Utilities are one of the most important things in life as we need them to function in any aspect of our life, such as in studying, doing household chores, improving our work performance, or even in relaxation. Electricity, water, and Internet are only half of the utilities needed by a small business or a big company to carry out their services effectively. However, with those utilities comes big bills which you will then need to pay on time so that service providers can let you continue to use those. In this article, we will discuss bill planners and how you can make one for yourself.

6+ Bill Planner Samples

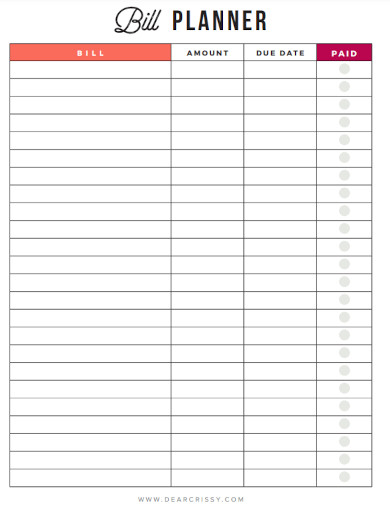

1. Bill Planner Template

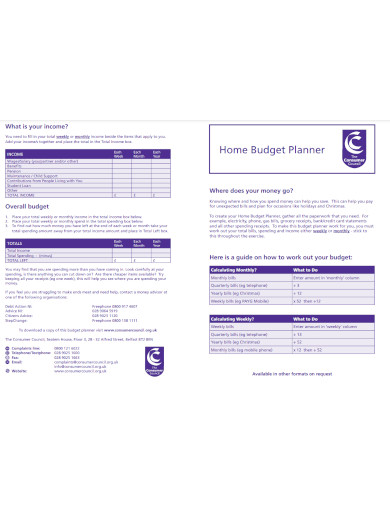

2. Home Bill Planner

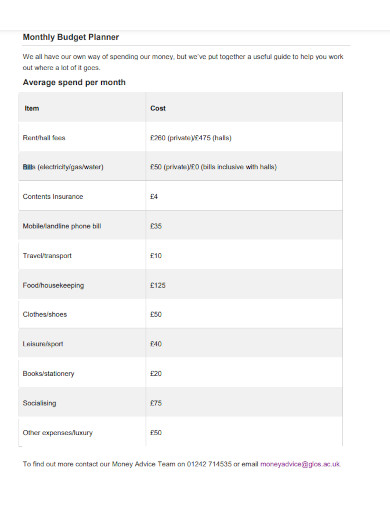

3. Monthly Bill Planner

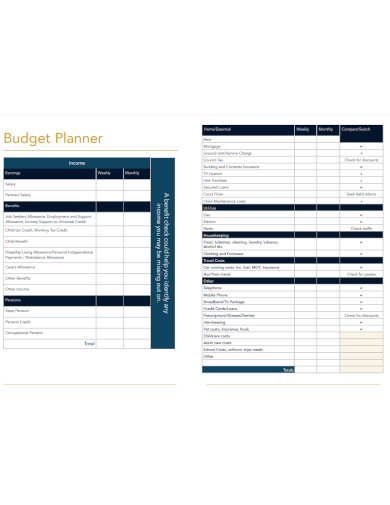

4. Self Bill Planner

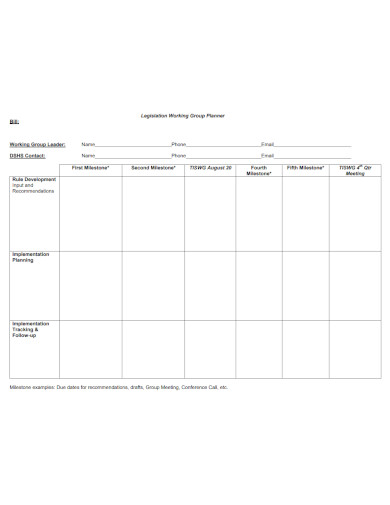

5. Group Bill Planner

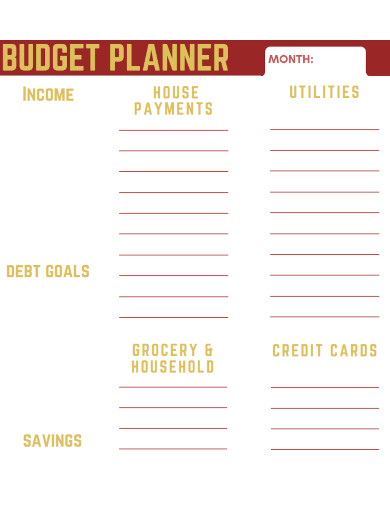

6. Budget Planner and Bill Reminder

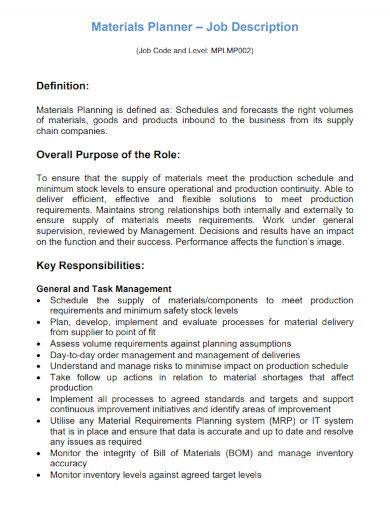

7. Bill of Materials Planner

What Is a Bill Planner?

A bill planner is a type of writing material wherein an individual can jot down their expenses and track their payments on utility bills. These utilities may include electricity, water, Internet, rental or lease payment, mobile phone bills, gas for transportation, laundry, cleaning service, and other related services. A bill planner can be used to track down how much is needed to pay bills on a monthly schedule and also serves as a reminder to an individual of what they had already paid for.

How to Make a Bill Planner?

Are you interested in keeping tabs on your utility bills consistently? In creating a bill planner, we highly suggest that you download a template first. Using a template will help you with time management greatly as you do not have to write anything from scratch. Furthermore, it has a premade design, so you only need to fill out the spaces. Here are some tips and advice that you can follow when you want to write a bill planner today.

1. Provide a Complete List of Your Payables

In the first part of your planner, you need to write down all of your payables. Aside from utilities, the other payables that you need to consider are your food expenses, apparel, entertainment, insurance, leisure activities, and other expenses that you are getting a daily or monthly billing for. You can list them in roster form or you can make a table where you can include columns and rows to separate and categorize them.

2. Do a Thorough Calculation of Your Monthly Income

One of the many reasons why some people fail to pay their dues is because they don’t have enough money set aside from their budget. That is why it is very important that you go over your budget plan and see whether your income is enough to cover all your expenses. To make sure whether your income is sufficient enough, try to incorporate the 20-30-50 rule when doing calculations.

3. Take Note of Extra or Unnecessary Expenses

Is your budget lacking but there are still a lot of payables left for you to consider? If your money is running out just by paying all of your expenses, it is time that you look back at what you are spending. Create an expense sheet on another paper where you can list down some of your previous expenditures, including your late night-out meals and online shopping orders. This method will help you see what you have been spending big lately and aid you in making a healthy decision on cutting off unnecessary expenses that you don’t really need.

4. Find Other Options To Pay Remaining Balances

Balances may seem small at first, but when they are not paid on time, they keep on piling up and would eventually reach greater heights than Mount Fuji. If you do not want to pay for interests and additional charges on payable balances, then find ways to pay them off slowly. You can take side jobs that pay well so that you can set the money from it aside to pay for the balances you’ve incurred without touching your other salary which is used to pay other accounts.

Why should I need a bill planner?

When bills pile up, most people tend to worry instantly because they think their money won’t suffice to pay them. When you use a bill planner, it becomes easier for you to track your payables and know if you have enough in your budget to pay off all accounts monthly. It also helps you organize your expenses so you can monitor your expenditures closely and efficiently.

What is an expense sheet?

An expense sheet is a type of document that contains information about an individual, family, or business expenditures. It usually includes itemized categories of expenses that include utilities, transportation, leisure, and emergency payables.

How can I benefit from a bill planner?

One of the benefits of having a bill planner is having needed peace of mind. Knowing that you have paid all of your financial obligations to your service providers will make you feel at ease because you do not have to worry about incurring debts or balances from them anymore.

Bill planners are very essential since they can help you oversee where your money is going and at the same time provides you with ways to save money. If you want to be responsible for your bills and become accountable for what you spend, then you need to download our template today. You can check out our sample of editable templates which you can find in our gallery.

Related Posts

FREE 10+ Meeting Planner Samples in PDF

FREE 10+ Course Planner Samples in PDF

FREE 8+ Calendar Planner Samples in PDF

FREE 10+ Cute Workout Planner Samples in PDF | MS Word | Apple Pages

FREE 10+ Financial Planner Samples in PDF | MS Word | Apple Pages

FREE 10+ Digital Planner Samples in PDF | Apple Pages | MS Word

FREE 7+ Year Life Plan Samples in PDF

FREE 6+ 7 Day Weekly Planner Samples in PDF

FREE 50+ Project Planner Samples in PDF | MS Word

FREE 50+ Planner Samples in PDF | MS Word

FREE 10+ Menu Planner Samples in PDF

FREE 10+ Training Planner Samples in PDF

FREE 8+ Birthday Planner Samples in PDF

FREE 10+ Yearly Planner Samples in PDF | MS Word | Apple Pages

FREE 3+ Covid Birth Plan Samples in PDF