularly until the basic invoice is paid.

- Keep a template for payment reminders to save time.

6. Keep Communication Lines Open

- Make sure your client has all your current contact information in case they have questions about the invoice.

- Be available to discuss any issues that might arise with the invoice.

7. Maintain Detailed Records

- Document all work done with dates and hours spent, so you can reference them if there are any discrepancies or disputes.

8. Number Your Invoices

- Each simple invoice should have a unique number to avoid confusion and make tracking easier.

9. Offer Multiple Payment Options

- The easier you make it for clients to pay, the faster you’ll receive payments. Include various payment methods such as bank transfers, online payments, or sample checks.

10. Review Your Invoicing Process Regularly

- Periodically review your invoicing process to identify any areas for improvement.

11. Plan for Taxes

- Keep in mind that your income from independent contracting is subject to taxes. Set aside a portion of each payment for this purpose.

12. Use Professional Templates

- A professional-looking invoice is more likely to be taken seriously. Use templates that reflect your brand and professionalism.

13. Secure Your Data

- Ensure that your invoicing system is secure, especially if you are storing personal client information.

14. Acknowledge Receipt of Payment

- When you receive a payment, send a sample receipt or a simple thank you message to acknowledge it.

15. Regularly Audit Your Invoices

- Regularly check your invoices against your bank records to ensure all payments are accounted for.

How to Create Independent Contractor Invoice?

To create an independent contractor invoice, follow these steps:

- Choose a Template: Select an invoice template from a software program or find a free one online.

- Fill in Your Information: Add your name, address, contact details, and logo to the template.

- Add Client Details: Include the client’s name, address, and contact information.

- Generate an Invoice Number: Create a unique invoice number for tracking.

- Date the Invoice: Put the date you are issuing the invoice format and the payment due date.

- List Services Provided: Detail the services you provided, with dates and hours worked if applicable.

- Set Prices: Add the cost for each service, including your rate and the total hours worked.

- Calculate the Total: Add up the costs of all services plus any taxes or additional fees to get the total amount due.

- Specify Payment Terms: Clearly state the payment deadline and accepted payment methods.

- Add Notes: Include any additional information or a thank you note to the client.

Who uses Independent Contractor Invoice?

Independent contractors, freelancers, and self-employed individuals use independent contractor invoices to bill clients for their services.

How do i Obtain Independent Contractor Invoice?

You can obtain an independent contractor invoice by creating one using a template from invoicing software, downloading a free template online, or designing one yourself using a sample program like Microsoft Word or Excel.

In conclusion, an independent contractor invoice is more than just a bill; it’s a reflection of your business and an essential tool for financial management. By incorporating all the necessary details and maintaining a professional appearance, contractors can ensure a smooth billing process that benefits both their workflow and their relationship with clients.

Related Posts

FREE 10+ Consultant Invoice Samples in PDF

FREE 10+ Sample Invoice for Consulting Services in PDF

FREE 9+ Sports Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 3+ Cake Invoice Samples [Wedding, Birthday, Order]

FREE 5+ Accounting Service Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Payment Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Agriculture Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Work Invoice Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Professional Invoice Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Cleaning Invoice Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 6+ Massage Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Work Order Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 5+ Legal Service Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Hourly Invoice Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 5+ Architecture Invoice Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF