Receipts are documents that acknowledges that a payment has been received for a particular item/service being sold. They can either be printed or written on sample paper, or can be digitally sent to the person or organization that purchased the items or utilized the service. For any sales transactions, whether through cash, credit, or check, receipts are important. This document serves as proof that said transaction existed between the seller and buyer.

Receipts can just be any piece of paper torn out from a book with written details and agreements regarding the sale. But making use of receipt templates and customizing one for your business can give a more organized impression. There are multiple Sample Receipts available that can be downloaded, edited, and be issued to your customers.

Download Sample Receipt Bundle

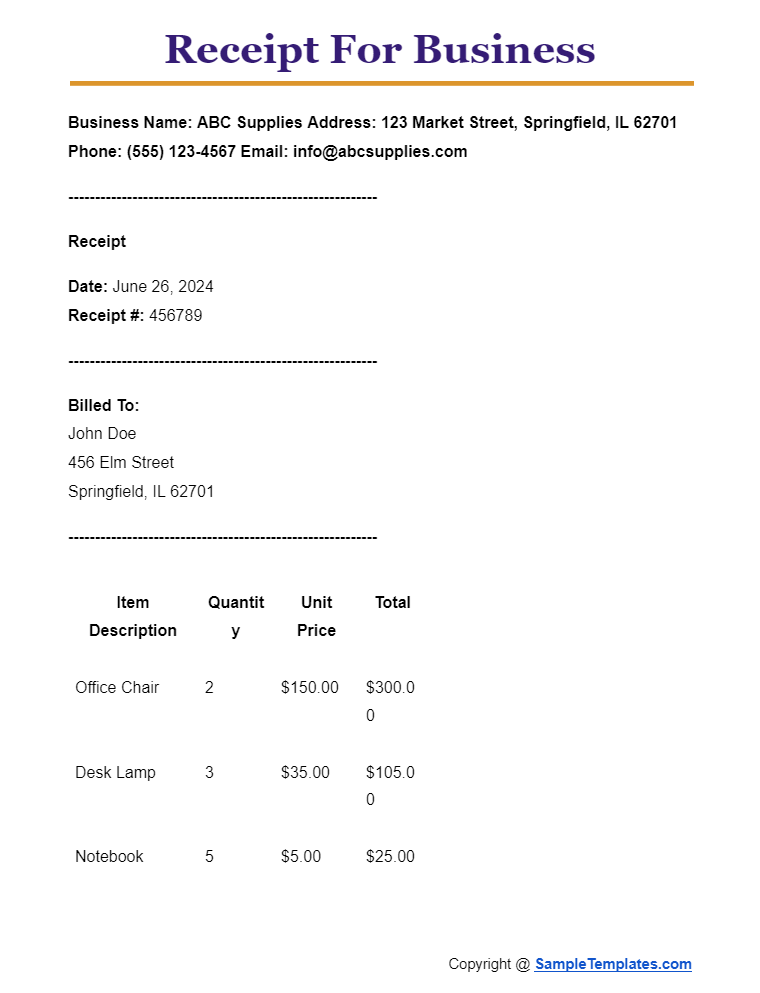

Receipt For Business

Business Name: ABC Supplies Address: 123 Market Street, Springfield, IL 62701 Phone: (555) 123-4567 Email: [email protected]

———————————————————-

Receipt

Date: June 26, 2024

Receipt #: 456789

———————————————————-

Billed To:

John Doe

456 Elm Street

Springfield, IL 62701

———————————————————-

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Office Chair | 2 | $150.00 | $300.00 |

| Desk Lamp | 3 | $35.00 | $105.00 |

| Notebook | 5 | $5.00 | $25.00 |

| Pens (Pack of 10) | 10 | $2.50 | $25.00 |

———————————————————-

Subtotal: $455.00

Tax (8%): $36.40

Total Amount: $491.40

———————————————————-

Payment Method: Credit Card

Card Number: **** **** **** 1234

Transaction ID: 78901234

———————————————————-

Thank you for your business!

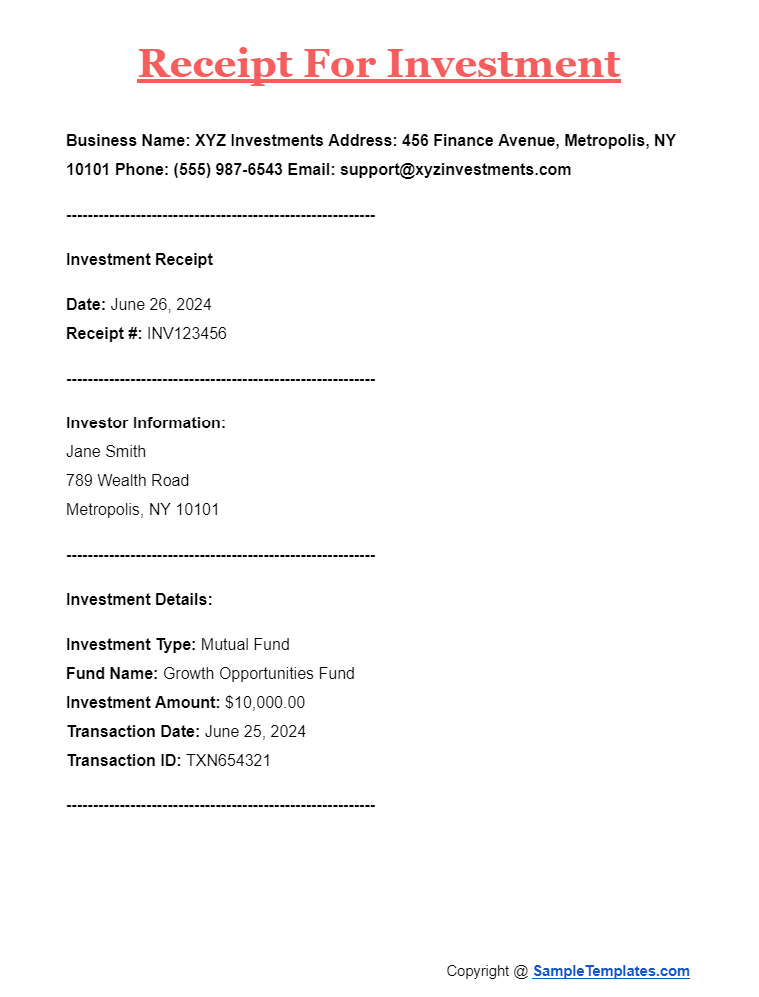

Receipt For Investment

Business Name: XYZ Investments Address: 456 Finance Avenue, Metropolis, NY 10101 Phone: (555) 987-6543 Email: [email protected]

———————————————————-

Investment Receipt

Date: June 26, 2024

Receipt #: INV123456

———————————————————-

Investor Information:

Jane Smith

789 Wealth Road

Metropolis, NY 10101

———————————————————-

Investment Details:

Investment Type: Mutual Fund

Fund Name: Growth Opportunities Fund

Investment Amount: $10,000.00

Transaction Date: June 25, 2024

Transaction ID: TXN654321

———————————————————-

Payment Method: Bank Transfer

Bank Account Number: **** **** **** 5678

Bank Name: Metropolis Bank

———————————————————-

Total Amount Invested: $10,000.00

———————————————————-

Thank you for your investment!

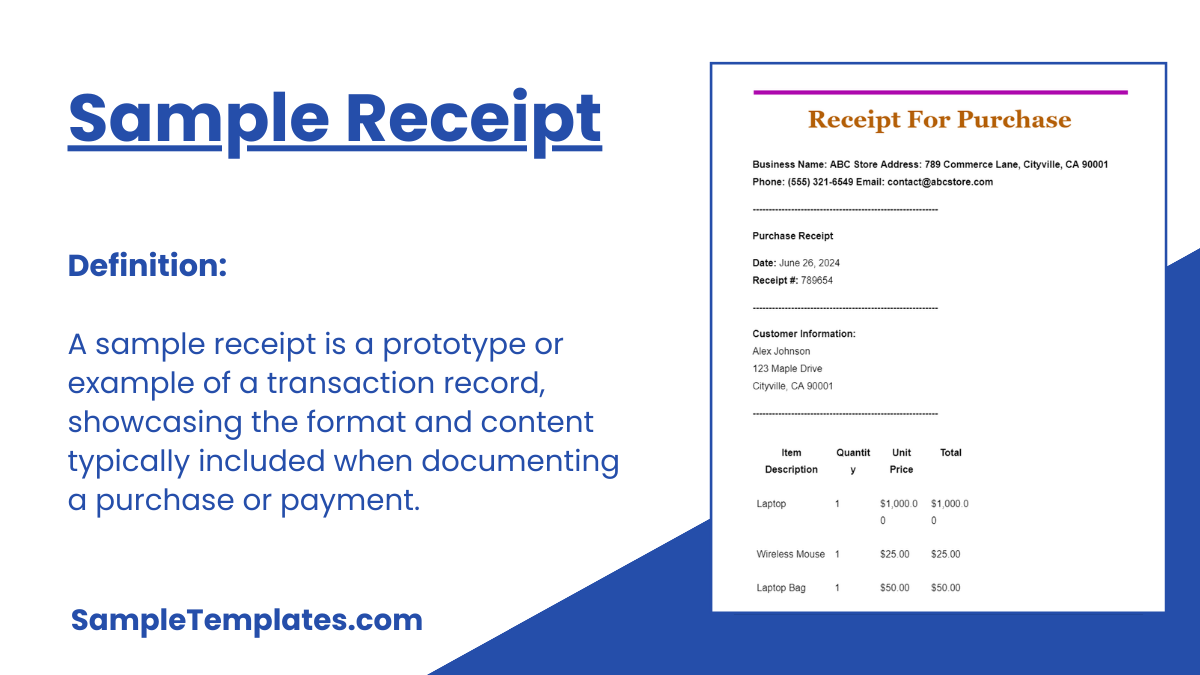

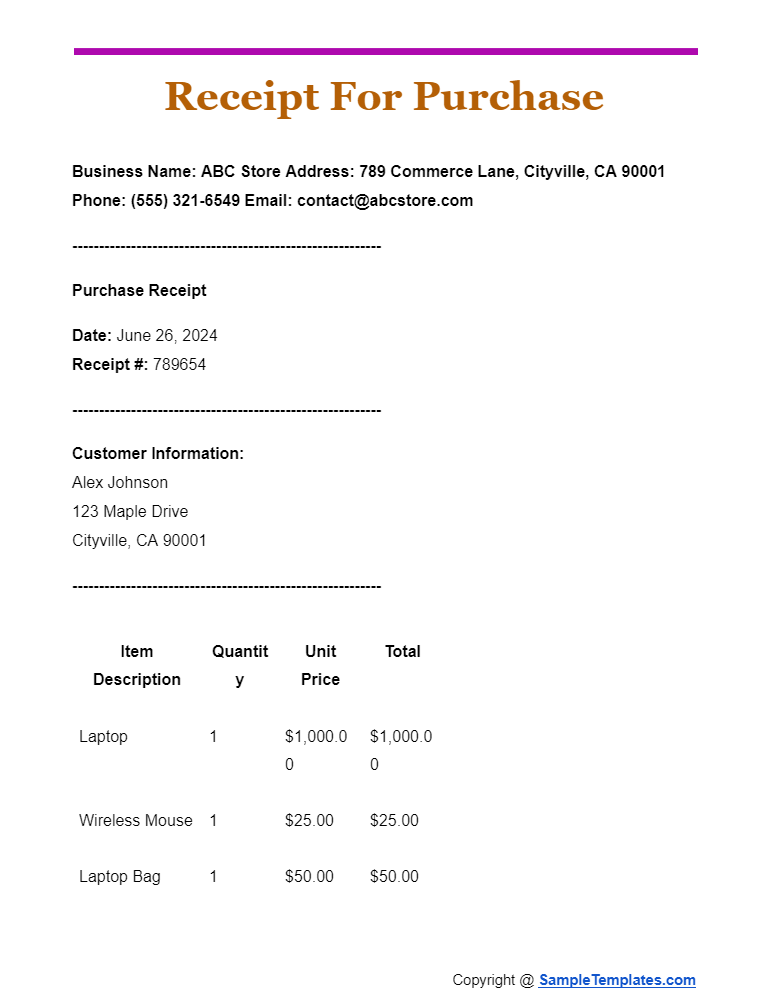

Receipt For Purchase

Business Name: ABC Store Address: 789 Commerce Lane, Cityville, CA 90001 Phone: (555) 321-6549 Email: [email protected]

———————————————————-

Purchase Receipt

Date: June 26, 2024

Receipt #: 789654

———————————————————-

Customer Information:

Alex Johnson

123 Maple Drive

Cityville, CA 90001

———————————————————-

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Laptop | 1 | $1,000.00 | $1,000.00 |

| Wireless Mouse | 1 | $25.00 | $25.00 |

| Laptop Bag | 1 | $50.00 | $50.00 |

| USB-C Cable | 2 | $10.00 | $20.00 |

———————————————————-

Subtotal: $1,095.00

Tax (7.5%): $82.13

Total Amount: $1,177.13

———————————————————-

Payment Method: Credit Card

Card Number: **** **** **** 7890

Transaction ID: 987654321

———————————————————-

Thank you for your purchase!

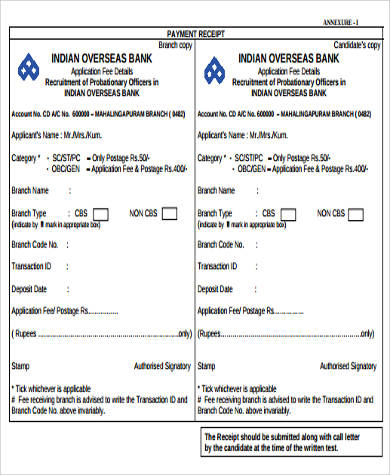

Goods Receipt Process

Browse More Templates On Samples Receipt

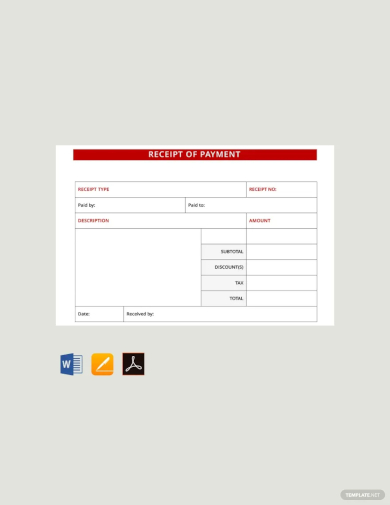

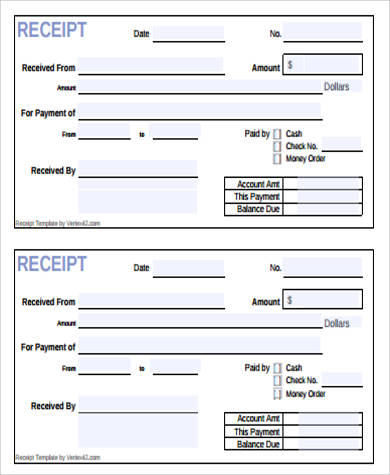

Editable Payment Receipt Template

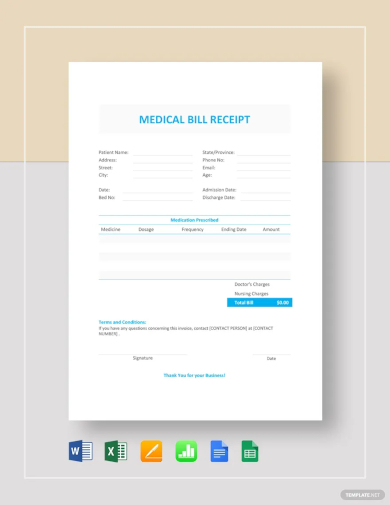

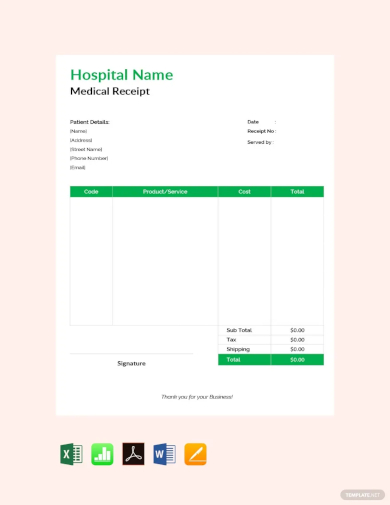

Medical Bill Receipt Template

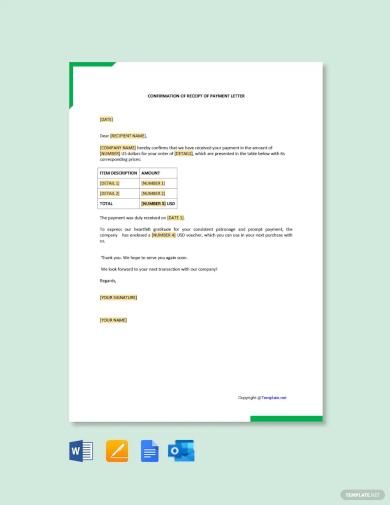

Confirmation of Receipt of Payment Letter Template

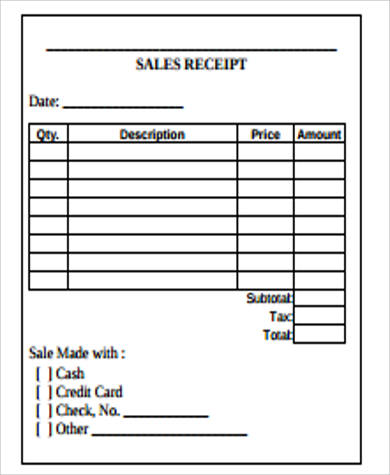

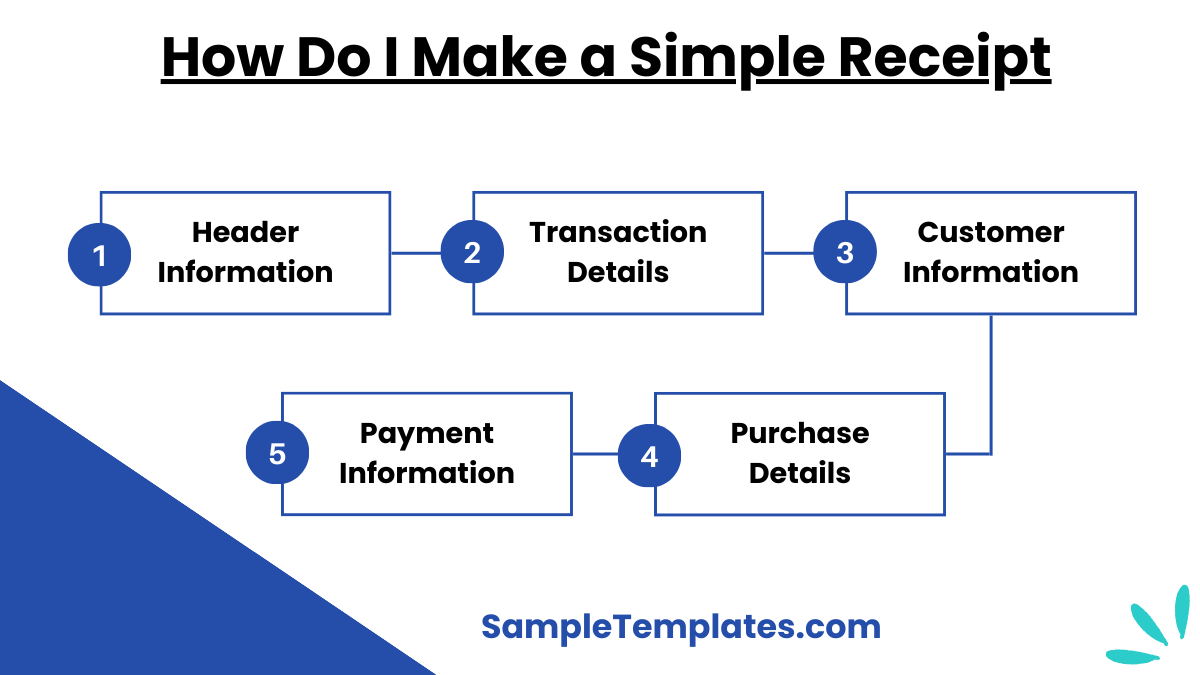

How Do I Make a Simple Receipt?

Creating a simple receipt can be done in a few easy steps. Here are five points to help you make one:

- Header Information:

- Include the business name, address, phone number, and email.

- Add the title “Receipt” to make it clear.

- Transaction Details:

- Date of the transaction.

- Unique receipt number for reference.

- Customer Information:

- Name and contact details of the customer.

- Purchase Details:

- List each item purchased with a description, quantity, unit price, and total price.

- Calculate the subtotal, any applicable taxes, and the total amount due.

- Payment Information:

- Specify the payment method (e.g., cash, credit card, bank transfer).

- Include any relevant transaction or confirmation number.

Sample Cash Receipt Template

Medical Receipt Template

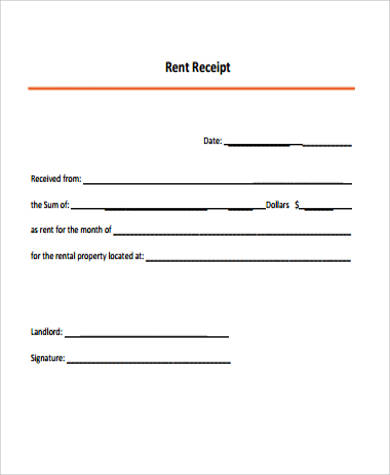

Sample Rent Receipt Template

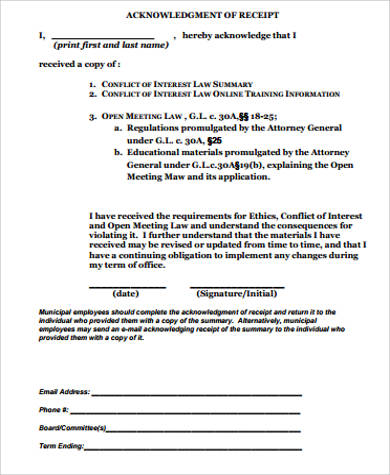

Acknowledgement Receipt Template

Sales Receipt in PDF

What are the Rules For Receipts?

Creating receipts involves adhering to certain rules to ensure they are clear, accurate, and legally compliant. Here are key rules to follow:

- Header Information:

- Business Name: Clearly state the name of the business.

- Business Contact Information: Include the address, phone number, and email of the business.

- Transaction Details:

- Date: The date when the transaction occurred.

- Receipt Number: A unique identifier for the receipt, which helps in tracking and record-keeping.

- Customer Information:

- Customer Name and Contact Details: Include the name and, if possible, the address of the customer. This helps in verifying the transaction if needed.

- Itemized List of Purchases:

- Description of Items: Clearly describe each item or service purchased.

- Quantity: Specify the number of items purchased.

- Unit Price: State the price per unit of the item.

- Total Price: Calculate the total price for each line item.

- Payment Details:

- Subtotal: The total amount before taxes and additional charges.

- Taxes and Fees: Clearly list any applicable taxes or additional fees.

- Total Amount: The final amount due, including taxes and fees.

- Payment Method: Indicate how the payment was made (cash, credit card, bank transfer, etc.).

- Transaction/Confirmation Number: If applicable, include a transaction or confirmation number for payment tracking.

- Return Policy:

- Clear Return/Refund Policy: Include the return or refund policy of the business, if applicable.

- Legibility and Accuracy:

- Clear and Legible: Ensure all information is clearly printed or written, and the receipt is free of errors.

- Accurate Calculations: Double-check all calculations to avoid discrepancies.

- Retention and Record-Keeping:

- Copies: Provide a copy to the customer and retain a copy for business records.

- Record-Keeping: Keep receipts organized and stored for a specific period as required by local laws and regulations (usually several years).

- Compliance with Local Laws:

- Legal Requirements: Ensure the receipt complies with local tax laws and business regulations, including proper tax identification numbers if required.

By following these rules, you can create receipts that are professional, compliant, and useful for both your business and your customers.

Cash Receipt Form Template

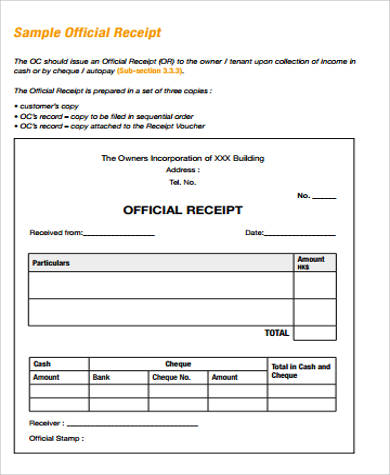

Payment Receipt Template

Printable Official Receipt Template

Receipts are very essential. A good example would be when it comes to disputes about the product or service offered. With receipts, it would be easier to track down when the sale happened and what the item/service was. This helps to keep a good relationship between the buyer and seller. Whether you are a large-scale businessman, a retail store owner, an online seller, or a service provider, receipts play an important role in your business analysis.

What are generally included in receipts?

- Date of purchase

- Receipt number

- Seller’s details—seller’s name, address, and contact information

- Customer’s details—customer name, address, and contact information

- Item description—includes the item number, quantity, and unit price

- Signatures of both seller and customer

- Return policy of the business or organization, if applicable

You can also take a look at our Sample Receipt Vouchers and Payment Receipt Samples for more information about receipt templates.

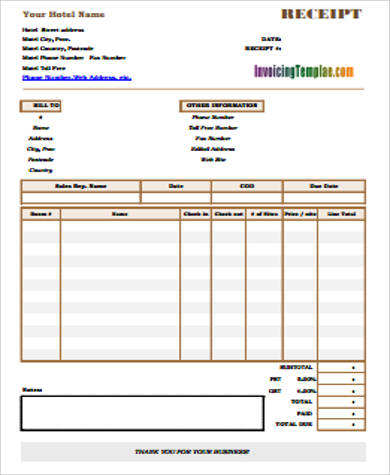

Hotel Receipt in PDF

How Do I Use these Receipt?

Using receipts effectively involves several steps to ensure they serve their purpose for both the business and the customer. Here’s how to use receipts:

- Issuing Receipts:

- Provide at Point of Sale: Always provide a receipt to the customer at the point of sale, whether in a physical store or online.

- Digital and Physical Copies: Offer both digital and physical copies if possible, especially for online transactions. Digital receipts can be emailed.

- Recording Transactions:

- Maintain Records: Keep a copy of each receipt for your records. This helps in tracking sales, managing inventory, and preparing for taxes.

- Organize Receipts: Organize receipts by date, customer, or transaction type to make them easy to retrieve when needed.

- Customer Service:

- Proof of Purchase: Encourage customers to keep their receipts as proof of purchase, which is necessary for returns, exchanges, and warranty claims.

- Return and Refund Process: Clearly communicate the return and refund process to customers and require the receipt for any returns or refunds.

- Accounting and Taxes:

- Expense Tracking: Use receipts to track expenses and sales for accurate accounting.

- Tax Documentation: Keep receipts as part of your financial records for tax reporting and audits.

- Analysis and Business Improvement:

- Sales Analysis: Analyze receipt data to understand sales trends, customer preferences, and inventory needs.

- Customer Feedback: Use receipts to solicit feedback from customers by including survey links or contact information.

Taxi Receipt Example

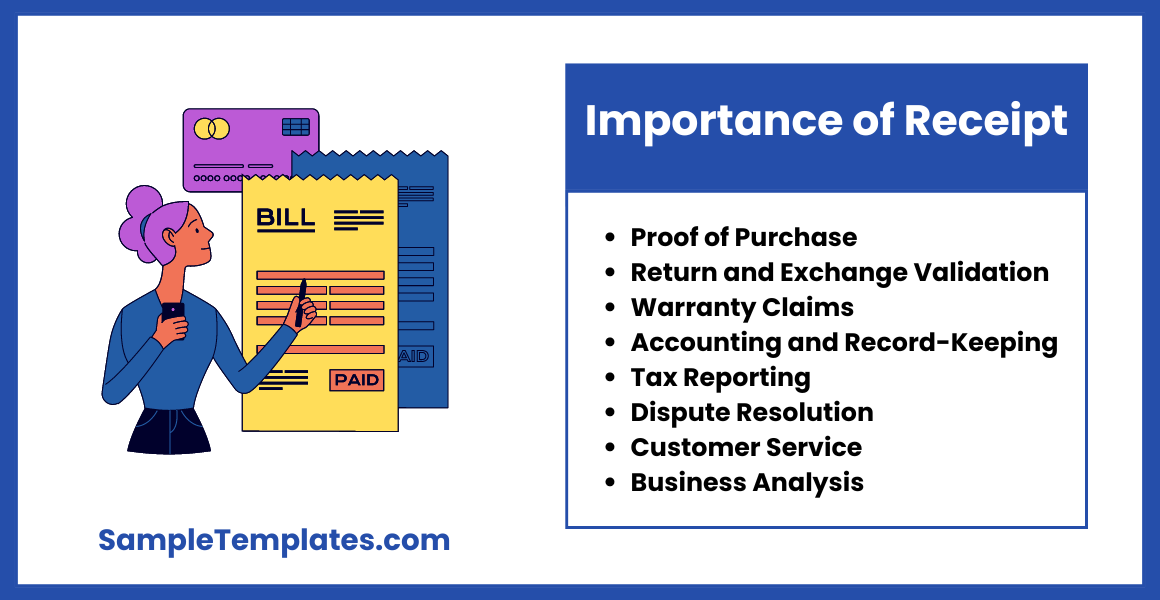

Importance of Receipt

Receipts are important for several reasons, serving both businesses and customers in multiple ways. Here are eight key points highlighting their importance:

- Proof of Purchase:

- Receipts provide evidence that a transaction has taken place, confirming the exchange of goods or services for payment.

- Return and Exchange Validation:

- They are necessary for customers to return or exchange products, as they verify the original purchase date and amount.

- Warranty Claims:

- Receipts are often required to validate warranty claims, ensuring that the product was purchased within the warranty period.

- Accounting and Record-Keeping:

- For businesses, receipts are essential for accurate accounting, helping track sales, expenses, and cash flow.

- Tax Reporting:

- Receipts serve as documentation for tax purposes, allowing businesses to report income and claim deductions accurately.

- Dispute Resolution:

- They can help resolve disputes between customers and businesses by providing a clear record of the transaction details.

- Customer Service:

- Receipts improve customer service by providing detailed transaction information, aiding in addressing customer inquiries and issues.

- Business Analysis:

- Businesses can analyze receipt data to gain insights into sales trends, customer preferences, and inventory management, aiding strategic decision-making.

These points illustrate the multifaceted role of receipts in ensuring transparent, efficient, and customer-friendly business operations.

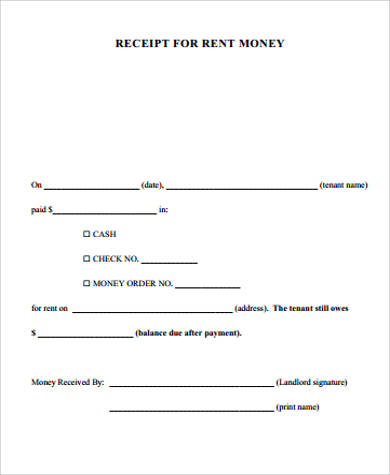

Receipt for Rent Money Template

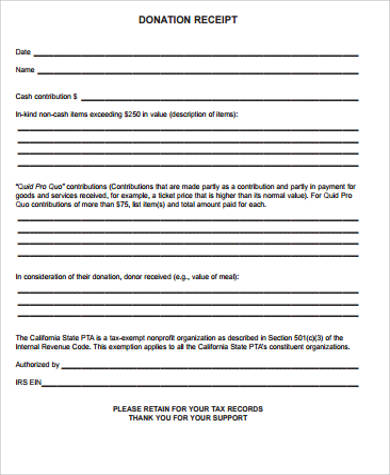

Sample Donation Receipt Template

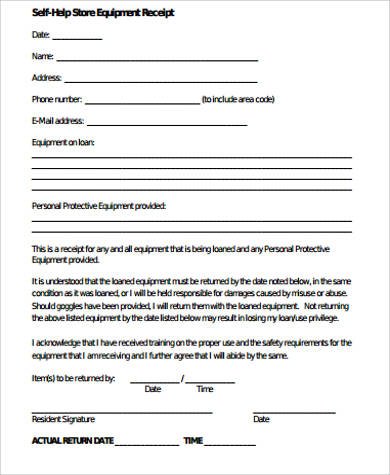

Equipment Receipt Template

Receipts should be issued for any type of financial transaction. This will aid in avoiding hassle when it comes to disputes between the customer and the seller or any other conflict or misunderstandings that may arise due to the transaction/s made. It can be easy to deal with and can be countered with professionalism.

For businesses and organizations, it can also be beneficial when it comes to taking into account the sales and revenues, promotions and discounts, and allowances. It will be easier to make financial reports and do daily inventories through the use of receipts.

Ready-made receipt templates will be easier to handle whenever you want to issue more professional and polished-looking receipts. Our Receipt Samples in Word are come in a variety of forms, simple formats, and designs. These can be used by any organization or business and are especially vital during the start-up phase whenever official forms and formats of documents are not yet ready for use. You can save time because there would be no need for you to make your own design for your receipts. Choosing the format that would best suit your company’s needs is very convenient. With the wide array of choices you can choose from, it’s an assurance that you will be able to find one that would be preferable for any of your business undertakings.

Related Posts

FREE 16+ Printable Hotel Receipt Templates in PDF | MS Word

FREE 6+ Sample rent receipt form in MS Word | PDF

FREE 10+ Sample Receipt Voucher Templates in PDF | MS Word

FREE 10+ Fee Receipt Samples in PDF | MS Word | Google Docs | Excel | Apple Numbers | Apple Pages

FREE 7+ Vehicle Sales Receipt Samples in MS Word | PDF

FREE How to Create a Car Rental Receipt [9+ Samples]

FREE 13+ Taxi Receipt Templates in PDF | Google Docs | Google Sheets | Excel | MS Word | Numbers | Pages

FREE 10+ Receipt Book Samples in PDF

FREE 10+ Online Receipt Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Personal Analysis Samples in MS Word | Google Docs | Pages | PDF

FREE 5+ Non Profit Receipt Samples in PDF

FREE 10+ Advance Receipt Samples in PDF | DOC

FREE 3+ Investment Receipt Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 3+ Enterprise Receipt Samples in PDF

FREE 10+ Tenant Receipt Samples in PDF | MS Word | Google Docs | Google Sheets | Excel