Making and sticking to a financial plan is one of the best methods to increase the likelihood of success in any endeavor, be it the launch of a new enterprise or the expansion of an existing one. An efficient business plan can assist in driving decision-making in the company, offer documentation for investors and other stakeholders, and act as a map to help you achieve your goals. When managing finances, some companies may want to work with financial advisors or employ software; however, for some groups, using templates provides an easy way to start the strategic planning process.

10+ Financial Planner Samples

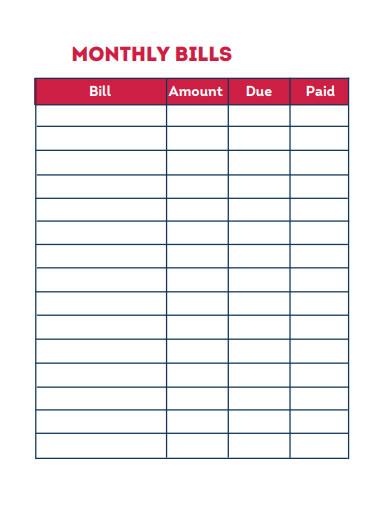

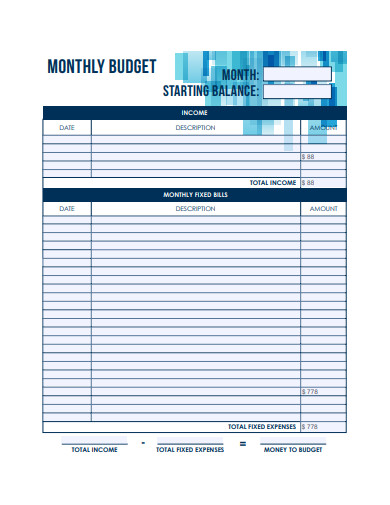

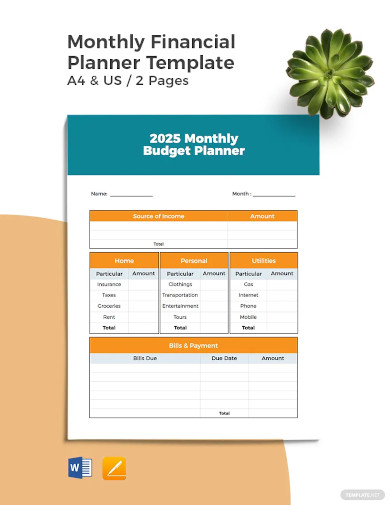

1. Monthly Financial Planner

2. 5 Year Financial Planner

3. Business Financial Planner

4. Retirement Financial Planner

5. Sample Financial Planner

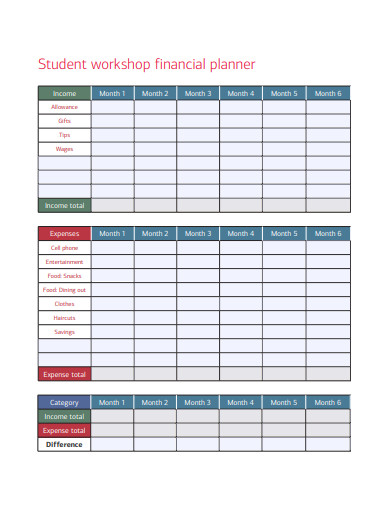

6. Student Workshop Financial Planner

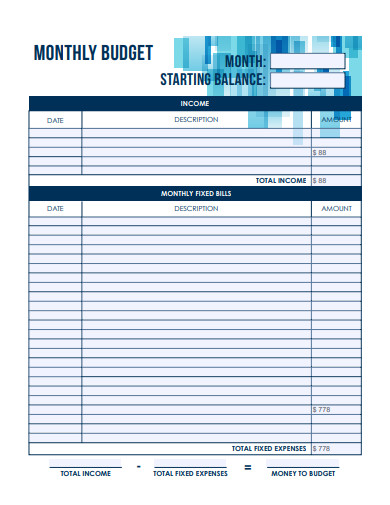

7. Sample Monthly Financial Planner

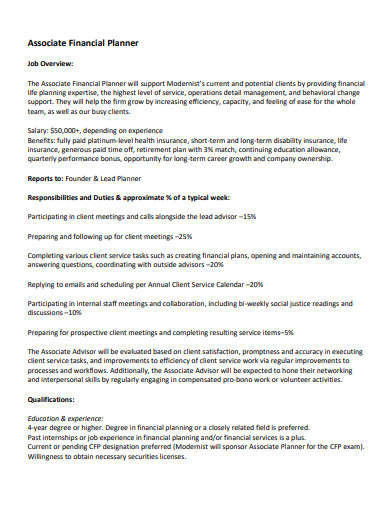

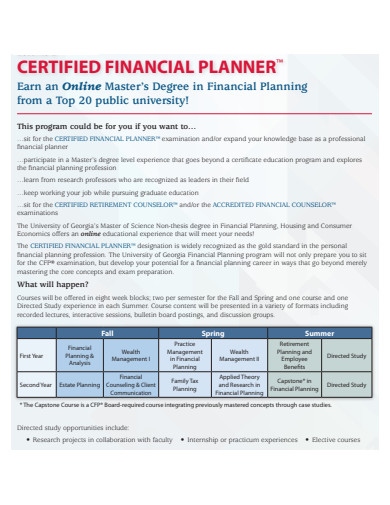

8. Associate Financial Planner

9. Basic Financial Planner

10. Financial Budget Planner

11. Printable Financial Planner

What Is a Financial Planner?

Using a financial plan template is crucial for anyone who wishes to easily and quickly construct a financial plan for personal or commercial endeavors. When you look at an example of a financial plan, you’ll notice that you can use it to create a budget that you can then use to keep track of your spending habits. Suppose you want to complete your project without going over your allotted funds. In that case, you have to ensure that the deliverables you create don’t cost more than you originally anticipated. Having a financial plan can help you accomplish your goal more effectively.

How To Make a Financial Planner?

It doesn’t matter if you’re organizing a wedding, a workplace party, a wedding fundraiser, or a conference; any tool that assists you in managing the process of event planning will help minimize stress and contribute to the success of your event. Therefore, a financial planner who is involved with an event in some capacity, including but not limited to venue rentals, programming, and advertising. In addition to this, it will compile the data that you submit into visual charts, which will allow you to quickly get an understanding of how your event budget is being allocated. Therefore, to get started, follow the instructions that are listed below.

Step 1- Review Current Situation

You need to have a solid idea of the location of the beginning of your journey before you can move on to the “planning” phase of the procedure. This requires you to investigate how your current financial condition stands at the moment. It’s easy to put off looking at your bank statements, but in all honesty, everyone may benefit from investing in more frequent financial checkups. However, it’s essential to keep track of your finances.

Step 2- Set Goals

You now have a foundation to build your path toward achieving monetary independence. The next thing you need to do is work out where you’re going. This is an essential part of your journey through “financial planning for dummies.” When making decisions regarding your finances, having well-defined goals gives you direction and clarity. Your objectives will reveal to you whether or not you are heading on the proper path.

Step 3- Create a Plan for your Debts

Debt is a topic that nobody likes considering, but if you want to be financially aware, you simply can’t afford to ignore its problems. Having a personal financial strategy might be beneficial. If your interest and repayments are dragging you down, you won’t be able to make significant headway toward your short-term or long-term goals. Find a way to pay back what you owe before you worry about anything else.

Step 4- Establish Emergency Fund

A rainy-day fund functions in a similar manner to a financial security blanket. It doesn’t matter how “prepared” you believe you are; there is always the possibility that a cost you weren’t expecting would sneak up on you and knock you off your feet.

What are the 4 pillars of financial planning?

Managing Cash Flow and Financial Resources, accumulating Wealth, managing Income Taxes, and planning for Retirement.

Which three financial documents are considered to be the most important?

The required financial statements are the balance sheet, the statement of income and expenses, and the statement of cash flows.

What exactly is the rule of 72 in finance?

You may determine with relative ease how much time will pass before your money increases by a factor of two using this method. You need to take the number 72 and divide it by the interest rate you anticipate achieving.

Even while you can construct a financial plan from scratch, using a template will make the process simpler and more efficient. A wide variety of financial plan template options are available to create a financial plan. All that is required of you is to enter the information into the appropriate fields. You also have the opportunity to modify or delete areas based on the information that is now at your disposal.

Related Posts

FREE 10+ Meeting Planner Samples in PDF

FREE 10+ Course Planner Samples in PDF

FREE 8+ Calendar Planner Samples in PDF

FREE 10+ Cute Workout Planner Samples in PDF | MS Word | Apple Pages

FREE 10+ Digital Planner Samples in PDF | Apple Pages | MS Word

FREE 7+ Year Life Plan Samples in PDF

FREE 6+ 7 Day Weekly Planner Samples in PDF

FREE 50+ Project Planner Samples in PDF | MS Word

FREE 50+ Planner Samples in PDF | MS Word

FREE 10+ Menu Planner Samples in PDF

FREE 10+ Training Planner Samples in PDF

FREE 6+ Bill Planner Samples in PDF

FREE 8+ Birthday Planner Samples in PDF

FREE 10+ Yearly Planner Samples in PDF | MS Word | Apple Pages

FREE 3+ Covid Birth Plan Samples in PDF