Credit reporting errors are common nowadays and that affects the credit score of an individual who might be looking to take advantage of it to get discounts or the best deals of certain commodities or items. As a result, it is now to the credit holder to take the necessary steps to dispute errors and the amount lost from their bank accounts. One of the ways to make a dispute is to make a credit dispute letter directed to the concerned government agency or financial institution.

It is a document narrating the inaccuracies of your credit report and the things that you think can help you pacify the situation. You need to be able to write your letter legibly and clear so that you can convey what you want to achieve. Keep reading to know what information you can include in your letter. If you want to get started with your own credit dispute, you can check out and download our free Credit Dispute Letter Samples to guide you through.

10+ Credit Dispute Letter Samples

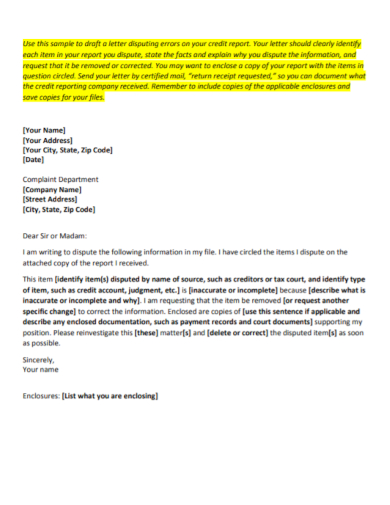

1. Credit Repair Dispute Letter

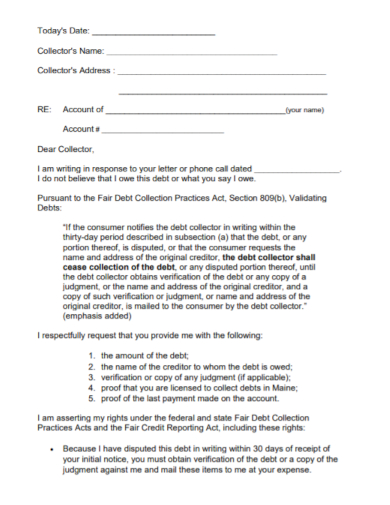

2. Credit Debt Collection Dispute Letter

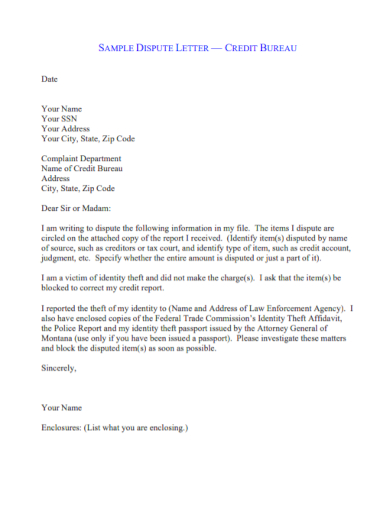

3. Credit Bureau Dispute Letter

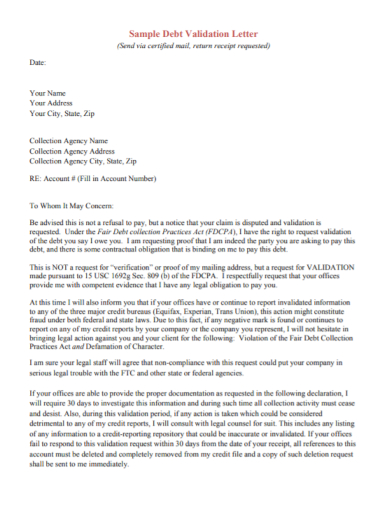

4. Credit Debt Validation Dispute Letter

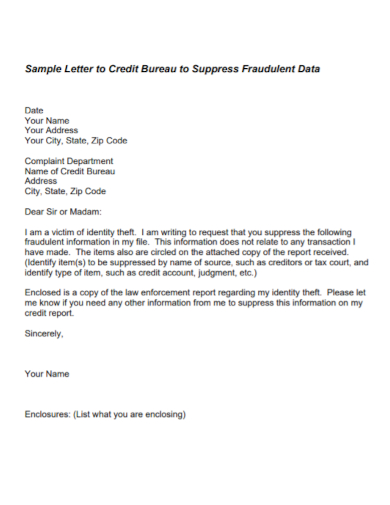

5. Credit Fradulant Data Dispute Letter

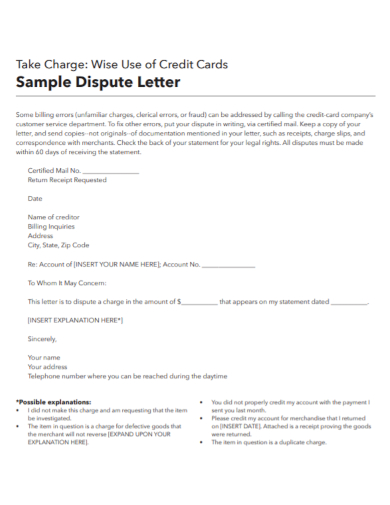

6. Credit Card Dispute Letter

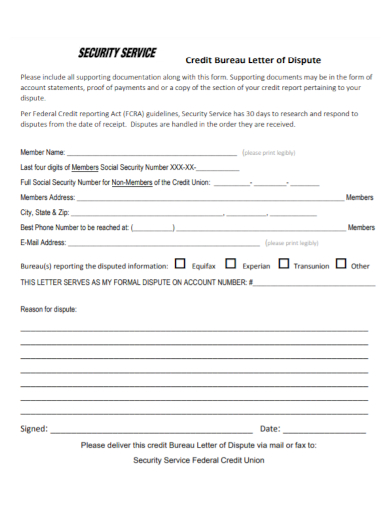

7. Credit Security Service Dispute Letter

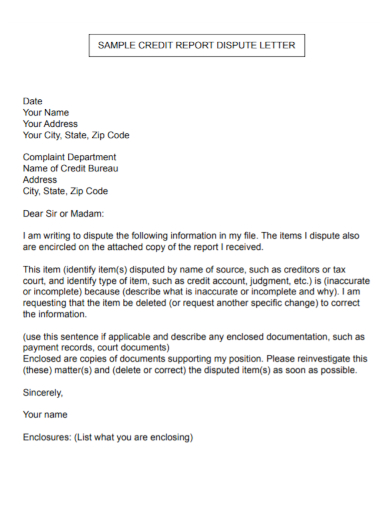

8. Credit Report Dispute Letter

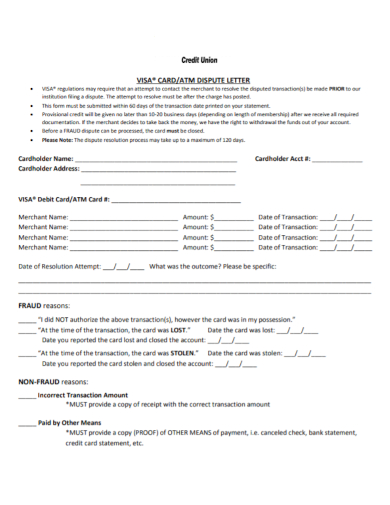

9. Credit Card ATM Dispute Letter

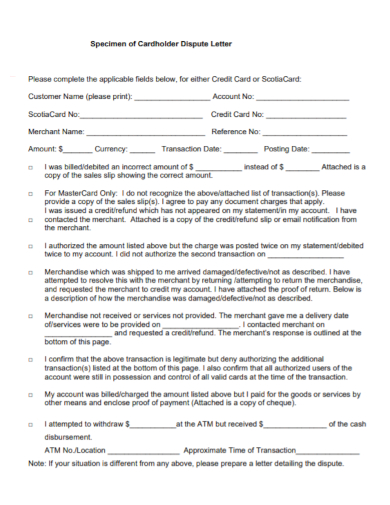

10. Credit Card Holder Dispute Letter

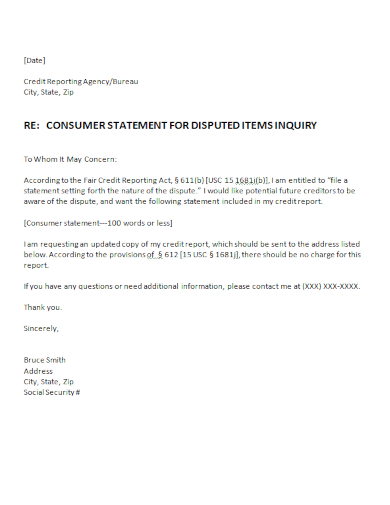

11. Credit Reporting Inquiry Dispute Letter

Contents of a Credit Dispute Letter

- Identification and other important details

Don’t forget to include in your letter the important details that will mobilize your dispute such as your name, account number, contact information, and date of birth among others. This will also be used by the concerned offices to track your records easily in their database system and identify the entry of your dispute. Also include the concerned office’s information such as its name and current address so that they will know that your dispute is intended for them and not for another office.

- Description of error

In describing the error in your credit report, it is important that it is clear and lacks complex sentence construction so that the concerned personnel will be able to understand what you want to say. Also, by being brief and clear with your explanation, available solutions to that particular problem are easily identified and can be put into action at the earliest time possible. This part of the letter can be limited to only 1 paragraph but if it needs more emphasis and a relatively long explanation, you can do it with not more than 2 paragraphs or less just enough to convey what went wrong.

- Supporting documents and proofs of error

Mention in your letter that you will be sending relevant documents that will support your claims and that the error didn’t originate from your side. Such documents include payment records or receipts or even court documents. In a separate paper and not included in the letter, it is best to present right away the document indicating the error on your credit report or credit card statement. Also, don’t forget to include a scanned copy of your identification cards, credit card, and bills that proves your profile and address.

- Suggestions to resolve the issue

This serves as the concluding part of your letter where you give your points of view of the issue and what you want the concerned officers to do in order to address the issue. The most immediate solution to this is to conduct an investigation because it may have rooted to a more serious issue such as identity theft or credit card hacking. Or, the solution could be as simple as removing the erroneous item from your credit report and making the necessary compensation to make up for the commotion and error. Nonetheless, you and the concerned officials should meet halfway and decide on the best solution so that both parties are equally considered.

It is a document stating an individual’s credit activities and current credit card standing.What is a credit report?

It is a number between 300-850 that tells about the creditworthiness of a credit cardholder. The higher the number, the higher the chances that the credit card holder is eligible to apply for lendings.What is the meaning of credit score?

The minimum amount that a borrower needs to pay to keep their account active.What is a minimum amount due?

Related Posts

FREE 5+ Sample Income Verification Letter

FREE 5+ Sample Disagreement Letter

FREE 57+ Authorization Letter Samples

FREE 34+ Sample Formal Letter Formats

FREE 23+ Sample Letters

FREE 20+ Sample Letters

FREE 13+ Sample Credit Reports

FREE 11+ Billing Statement Samples

FREE 10+ Debt Letter Samples

FREE 10+ Settlement Worksheet Samples

FREE 10+ Debit Memo Templates

FREE 9+ Credit Reports

FREE 101+ Sample Letter Templates

FREE 12+ Demand Letter Templates

FREE 11+ Sample Novation Agreement Templates