There are different types of costs when a business is involved in the manufacturing process of producing goods and services. There are direct costs that consist of expenses from direct materials and direct labor to produce the product and there are indirect expenses called overhead costs that consist of other expenditures that support the production of the manufacturing business. Manufacturing overhead cost is the sum of all the indirect costs which are obtained while manufacturing a product. It is added to the cost of the final product along with the direct material and direct labor costs when businesses need to put a price on the product. If you want to smartly make a budget for your overhead costs, you’re in the right place. This article will guide you on how to make a manufacturing overhead budget.

10+ Manufacturing Overhead Budget Samples

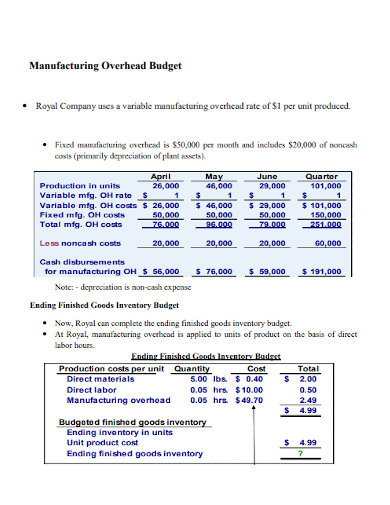

1. Free Manufacturing Overhead Budget Template

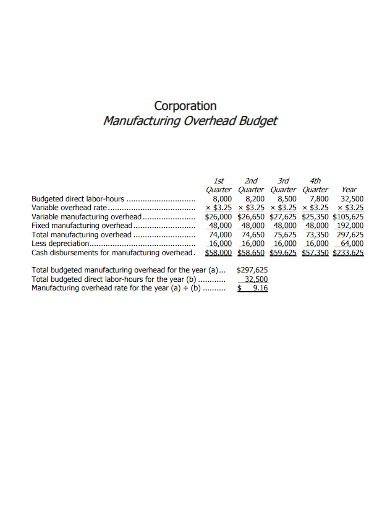

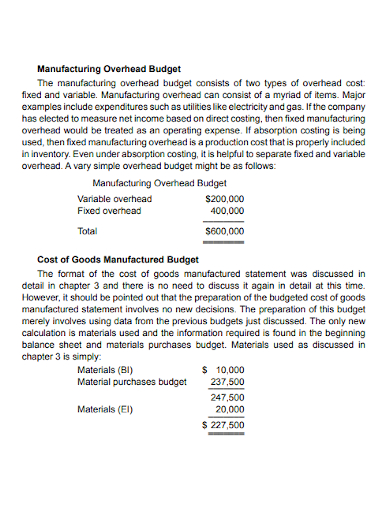

2. Corporation Manufacturing Overhead Budget

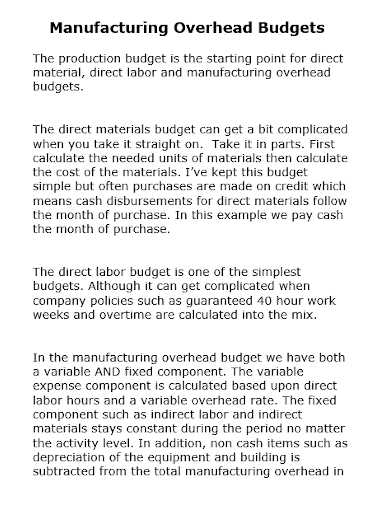

3. Budget Project Manufacturing Overhead

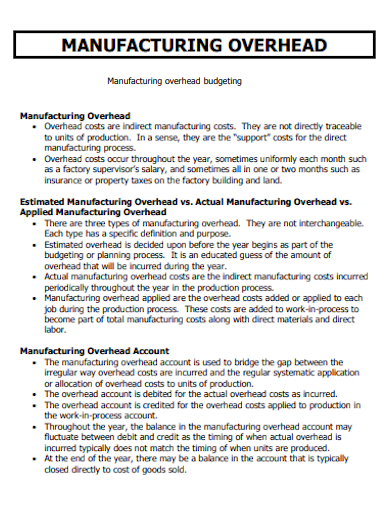

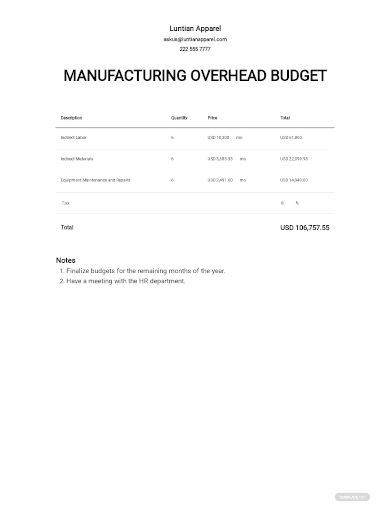

4. Manufacturing Overhead Budgeting Account

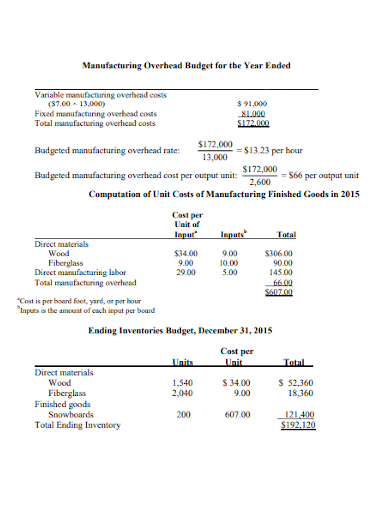

5. Manufacturing Overhead Budget for Year Ended

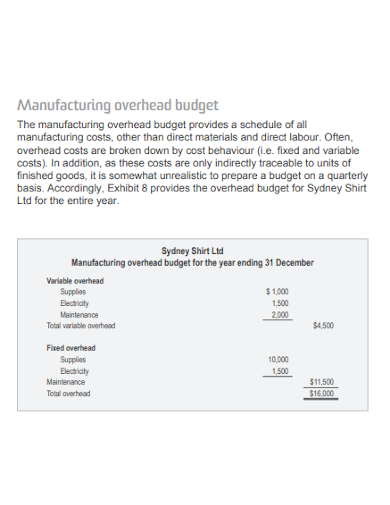

6. Manufacturing Overhead Budget and Planning

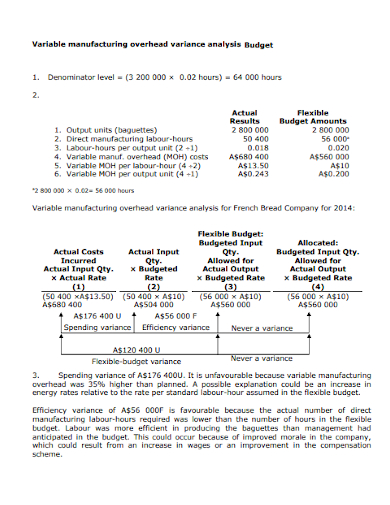

7. Manufacturing Overhead variance Budget Analysis

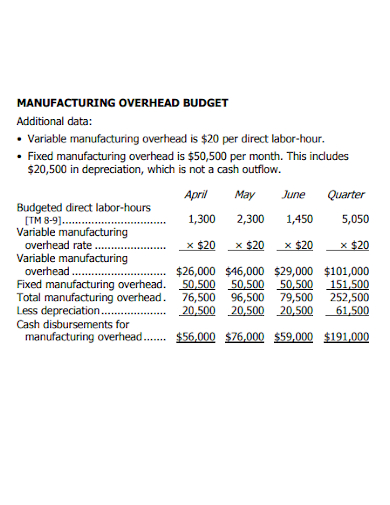

8. Manufacturing Overhead Labour Hour Budget

9. Company Manufacturing Overhead Budget

10. Cost of Goods Manufacturing Overhead Budget

11. Sample Manufacturing Overhead Budget

What Is Included in Manufacturing Overhead?

Aside from budgeting for labor and raw materials to manufacture products, you also need to budget other factors and utilities to sustain your operations. These overhead costs should be included in your budget and should be used as a part of the calculation for the cost of finished good inventory. Remember that these costs exclude variable costs required to manufacture products, such as direct materials and direct labor. Examples of manufacturing overhead costs are:

- Rent of the building where you manufacture products

- Property taxes and insurance on manufacturing facilities and equipment

- Communication systems and computers for your facility

- Maintenance on manufacturing equipment

- Salaries of maintenance personnel, janitorial staff, factory management team, material handlers, and quality control staff

- Factory supplies that are not directly associated with the product making

- Utilities for factory

How to Calculate Manufacturing Overhead Rate?

1. Calculate the Total Manufacturing Overhead

Start by identifying the manufacturing overhead costs that help your factory production run as smoothly as possible. Add all the indirect costs you have monthly to calculate the manufacturing overhead costs.

2. Determine the Overhead Rate

Now that you’ve estimated the manufacturing overhead costs for a month, the next thing to do is to determine the manufacturing overhead rate. This is the percentage that you must pay for overheads every month. To know your overhead rate, divide your monthly overhead costs by your total monthly sales and multiply it by 100.

If your overhead rate is low, it means that you’re using your resources efficiently. If your overhead rate is high, it may indicate a lagging production process.

FAQs

How to reduce your manufacturing overhead?

If your business is looking to reduce and manage overhead costs, consider doing these steps:

-

Make a budget for a higher estimate of overhead costs

-

Do preventative maintenance to reduce costs of repairs.

-

Reuse old equipment parts if they are still working properly.

-

Hire an in-house maintenance professional if you don’t have one.

-

Discuss overhead reduction goals with employees.

-

Build relationships with vendors to obtain perks such as discounts.

-

Reduce the need for office supplies especially if they are not needed.

-

Rent out extra space if you have.

What are the types of overhead costs?

There are three types of overhead costs and these are:

-

Fixed: These types of costs do not change regularly and whatever activity the business is doing, these costs won’t get affected. Examples of fixed overhead costs are rent, mortgage, government fees, and property taxes.

-

Variable: These types of costs change depending on the production output. Examples are operational utilities such as electric, gas, shipping costs, maintenance situations, legal fees, and advertising.

-

Semi-variable: These types of costs change over time depending on the business activity. The costs may either increase or decrease. Some examples of semi-variable costs may include operational utilities, rent, and insurance.

The overhead costs in manufacturing are essential to efficiently run your operations. Furthermore, knowing the manufacturing overhead expenses will greatly help you create a good budget for your overhead. You can set aside the amount of money needed to cover all of those costs. You can also track your costs well and help you stick to a proper budget and determine how you can reduce your overhead costs in the future. To help you get started making the budget, download our free sample templates above to use as your guide!

Related Posts

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word

FREE 10+ Architecture Budget Samples in PDF

FREE 10+ Capital Budget Samples in PDF | MS Word | Google Docs | Google Sheets | Excel | Apple Numbers | Apple Pages

FREE 10+ Budget Tracker Samples in PDF | DOC

FREE 4+ Corporate Monthly Budget Samples in MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Profit and Loss Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF