Account reconciliation refers to a process that involves the comparison of two sets of financial reports or account balance sheets to determine whether the data they contain are correct, accurate, and in agreement with each other. This process also confirms if the accounts in a company’s general ledger are complete, consistent, and correct. There are other types of reconciliation such as bank reconciliation, vendor reconciliation, intercompany reconciliation, business-specific reconciliation, and customer reconciliation. However, there is also a type called budget reconciliation which is a tool or special process that Congress uses to make the legislation easier and faster to pass in the Senate.

FREE 11+ Budget Reconciliation Templates in PDF | MS Word

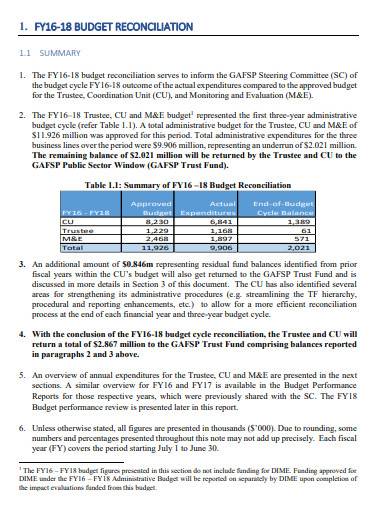

1. Sample Budget Reconciliation Procedure Template

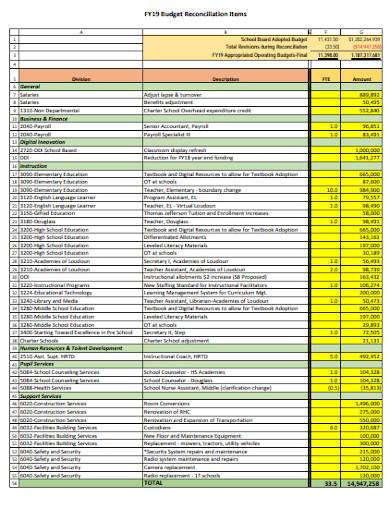

2. Budget Reconciliation Items Template

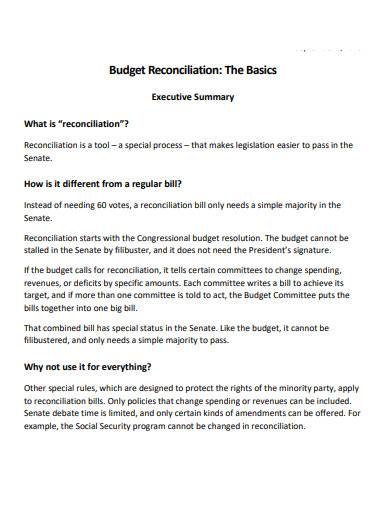

3. Basic Budget Reconciliation Template

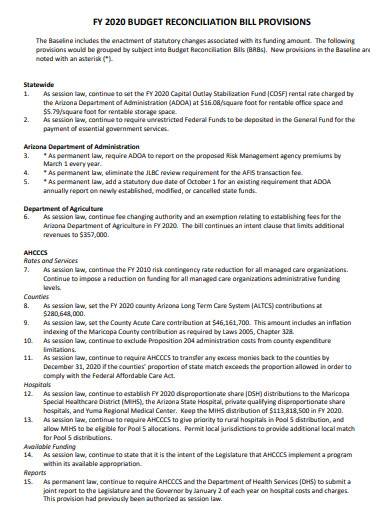

4. Budget Reconciliation Bill Provision Template

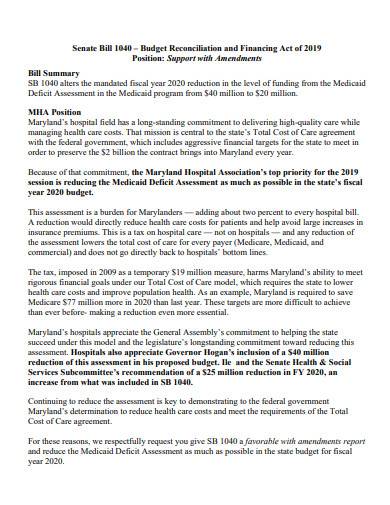

5. Budget Reconciliation and Financing Template

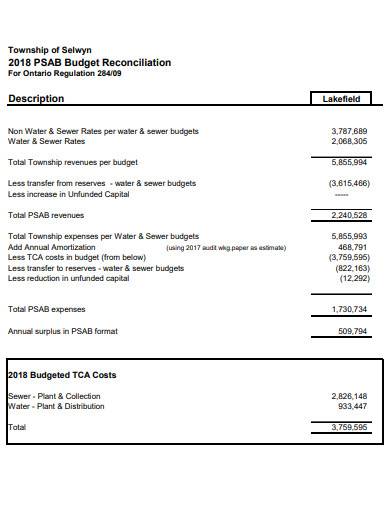

6. Township Budget Reconciliation Template

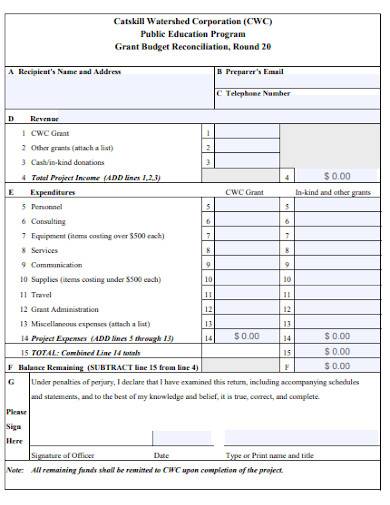

7. Grant Budget Reconciliation Template

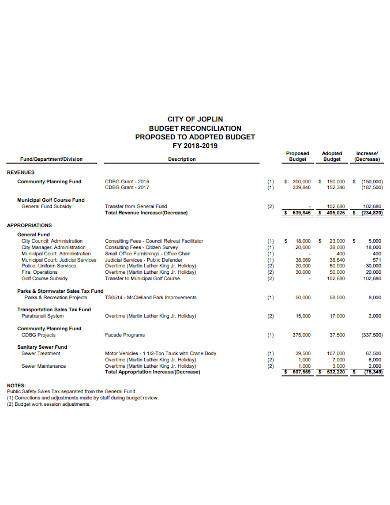

8. Proposed to Adopted Budget Reconciliation Template

9. Simple Budget Reconciliation Template

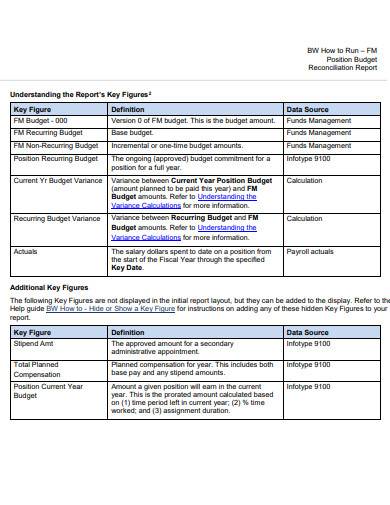

10. Budget Reconciliation Report Template

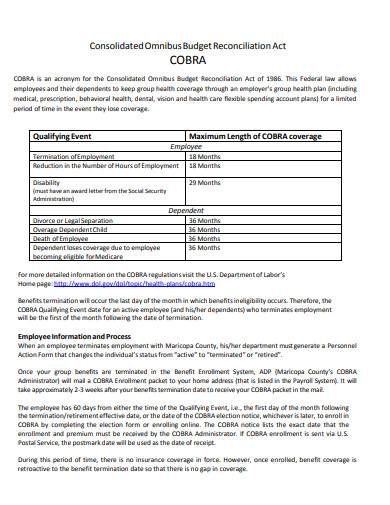

11. Consolidated Bus Budget Reconciliation Template

12. Budget Reconciliation Format

What is a Budget Reconciliation?

Budget reconciliation is a process in which a qualified individual reviews transactions and their supporting documentation, then resolves any issues or discrepancies they will discover. This process involves two different activities or roles and responsibilities. The first activity includes a detailed review of transactions and relevant documentation and the second activity involves a high-level budget review and data analysis that will be conducted by the person accountable for the said budget or also called the budget reviewer.

How to Evaluate the Result of a Budget Reconciliation

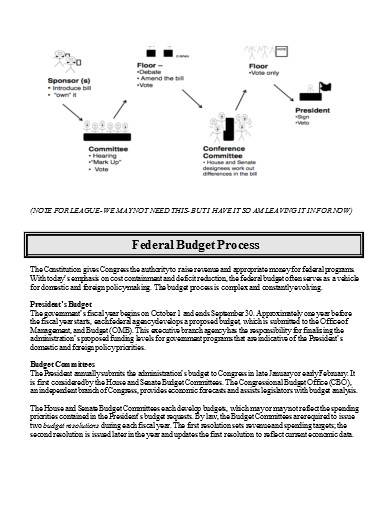

The budget reconciliation process is sometimes used by Congress to immediately advance high-priority fiscal legislation and also allows expedited review and consideration of particular tax, spending, and debt-limit legislation. Reconciliation is also a part of Congress’ responsibility of coming up with a budget resolution and is commanded by a set of rules provided in the Congressional Budget Act of 1974. This process starts at the beginning of every calendar year once Congress receives a budget proposal from the office of the President.

Step 1: Define the Process’ Goals and Metrics

Before starting with your budget reconciliation process, make sure that you have a clear idea of what you want to accomplish and the strategic action plan you will take to achieve them. Using the SMART goal worksheets or goal-setting metrics will help you in aligning your budget reconciliation process with your management plans, objectives, priorities, and development plans.

Step 2: Use Tools to Compare Different Scenarios and Trade-offs

Evaluating the performance and results of your budget reconciliation process involves conducting a comparison of various scenarios and trade-offs. You can use tools like budget models, projections, and simulations to assess and analyze the feasibility, sustainability, and effectiveness of your choices.

Step 3: Work with Stakeholders and Experts

The technical process of a budget reconciliation requires feedback from different stakeholders and experts, therefore, they must be informed of this process. These people can include co-workers, committees, staff, analysts, auditors, and more.

Step 4: Make Sure to Monitor the Progress and Make Necessary Adjustments

Budget reconciliation is an ongoing process that requires adjustments and revisions from time to time. Make sure to monitor your progress and make adjustments to your plans as you deem necessary. You can also utilize tools such as feedback loops, data analysis, and performance indicators to track and monitor your progress and results.

FAQs

What is a reconciliation bill?

A reconciliation bill is utilized by an organization to reconcile differences between two different versions of a proposed bill. Reconciliation is a procedure in which the Senate is allowed to submit legislation with a simple majority vote instead of the 60-vote result that is required for most bills.

What are the applied restrictions on budget reconciliation?

Based on the Byrd Rule, legislative provisions are disqualified from budget reconciliation if they increase the budget deficit beyond the budget window, produces no budgetary effects, and make changes to Social Security.

What are the different ways of reconciling financial reports or records?

Financial reports or records can be reconciled using two options. These are the document review which includes reviewing existing transactions or documents and the analytical review which uses account activity levels to estimate the amount to be recorded in the account.

Reconciliation is an accounting process performed by departments or companies to provide reasonable assurance that their transactions are authorized, allowable, correct, and reasonable. Budget reconciliation enables businesses or organizations to review their transactions and supporting documentation and resolve any possible discrepancies that they might discover.

Related Posts

FREE 10+ Manufacturing Overhead Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 5+ Small Freelance Team Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel PDF

FREE 10+ Annual IT Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Personal Budget Planner Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Numbers | Apple Pages | PDF

FREE 5+ Yearly Budget Planner Samples in PDF | XLS

FREE 10+ Expense Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF