Before the year would come to an end, companies would often hold meetings to discuss their annual business budget for the upcoming year. A budget is a detailed plan that would outline how to manage and spend your money wisely. For business organizations, this will help them determine what needs to be prioritized. Besides running a business is not an easy task, and for it to continuously develop and gain success would mean putting up with various expenses in different sectors that comprise the organization. This is why budgeting plays a key role to make sure that the company has enough funds to pay for its expenses. Budget plans could be prepared for a month, quarter, or year. In this article, let us discuss further how to prepare an annual business budget. If you need to start working on this business budget, we’ve got a list of annual business budget samples that are available for download on this page.

10+ Annual Business Budget Samples

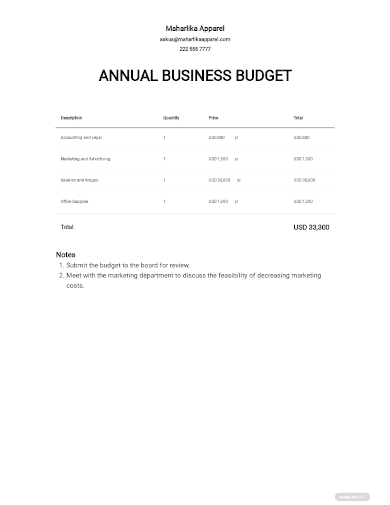

1. Annual Business Budget Template

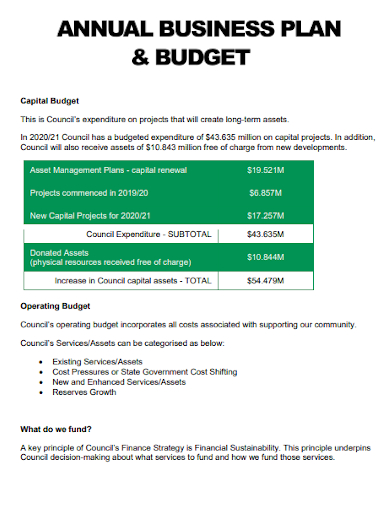

2. Annual Business Capital Budget Plan

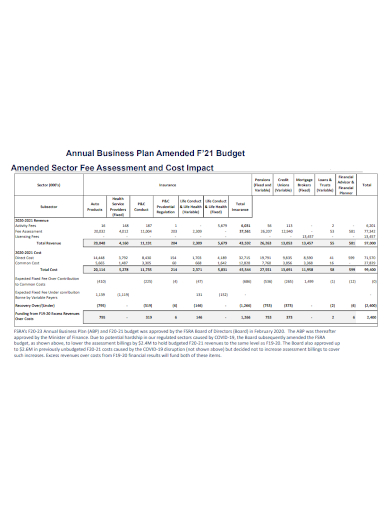

3. Annual Business Amended Budget

4. Annual Basis Business Budget Planning

5. Annual Business Budget Policy

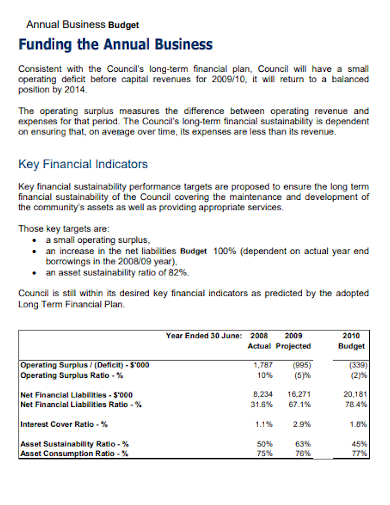

6. Funding Annual Business Budget

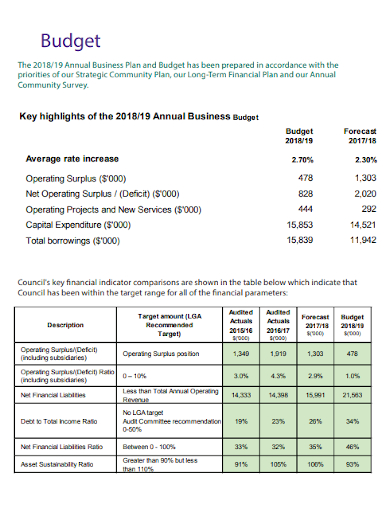

7. Sample Annual Business Budget

8. Annual Business Budget Request & Performance Plan

9. Editable Annual Business Budget

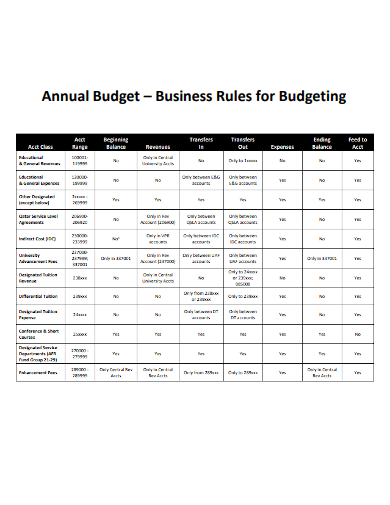

10. Annual Budget & Business Rules

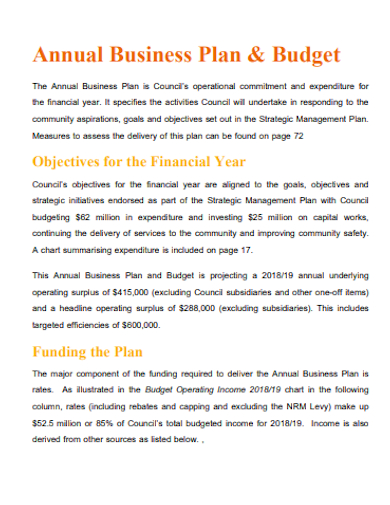

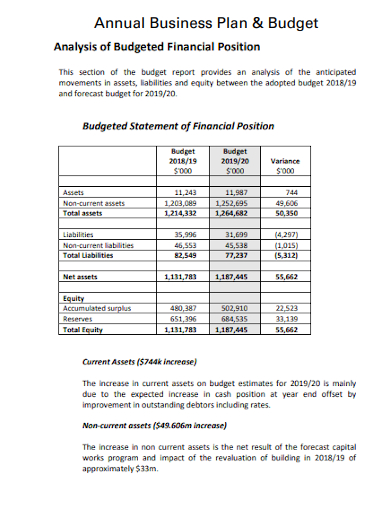

11. Annual Business Plan & Budget Analysis

What Is an Annual Business Budget?

Preparing an annual business budget is part of a company’s financial planning process. And each company division would need funds to be able to successfully operate. For example, the marketing department has a number of expenses from advertisements and promotions that they need to engage in to make sure a company’s product or service will be able to sell in the market. That being said, preparing an overall budget is crucial in a company’s survival. Too many expenses would mean adjustments has to be made. This is why management often prepares their annual budget beforehand. An annual business budget is a financial plan based on a company’s revenue and expenses expected over the course of a year. Preparing a business budget will help organization leaders determine how well the company is doing.

How To Prepare an Annual Business Budget?

An annual business budget will help companies identify their available capital, predict their revenues and make estimates when it comes to the expenses for the year. When efficiently prepared, management can make financial and operational decisions. And more importantly, can find ways to reduce or avoid debt and set aside funds in case of emergencies that may cause business disruptions. Now that we have pointed out how important a business budget is, it is time to understand how to prepare this document. Take note that every budgeting plan is never the same due to several factors but we have several tips below that can help you prepare an efficient annual business budget for your company.

I. Sales and Revenue

There are several vital components that make up a business budget and one of which is the company’s sales and revenue. Revenue is used to pay for the different expenses a company incurs. But where do you source out your revenue? Depending on what type of industry your company is engaged in, revenue comes from sales of a product or from services contracted. For the upcoming year, you would need to determine estimated sales and revenue your company will be making.

II. Expenses

Also, another important component is the estimated cost and expenses the company will be incurring for the next year. And a company incurs different expenses, again depending on their industry. For example, if your company produces laundry soap and detergent, so production costs play a key role in your expenses. So start determining what falls under direct and indirect expenses.

III. Data Comparison

In most cases, data and information from previous budget plans are pulled out for comparison. This will help management identify the recurring expenses and trends that can help them organize their business budget plan.

IV. Team Effort

The finance department may be in charge of the business budget preparations, but other company departments must submit their own data to help come up with the overall budget.

V. Monitoring and Revisions

It is expected that revisions are to be made over the course of time since the budget is created over forecasted data. That being said, it is important to keep monitoring your business budget and implement revisions if there is a need to.

FAQs

What Is the Difference Between Direct and Indirect Expenses?

Direct expenses are expenses that go into producing goods or providing services whereas indirect expenses incur when in day-to-day business operations.

What Is a Budget Cycle?

A budget cycle is the time frame a budget covers, with companies using monthly, quarterly or annual budget cycles to control costs and streamline administrative duties.

What Is a Budget Surplus?

This is when an income or revenue exceeds expenditure. Meaning there is still money left even after paying the expenses.

An annual business budget is an important tool that can help companies with their decision-making and set their priorities straight. To make it easier for you to prepare one, don’t forget to download our free templates!

Related Posts

FREE 10+ Annual IT Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Personal Budget Planner Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Numbers | Apple Pages | PDF

FREE 5+ Yearly Budget Planner Samples in PDF | XLS

FREE 10+ Expense Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word

FREE 10+ Architecture Budget Samples in PDF