Your business’ fixed asset fuel your daily operations. From the PCs working on the top of every desk, the programs you use to get all your work done, and the very office room you’re in, these are all fixed assets that are vital to keeping your business up and running. It’s important to dedicate the right support for this when you draft your financial documents. A capital expenditure budget makes sure that you’ll take care of your fixed assets efficiently. This helps identify how to maintain these resources and make new asset acquisitions. Read below for more details about this.

FREE 7+ Capital Expenditure Budget Samples

1. Capital Expenditure Budget Template

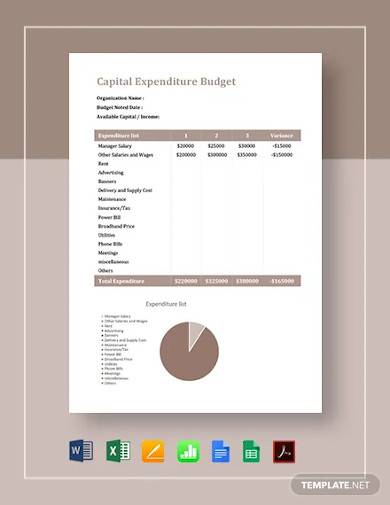

2. Expenditure Budget Template

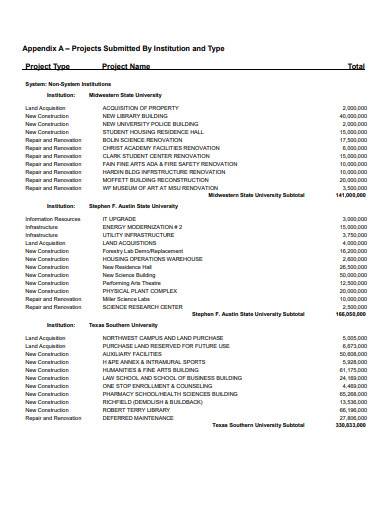

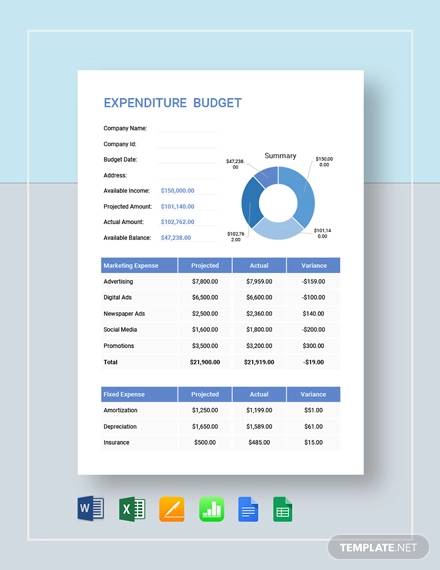

3. Capital Expenditures Budget Proposal

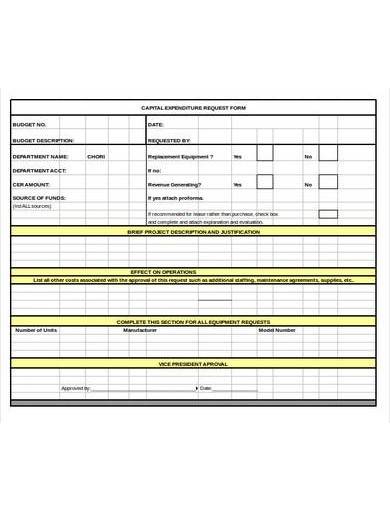

4. Capital Expenditure Budget Request Form

5. Sample Capital Expenditure Budget

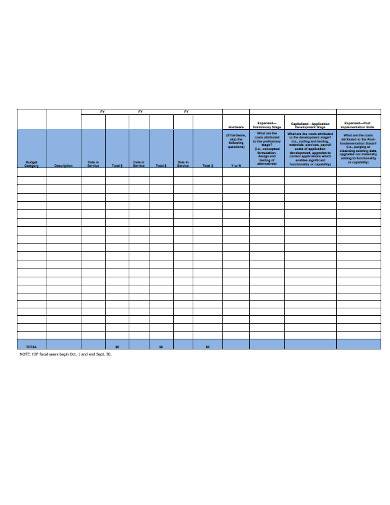

6. Capital Budget Request Expenditure

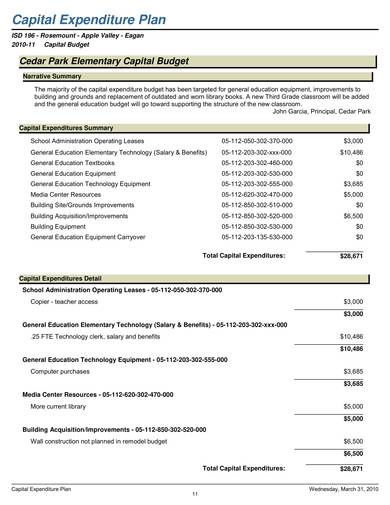

7. Capital Expenditure Budget Plan

8. Simple Capital Expenditure Budget

What Is a Capital Expenditure Budget?

A capital expenditure budget is a plan that provides a comprehensive account of a company’s expenses regarding their fixed assets. This helps a company prepare for future needs regarding their materials, equipment, and facilities. While this document’s main purpose is to identify the fixed assets’ costs, this can also help them determine if the income they’re spending on the asset is generating a return or they require new assets acquisitions.

The Different Types of Fixed Assets

What do fixed assets mean? Investopedia defines fixed assets as tangible properties that a business uses long-term on their operations. They are listed on balance sheets as property, plant, and equipment. They are ownerships that aren’t converted to cash right away, and the longer they’re used, the more their value decreases known as depreciation. According to the Bureau of Economic Analysis, it’s important to know the data about the fixed assets because it provides details of the economy’s scope on goods and services production.

Here are the different types of fixed assets that you should know about:

1. Land. It is a fixed asset whose value doesn’t cease or depreciate.

2. Building. These are assets involving a concrete property such as offices and factories.

3. Softwares. They’re useful in manning digital processes in a business’ daily operations.

4. Computer equipment. These assets include PCs, laptops, and other computer accessories. Because technology constantly produces upgrades after every few years, this type of asset at least have five years before it depreciates.

5. Machines. These are useful in production and manufacturing.

6. Vehicles. Vehicles are a significant asset to businesses that cater to delivery and transport services.

7. Intangible assets. This asset involves invisible material such as trademarks, copyrights, and patents. Parties agreeing to use this type of asset usually sign an agreement.

How to Make a Capital Expenditure Budget

Here are some useful steps to help you make a capital expenditure budget:

1. Determine the Budgeting Goal

Start the process by having a thorough knowledge of your budgeting goal. Do you have fixed assets to maintain? Are you planning to purchase one? Do you want to consider the financial need before you decide on a purchase? Aside from already having a fixed asset, a capital expenditure budget spreadsheet can also help you determine if your resources can support an additional asset or not. Therefore it helps you make an informed decision. Knowing the goal plan behind your budgeting helps you find out if you need a fixed asset purchase to support your business and if you have the resources to do so.

2. List Down the Fixed Assets

Don’t forget the main items of your budget list—the fixed assets. This will determine how your budget allocation goes. To make a well-organized budget sheet, divide your fixed assets into different categories. You can have machinery, transportations, buildings, land properties, and others, depending on your business needs. Determine what activities regarding your assets do you need to fund. You can put in maintenance work, parts purchase, and needs for seasonal or regular updates. You might also want to check some of your materials and identify whether you need a new one or need to use a newer model to improve your operations.

3. Have a Projected Costs Calculation

Now that you have the list of your fixed assets, you need to put a price tag on each item to find the total projected costs you need to fund on a specific amount of time. This depends on whether you’re making an annual budget or a monthly budget for your operations. The projected costs help you make allocate the right amount you need to dedicate for your capital expenditure from your income or sources. Be sure to incorporate the right amount to your fixed assets by referring to your previous budget reports. If you’re just starting out, you can research how much it will cost you to acquire and maintain your needed assets so you can have a well-thought financial plan.

4. Arrange on a Neat Layout

Never underestimate the power of a well-organized layout in structuring a budget plan. You need to place your capital expenditures on a neat and well-structured layout, so it’s easier to interpret and comprehend. Provide different sections for each variety of your fixed assets, so it’s more convenient to assess costs and items Use formal fonts and avoid unnecessary additions. Provide ample space in between different parts for a clean and orderly look. Double-check your budget for errors and miscalculations. Being meticulous with your output is a significant part of the process, especially if you submit it to an executive for review.

FAQs

How do you calculate capital expenditures?

Here are four simple steps of calculating capital expenditures:

- Get your financial statements

- Subtract the total amount of fixed assets

- Subtract the calculated depreciation

- Add the depreciation total

What is a turnover ration in fixed assets?

The turnover ration in fixed assets determines whether or not an organization uses these assets to generate income effectively.

How does capital expenditure impact profit?

Capital expenditure affects profit when its assets depreciate and cause a decrease in the income statement.

Capital expenditure budgets should be among your organization’s financial priorities. It’s not enough that you already have enough fixed assets at hand. You should know that these properties and materials need constant maintenance and update to perform smoothly. They are a vital element to keep your operations in perfect condition. Have a capital expenditure budget template to help you manage these assets’ funding. Scroll through our collection and download now!

Related Posts

FREE 10+ Advertising Budget Samples in PDF

FREE 10+ Manufacturing Overhead Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 5+ Small Freelance Team Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel PDF

FREE 10+ Annual IT Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 5+ Yearly Budget Planner Samples in PDF | XLS

FREE 10+ Expense Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF