A number of businesses have their own petty cash that they are able to use to pay for small expenses. Petty cash fund is kept by a cash custodian which is a small amount of company cash, often kept on hand (in a locked drawer or cash box), to pay for minor or incidental expenses, such as office supplies or employee reimbursements. These funds are used whenever the company does not need to issue a check to pay for expenses. When you need to use the petty cash fund, a petty cash receipt is a form that needs to be filled out for proper documentation. To know more about this, let us discuss this further below. Also, don’t forget to check out our pettycash receipt samples that you can download for free on this page.

10+ Pettycash Receipt Samples

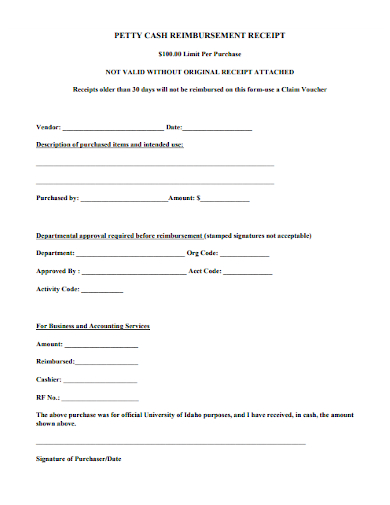

1. Pettycash Reimbursement Receipt

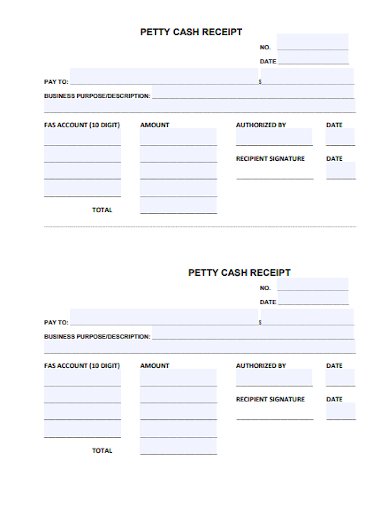

2. Sample Pettycash Receipt

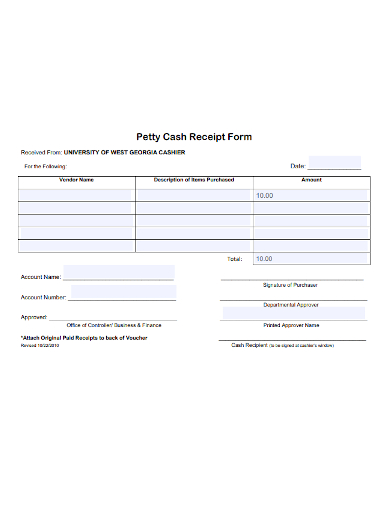

3. Petty Cash Receipt Form

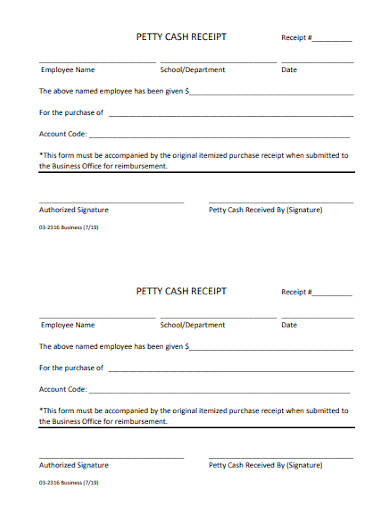

4. Basic Pettycash Receipt

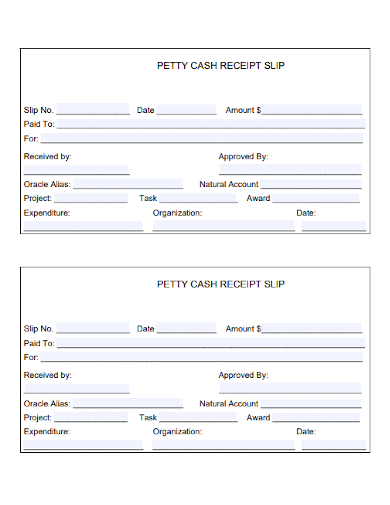

5. Pettycash Receipt Slip

6. Formal Pettycash Receipt

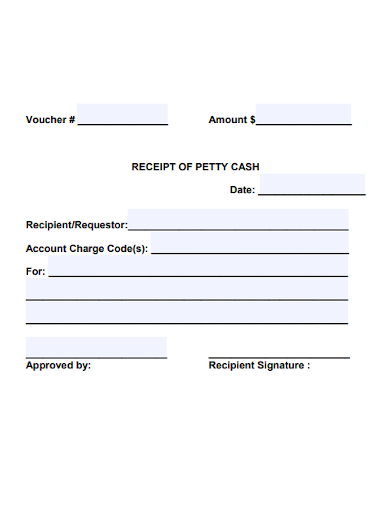

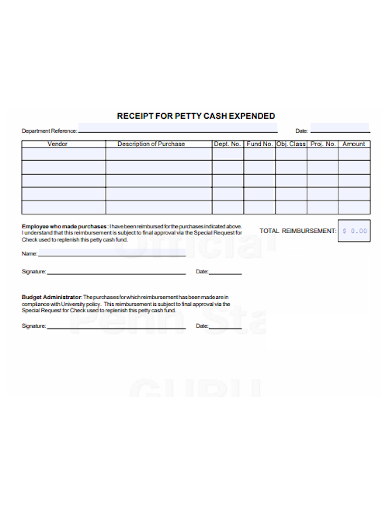

7. Receipt of Pettycash Expended

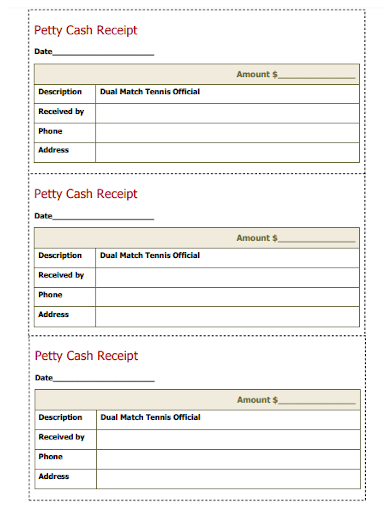

8. Printable Pettycash Receipt

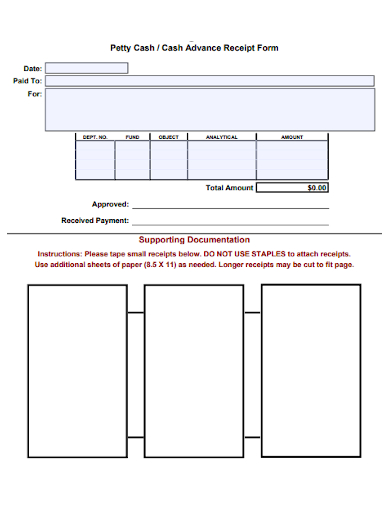

9. Pettycash & Cash Advance Receipt Form

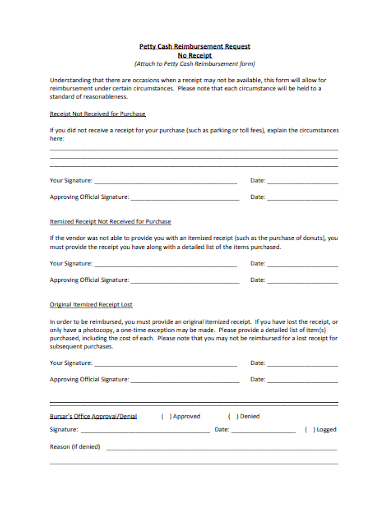

10. Petty Cash Reimbursement Request No Receipt

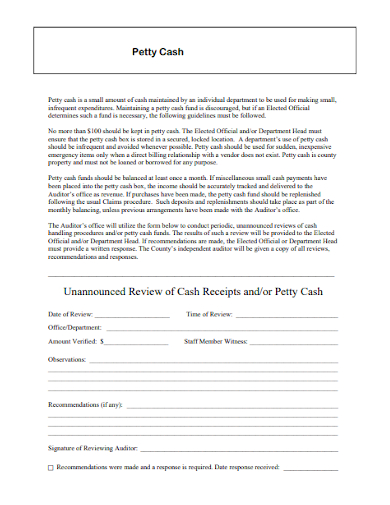

11. Unannounced Review of Cash Receipts & Petty Cash

What Is a Petty Cash Receipt?

When using company funds to purchase or pay for expenses, it is important to properly document all these transactions. At the end of the day, the accounting department would need to undergo periodic reconciliations, with transactions also recorded on the financial statements. In larger corporations, each department might have its own petty cash fund to pay for its own individual expenses. The documentation or reconciliation process is accomplished by providing a petty cash receipt. This is a form used to document cash payments from a petty cash box. The form is filled out by the petty cash custodian, documenting the reason for a petty cash payment and the amount of the payment, as well as the date. One of the main purposes of providing a petty cash receipt is to avoid misuse of the funds so there is a need to balance and monitor these periodically.

How To Prepare a Petty Cash Receipt?

Asking for funds to pay for expenses from accounting can be a lengthy process sometimes. You need to provide proof–purchase orders, receipts, invoices–then accounting would need to seek approval or signatures from a few individuals who are authorized to approve disbursements and can only do so for expenses related to legitimate company activities or operations. This is applicable if you need to pay for costly expenses, yet when using a petty cash fund a form is simply filled out and of course, proof is normally needed for the expenses as well to control its usage. A petty cash fund can be used for office supplies, cards for customers, short travel expenses, paying for a catered lunch for employees, or reimbursing employees for expenses. Each petty cash receipt form may differ per company, some would develop their own personalized copies or may use a more generic form. But generally, the following components below should be available in this form:

1. Petty Cash Control Number

Enter the sequential number assigned by the custodian of the petty cash fund. This number is assigned and controlled by the cash custodian.

2. Date

The date entered should be the date where the form is issued or prepared.

3. Payee

The payee’s name must be included in the petty cash receipt. This is the person/entity or company that will receive the petty cash disbursement.

4. Amount and Description

Enter the total amount of the payment and the description of what the funds were used for.

5. Authorization

In some cases, there should be a portion in the receipt where the signature of the authorized signer of the account(s) to be charged and the date the petty cashed receipt was signed. The “Authorized By” field must contain a handwritten signature; signature stamps or the authorized signer’s initials are not acceptable.

6. Received By

A signature from the recipient and the date must be included in the document to ensure that the cash has been properly received.

As mentioned the petty cash receipt will serve as verification when the amount of cash in the petty cash box is reconciled, the amount of cash remaining in the box plus the amount of the petty cash receipts should match the original funding amount for the petty cash box.

FAQs

Why Is it Called “Petty” Cash?

The word “petty” is derived from something small or petit, as so the main purpose of petty cash is to pay for small purchases or expenses.

What are Reimbursements?

Reimbursement is a payment made to another party that he or she has made on behalf of an organization. An example of this is travel or meal expenses incurred by an employee while out on official duty.

What Is a Petty Cash Custodian?

A cash custodian is in charge of managing and keeping the petty cash fund safe. The custodian will maintain and document all expenses from the petty cash. By giving this responsibility to one custodian, it means that you will retain internal control over the money.

A petty cash receipt will ensure that you are able to track and control the flow of cash in regards to paying small expenses and making sure this is not misused.

Related Posts

FREE 39+ Sample Receipt Forms

FREE 36+ Printable Receipt Forms

FREE 30+ Cash Receipt Templates

FREE 16+ Sample Receipt Forms

FREE 13+ Petty Cash Voucher Templates

FREE 10+ Petty Cash Reconciliation Samples and Templates

FREE 10+ Cash Book Samples

FREE 8+ Sample Petty Cash Log Templates

FREE 7+ Sample Cash Payment Receipts

FREE 12+ Gym Membership Receipt Samples & Templates

FREE 11+ Printable Hotel Receipt Templates

FREE 11+ Medical Bill Receipt Templates

10+ Sample Construction Receipt Templates

FREE 9+ Sample Petty Cash Request Forms

FREE Simple Steps to Create a Receipt