To maintain the sustainability and success of a company, business owners must consider having an efficient and effective bookkeeping system. In an article from the National Federation of National Businesses (NFIB), account bookkeeping is an integral part of running a business, whether a small business or an established one. That is why bookkeepers need to ensure that their bookkeeping tasks are completed. This is where the bookkeeping checklist comes in handy. In this article, you will be able to know the importance of bookkeeping and the purpose of using bookkeeping checklists. Continue reading below!

What is a Bookkeeping Checklist?

According to an article from Chron, bookkeeping refers to the documentation of a company’s financial transactions, such as sales, earned revenue, interest, payroll, loans, investments, and other company expenses. The primary objective of bookkeeping is to create recorded data of operations that can be summed and used for multiple reasons—generating financial reports. That is why business owners need to practice bookkeeping. However, bookkeeping requires certain data and figures to be accurate. Hence, bookkeepers use a bookkeeping checklist to track their bookkeeping tasks.

A bookkeeping checklist is one of the essential worksheets that company bookkeepers use to track bookkeeping tasks. It is a type of accounting form that contains a list of assignments that bookkeepers must do—whether daily, weekly, monthly, or yearly. With this, bookkeepers will be able to ensure that all the necessary data and information to be used in bookkeeping will be gathered.

12+ Bookkeeping Checklist Samples and Templates in PDF | MS Word

The sample templates presented below are well-made bookkeeping checklist templates that are pre-formatted in MS Word and PDF file formats. These templates also contain sample content that you can customize anytime. Check them out now!

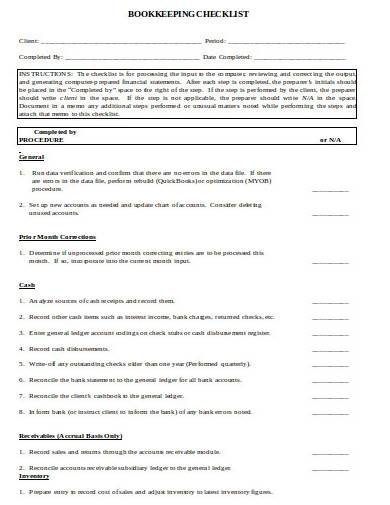

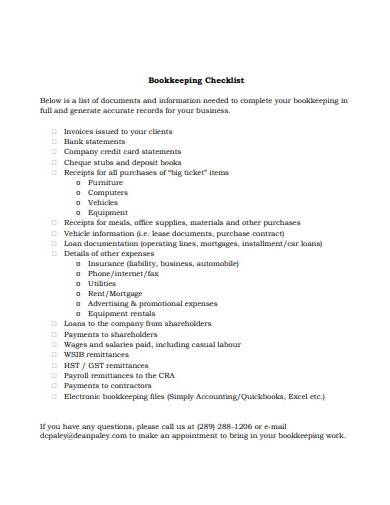

1. Bookkeeping Checklist Template

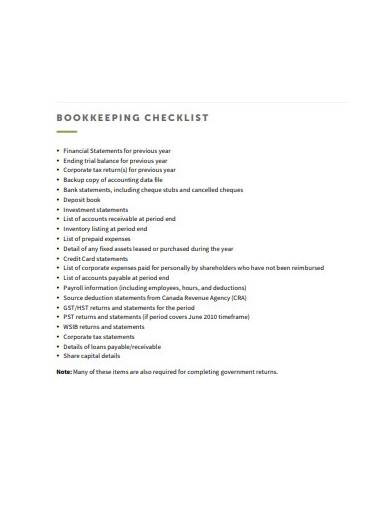

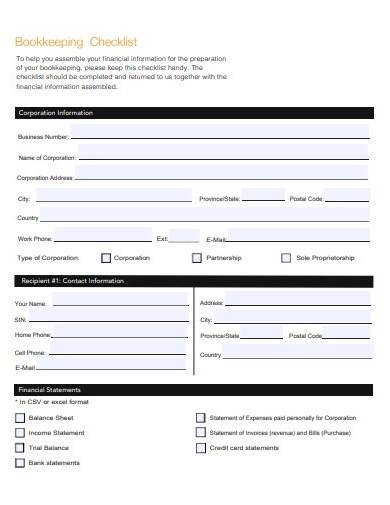

2. Sample Bookkeeping Checklist

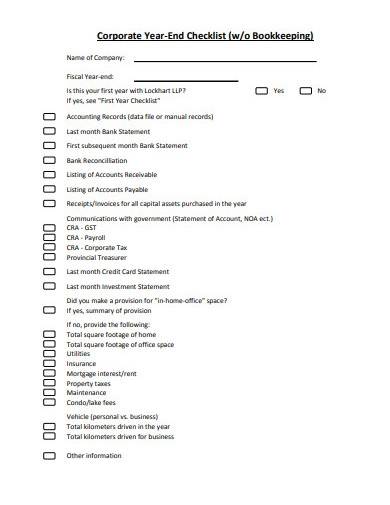

3. Corporate Year-End Checklist Template

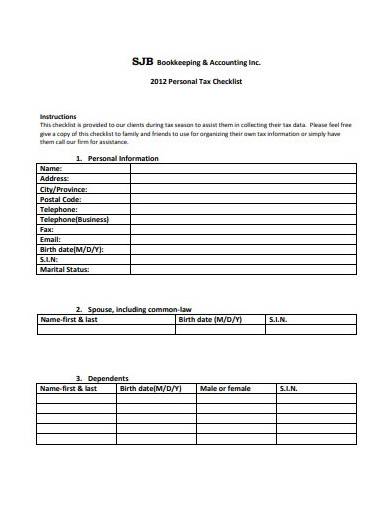

4. Personal Tax Checklist Template

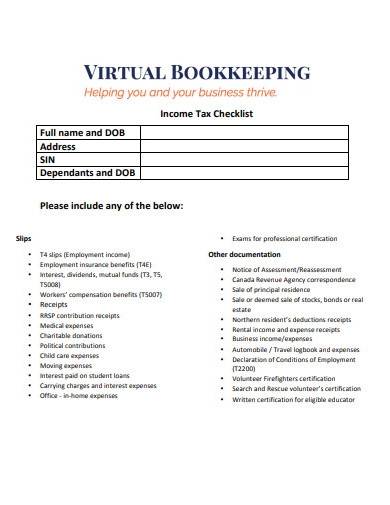

5. Income Tax Checklist Template

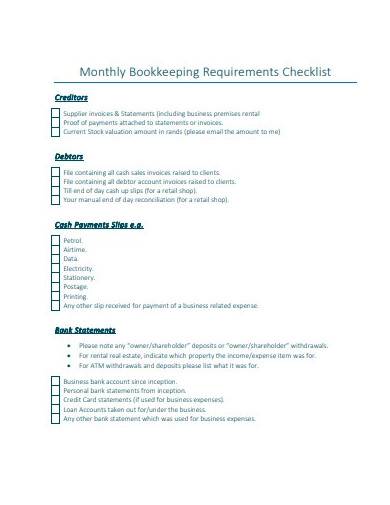

7. Monthly Bookkeeping Requirements Checklist

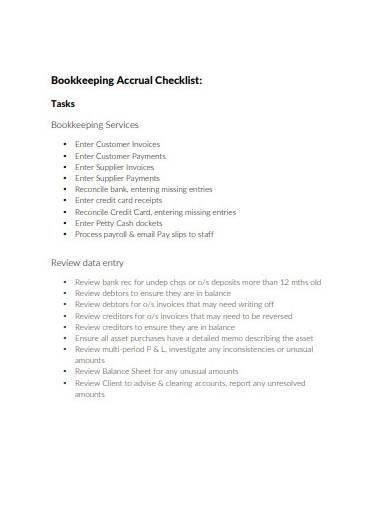

8. Bookkeeping Accrual Checklist Template

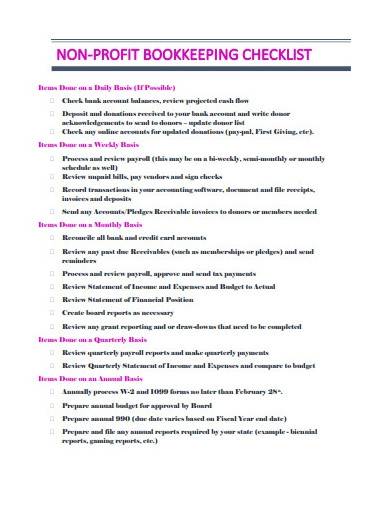

9. Non-Profit Bookkeeping Checklist Template

10. Basic Bookkeeping Checklist Template

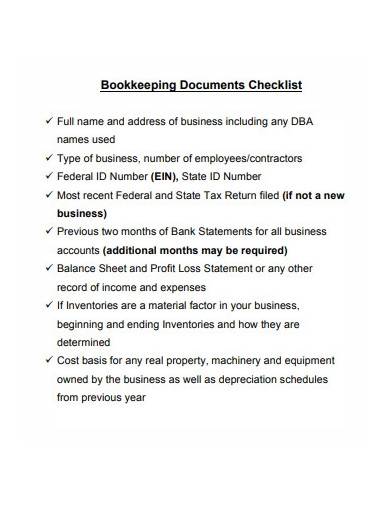

11. Sample Bookkeeping Documents Checklist

12. Bookkeeping Checklist Example

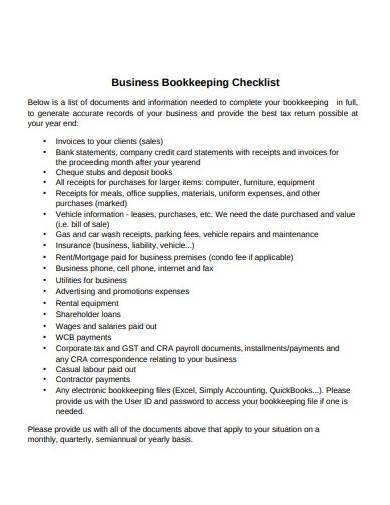

13. Business Bookkeeping Checklist

How to Make a Bookkeeping Checklist

Making a useful and efficient bookkeeping checklist is not a hard task. It is simply listing bookkeeping assignments that bookkeepers must do to keep everything running smoothly. But, if you want to make sure that you are doing it right, you might as well follow some tips. In this article, we have provided you some essential pointers on making an effective bookkeeping checklist that you can use during your business’ bookkeeping process. Here’s how.

1. Gather Information

Before you begin making a bookkeeping checklist, it is essential to prepare all the needed content to be placed on it first. Bookkeeping checklists are used by bookkeepers to layout specific accounting tasks to make sure there’s no data being missed out. That is why it is imperative to identify those tasks. You may pen down these details in a separate blanks sheet.

2. Outline the Checklist

Once you have already prepared your content, it is time to start making a bookkeeping checklist by creating its outline. Since it carries out the list of essential tasks that need to be covered for your single-entry or double-entry bookkeeping process, you can use tables to present data precisely. In doing so, you may utilize any software application of your choice as long as it enables you to craft columns and rows as neatly as possible. Nonetheless, make sure that your bookkeeping checklist outline is enough for the amount of content you will place. You may also leave a space for notes in case you have some.

3. Add Labels

After you have outlined your bookkeeping checklist, the next thing you need to do is to incorporate labels. The labels will serve as indicators of what data are placed under it. For bookkeeping checklists, it usually includes dates, categories, description of bookkeeping activities, status, completion dates, and remarks. You may also utilize legends to make your bookkeeping checklist more precise.

4. List Down Content

Finalize your bookkeeping checklist by structuring the bookkeeping items, the ones that you gathered before, logically. If one task is similar to another, you may group and organize them together. This bookkeeping checklist serves as your guide. Hence, it should be clear and precise. Nonetheless, make sure that each bookkeeping task falls under its corresponding labels—category task on the category section, task description to the task description area, and so on.

What are the bookkeeping tasks adapted in a bookkeeping checklist?

A bookkeeping checklist allows bookkeepers to track their various bookkeeping assignments, whether on a day-to-day basis, weekly, or monthly. These bookkeeping tasks usually consist of entering sales invoices, purchase invoices, petty cash receipts, bank receipts, and cheque payments. This also includes other financial statements, such as running balance sheets and profit and loss statements.

What are the two types of bookkeeping system?

Bookkeeping has two different systems that bookkeepers use to calculate business books and create financial statements. The first type is the single-entry bookkeeping system. This refers to companies or organizations with uncomplicated and minimum transactions. This system only records cash sales and business expenses. The second type of bookkeeping system is the double-entry, which is used by businesses with complex transactions. This system creates entries for both income and expense and other corresponding accounts.

What are the benefits of bookkeeping?

Aside from helping business owners identify their company’s financial health status, accurate bookkeeping also gives several perks that companies will surely benefit from. Bookkeeping allows entrepreneurs management cash well, helps in business decision-making, and reduces risks. Hence, it is imperative to make sure that every data placed in the bookkeeping tracker are accurate.

What are the types of bookkeeping accounts?

There are ten basic types of bookkeeping accounts that bookkeepers must use to organize company finances. These basic accounts include cash, accounts receivable, accounts payable, loans payable, sales, purchases, payroll expenses, inventory, retained earnings, and owners equity.

Bookkeeping is one of the necessary processes that allows company owners to generate financial statements and identify their business’s financial health. That is why it should not be ignored. To do so, you will need to gather all the necessary data and figures in a specified time. Hence, you will need a checklist material to itemize all the important bookkeeping tasks. So, if you ever need one, you can browse out our collection of professionally made sample bookkeeping checklist templates. Download now!

Related Posts

FREE 10+ Program Description Samples in PDF | MS Word

FREE 10+ Award Ceremony Program Samples & Templates in MS Word | PDF

FREE 10+ Social Media Marketing Agreement Samples in MS Word | Pages | Google Docs | PDF

FREE 10+ Retail Marketing Plan Samples in MS Word | Pages | Google Docs | PDF

FREE 10+ Marketing Audit Samples in MS Word | Pages | Google Docs | PDF

FREE 10+ Digital Marketing Business Plan Samples in MS Word | Pages | Google Docs | PDF

FREE 10+ Consultant Marketing Plan Samples in PDF | MS Word

FREE 10+ Contractor Letterhead Samples in PDF | MS Word

School Excuse Letter Samples & Templates

School Absence Letter Samples & Templates

FREE 4+ Sample Proposal Letters for Cleaning Service [ Hotel, Proposal invitation ]

FREE 3+ Sample Proposal Letters for Funding in PDF | MS Word | Google Docs

FREE 5+ English Tutor Cover Letter Samples in MS Word | PDF

FREE 5+ Contractor Letter of Intent Samples in PDF | MS Word

FREE 5+ Contractor Letter of Commitment Samples in PDF | DOC