Businesses are required to keep receipts and pay taxes either quarterly or annually, depending on the type of business they run. In today’s technologically advanced world, receipts are almost always kept digitally. Paper receipts are only used when the customer doesn’t provide an electronic option, like an e-mail address. In other words, paper receipts are only used when the customer does not want an electronic receipt. Customers have the right to get receipts, which show that their payments have been taken care of. In addition to being proof of ownership, receipts can be used for a wide range of other things, such as the following: For example, a customer needs to bring back or exchange an item to a store with the sample receipt. Other stores also need receipts for product warranties, and these receipts usually need to be given within a certain amount of time after the product was bought. Also, most receipts need to be given out within a certain amount of time after the item was bought. The Internal Revenue Service needs proof of certain expenses, so receipts are also helpful for tax purposes.

A receipt is a piece of paper that proves that a valuable item was given from one person to another. This happens when someone gives someone else a receipt for the item. For both business-to-business and stock market transactions, a receipt for the transaction in question can be given. In addition to the receipts that stores and service businesses give out, these are also given out. For example, when the term of a futures contract ends, the person who owns the sample contract usually gets a delivery instrument that can be used as a receipt and traded for the underlying asset. This is because the delivery instrument serves as a receipt for the person who owns the futures contract.

Download Honorarium Receipt Bundle

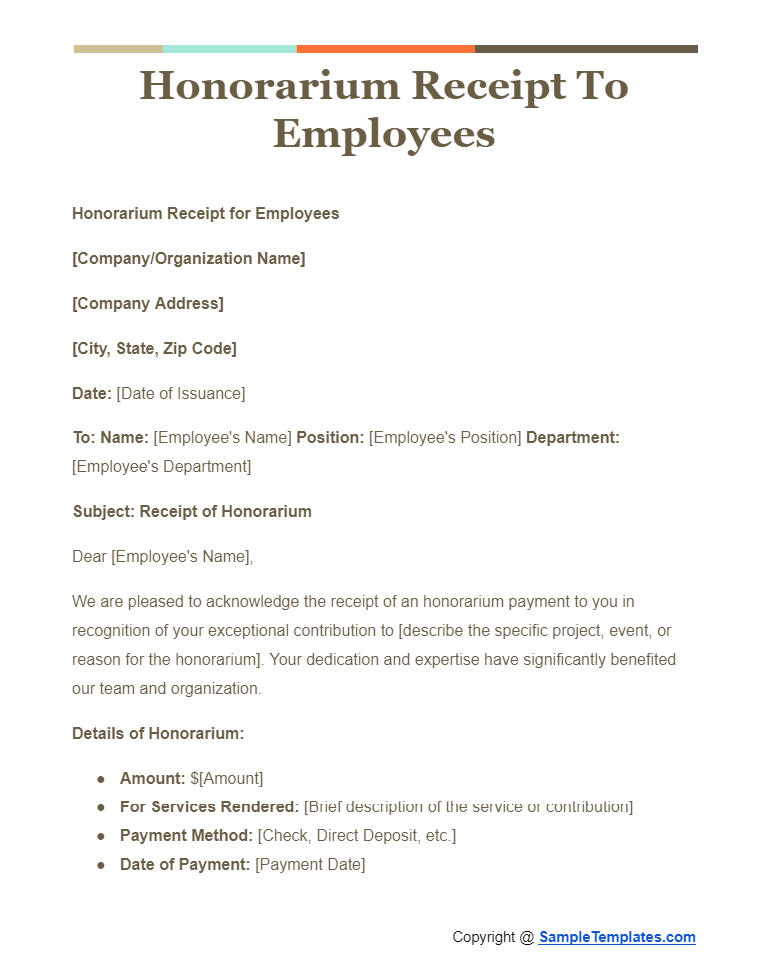

Honorarium Receipt To Employees

Honorarium Receipt for Employees

[Company/Organization Name]

[Company Address]

[City, State, Zip Code]

Date: [Date of Issuance]

To: Name: [Employee’s Name] Position: [Employee’s Position] Department: [Employee’s Department]

Subject: Receipt of Honorarium

Dear [Employee’s Name],

We are pleased to acknowledge the receipt of an honorarium payment to you in recognition of your exceptional contribution to [describe the specific project, event, or reason for the honorarium]. Your dedication and expertise have significantly benefited our team and organization.

Details of Honorarium:

- Amount: $[Amount]

- For Services Rendered: [Brief description of the service or contribution]

- Payment Method: [Check, Direct Deposit, etc.]

- Date of Payment: [Payment Date]

This honorarium is a token of our appreciation for your extraordinary efforts and is separate from your regular compensation. We are incredibly grateful for your commitment and enthusiasm towards our collective goals.

Please keep this document as a receipt for your records. Should you have any questions or require further information, please do not hesitate to contact [Contact Person’s Name] at [Contact Person’s Email/Phone].

Thank you once again for your valuable contribution.

Sincerely,

[Your Name]

[Your Position]

[Company/Organization Name]

[Contact Information]

Employee Acknowledgment:

I, [Employee’s Name], hereby acknowledge the receipt of the honorarium described above and confirm that the details are correct.

Signature: ______________________

Date: ______________________

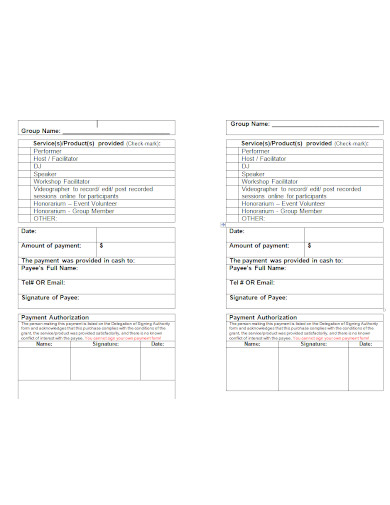

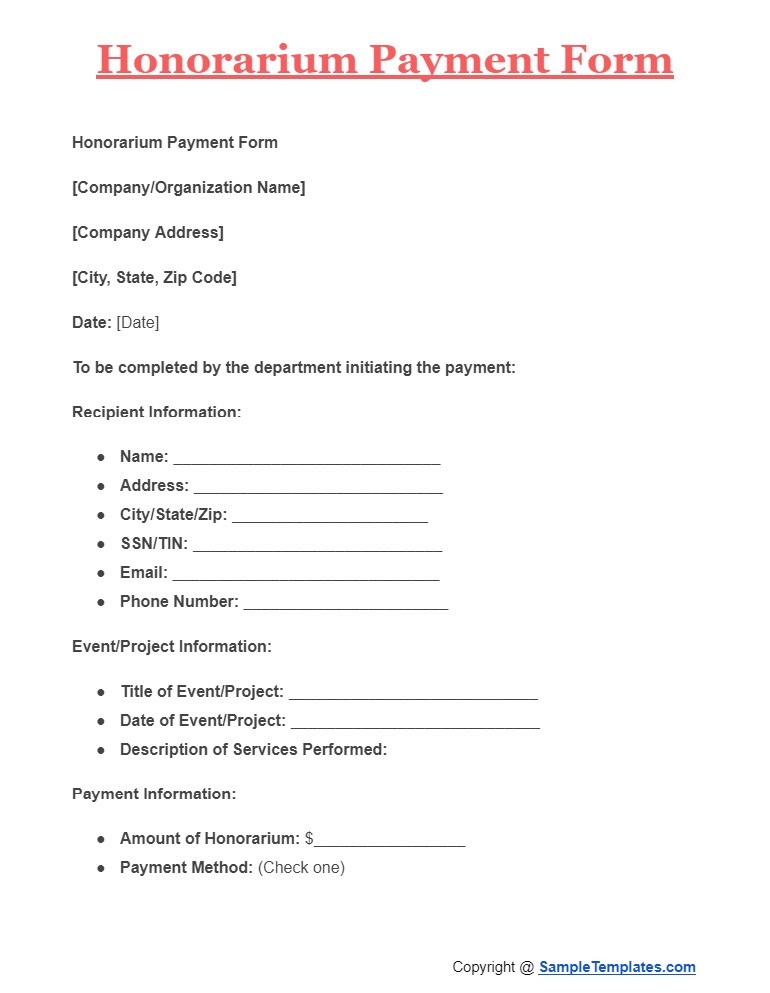

Honorarium Payment Form

Honorarium Payment Form

[Company/Organization Name]

[Company Address]

[City, State, Zip Code]

Date: [Date]

To be completed by the department initiating the payment:

Recipient Information:

- Name: ______________________________

- Address: ____________________________

- City/State/Zip: ______________________

- SSN/TIN: ____________________________

- Email: ______________________________

- Phone Number: _______________________

Event/Project Information:

- Title of Event/Project: ____________________________

- Date of Event/Project: ____________________________

- Description of Services Performed:

Payment Information:

- Amount of Honorarium: $_________________

- Payment Method: (Check one)

- Check

- Direct Deposit

- Special Instructions:

Authorization:

- Requested by: _________________________

- Position: _____________________________

- Department: __________________________

- Signature: ____________________________

- Date: ________________________________

Approval:

- Approved by: _________________________

- Position: ____________________________

- Signature: ___________________________

- Date: ________________________________

For Payroll/Accounting Use Only:

- Processed by: ________________________

- Date Processed: ______________________

- Payment Date: ________________________

- Check/Direct Deposit Number: __________

Comments/Additional Information:

Instructions for Completion: Please ensure all sections are completed fully and accurately to avoid any delays in the payment process. Once completed, please submit this form to the Payroll or Accounting Department for processing. If you have any questions during the completion of this form, please contact [Contact Person’s Name and Information].

Please attach any additional documentation necessary to support the honorarium payment.

[Company/Organization Name]

[Contact Information]

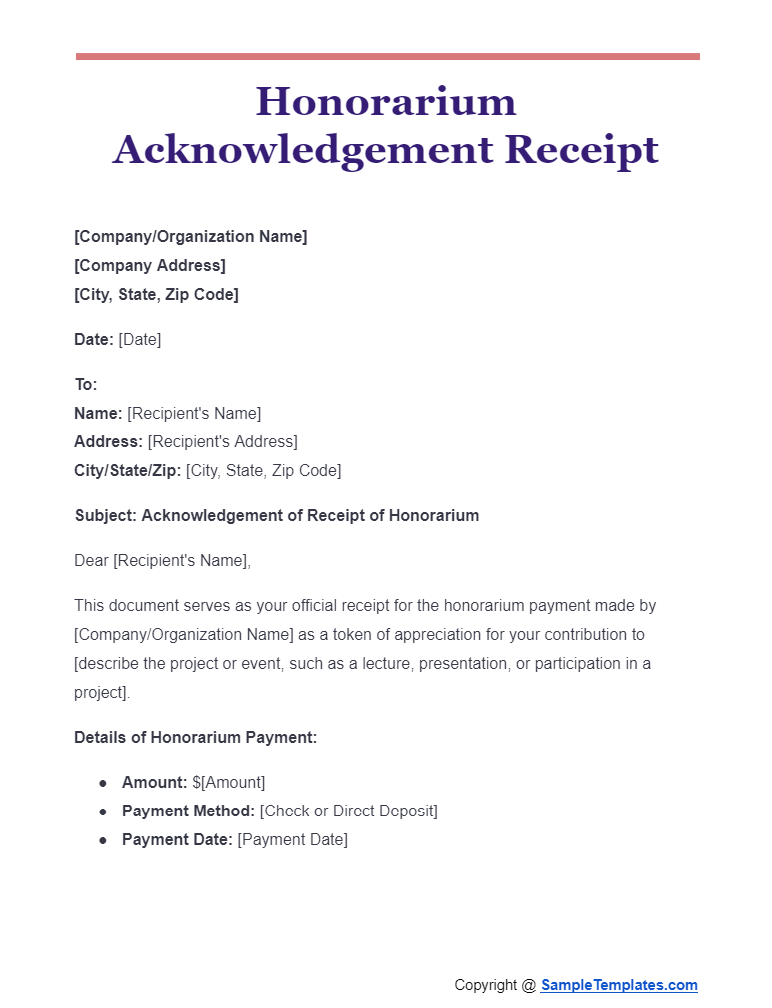

Honorarium Acknowledgement Receipt

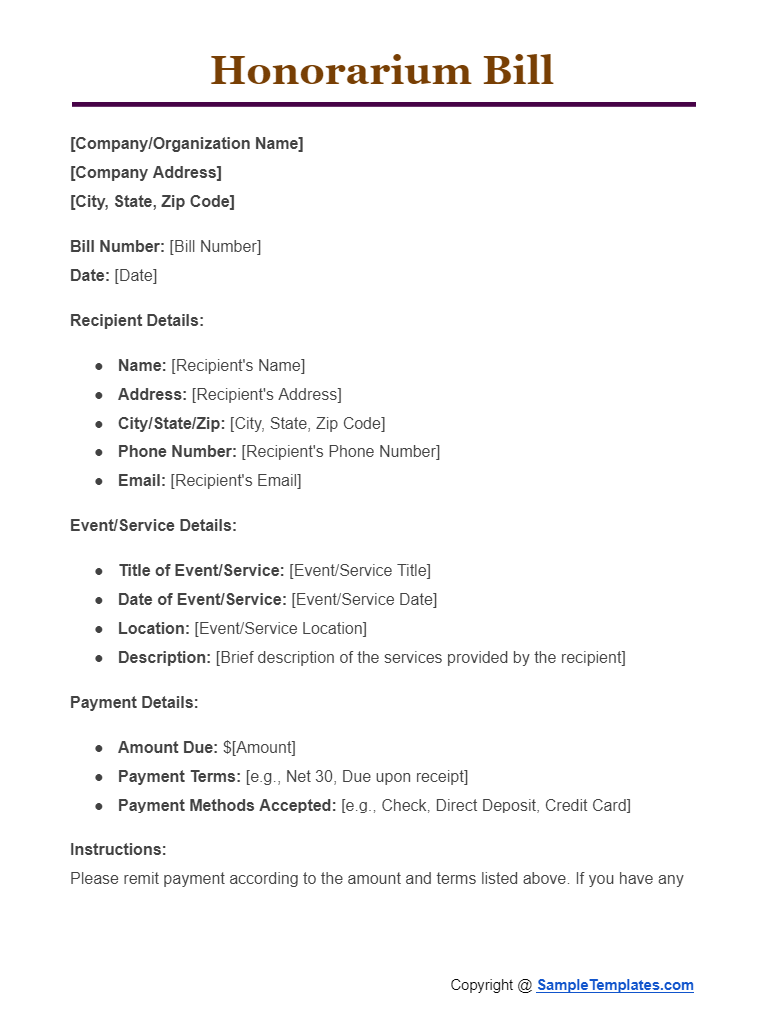

Honorarium Bill

Browse More Templates On Honorarium Receipt

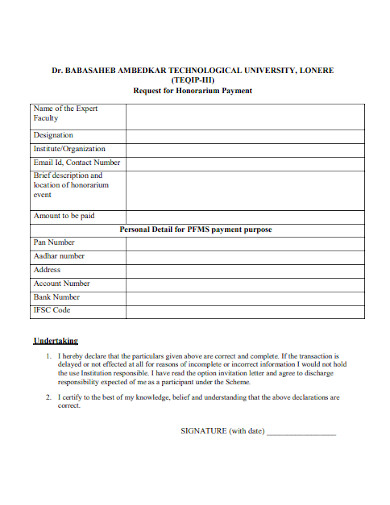

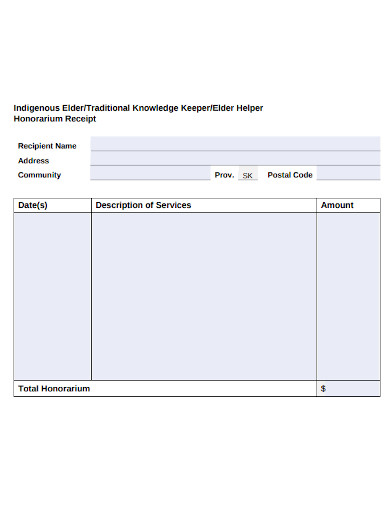

1. University Honorarium Receipt

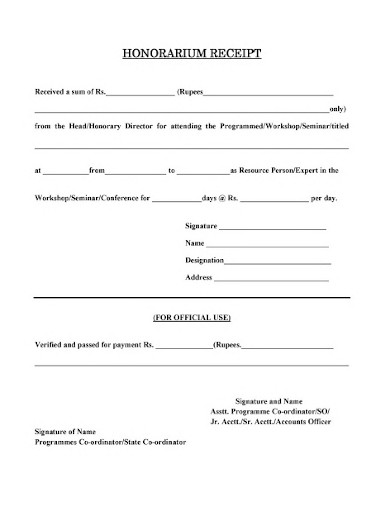

2. Standard Honorarium Receipt

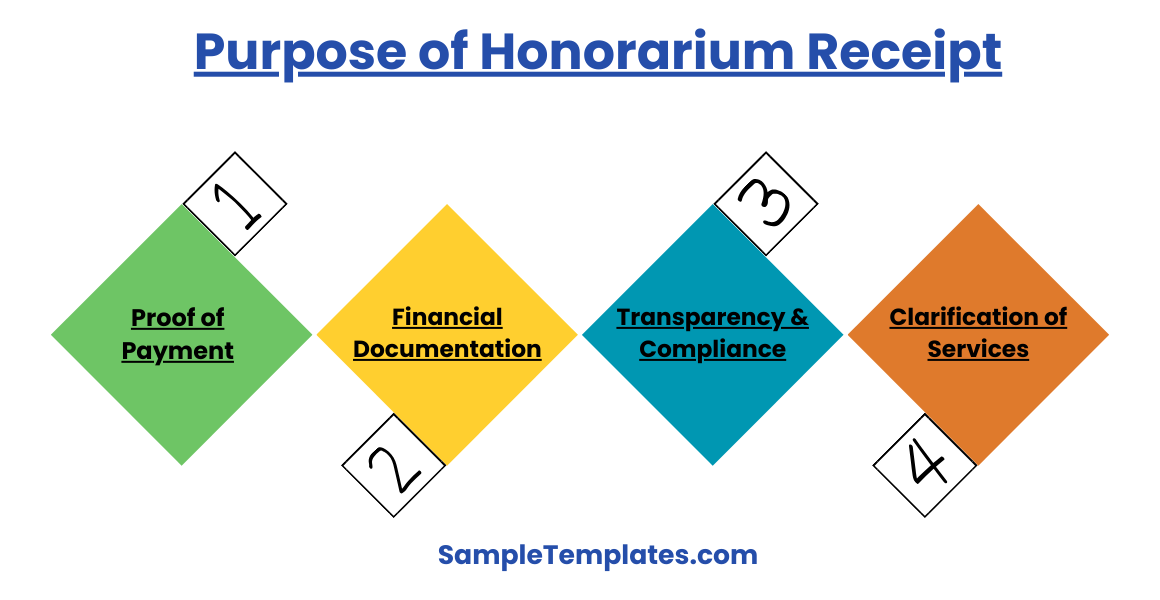

Purpose of Honorarium Receipt

The purpose of an Honorarium Receipt is to provide a formal acknowledgement of the receipt of an honorarium payment. This receipt serves several important functions:

- Proof of Payment: It acts as a record that the honorarium has been paid to the recipient, detailing the amount and the date of payment.

- Financial Documentation: It helps both the giver and the receiver maintain accurate financial records, facilitating easier accounting and tax preparation.

- Transparency and Compliance: It ensures transparency in financial transactions and helps organizations comply with internal policies and external regulatory requirements concerning non-salary compensations.

- Clarification of Services: It often specifies the reason for the honorarium, such as compensation for a guest lecture, performance, or participation in a special event, which clarifies the nature of the non-contractual service provided.

Overall, the honorarium receipt is a crucial document for managing and acknowledging special payments that are not covered by standard employment or contractual agreements.

3. Honorarium Payment Receipt

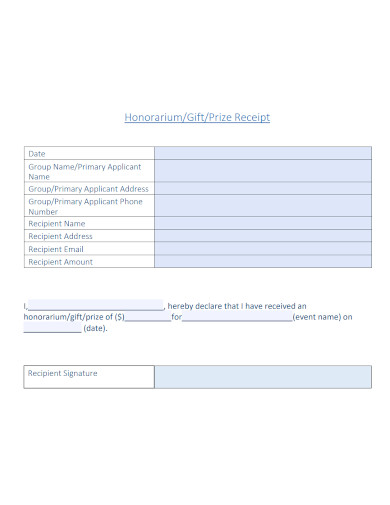

4. Honorarium Gift Receipt

5. Basic Honorarium Receipt

Importance of Honorarium Receipt

The importance of an Honorarium Receipt extends across several key areas:

- Legal Compliance: It helps organizations and individuals comply with legal and regulatory requirements related to financial transactions and reporting. By providing a documented proof of payment, it supports adherence to tax laws and audit regulations.

- Financial Integrity: The receipt ensures that all transactions are properly recorded, reducing the risk of financial discrepancies. This is crucial for maintaining accurate and transparent financial records for both the payer and the recipient.

- Proof of Payment for Services Rendered: An honorarium is often given in recognition of special services or expertise provided on a voluntary or occasional basis. The receipt acts as a formal acknowledgment that these services have been rendered and appropriately compensated, which can be important for the recipient’s records and future engagements.

- Professionalism: Providing a receipt reflects professional handling of informal or occasional transactions. It demonstrates an organization’s commitment to fair practice and respect for those who contribute their expertise.

- Facilitates Tax Preparation: For the recipient, an honorarium receipt is essential for personal tax records. It helps in accurately reporting income and determining tax liabilities.

- Dispute Avoidance and Resolution: Should any disputes arise about the payment or the terms of service, the honorarium receipt serves as a reliable piece of evidence that can clarify the terms and confirm the transaction.

Overall, honorarium receipts play a pivotal role in ensuring ethical practices, legal compliance, and financial transparency in transactions involving non-contractual compensation.

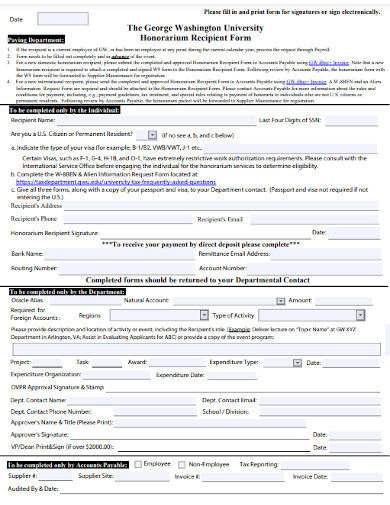

6. Honorarium Receipt Form

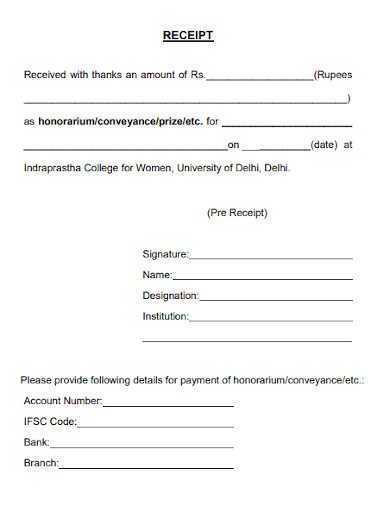

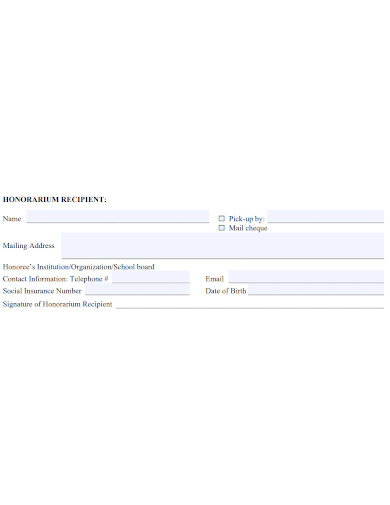

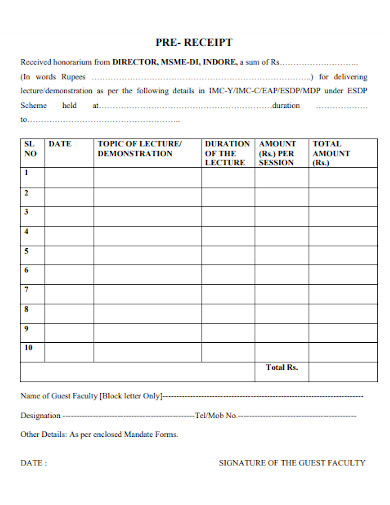

7. Honorarium Pre-Receipt

8. Honorarium Receipt Sample

9. Honorarium Receipt in PDF

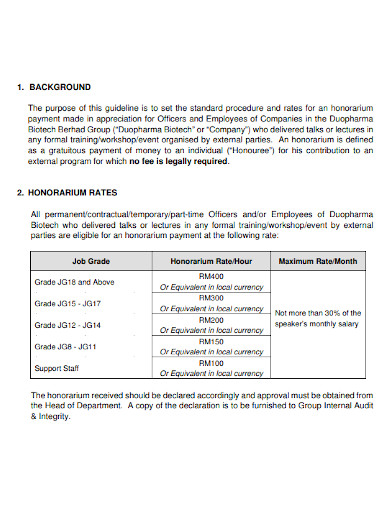

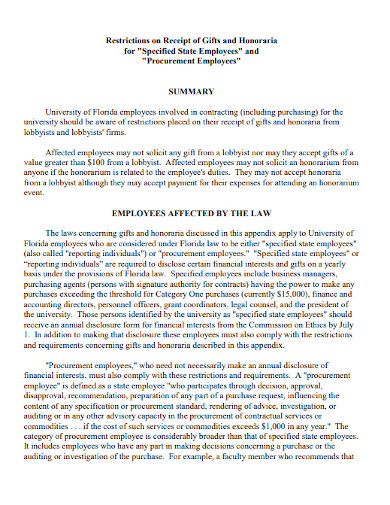

10. Restrictions on Honorarium Receipt

11. Honorarium Receipt in DOC

How To Write an Honorarium Receipt?

- An Advanced receipt can be issued with this paperwork

If you use the forms on this website, you will be able to keep an accurate record of the money your customer has paid you. To get started, decide if you want to use a word processor (like Microsoft Word) or a PDF editor to create this document with the necessary information. You can choose either one of these two options. If you want to add information to this document or just print it from your browser, click the “PDF” button or link. If you want a Word or ODT file instead, click the “Word” or “ODT” button. When you’re done saving this document, you can open it and either print it or add information to it right on the screen. After you have saved the document, you will be able to do this. - The receipt header is expected to detail the payee

The first few lines of this receipt are left blank on purpose so that the name of the company, its location, and any other important contact information can be written there. Write the full name of the Payee on the line that says “Company Name.” In addition to these important pieces of information, you must also write down the Payee’s phone number (s). In this field, you will need to put the correct information for both the Payee’s “Phone” and “Fax” numbers. These fields are in the section called “Payee Information.” - Present the details that must be recorded

One of the first things that will be used to identify this document is the “Date” it was issued. This will be one of the first things that people will use. Then, this information is labeled correctly and written in the first space that has been set aside for it, which is right below the information about the Payee. You must make a transaction number that is unique to this receipt and put it in the “Receipt #” field. - Document the customer with the concerned payment history

This receipt has a table in the middle where you can write down information about the payment. There is a four-column table in the middle of this page. First column: Business Client quantities. This information goes with the order’s “Description.” Next, tell me what “Unit Price” means on this receipt from a business. This is the price of one thing, unit, or service. Multiply the amount by the “Unit Price” in the “Total” box. You can write a summary of the financial information on the lines below the table. Write the subtotal after adding up the numbers in the “Total” column. There are taxes to think about. Enter the “Tax Rate” on the next line. Multiply “Tax Rate” by “Subtotal” and write the result on “Tax” After “Subtotal” and “Tax,” write “Total Amount Due.” “Client/Customer Information” wants to know more about how to pay. On the “Name” line, you need to write down the ID number of the payer. The method of payment must match the information (if applicable). In “Street Address” and “City, State, Zip,” the Payer’s credit card or bank address should go. Add the Payer’s phone number and email address, if you have them. Right next to the information about the Payer, there are checkboxes for “Payment Method.” - Only the payee can execute this document

The person in charge of reporting the information above needs to sign the “Authorized Signature” line to show that the information is correct. The last line, which says “Title,” was added so that it was clear what role the Signature Party played in the business.

FAQs

What is a business receipt template?

A receipt template for a business is a piece of paper that shows that a company has been paid for a good or service. In contrast to an invoice, which is given to customers and clients as a “demand for payment,” a business receipt is only given after the transaction it is about has been completed. Most places of business require a receipt before you can return or get a refund for an item. There is a chance that a receipt will be needed to prove that the purchase was valid for tax purposes.

What are the types of business receipts?

- Cash register tapes, deposit information (cash and credit sales), receipt books, invoices, and 1099-MISC forms are examples of gross receipts.

- Purchase receipts and raw material receipts (These should demonstrate the amount paid and confirm that the purchases were essential business purchases; papers could include canceled checks or other documentation that identify the payee, amount, and evidence of payment/electronic fund transfers.)

- Tape receipts from the cash register

- Receipts and statements from credit cards

- Invoices

- Petty cash slips are used for modest monetary transactions.

A receipt is a piece of paper that serves as proof of a financial transaction, like the purchase of goods or services, the donation of items, the deposit of funds to secure a lease or the withdrawal of petty cash from a business fund. Buying or selling goods or services, giving things away, or buying or selling goods or services are all examples of this type of transaction. Customers, businesses, and other groups all need receipts so they can keep track of the money they spend. Keeping records means keeping track of receipts. This is very important around tax time, when people may need receipts to claim deductions and businesses may need receipts to support an audit.

Related Posts

FREE 41+ Sample Receipts in PDF MS Word

FREE 9+ Sales Service Receipt Templates in PDF

FREE 8+ Loan Receipt Templates Examples In MS Word PDF

FREE 7+ Sample Payment Receipt Forms in PDF

FREE 10+ Goods Receipt Templates in PDF MS Word | Excel

FREE 10+ Commission Receipt Samples [ Charity, Brokerage, Real ...

FREE How to Make a Receipt Using Microsoft MS Word? [ Simple ...

FREE 7+ Photography Receipt Templates in MS Word PDF

FREE 39+ Sample Receipt Forms in PDF MS Word

FREE 9+ Tooth Fairy Receipt Samples & Templates in PDF

FREE 11+ Printable Hotel Receipt Templates in PDF MS Word

FREE 7+ Company Receipt Samples & Templates in PDF

FREE 11+ Receipt Samples in MS Word PDF

FREE 8+ Dental Receipt Samples & Templates in PDF MS Word ...

FREE 15+ Blank Sales Receipt Templates in PDF Excel