Business budget analysis is a process that involves an evaluation of the business budget plan created for a particular company. With this process, companies can determine and analyze any existing or possible issues that may impact their financial analysis sector. Budget management and planning enable individuals or businesses to understand how much funds they currently have, had spent, and how much they will need for future use. Budgeting can also help them make important decisions in their financial plan like cutting down unwanted expenses, increasing employees, or acquiring new pieces of equipment.

FREE 10+ Purchase Budget Samples

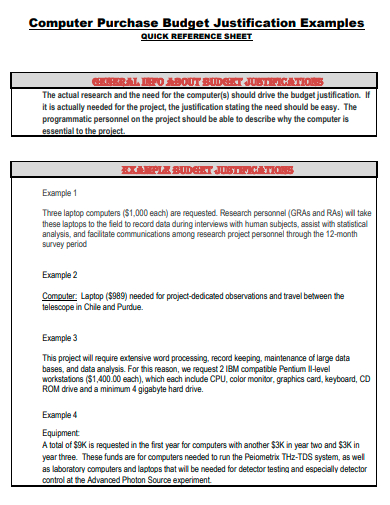

1. Computer Purchase Budget

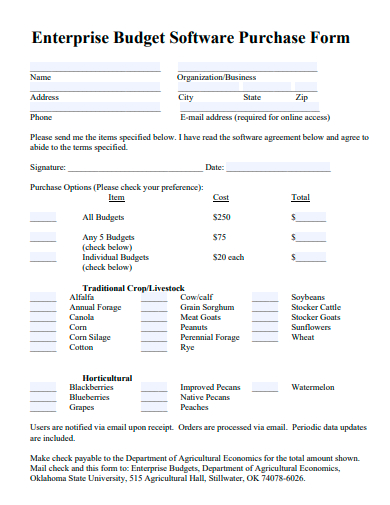

2. Purchase Enterprise Budget Software Form

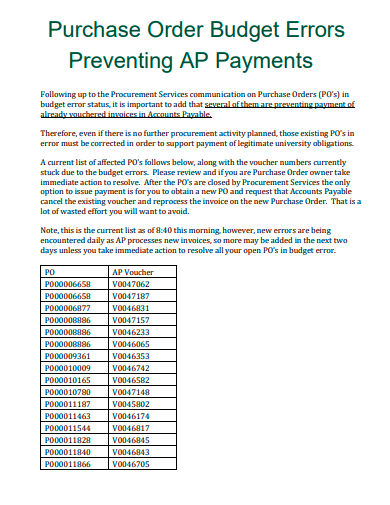

3. Purchase Order Budget Errors

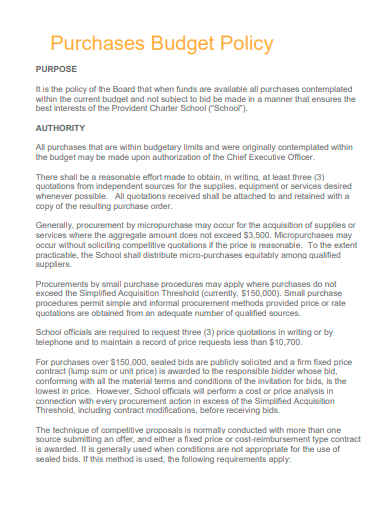

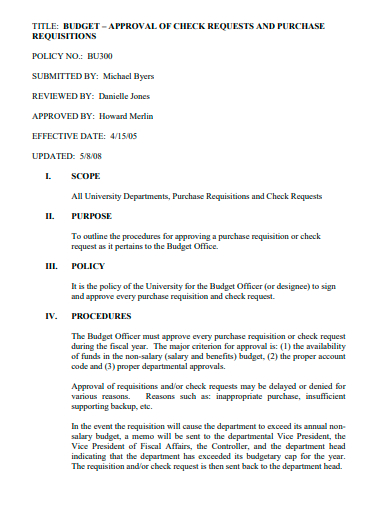

4. Purchases Budget Policy

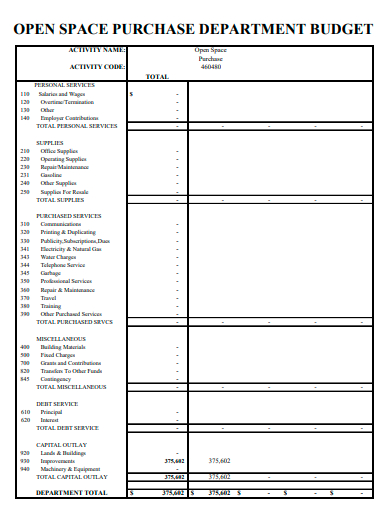

5. Open Space Purchase Department Budget

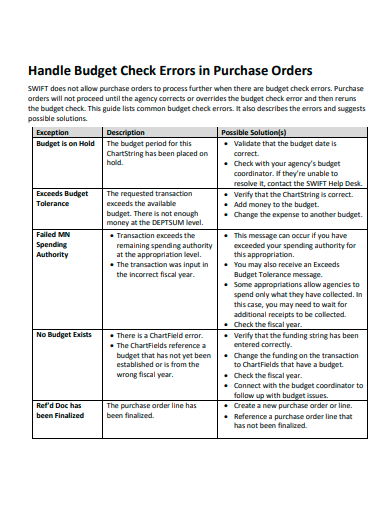

6. Purchase Orders Budget Check Errors

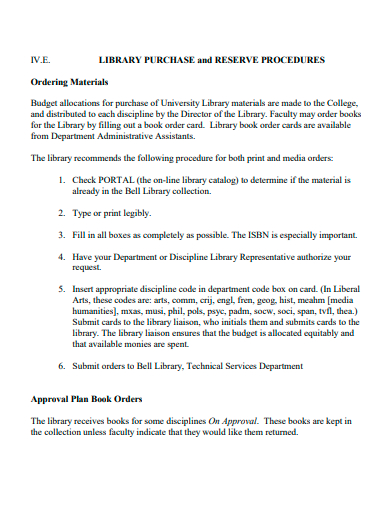

7. Library Purchase Budget

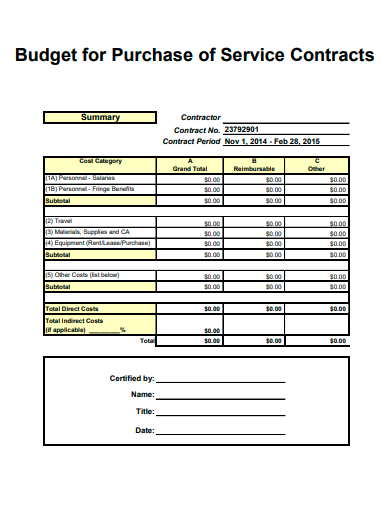

8. Purchase of Service Contracts Budget

9. Purchase Requisitions Budget

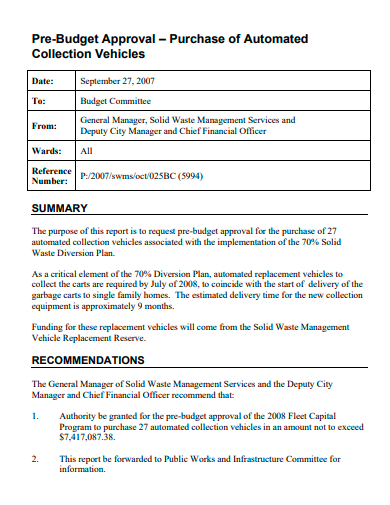

10. Purchase of Automated Collection Vehicles Pre-Budget

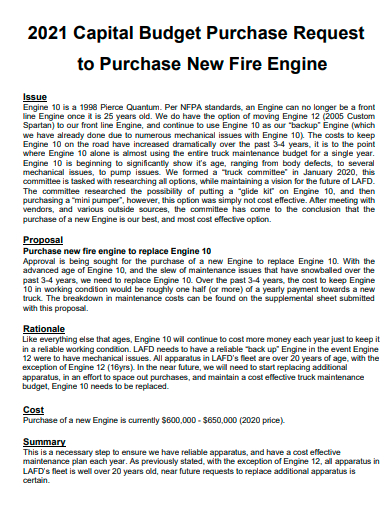

11. Purchase New Fire Engine Capital Budget

What is a Purchase Budget?

A purchase budget is part of a company’s inventory management system and management plan which determines how much inventory is needed to be purchased in each budget period. It contains the amount needed to make sure that there is enough inventory on hand to satisfy customer orders for products. To create a plan for material budget to be purchased, business owners must look at or review their past performance to determine their future needs, build break-even points, conduct cash flow analysis, and project their earnings.

How to Prepare a Purchase Budget

A purchase budget for materials enables business owners to determine the amount or number of goods that their company will need to sell to be able to achieve and realize their business goals and objectives. With its ability to outline and determine their current and future inventory, businesses can determine whether they have correct inventory levels in stock at any given time as well as enable them to distribute cash to purchase needed materials.

Step 1: Determine the Materials You Will Require

Create a forecast on what your company will be needing to purchase in the following year. List down what is needed to be budgeted as well as how much your department is willing to spend for the listed material or service.

Step 2: Learn More About Your Vendor Options

After analyzing the materials or services you will be purchasing, look for the correct supplier or vendor. This step requires you to give more attention and willingness to negotiate terms to establish better payment terms, lower prices, and create more opportunities for advantageous terms and conditions.

Step 3: Align Your Data With Your Financial Plan

Once you have acquired all the factors you need, make sure that they are aligned with your financial plan that will make payments during the entire year. Companies utilize the traditional way of management which is monitoring the entire process of acquisition but it is also important to create a detailed prior budget.

Step 4: Take Advantage of Budgeting Tools

Make sure that buyers are informed about how much available budget an item has and that your purchases are within your established budget. You can also use various tools to better control your data such as your expenditures.

FAQs

What are the different types of budgets?

The different types of budgets that contribute to making a business plan include the master budget, operating budget, cash budget, financial budget, labor budget, and static budget.

What are the components of a budget?

A budget contains the estimated revenue which includes sales forecast and cost estimate, fixed costs, variable costs, one-time expenses, cash flow, and profit.

What factors should be considered when making a purchase budget?

When making a purchase budget, consider your inventory beginning balance, desired service levels, product terminations, and the impact on cash in which the anticipated amount of product purchases are listed in a budgeted balance sheet.

As a part of its inventory management, companies create purchase budget plans to determine the number of materials or cost of labor they will be requiring for the following year. This process enables businesses to plan their business costs, coordinate their assets to meet their business goals and objectives, and control their expenditures. A purchase budget also allows businesses to determine their inventory levels, allocate cash, and take into account their expected future levels of production.

Related Posts

FREE 10+ Personal Budget Planner Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Numbers | Apple Pages | PDF

FREE 5+ Yearly Budget Planner Samples in PDF | XLS

FREE 10+ Expense Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word

FREE 10+ Architecture Budget Samples in PDF

FREE 10+ Capital Budget Samples in PDF | MS Word | Google Docs | Google Sheets | Excel | Apple Numbers | Apple Pages