Individuals or businesses use a wide variety of financial tools that matches their budget plans and financial risk management plans which is also an essential aspect for achieving their personal goals as well as business goals. With an effective budget worksheet, you can keep track of your expenses, determine your spending patterns, and enhance your ability to save money every month. As a business owner, this worksheet will enable you to identify the areas in which you might be overspending which also allows you to improve your financial and budget planning.

19+ Budget Spreadsheet Samples

1. Budget Spreadsheet Template

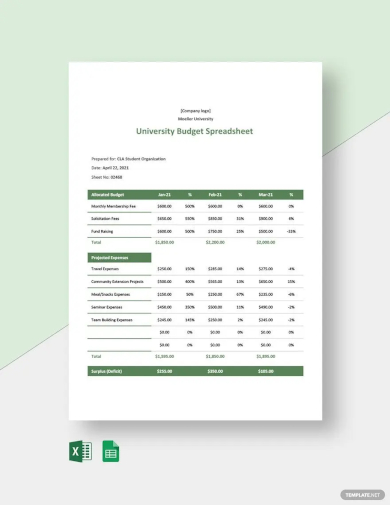

2. University Budget Spreadsheet Template

3. Monthly Budget Spreadsheet Template

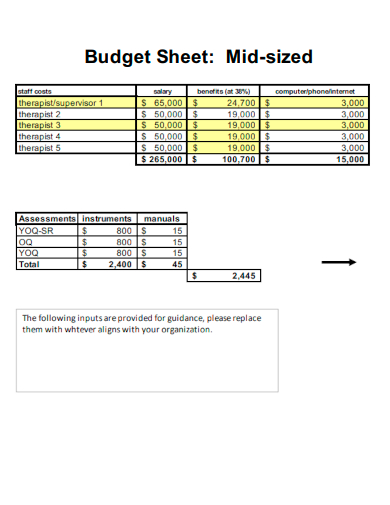

4. Budget Midsized Spreadsheet

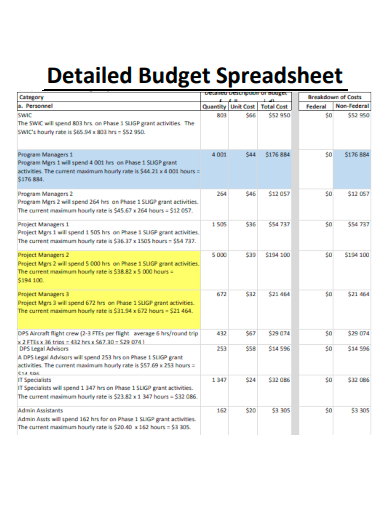

5. Detailed Budget Spreadsheet

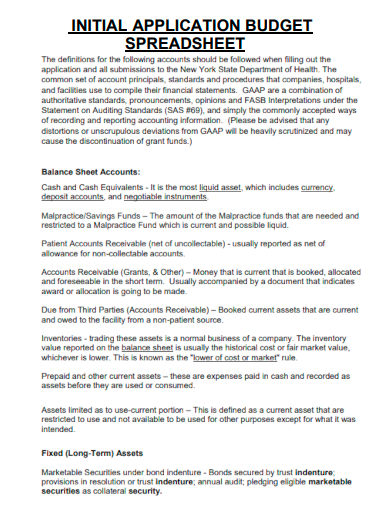

6. Initial Application Budget Spreadsheet

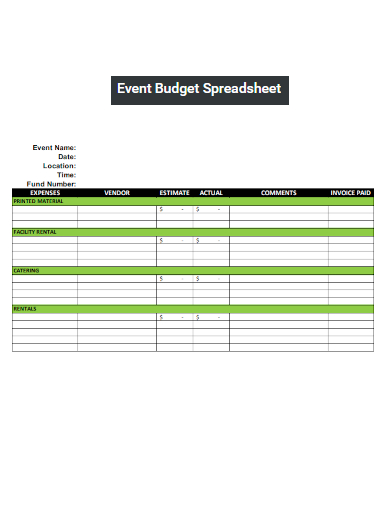

7. Event Budget Spreadsheet

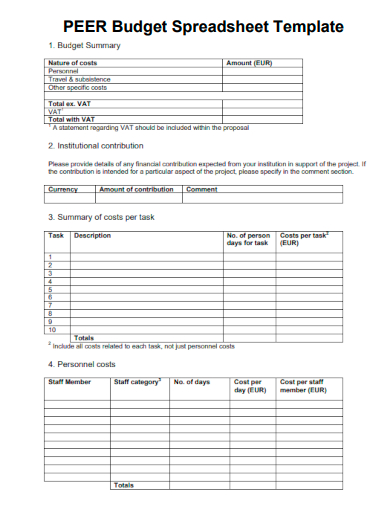

8. Peer Budget Spreadsheet Template

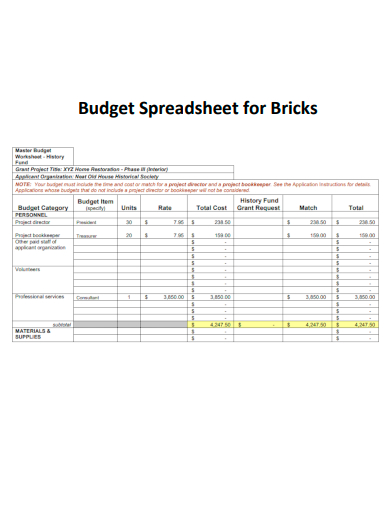

9. Budget Spreadsheet for Bricks

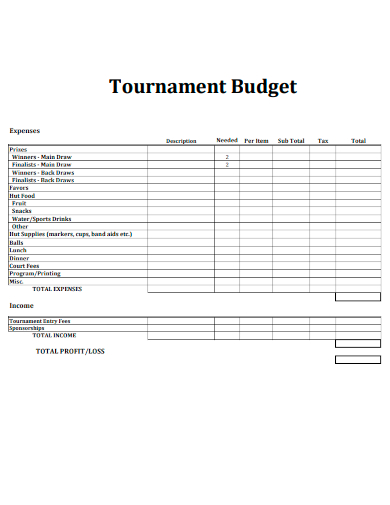

10. Tournament Budget Spreadsheet

11. Human Resources Spreadsheet Budgeting

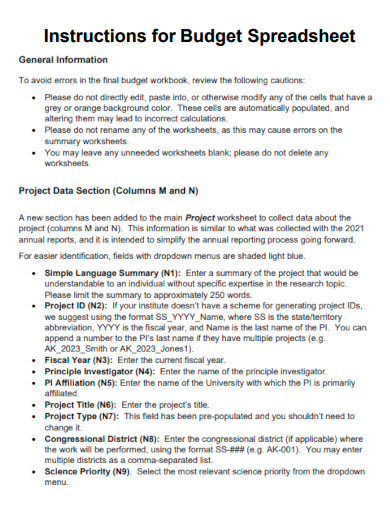

12. Instructions for Budget Spreadsheet

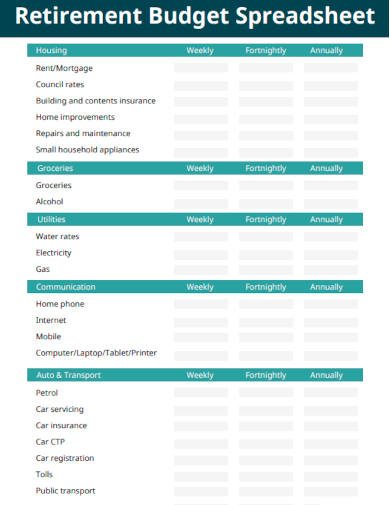

13. Retirement Budget Spreadsheet

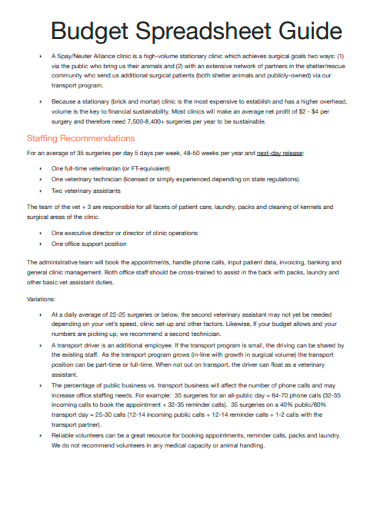

14. Budget Spreadsheet Guide

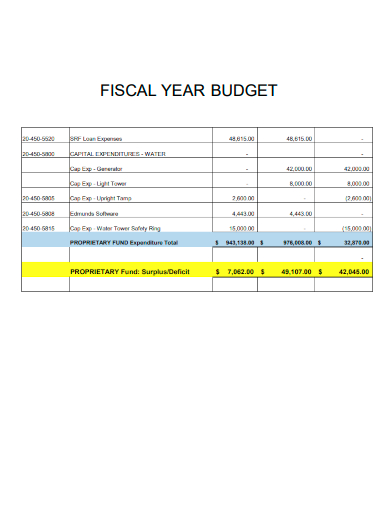

15. Fiscal Year Budget Spreadsheet

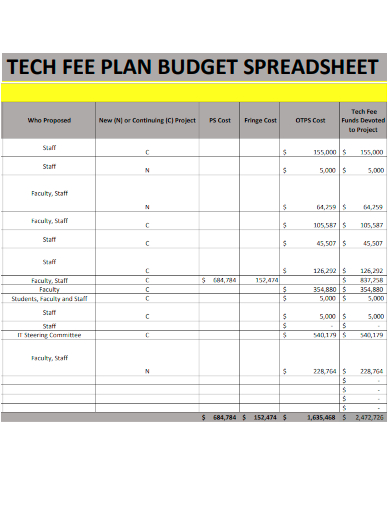

16. Tech Fee Plan Budget Spreadsheet

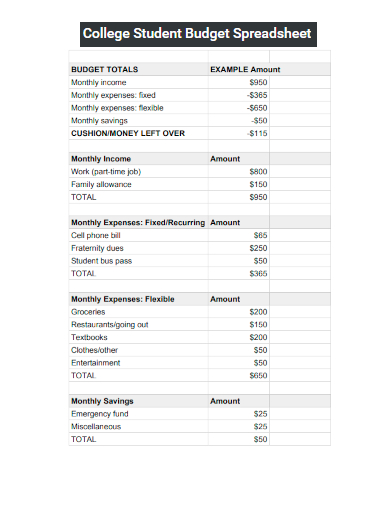

18. College Student Budget Spreadsheet

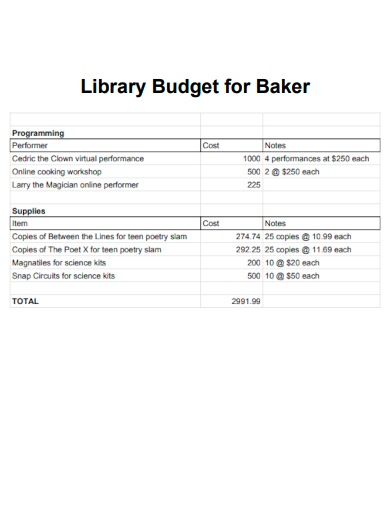

19. Library Budget for Baker Spreadsheet

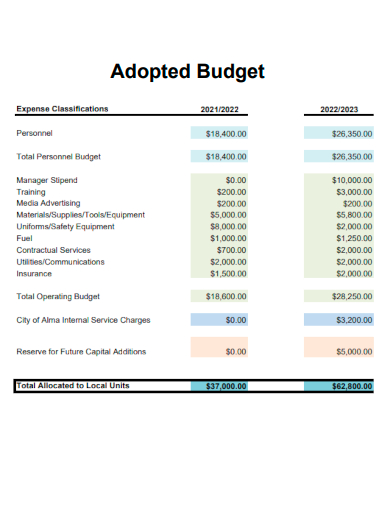

20. Adopted Budget Spreadsheet

What is a Budget Spreadsheet?

A budget spreadsheet refers to a document or template that allows businesses as well as private individuals to track their income and expenses within a specified period of time, enabling them to determine the most effective way to save and manage their money or finances. This spreadsheet makes it easier to monitor and track various aspects of your spending, whether it is a daily, weekly, monthly, quarterly, or annual expenditure. Other templates you can use include a budget checklist, budget planner, budget chart, budgeting sheet, operational budget, and more.

How to Create a Budget Spreadsheet

Using a budget spreadsheet not only helps you keep track both of your income and expenses but also enables you to determine which areas where you can save money as well as provide you with a detailed overview of your financial habits. Personal budget spreadsheets provide you with a method by which you can determine your financial health and help you in planning your budget that will cover a certain period, which can be monthly or yearly.

Step 1: Decide on Which Platform to Use

The first step is to decide which platform to use which can be based on your preference. You can use word processors such as Google, Microsoft, or Apple. If you want to save time and do not want to start from scratch, these applications offer ready-made templates or you can download one online.

Step 2: Create a Breakdown of Your Income and Expenses

Your income is the major category that can be found in your spreadsheet. Determine your net income which can be done by subtracting your expenses from the total money you have earned. These expenses refer to your taxes and interest payments.

Step 3: Set Up Your Budget Spreadsheet

You can set up your budget spreadsheet as simple or as detailed as you prefer. You can include one category for your total income and another for your expenses. Then, create subcategories underneath them to list down the types of income and expenses you have in more detail.

Step 4: Income the Details of Your Income and Expenses

Once you have set up your spreadsheet, you can now plug in the information about your income and expenses. This financial information will be helpful to you and can serve as your future reference. Then, update your spreadsheet as regularly as changes occur in your financial management.

FAQs

What are the benefits of using a budget worksheet?

With a budget worksheet, you can efficiently track your income and expenses in one centralized location, help you spend within your budget, tally your planned expenses, savings, and income, calculate your disposable income at the end of every period, and determine your spending patterns.

What are the basic sections that must be included in a budget worksheet?

A budget worksheet commonly contains sections for finances such as your income, housing and utilities, transportation, food, healthcare, personal care, family, finances, miscellaneous, and savings.

What are the fixed and variable expenses?

The fixed expenses refer to the consistent expenses you have to pay every month but can also have smaller fluctuations based on your usage like insurance, transportation, loan payments, and more while the variable expenses can change every month such as your food, clothes, personal care, and more.

A budget spreadsheet is a type of money management tool that can help you in tracking your income, monthly expenses, and more. It is also one of the most accessible tools you can use to also identify areas in your expenses that can cut to save more money and provides you with a detailed overview of your financial situation and habits. With this template, you can easily monitor and track your progress and make necessary adjustments in your budget plan which will enable you to reach your financial goals.

Related Posts

FREE 10+ Advertising Budget Samples in PDF

FREE 10+ Manufacturing Overhead Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 5+ Small Freelance Team Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel PDF

FREE 10+ Annual IT Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 5+ Yearly Budget Planner Samples in PDF | XLS

FREE 10+ Expense Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word