10+ Family Budget Planner

Raising a family is a noble job, but the expenses that come with it is not something that should be taken lightly. From paying your mortgage, tuition fees, loans, bills, children necessities, and etc., household expenses can be very costly. You can simply manage your spending, save, and monitor and meet your financial objectives if you have a household budget in place. Need some help with this? Y0u’ve come to the right place! In this article, we provide you with free and ready-to-use samples of Family Budget Planners in PDF and DOC formats that you could use to properly plan your family’s expenses. Keep on reading to find out more!

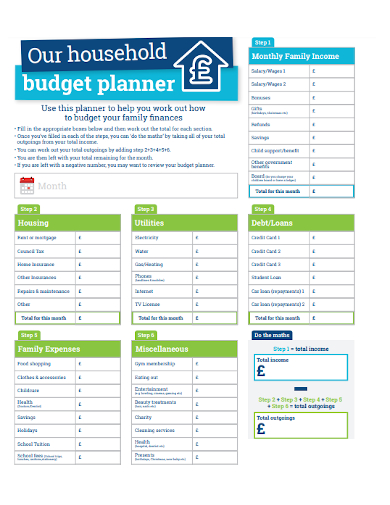

1. Family Budget Planner Template

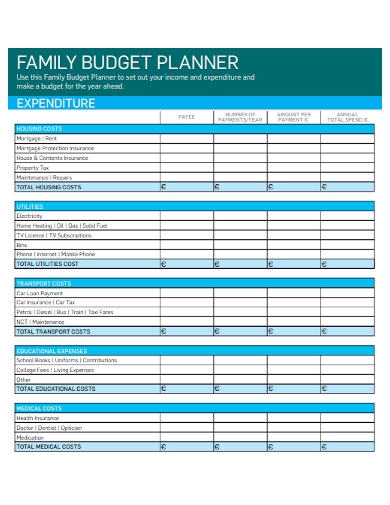

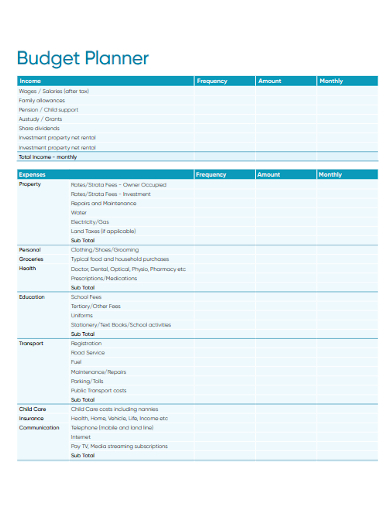

2. Family Expenditure Budget Planner

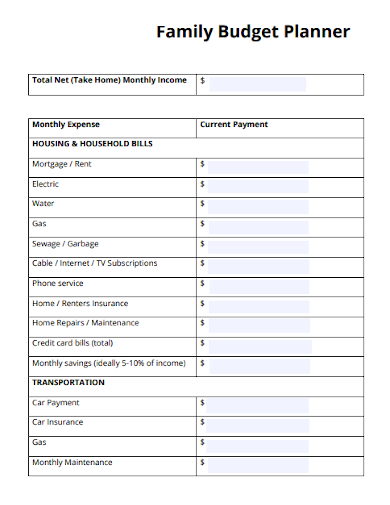

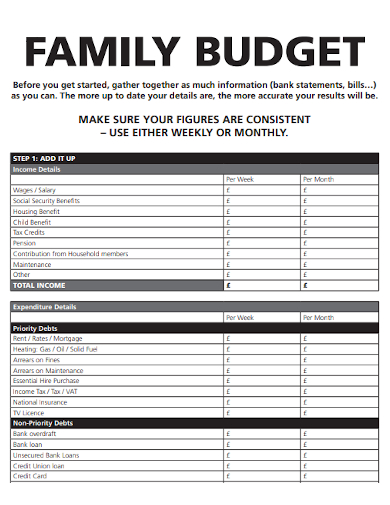

3. Sample Family Budget Planner

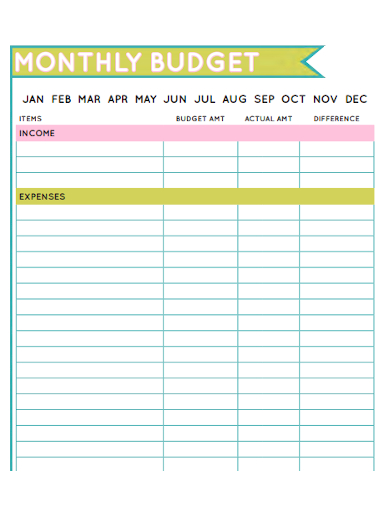

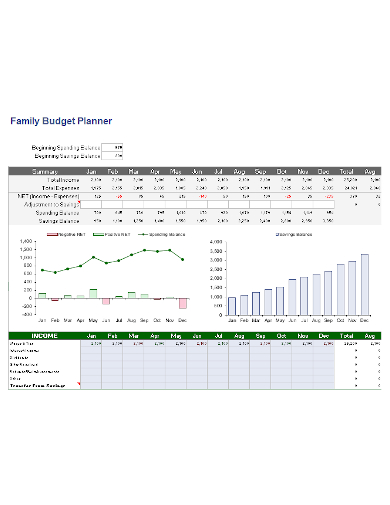

4. Family Monthly Budget Planner

5. Family Household Budget Planner

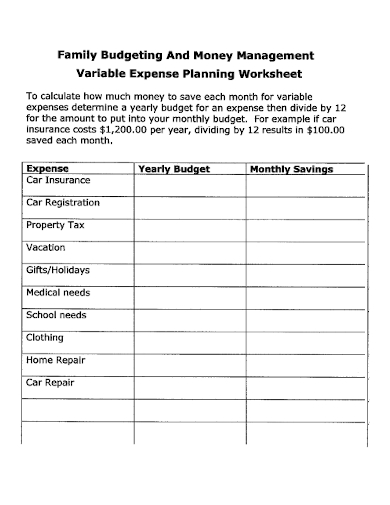

6. Family Budgeting & Management Planning Worksheet

7. Editable Family Budget Planner

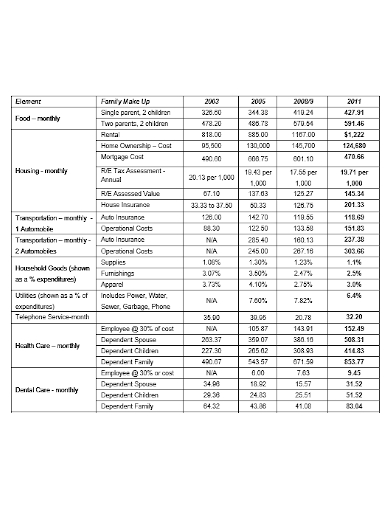

8. Family Allowances Budget Planner

9. Family Yearly Budget Planner

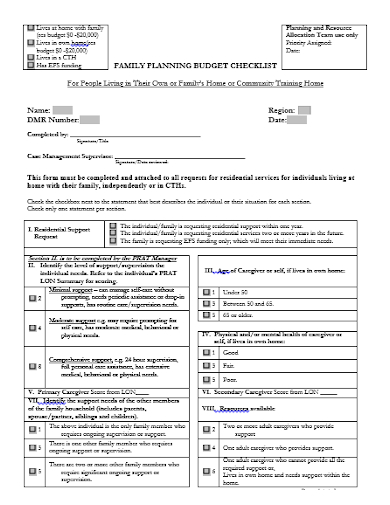

10. Family Budget Planning Checklist

11. Printable Family Budget Planner

What Is a Family Budget Planner?

A family budget is a plan for your household’s incoming and outgoing funds over a certain time period, such as a month or year. For example, you may set a goal of allocating a specific cash amount or % of your combined monthly income to various costs such as food, as well as saving, investing, and debt repayment. The fundamental goal of a family budget is to determine how a family’s money will be spent, used, and distributed among various types of products, services, and savings.

How to Make a Family Budget Planner

Keeping track of family costs within the context of a set of shared family objectives can help prevent money from slipping away unnecessarily. A Family Budget Planner Template can help provide you with the framework you need to ensure that you have a well-prepared and robust budget planner on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, follow these steps below to guide you:

1. Calculate your earnings.

The first step in creating a budget is to figure out how much money you will have coming in. The job(s) you and your spouse hold are likely to account for the majority of your household income. If you have other sources of income, such as stocks or a rental property, make sure to include these in your monthly total as well.

2. Subtract all of your fixed expenses.

After you’ve determined how much money you’ll be bringing in each month, remove your essential fixed costs from the total. These are costs that you must pay each month and that you cannot modify for the time being. Bills such as your mortgage or rent, utilities, auto payments, and insurance premiums all fall under this category.

3. Set a financial target for yourself.

After you’ve deducted your required spending, create a target savings goal from the remainder. This is money you’ll set away for long-term financial objectives such as creating an emergency fund, saving for education, and planning for retirement. It’s critical to set money away as soon as you get a paycheck since it’s all too simple to spend everything and wind up with nothing left over.

4. Keep track of your variable expenditures.

Variable spending should be the last category in your budget. This is money that you are in charge of and may change if required. You’ll know where your money goes each month if you split it down into sections, and you’ll be able to discover methods to cut the budget if required.

FAQ

What is the 50-30-20 rule in terms of budgeting?

The 50/30/20 rule is a simple budgeting approach that can assist you in successfully, easily, and sustainably managing your money.

What are the benefits of having a family budget?

A family budget is necessary for effective money management. That’s because a family budget aids you in spending your money sensibly on the items you require – your necessities.

What are the five goals of planning a budget?

A budget is used to plan, manage, track, and improve a person’s financial status.

Overall, developing and maintaining a family budget may take some time and work, but knowing where your money is may help you make better long- and short-term financial decisions, as well as provide you piece of mind. To help you get started, download our easily customizable and comprehensive samples of Family Budget Planners today!

Related Posts

FREE 10+ Advertising Budget Samples in PDF

FREE 10+ Manufacturing Overhead Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 5+ Small Freelance Team Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel PDF

FREE 10+ Annual IT Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 5+ Yearly Budget Planner Samples in PDF | XLS

FREE 10+ Expense Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word