10+ Monthly Budget Worksheet

A budget is just a tool for gaining a faster and more effective understanding of your spending patterns. By detailing all of your monthly income and expenses, you may receive a real picture of your own cash flow, allowing you to make better and more educated financial decisions. If your financial status is altering as a result of an unexpected economic recession or unemployment, now is a good opportunity to become acquainted with these resources and plan ahead of time to ensure you’ll be okay in the long term. You need a monthly budget worksheet! Need some help with writing your budget worksheet? Look no further, because we’ve got you covered. In this article, we provide you with free and ready-made samples of Monthly Budget Worksheets in PDF and DOC format that you could use for your benefit. Keep on reading to find out more!

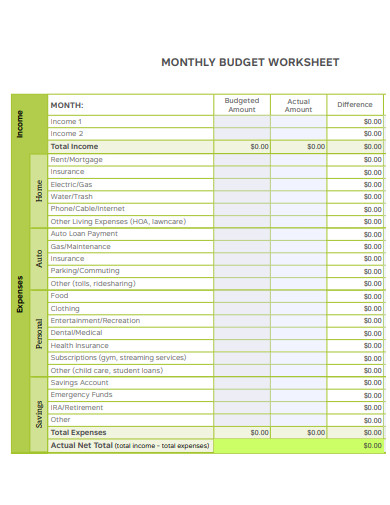

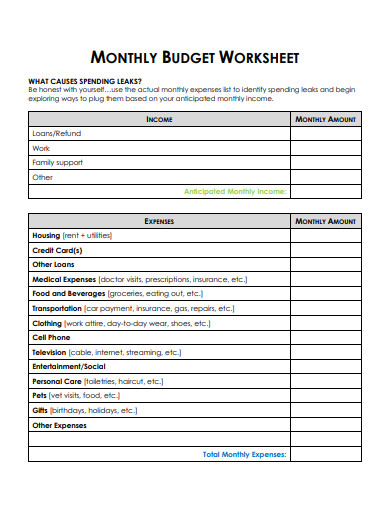

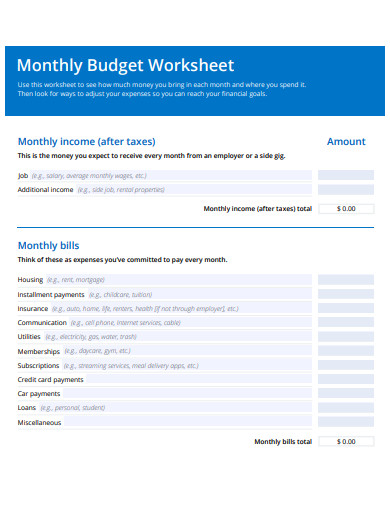

2. Sample Monthly Budget Worksheet

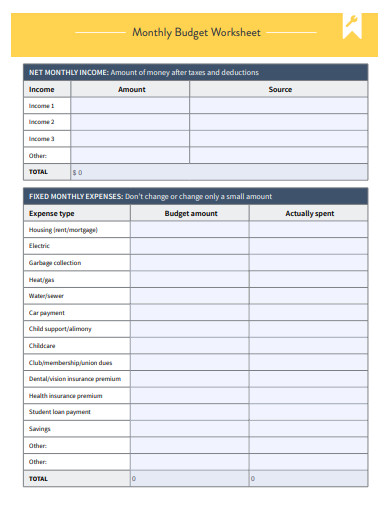

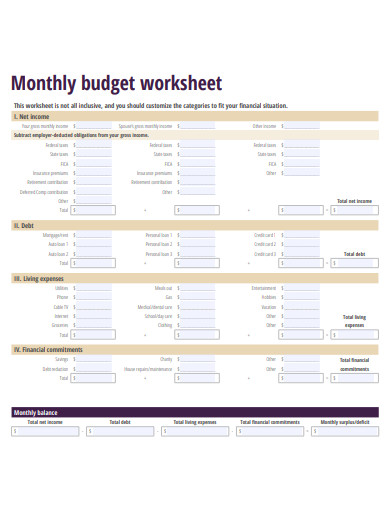

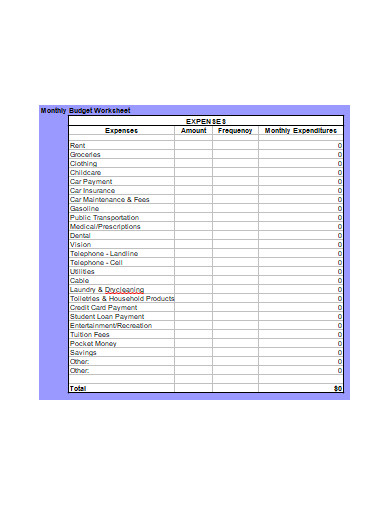

3. Simple Monthly Budget Worksheet

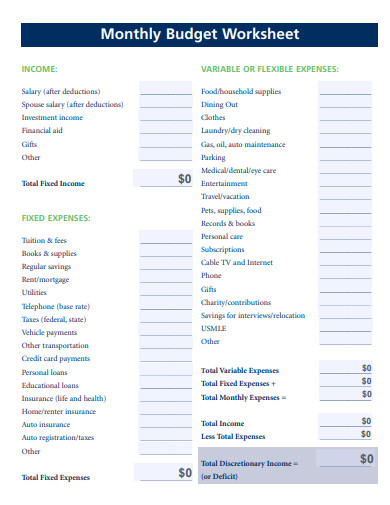

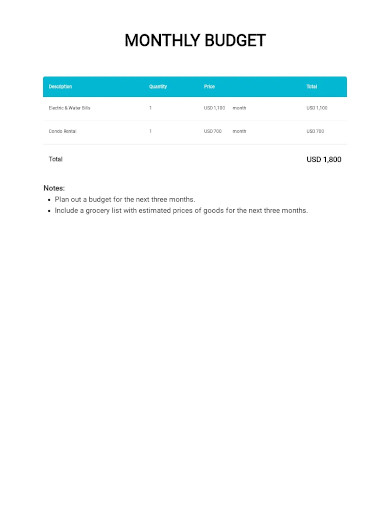

4. Monthly Budget Worksheet Example

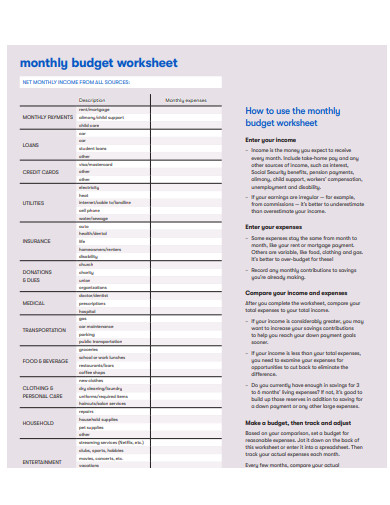

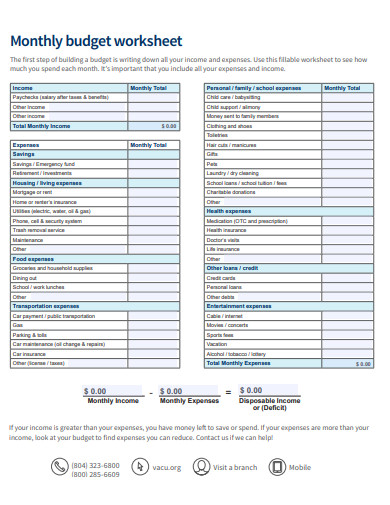

5. Basic Monthly Budget Worksheet

6. Formal Monthly Budget Worksheet

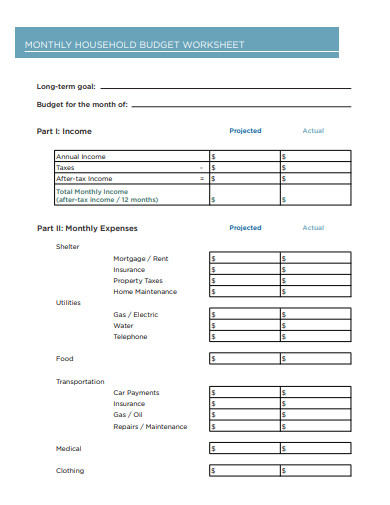

7. Monthly Household Budget Worksheet

8. Professional Monthly Budget Worksheet

9. Monthly Business Budget Worksheet

10. Editable Monthly Budget Worksheet

11. Printable Monthly Budget Worksheet

What Is a Monthly Budget Worksheet?

A Monthly Budget Worksheet allows a person to assess his financial situation and plan expenditures over a period of time, generally a month or a year. They provide an excellent means of keeping track of our finances. We may learn how to manage our money and prepare for the future by utilizing a budgeting worksheet. A budget spreadsheet may help you keep track of your income and spending, as well as any savings you make. A good budget can also help you keep track of your expenditures and see any patterns in your finances. You may also identify where you may be overpaying in order to better your spending and find new methods to save money each month.

How to Make a Monthly Budget Worksheet

A good budget worksheet may assist you in keeping track of your costs, identifying spending trends that can help you avoid overspending, and increasing your capacity to save money each month. A Monthly Budget Worksheet Template can help provide you with the framework you need to ensure that you have a well-prepared and robust worksheet on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, follow these steps below to guide you:

1. Determine your net income.

Your net income is the cornerstone of a successful budget. That’s your take-home pay, which is the sum of your income or salary less taxes and employer-provided benefits like retirement plans and health insurance. Focusing on your total compensation rather than your net income may lead to overspending since you will believe you have more money than you really do.

2. Monitor your expenditures.

Recording and classifying your costs will help you figure out where you spend the most money and where you can save the most money. Start by making a list of your fixed costs. Regular monthly costs include rent or mortgage payments, utilities, and automobile payments. This is an area where you might be able to save money. Credit card and bank statements are fantastic places to start since they itemize and classify your monthly expenses.

3. Establish realistic objectives.

Make a list of your short- and long-term financial goals before you start combing through the data you’ve collected. Remember that your objectives don’t have to be written in stone, but knowing what they are might help you stay on track with your budget. If you know you’re saving for a vacation, it could be simpler to minimize costs.

>4. Develop a strategic plan.

That’s how it all comes together: your actual spending vs. your desired expenditure. Use your list of variable and fixed costs to estimate how much you’ll spend in the following months. Then consider your net income and priorities. Consider establishing specific—and reasonable—spending limitations for each cost area.

FAQs

What is a reasonable monthly budget?

According to this formula, you should spend 50% of your after-tax income on needs, 30% on desires, and 20% on savings and debt repayment.

In terms of money, what is the 72 rule?

The Rule of 72 is a formula that predicts how long it will take to double your money at a certain rate of return.

What exactly is the point of a budget?

To put it another way, a budget keeps you on track toward your long-term financial objectives by allowing you to regulate your spending and consistently save and invest a percentage of your income.

Because most budget worksheets are separated into categories, they may help you figure out where the majority of your money goes and whether you’re spending too much of it on non-essential items. To help you get started, download our easily customizable and comprehensive samples of Monthly Budget Worksheets today!

Related Posts

FREE 10+ Annual IT Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Personal Budget Planner Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Numbers | Apple Pages | PDF

FREE 5+ Yearly Budget Planner Samples in PDF | XLS

FREE 10+ Expense Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word

FREE 10+ Architecture Budget Samples in PDF

FREE 10+ Capital Budget Samples in PDF | MS Word | Google Docs | Google Sheets | Excel | Apple Numbers | Apple Pages