As a new small-business owner, you’ll have to learn a number of new skills. One of them is figuring out how to make a business budget, which can be frightening, especially if you’re just getting started. How do you know where to go for the proper financial data, let alone master the jargon of business finance, and put it all together in the right order? This may be enough to deter some people from even considering launching a business. According to one research, the majority of small-business owners don’t even have a budget. Many individuals consider budgeting to be their least favorite aspect of owning a business, but if you want to be successful, you’ll need to create and maintain a comprehensive business budget.

10+ Business Plan Budget Samples

What is the meaning of a business budget? A business budget is a spending plan based on your income and costs for your company. It determines your available capital, forecasts your spending, and aids in income forecasting. A budget can assist you in planning your business activities and serve as a benchmark for establishing financial goals. It can assist you in overcoming short-term challenges as well as long-term plans.

1. Business Plan Budget Template

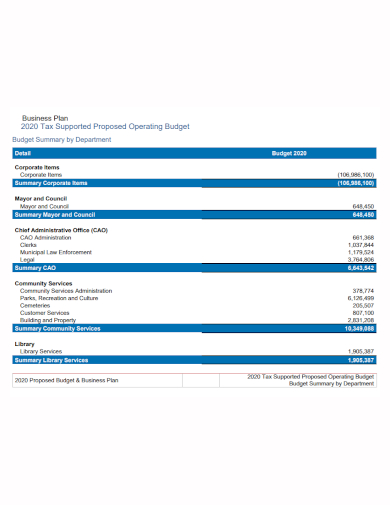

2. Corporate Business Plan Budget Template

3. Simple Business Plan Budget Template

4. HR Business and Budget Plan

5. Business Project Plan Budget

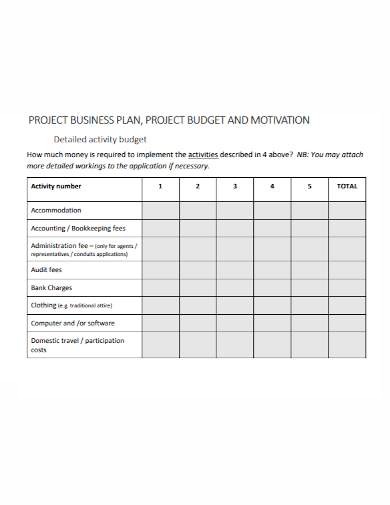

6. Project Business Plan Motivation Budget

7. 5 Year Business Budget Plan

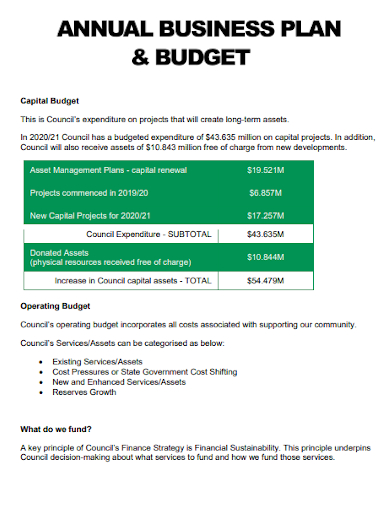

8. Annual Business Capital Budget Plan

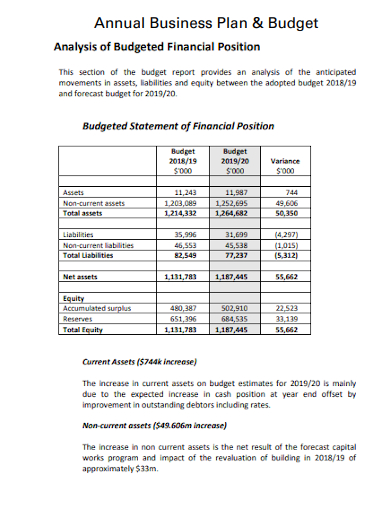

9. Annual Business Plan Budget Analysis

10. Business Plan Budget Proposal

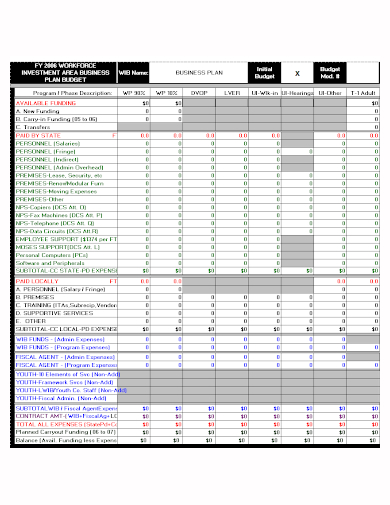

11. Investment Business Plan Budget

Creating Business Plan Budget

- Tally all your source of income – When creating a small business budget, you must first determine how much money your company generates each month and where that money comes from. Your sales figures (which can be accessed via the Profit & Loss report function) are a wonderful place to start. Then, throughout the month, you can add any new sources of income for your firm. Your business plan will determine the total amount of income sources you have.

- Determine fixed costs – After you’ve figured out your revenue, it’s time to figure out your expenses, starting with fixed costs. Any expenses that remain the same from month to month are considered fixed costs. Rent, some utilities (such as the internet or phone plans), website hosting, and payroll expenditures are all examples of this. Examine your expenses to discover which ones have remained consistent from month to month. These are the expenses that will be classified as fixed costs. Once you’ve determined these expenditures, add them together to get your total fixed cost expenses for the month.

- Include variable expenses – Variable costs don’t have a set price and fluctuate month to month depending on your company’s profitability and activities. Usage-based utilities (such as electricity or gas), shipping expenses, sales commissions, and travel costs are examples of these. By definition, variable expenses will fluctuate from month to month. You can spend more on the variables that will help your firm scale faster if your profits are larger than projected. However, if your profits are falling short of expectations, consider reducing these variable costs until you can increase your profitability.

- Predict one-time spends – Many of your business expenses, whether fixed or variable, will be recurring costs that you pay each month. However, there are expenditures that will occur significantly less frequently. Just remember to include those costs in your budget as well.

- Pull it all together! – You’ve gathered all of your sources of income as well as all of your outgoings. What comes next? Putting it all together to get a full picture of your monthly financial situation. To calculate your overall profitability, combine your total income and total expenses (i.e., total fixed costs, variable expenses, and one-time spending) to your business budget, then compare cash flow in (income) to cash flow out (expenses).

FAQs

What are the different types of budget?

- Master budget

- Operating budget

- Cash budget

- Financial budget

- Labor budget

- Static budget

What are the components of a budget?

- Estimated revenue

- Fixed cost

- Variable cost

- One-time expenses

- Cash flow

- Profit

A budget serves as a road map for your company. It assists you in forecasting cash flow, identifying functional areas that require improvement, and running company operations smoothly. Successful organizations devote a significant amount of time and attention to developing realistic budgets because they are an effective way of tracking how far the company has progressed toward its objectives.

Related Posts

FREE 5+ Small Freelance Team Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel PDF

FREE 10+ Annual IT Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Personal Budget Planner Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Numbers | Apple Pages | PDF

FREE 5+ Yearly Budget Planner Samples in PDF | XLS

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word

FREE 10+ Architecture Budget Samples in PDF