Despite the multitude of businesses and the variety of goods and services offered today, they all have one thing in common: the need to make money. As cruel and straightforward as that may sound, the reality is that businesses cannot function without profit and revenue. However, with the ever-evolving nature of commerce nowadays, corporate stagnation is equally detrimental to the misuse of funds. Hence, the problem now becomes formulating an effective budget plan that balances expenditure for upgrades without overspending your profit.

What is Budget Monitoring?

The rise and fall of various small businesses and well-known corporations revolve around multiple factors such as lack of target market impact, no consideration for employees, and lack of general management. Yet, one particular factor that stands out like a sore thumb is the absence of budget monitoring. But what exactly is this concept? Budget monitoring is the process of stabilizing the money situation of a company—think of it as babysitting cash bricks.

While the notion itself is relatively self-explanatory, the more particular aspects lie in the financial skills needed to monitor expenditures and profit. Monitoring a budget requires knowledge on various documents such as audit reports, budget proposals, and financial statements. Despite the need to understand different documents of varying formats and texts, budget monitoring is a necessity to ensure that all transactions are legitimate, profitable, and essential to company growth.

The Fuel of Every Business

Very few things resonate with speed and power like sports cars do. With certain models able to reach speeds of zero to sixty in two seconds, and with top speeds close to three hundred miles per hour, there is no question that these are no ordinary cars. However, one thing they do have in common with your average joe of a car is what powers the engine: fuel. Despite the difference of top speeds between car models, all vehicles run at approximately 0 mph with an empty tank. How is this relevant? Simply put, money is the fuel that drives all businesses forward. No matter how extravagant, common, or fast-growing a company is, if their bank account is as empty as a flat tire is of air, they’re going nowhere fast.

10+ Monitoring a Budget Samples in PDF | DOC

It isn’t the size of the budget that defines a project’s success, but how it’s used. If you want to successfully implement your plan, start with practicing restraint in expenditure. To help you track financial processes, here are a few sample templates you can use.

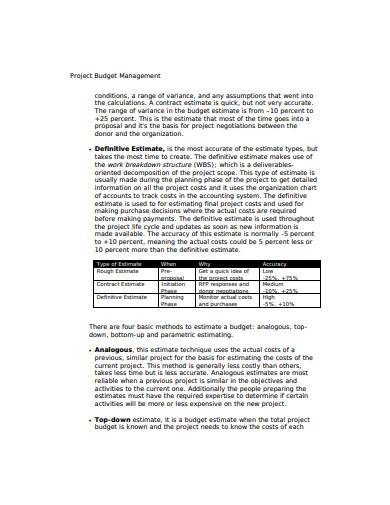

1. Project Budget Monitoring Sample

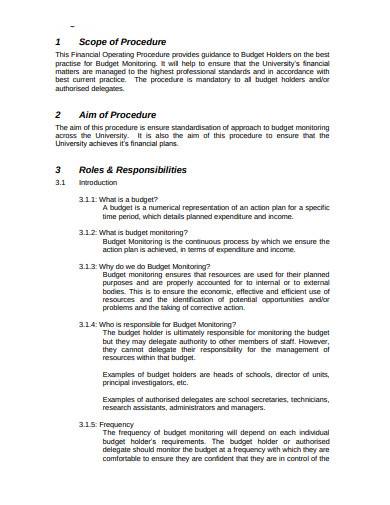

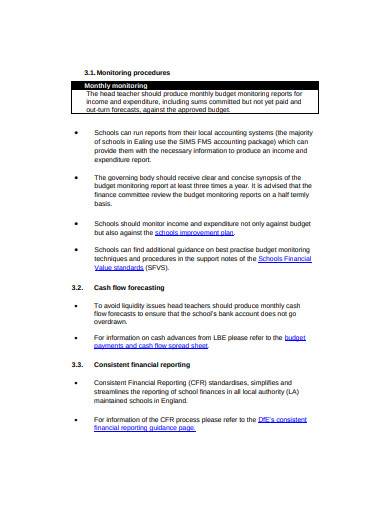

2. Budget Monitoring Procedure Template

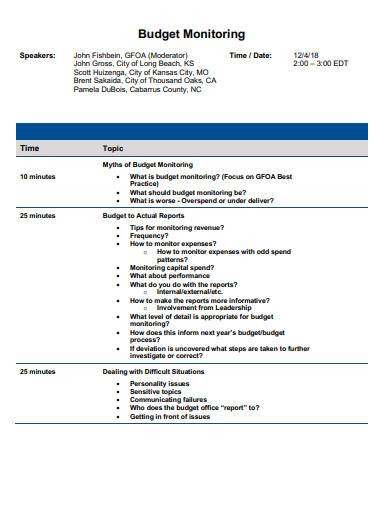

3. Budget Monitoring Forum Sample

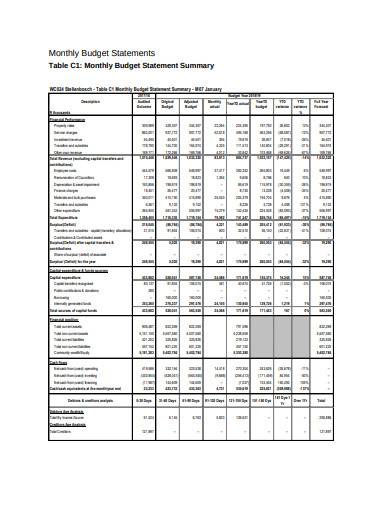

4. Monthly Budget Monitoring Statement in PDF

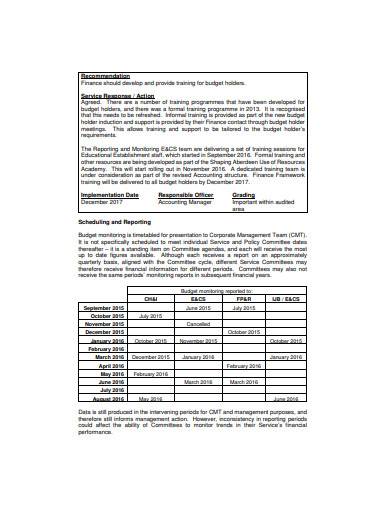

5. Finance Budget Monitoring Sample

6. Budget Monitoring Template

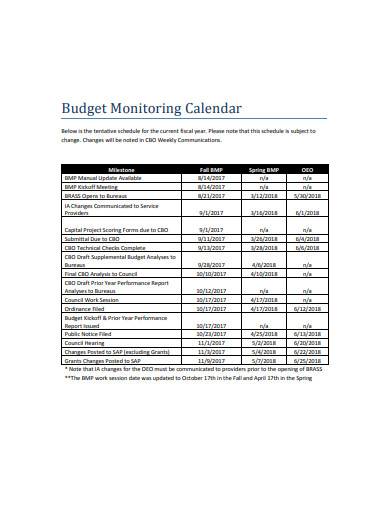

7. Budget Monitoring Calendar Sample

8. General Budget Monitoring Template

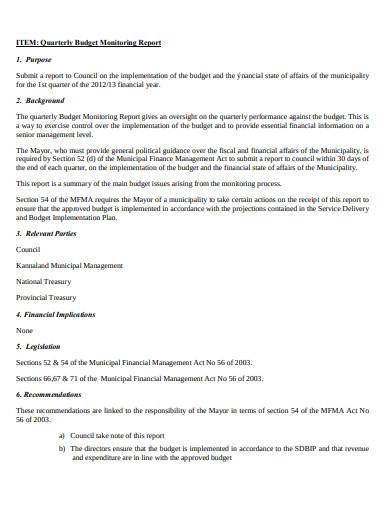

9. Quarterly Budget Monitoring Report Sample

10. Budget Monitoring Manual Sample

11. Budget Monitoring in DOC

How to Monitor Your Budget

It’s one thing to keep yourself from buying one too many cups of coffee a day to save up for a good book. It’s another to tracking the spending pattern of a major corporation. A company’s budget is made up of both the incoming revenue, and the outgoing expenses, so to track where the money goes requires a bit of finesse. As such, it’s a good thing that you have these tips and tricks to guide you in securing your industry’s monetary future.

1. Set Expenditure Limitations

Whether it’s a set amount, a set quantity of items, or both, establishing limits to how much cash the company shells out is a great starting point. Imagine the damage a failed project has on your business if you spent hundreds of thousands of dollars on it? Prevent this from happening to you by setting expenditure limits.

2. Meticulously Analyze Purchases

Does the project need a buffet for the members every week? How much scaffolding is required on the construction plan? Are you sure it’s necessary to make this purchase? These are some question you should ask when analyzing purchases. Keep in mind that although a bit of moral boosting is good, the main investment of your cash should be relevant to company growth.

3. Document Anomalies

If you find that receipts and prices don’t add up, note them down. If the purchase order and actual items on-hand post-purchase are different, take them into account. Anomalies are what ruin a business from the inside out, so you should have no tolerance for intentional sabotage—however, a few minor, honest mistakes are forgivable.

4. Report All Observations

The government regularly utilizes financial and audit reports to present information and observations, and for good reason. Monitoring budget requires continuous updates on cash flow, debt, and all the above-mentioned factors. As such, using a report-format document allows you to formulate better methods of budget management.

The merit of the old idiom “money doesn’t grow on trees” holds relevance to this day. It’s surprisingly easy to run a business down to the ground without proper financial planning, so it’s your responsibility to make sure that your budget is monitored regularly. Because once that bank account dries up, it’ll be quite difficult to fill it up again.

Related Posts

FREE 12+ Accounting Spreadsheet Samples

9+ Sample Key Log Templates

9+ Sample Blood Pressure Chart Templates

7+ Sample Weight Loss Charts

5+ Sample Boys Growth Charts

14+ Sample Expense Report Forms

7+ Sample Project Scorecard Templates

10+ Sample Heart Rate Chart Templates

7+ Sample Employee Performance Review Documents

27+ Free Daily Log Samples

8+ Phone Call Log Templates

10+ Sample Purchase Request Forms

FREE 9+ Project Progress Report Samples

15 Timeline Templates

7+ Sample Phonics Worksheets